Sales Tax In Tacoma Wa

Understanding the intricacies of sales tax is crucial for businesses and consumers alike, especially in regions like Tacoma, Washington, where it can significantly impact financial decisions and transactions. In this comprehensive guide, we will delve into the specifics of sales tax in Tacoma, exploring the rates, regulations, and their practical implications.

Unraveling the Tacoma Sales Tax System

The sales tax landscape in Tacoma is a complex interplay of local, state, and municipal regulations. At its core, sales tax is a consumption tax levied on the sale of goods and services. In Tacoma, this tax is applied at various levels, contributing to the overall economic framework of the region.

State Sales Tax: A Foundation

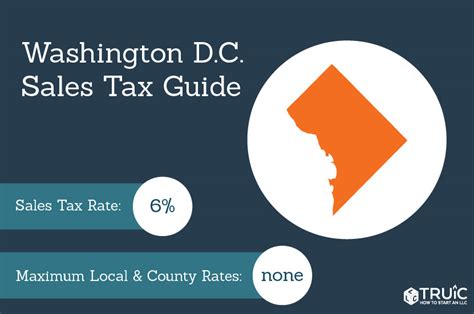

The state of Washington sets a baseline sales tax rate, which forms the backbone of the taxation system. As of the latest information, this rate stands at 6.5%, a percentage that significantly influences the cost of goods and services for residents and businesses alike. This state tax is applied uniformly across Washington, serving as a consistent benchmark.

However, the sales tax structure in Washington is unique in that it allows for additional local and municipal taxes to be levied on top of the state rate. These additional taxes can vary significantly from one jurisdiction to another, adding a layer of complexity to the overall sales tax landscape.

Tacoma’s Local Sales Tax: A Distinct Advantage

Tacoma, being a vibrant city with a rich cultural heritage and a thriving business community, has its own local sales tax rate. As of the latest available information, this rate is set at 1.5%, bringing the total sales tax in Tacoma to 8.0%. This additional tax revenue is crucial for the city’s development, funding various public services and infrastructure projects.

The city's local sales tax rate is not only a source of revenue but also a strategic tool. It allows Tacoma to offer a competitive advantage to businesses and consumers, potentially influencing economic growth and consumer behavior. A lower sales tax rate can make the city more attractive for businesses to establish their operations, and for consumers to make purchases, thereby stimulating the local economy.

Special Considerations: Exemptions and Discounts

While the sales tax rates in Tacoma provide a general framework, it’s important to note that certain goods and services may be exempt from sales tax or qualify for reduced rates. These exemptions can vary based on the nature of the transaction, the type of business, and even the end-use of the product.

For instance, many states, including Washington, offer sales tax exemptions or discounts for certain purchases, such as groceries, prescription drugs, or educational materials. These exemptions can significantly reduce the financial burden on consumers and encourage spending in specific sectors.

| Category | Sales Tax Rate |

|---|---|

| State Sales Tax | 6.5% |

| Tacoma Local Sales Tax | 1.5% |

| Total Sales Tax in Tacoma | 8.0% |

Implications for Businesses and Consumers

The sales tax rate in Tacoma has profound implications for both businesses and consumers. For businesses, especially those in the retail and service sectors, the tax rate directly affects their pricing strategies and profitability. A higher sales tax rate can eat into their profit margins, while a lower rate can make their goods and services more competitive in the market.

From a consumer perspective, the sales tax rate influences purchasing decisions and the overall cost of living. A higher sales tax rate can make everyday purchases more expensive, potentially impacting household budgets and spending habits. On the other hand, a lower rate can provide a welcome relief, making the city a more affordable place to live and shop.

Strategies for Businesses: Navigating the Tax Landscape

Businesses operating in Tacoma need to carefully consider the sales tax rate when setting their prices. They must factor in the tax rate to ensure their products remain competitive while still generating sufficient profit. This delicate balance often requires strategic pricing and a deep understanding of the local market.

Furthermore, businesses must stay updated with any changes to the sales tax rate or regulations. Such changes can significantly impact their operations and financial health. Staying informed allows businesses to adapt their strategies and maintain their competitive edge in the market.

Consumer Awareness: Making Informed Choices

For consumers, understanding the sales tax rate is crucial for making informed purchasing decisions. A clear grasp of the tax rate can help consumers budget effectively and compare prices across different retailers. It also encourages consumers to explore tax-exempt or discounted purchases, further optimizing their spending.

In Tacoma, where the sales tax rate is relatively competitive, consumers can feel confident about their purchasing power. The city's rate provides a balance between generating revenue for essential services and keeping the cost of living affordable.

Conclusion: A Dynamic Sales Tax Landscape

The sales tax system in Tacoma is a dynamic and carefully calibrated mechanism. It balances the needs of the city, the state, and its residents, while also providing a competitive environment for businesses. The rate, although subject to change, currently offers a stable and predictable framework for economic growth and consumer spending.

As we've explored, the sales tax rate in Tacoma influences every aspect of the city's economy, from business operations to consumer choices. It is a vital component of the city's financial health and a key factor in its economic success. Understanding and navigating this sales tax landscape is essential for all stakeholders, ensuring a prosperous and sustainable future for Tacoma.

How often are sales tax rates reviewed and updated in Tacoma, WA?

+Sales tax rates in Tacoma are subject to periodic reviews and can be updated annually or as needed. These updates are often based on economic factors, legislative decisions, and the city’s financial requirements.

Are there any special sales tax holidays in Tacoma, WA?

+Yes, Tacoma, like many other cities in Washington, sometimes offers sales tax holidays for specific items or occasions. These holidays can provide a significant boost to consumer spending and are often timed to coincide with major shopping events.

How do businesses in Tacoma handle sales tax collection and remittance?

+Businesses in Tacoma are responsible for collecting sales tax at the point of sale and remitting it to the appropriate tax authorities. This process involves careful record-keeping and compliance with state and local regulations to ensure accurate tax collection and reporting.