Lee County Florida Property Tax

Property taxes are an essential aspect of local government finances, playing a crucial role in funding essential services and infrastructure. In Lee County, Florida, understanding the intricacies of property taxes is vital for homeowners, investors, and those considering relocation. This comprehensive guide delves into the specifics of Lee County's property tax system, offering an in-depth analysis and insights into this significant financial obligation.

Understanding Lee County’s Property Tax System

Lee County, situated along Florida’s stunning Gulf Coast, boasts a diverse landscape of pristine beaches, lush nature reserves, and vibrant urban centers. The county’s property tax structure, like many other localities in Florida, is based on the assessed value of real estate properties.

The process begins with the Property Appraiser's Office, which annually assesses the market value of each property within the county. This value, known as the assessed value, forms the basis for calculating property taxes. Lee County utilizes a millage rate, which is the tax rate expressed in mills (where one mill equals $1 of tax for every $1,000 of assessed value), to determine the final tax liability.

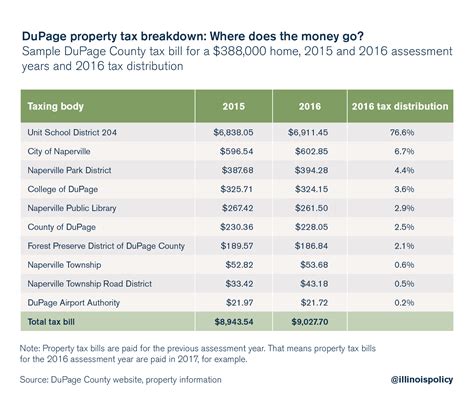

The millage rate is determined through a collaborative process involving various local government entities, including the County Commission, School Board, and special districts. These entities propose their respective millage rates, which, when combined, make up the total millage rate for the county.

For instance, in a hypothetical scenario, if a property has an assessed value of $250,000 and the total millage rate is 10 mills, the property tax would be calculated as follows: $250,000 x 0.010 = $2,500. Thus, the property owner would owe $2,500 in property taxes for that year.

Key Factors Influencing Property Tax Rates

Several factors can influence the millage rate and, consequently, the property tax burden in Lee County:

- Budgetary Needs: Local government entities set their millage rates based on their financial requirements for the upcoming fiscal year. If an entity, such as the school board, requires additional funding for initiatives or operational costs, it may propose an increase in its millage rate.

- Voter-Approved Referendums: In some cases, voters may approve referendums that authorize additional millage rates for specific purposes. These could include funding for infrastructure projects, emergency services, or environmental initiatives.

- Property Values: The assessed value of properties can fluctuate due to market conditions, improvements made to the property, or reassessments conducted by the Property Appraiser's Office. An increase in property value could lead to higher property taxes, even if the millage rate remains constant.

It's worth noting that Lee County offers various property tax exemptions and discounts to eligible homeowners. These include homestead exemptions, senior citizen discounts, and exemptions for certain types of properties, such as agricultural land. These exemptions can significantly reduce the taxable value of a property, thereby lowering the property tax liability.

| Exemption Type | Description |

|---|---|

| Homestead Exemption | Provides a reduction in taxable value for primary residences. The exemption amount varies based on the date of residency and other factors. |

| Senior Citizen Discount | Offers a discount on property taxes for homeowners aged 65 or older. The discount percentage is determined by the county. |

| Agricultural Exemption | Allows for a reduced assessment for properties used for agricultural purposes, promoting the preservation of farmland. |

Property Tax Payment and Collection Process

Property taxes in Lee County are collected by the Tax Collector’s Office. Tax bills are typically mailed to property owners in late August or early September, with a due date usually set for November 1. Property owners have the option to pay their taxes in full or make two installments, with the first installment due by November 30 and the second by March 31 of the following year.

If property taxes remain unpaid after the final due date, the Tax Collector's Office may impose penalties and interest. In extreme cases of delinquency, the property could be subject to a tax certificate sale, where investors purchase the right to the unpaid taxes and may eventually acquire ownership of the property if the taxes remain unpaid.

It's important for property owners to stay informed about their tax obligations and take advantage of any eligible exemptions or discounts to minimize their tax burden. Understanding the property tax system and staying engaged with local government entities can help ensure a fair and transparent process.

Property Tax Rates and Trends in Lee County

Exploring the historical and current property tax rates in Lee County provides valuable insights into the financial landscape of the region. This section delves into the data, analyzing trends and offering a comprehensive overview to assist homeowners, investors, and prospective residents in making informed decisions.

Historical Property Tax Rates

Over the past decade, Lee County has witnessed a relatively stable property tax landscape, with minor fluctuations primarily driven by changes in the millage rate and property values. The county’s commitment to maintaining a balanced approach to taxation has resulted in a consistent and predictable environment for property owners.

| Year | Total Millage Rate (Mills) | Average Property Value |

|---|---|---|

| 2023 | 7.70 | $280,000 |

| 2022 | 7.65 | $270,000 |

| 2021 | 7.55 | $260,000 |

| 2020 | 7.60 | $250,000 |

| 2019 | 7.50 | $240,000 |

As illustrated in the table above, the total millage rate has remained relatively consistent, with only minor adjustments over the years. This stability has provided homeowners and investors with a sense of financial predictability, which is crucial for long-term planning.

Current Property Tax Rates and Market Conditions

As of 2023, Lee County’s total millage rate stands at 7.70 mills, a slight increase from the previous year. This rate is composed of millage rates set by various local government entities, including the County Commission, School Board, and special districts.

The current market conditions in Lee County are characterized by a robust real estate market, with increasing property values due to high demand and limited inventory. This appreciation in property values, coupled with the slightly higher millage rate, may result in an increased property tax burden for some homeowners.

| Entity | Millage Rate (Mills) |

|---|---|

| County Commission | 1.20 |

| School Board | 3.85 |

| Special Districts | 2.65 |

Breaking down the millage rate by entity provides a clearer picture of how the total millage rate is determined. The School Board, with its significant millage rate, plays a substantial role in funding education-related initiatives and operations.

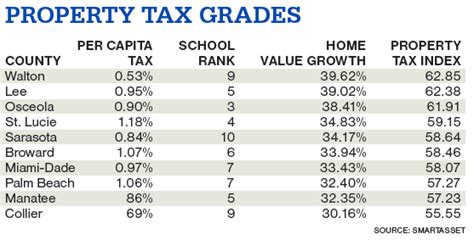

Comparative Analysis with Other Florida Counties

When compared to other counties in Florida, Lee County’s property tax rates are relatively moderate. Some counties, particularly those with larger urban centers, may have higher millage rates to support more extensive infrastructure and services. However, Lee County’s balance between providing essential services and maintaining a competitive tax environment is a key factor in its appeal to homeowners and investors.

For instance, a comparative analysis with neighboring counties reveals that Lee County's millage rate is slightly lower than that of Collier County (8.00 mills) but higher than Charlotte County (7.00 mills). These variations highlight the unique financial considerations and priorities of each county's local government.

Impact of Property Tax Rates on Homeownership

Property tax rates are a significant consideration for individuals contemplating homeownership in Lee County. While the county’s tax rates are generally competitive, it’s essential to factor in the potential impact on monthly expenses. For first-time homebuyers, in particular, understanding the tax liability can be crucial in financial planning and budgeting.

Consider the example of a hypothetical homeowner with a property valued at $300,000. Using the current millage rate of 7.70 mills, the annual property tax would be calculated as follows: $300,000 x 0.0770 = $2,310. This amount could be divided into two installments, with the first due by November 30 and the second by March 31 of the following year.

For those considering a move to Lee County, researching property tax rates and understanding the potential financial commitments is an essential step in the home-buying process. It's advisable to consult with local real estate professionals and financial advisors to gain a comprehensive understanding of the county's tax landscape.

Lee County’s Property Tax Relief Programs

Lee County recognizes the financial obligations that come with property ownership and offers a range of property tax relief programs to assist homeowners. These initiatives are designed to provide support to eligible residents, making homeownership more affordable and sustainable.

Homestead Exemption

The Homestead Exemption is one of the most significant property tax relief programs in Lee County. This exemption reduces the taxable value of a property for homeowners who use it as their primary residence. The amount of the exemption depends on various factors, including the date of residency and other qualifications.

To qualify for the Homestead Exemption, homeowners must meet certain criteria, such as:

- The property must be the primary residence of the homeowner.

- The homeowner must be a Florida resident.

- The homeowner must apply for the exemption annually by a specified deadline.

The Homestead Exemption can significantly reduce the taxable value of a property, resulting in lower property taxes. For example, if a homeowner qualifies for a $50,000 Homestead Exemption on a property valued at $300,000, the taxable value would be reduced to $250,000. This reduction in taxable value directly impacts the property tax calculation, potentially saving the homeowner hundreds of dollars annually.

Senior Citizen Discounts

Lee County offers additional property tax relief for senior citizens, providing a discount on property taxes for homeowners aged 65 or older. The discount percentage is determined by the county and can vary from year to year. This initiative aims to support senior citizens in maintaining their homes and ensuring their financial stability during retirement.

To qualify for the Senior Citizen Discount, homeowners must meet the following criteria:

- The homeowner must be 65 years of age or older.

- The property must be the primary residence of the homeowner.

- The homeowner must apply for the discount annually by a specified deadline.

The Senior Citizen Discount can provide a substantial reduction in property taxes, offering senior homeowners financial relief and peace of mind. For instance, if a senior homeowner qualifies for a 20% discount on their property taxes, they could save a significant amount each year, especially when coupled with other tax relief programs.

Additional Property Tax Relief Programs

In addition to the Homestead Exemption and Senior Citizen Discount, Lee County offers several other property tax relief programs to assist eligible homeowners. These programs are designed to provide financial support to specific groups or for specific purposes, ensuring that property ownership remains accessible and sustainable for a diverse range of residents.

- Widow/Widower Exemption: This exemption provides a reduction in taxable value for surviving spouses of deceased homeowners.

- Totally and Permanently Disabled Exemption: Designed to assist individuals who are permanently disabled, this exemption reduces the taxable value of their property.

- Military Service Exemption: Lee County offers property tax exemptions for active-duty military personnel and veterans, honoring their service and supporting their financial well-being.

- Agricultural Exemption: To promote the preservation of farmland, Lee County provides a reduced assessment for properties used for agricultural purposes.

These additional relief programs demonstrate Lee County's commitment to supporting its residents and ensuring that property ownership is an achievable goal for a wide range of individuals and families. By offering a comprehensive suite of tax relief initiatives, the county fosters a sense of community and stability, encouraging long-term residency and investment.

The Impact of Lee County’s Property Taxes on the Local Economy

Lee County’s property taxes play a pivotal role in shaping the local economy, influencing various aspects from real estate market dynamics to business development and community infrastructure. Understanding this intricate relationship provides valuable insights into the economic health and future prospects of the region.

Real Estate Market Dynamics

Property taxes are a significant consideration for homebuyers and investors in Lee County’s real estate market. The tax liability can impact the affordability of properties, affecting the decision-making process for prospective buyers. A competitive and predictable property tax environment, as offered by Lee County, can stimulate market activity and attract investment.

For instance, a stable property tax structure encourages long-term investments in real estate, as homeowners and investors can better forecast their financial obligations. This predictability fosters confidence in the market, leading to increased transactions and a healthier real estate ecosystem.

Business Development and Job Creation

Lee County’s property tax structure also influences business development and job creation within the region. Businesses, particularly those considering expansion or relocation, carefully evaluate the tax landscape as a key factor in their decision-making process.

A competitive property tax environment can make Lee County an attractive destination for businesses, leading to increased economic activity and job opportunities. Lower property taxes can reduce overhead costs for businesses, making it more feasible to establish or expand operations in the county. This, in turn, contributes to a thriving local economy and enhances the county's reputation as a business-friendly location.

Funding Essential Services and Community Infrastructure

Property taxes are a primary source of revenue for local governments, including Lee County. This revenue is vital for funding essential services such as public safety, education, healthcare, and community infrastructure development.

By collecting property taxes, Lee County is able to:

- Support a robust public school system, ensuring high-quality education for its residents.

- Maintain and improve critical infrastructure, including roads, bridges, and public transportation systems.

- Provide emergency services, ensuring the safety and well-being of the community.

- Invest in environmental initiatives, preserving the county's natural beauty and resources.

The efficient allocation of property tax revenue is crucial for maintaining and enhancing the quality of life in Lee County. A well-managed tax system ensures that residents receive the services and amenities they need, fostering a sense of community and civic pride.

Community Engagement and Civic Participation

Lee County’s property tax system also encourages community engagement and civic participation. Residents have a vested interest in the tax process, as they directly benefit from the services and infrastructure funded by property taxes. This connection fosters a sense of ownership and responsibility within the community.

Through town hall meetings, public hearings, and other participatory avenues, residents have the opportunity to voice their opinions and influence the tax decision-making process. This engagement strengthens the democratic principles of the county and ensures that the tax system remains responsive to the needs and aspirations of the community.

Sustainable Economic Growth

The impact of Lee