5695 Tax Form

Unveiling the 5695 Tax Form: A Comprehensive Guide to Understanding and Utilizing this Crucial Document

In the complex world of taxes, the 5695 tax form stands as a critical tool for individuals and businesses alike. This form, officially known as the Form 5695: Residential Energy Credits, plays a vital role in the energy efficiency and renewable energy initiatives of the United States. With its specific focus on residential energy credits, it provides an avenue for taxpayers to claim credits for eligible expenses, thereby promoting sustainable practices and offering financial incentives. This article aims to delve into the intricacies of the 5695 tax form, exploring its purpose, eligibility criteria, and the process of claiming credits, while also highlighting its significance in the broader context of environmental and energy policies.

The Purpose and Importance of Form 5695

Form 5695 is a specialized tax document designed to encourage and support residential energy efficiency and the adoption of renewable energy systems. It allows taxpayers to claim credits for specific expenses incurred in making their homes more energy-efficient or by installing qualifying renewable energy equipment. By providing financial incentives, this form plays a crucial role in the nation’s efforts to reduce carbon emissions, promote sustainable living, and foster a transition towards a greener economy.

The credits claimed on Form 5695 can significantly impact a taxpayer's overall tax liability. For instance, consider the case of a homeowner who installs a solar water heating system in their residence. By completing Form 5695, they can claim a credit based on the qualified expenses related to the installation. This credit directly reduces their tax burden, making the transition to renewable energy more financially viable and attractive. Moreover, the cumulative effect of such credits across numerous taxpayers contributes to a broader societal shift towards environmentally conscious practices.

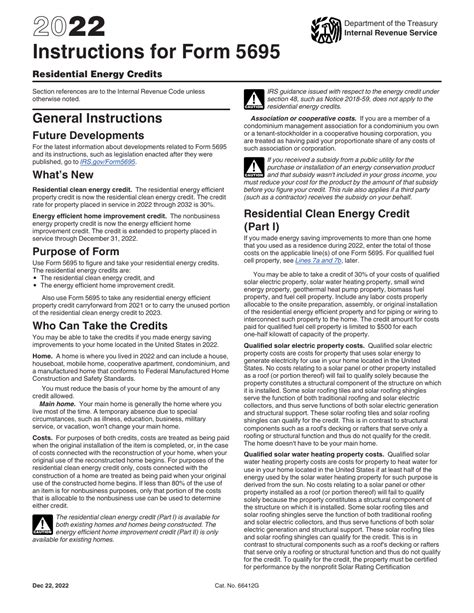

Eligibility and Qualifying Expenses

Not all expenses related to energy efficiency or renewable energy automatically qualify for credits on Form 5695. To be eligible, expenses must meet specific criteria outlined by the Internal Revenue Service (IRS). These criteria are designed to ensure that only legitimate and substantial investments in energy efficiency and renewable energy are rewarded with tax credits.

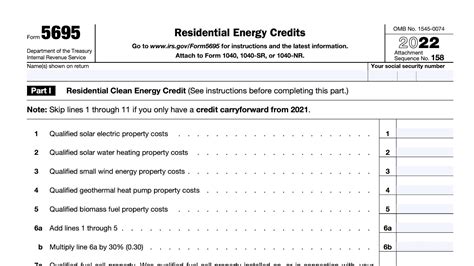

Qualifying expenses typically include the installation of renewable energy equipment such as solar panels, wind turbines, geothermal heat pumps, and fuel cell property. Additionally, expenses related to energy-efficient improvements like insulation, energy-efficient windows, and certain HVAC systems may also be eligible. It's important to note that the eligibility of these expenses is subject to specific thresholds and requirements, which are detailed in the instructions provided with Form 5695.

| Qualifying Expenses | Description |

|---|---|

| Solar Panels | Installation costs of solar panels for electricity generation or water heating. |

| Wind Turbines | Costs associated with wind energy systems for residential use. |

| Geothermal Heat Pumps | Expenses related to geothermal systems for heating and cooling. |

| Fuel Cell Property | Investment in fuel cell property with at least 0.5 kilowatt capacity. |

| Energy-Efficient Windows | Qualified expenses for installing energy-efficient windows. |

One key aspect to consider is the eligibility of expenses based on the type of residence. For instance, Form 5695 applies to both primary residences and second homes, but not to rental properties or properties used for business purposes. Additionally, the form requires specific documentation and proof of expenses, ensuring that only legitimate and verified investments are considered for credits.

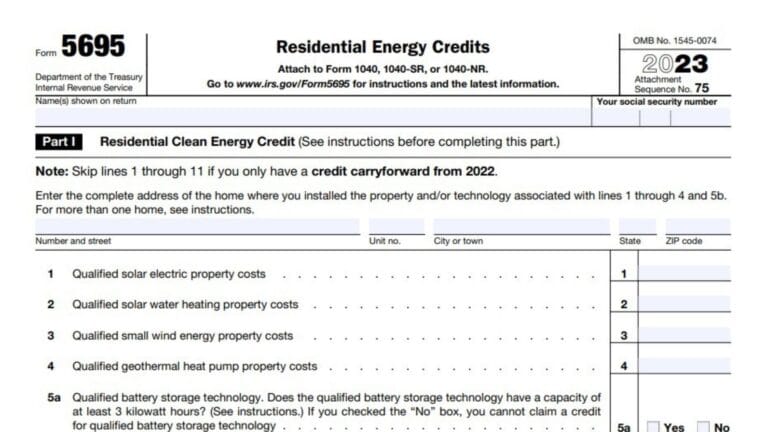

Completing Form 5695: Step-by-Step Guide

Completing Form 5695 involves a detailed process to ensure accuracy and compliance with IRS regulations. Here’s a step-by-step guide to help you through the process:

- Gather Required Information: Before you begin, collect all the necessary documents and information related to your eligible expenses. This includes receipts, invoices, and any other supporting documentation. Ensure that you have the exact dates, amounts, and descriptions of the expenses.

- Obtain Form 5695: You can access Form 5695 and its instructions directly from the IRS website or through tax preparation software. Make sure you are using the most recent version to avoid any discrepancies.

- Read the Instructions: Carefully read the instructions provided with the form. These instructions will guide you through the specific requirements, eligibility criteria, and any changes in the law that may affect your credits.

- Complete Section A: In Section A, you'll provide your personal information, including your name, address, and tax identification number. Ensure that this information matches your tax return to avoid processing delays.

- Identify Eligible Expenses: Refer to the list of qualifying expenses provided in the instructions. Match your expenses to the eligible categories and calculate the total amount for each category. This step is crucial to ensure that you claim credits for all eligible expenses.

- Calculate the Credit: Using the worksheets provided with Form 5695, calculate the credit amount for each category of eligible expenses. These worksheets take into account factors like the base amount, any applicable limitations, and the credit percentage.

- Transfer the Credit to Form 1040: Once you've calculated the credit amounts, transfer them to the appropriate lines on your Form 1040. This ensures that the credits are applied to your overall tax liability, potentially reducing the amount you owe or increasing your refund.

- Sign and Submit: Finally, sign and date the completed Form 5695 and include it with your tax return. Ensure that you keep a copy of the form and all supporting documentation for your records.

Throughout the process, it's essential to maintain accurate records and documentation. This not only ensures compliance with IRS regulations but also provides a clear audit trail in case of any future inquiries.

Maximizing Your Credits and Future Implications

Form 5695 offers a unique opportunity for taxpayers to not only reduce their tax liability but also to actively contribute to a more sustainable future. By claiming credits for eligible expenses, individuals and businesses can offset the initial costs of investing in energy efficiency and renewable energy, making these initiatives more financially feasible and attractive.

Moreover, the cumulative impact of Form 5695 credits can have a significant effect on the broader energy landscape. As more taxpayers claim these credits, there is a collective push towards a greener economy, reduced carbon emissions, and a more sustainable society. The financial incentives provided by Form 5695 serve as a powerful tool to accelerate the transition to renewable energy and encourage widespread adoption of energy-efficient practices.

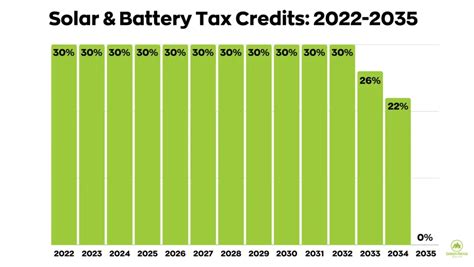

Looking ahead, the future implications of Form 5695 are promising. As the world continues to prioritize sustainability and combat climate change, the role of this form is likely to expand and evolve. Potential future developments may include an expansion of eligible expenses, increased credit amounts, or new incentives to further encourage residential energy efficiency and renewable energy adoption. Additionally, the data collected through Form 5695 can provide valuable insights into the effectiveness of current energy policies and guide the development of future initiatives.

In conclusion, Form 5695 is more than just a tax form; it is a catalyst for positive change. By understanding its purpose, eligibility criteria, and the process of claiming credits, taxpayers can actively participate in shaping a greener future while also benefiting from financial incentives. As we navigate the complex landscape of energy and environmental policies, the role of Form 5695 will undoubtedly continue to grow, offering both individual and societal benefits.

What is the eligibility criteria for claiming credits on Form 5695?

+

To be eligible for credits on Form 5695, expenses must be directly related to the installation of renewable energy equipment or energy-efficient improvements. These expenses must meet specific criteria outlined by the IRS, including thresholds and requirements. It’s important to refer to the official IRS guidelines or consult a tax professional to ensure your expenses meet the eligibility criteria.

How do I calculate the credit amount on Form 5695?

+

The credit amount on Form 5695 is calculated using the worksheets provided with the form. These worksheets take into account factors like the base amount, any applicable limitations, and the credit percentage. It’s crucial to follow the instructions carefully and use the correct worksheets for each category of eligible expenses.

Can I claim credits for multiple eligible expenses on Form 5695?

+

Yes, you can claim credits for multiple eligible expenses on Form 5695. However, it’s important to calculate the credit for each category of expenses separately and transfer the total credit amount to your Form 1040. Make sure to keep detailed records of all eligible expenses and their corresponding credit amounts.

Are there any limitations or restrictions on the credit amounts claimed on Form 5695?

+

Yes, there are limitations and restrictions on the credit amounts claimed on Form 5695. These limitations vary depending on the type of expense and the specific credit being claimed. It’s essential to refer to the instructions provided with the form to understand the applicable limitations and ensure that you claim the correct credit amounts.

Can I carry over unused credits from one tax year to the next on Form 5695?

+

The rules regarding the carryover of unused credits on Form 5695 vary depending on the specific credit being claimed. Some credits can be carried over to future tax years, while others have specific limitations or requirements. It’s crucial to consult the instructions or seek professional advice to understand the carryover rules for your particular situation.