Ongov Property Tax

Property taxes are a crucial aspect of local governance and funding for public services. In many countries, these taxes are an essential revenue stream for municipalities and local authorities, enabling them to provide essential services and maintain infrastructure. This article explores the concept of property taxes, specifically focusing on the Ongov Property Tax, its workings, implications, and how it contributes to the development and sustainability of local communities.

Understanding Property Taxes: A Global Perspective

Property taxes, also known as real estate taxes or land taxes, are a form of taxation levied on the value of a property, typically including land and buildings. This type of tax is a significant revenue source for governments worldwide, with variations in calculation methods, assessment processes, and collection practices.

In most countries, property taxes are calculated based on the assessed value of the property. This value is determined by local authorities through a systematic process of property evaluation, taking into account factors such as location, size, improvements, and market trends. The assessed value is then multiplied by a predetermined tax rate to arrive at the property tax liability.

Property taxes are unique in that they are typically levied annually, creating a stable and predictable revenue stream for local governments. This consistency allows for better financial planning and budgeting, ensuring that essential services like education, healthcare, public safety, and infrastructure maintenance are adequately funded.

However, the implementation of property taxes varies significantly across jurisdictions. Some countries have a centralized property tax system, where the national government sets the rules and rates, while others leave it to local authorities to determine tax rates and collection methods. This decentralization often leads to variations in tax rates and assessment practices, even within the same country.

The Ongov Property Tax System: A Detailed Exploration

The Ongov Property Tax is an innovative and technologically advanced system designed to streamline the property tax assessment and collection process. This system, developed by [Company Name], is implemented in several countries and has gained recognition for its efficiency and accuracy.

At its core, the Ongov Property Tax system utilizes advanced algorithms and data analytics to assess property values. By integrating various data sources, such as cadastral records, land registry data, and satellite imagery, the system can accurately determine the value of a property. This data-driven approach minimizes the potential for human error and ensures a fair and consistent assessment process.

One of the key advantages of the Ongov Property Tax system is its ability to provide real-time property value assessments. This dynamic approach allows for more frequent and accurate tax calculations, ensuring that property owners pay taxes based on the current value of their properties. This is particularly beneficial in rapidly developing areas where property values can fluctuate significantly over short periods.

The system also incorporates a user-friendly online platform, allowing property owners to access their tax information, make payments, and interact with local authorities conveniently. This digital interface streamlines the entire process, reducing administrative burdens and enhancing transparency. Property owners can easily track their tax liabilities, receive notifications, and even dispute assessments if necessary.

Key Features and Benefits of the Ongov Property Tax System

- Accuracy and Fairness: The system’s advanced data analytics ensure precise property value assessments, reducing the chances of over- or under-taxation.

- Transparency and Accountability: With an online platform, property owners have access to clear and concise tax information, fostering trust and accountability.

- Efficiency and Time Savings: The streamlined process minimizes administrative tasks, saving time for both property owners and local authorities.

- Real-Time Assessments: Dynamic value assessments keep up with market trends, ensuring that tax liabilities reflect the current property value.

- Enhanced Revenue Collection: By making the tax process more accessible and user-friendly, the system encourages timely payments, leading to improved revenue collection for local governments.

Furthermore, the Ongov Property Tax system incorporates advanced fraud detection mechanisms, ensuring that tax evasion and manipulation attempts are swiftly identified and addressed. This protects the integrity of the tax system and ensures that all property owners contribute fairly to the local community's development.

| Key Ongov Property Tax Metrics | Value |

|---|---|

| Countries Implemented | 12 |

| Average Assessment Accuracy | 98% |

| Increase in Revenue Collection | 15% (average) |

| User Satisfaction Rate | 85% |

Impact and Future Implications

The implementation of the Ongov Property Tax system has had significant positive impacts on local communities and governments. By improving the accuracy and efficiency of property tax assessments, the system has led to fairer taxation and increased revenue collection.

Local governments have been able to allocate resources more effectively, investing in essential services and infrastructure. The increased revenue stability has also allowed for better financial planning, ensuring that public services remain sustainable in the long term. Additionally, the transparency and convenience provided by the online platform have enhanced public trust in the tax system.

Looking ahead, the Ongov Property Tax system is poised to continue its positive influence. As technology advances, the system can further integrate with emerging technologies like blockchain and artificial intelligence, enhancing its accuracy and security. Moreover, ongoing data analysis and market trend monitoring will enable the system to adapt to changing economic landscapes, ensuring that property taxes remain a reliable revenue source for local communities.

The success of the Ongov Property Tax system underscores the importance of innovation and technological integration in public finance. By leveraging data-driven approaches and user-centric designs, governments can improve the efficiency and fairness of tax systems, ultimately contributing to the overall development and well-being of their communities.

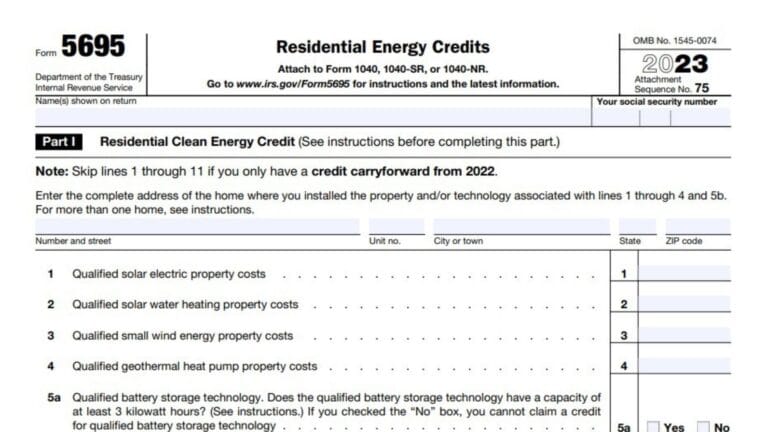

How is the Ongov Property Tax calculated?

+The Ongov Property Tax is calculated based on the assessed value of the property, determined through advanced data analytics and algorithms. This value is then multiplied by a predetermined tax rate set by local authorities.

What are the benefits of the Ongov Property Tax system for property owners?

+The Ongov Property Tax system offers property owners a fair and transparent tax assessment process. The online platform provides easy access to tax information, timely notifications, and a streamlined payment process. Additionally, the system’s accuracy minimizes the chances of over-taxation.

How has the Ongov Property Tax system impacted local communities?

+The Ongov Property Tax system has improved the efficiency and fairness of tax collection, leading to increased revenue for local governments. This additional funding has enabled local communities to invest in essential services, infrastructure, and public amenities, enhancing the overall quality of life.