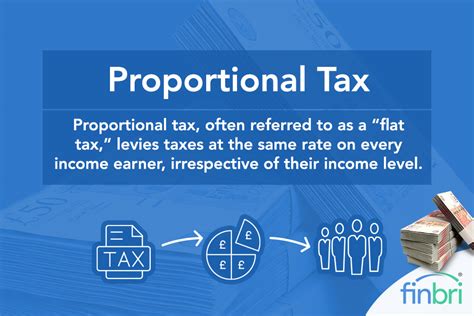

Proportional Tax Definition

Understanding the concept of a proportional tax is essential in the realm of taxation and economics. It forms the basis for a fundamental system of taxation, impacting individuals and businesses alike. Let's delve into the specifics of what a proportional tax is, how it works, and its implications.

Defining Proportional Tax

A proportional tax, often referred to as a flat tax, is a tax system where individuals or entities pay a fixed percentage of their income or revenue as tax, regardless of their total earnings or turnover. In simpler terms, the tax rate remains the same across all income levels, resulting in a consistent amount of tax owed for each dollar earned.

For instance, if the proportional tax rate is set at 15%, an individual earning $10,000 would pay $1,500 in taxes, while someone earning $50,000 would pay $7,500, maintaining the same tax-to-income ratio.

How Does Proportional Tax Work?

The mechanics of a proportional tax system are straightforward. The tax authority, often a government body, establishes a flat tax rate, which is then applied uniformly to all taxpayers. This rate remains constant, ensuring fairness and simplicity in tax calculations.

Consider a scenario where the government sets a proportional tax rate of 20% on personal income. In this system, every individual earning any amount of income pays 20% of their earnings as tax. So, an individual earning $20,000 annually would pay $4,000 in taxes, while someone with a $100,000 income would contribute $20,000 to the tax revenue.

Calculation Example

Let’s illustrate this with a concrete example. Suppose we have two individuals, Alice and Bob, who have different annual incomes.

| Individual | Annual Income ($) | Tax Rate (%) | Tax Owed ($) |

|---|---|---|---|

| Alice | 50,000 | 18 | 9,000 |

| Bob | 100,000 | 18 | 18,000 |

In this scenario, both Alice and Bob pay an equal percentage of their income as tax, despite their varying income levels. This uniformity is the hallmark of a proportional tax system.

Key Characteristics and Implications

- Simplicity and Transparency: Proportional tax systems are known for their simplicity. The flat rate structure makes tax calculations straightforward and reduces the complexity often associated with progressive tax systems.

- Fairness Debate: While proponents argue that a flat tax ensures equal treatment for all taxpayers, critics raise concerns about its fairness. As the tax rate remains constant, those with higher incomes pay a smaller percentage of their earnings in taxes, which can be seen as favoring the wealthy.

- Revenue Generation: The predictability of a flat tax rate can lead to more stable tax revenue for governments. However, it may not generate enough revenue to fund extensive social welfare programs or address income inequality.

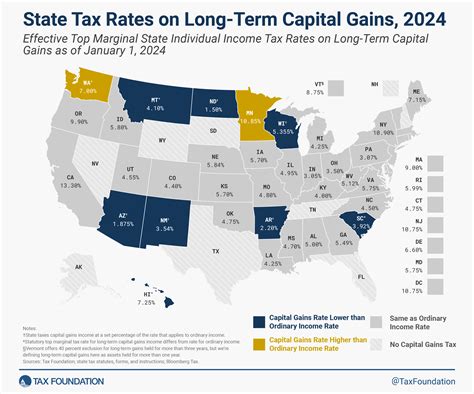

- International Comparisons: Proportional tax systems are less common globally compared to progressive tax systems. However, certain countries like Estonia and some U.S. states have implemented flat tax rates, providing real-world examples for analysis.

Real-World Applications and Case Studies

To gain a deeper understanding, let’s explore how proportional tax systems have been implemented and their impact.

Case Study: Estonia’s Flat Tax

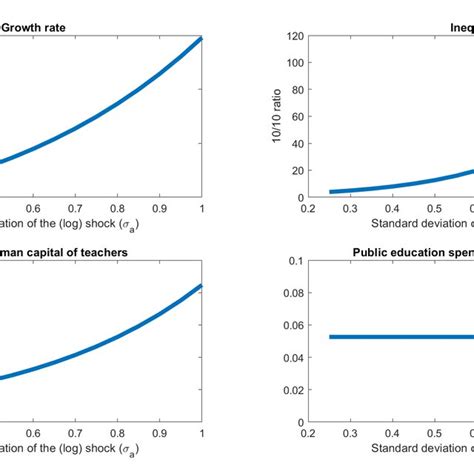

Estonia, a Baltic nation, introduced a flat tax rate of 21% in 1994. This move was aimed at simplifying the tax system and attracting foreign investment. The flat tax, combined with other economic reforms, contributed to Estonia’s rapid economic growth in the following decades.

The Estonian experience offers valuable insights into the potential benefits and challenges of a flat tax system. While it promoted economic efficiency, it also raised questions about social equity, particularly in the context of public services and welfare support.

Lessons from U.S. States

In the United States, several states have adopted flat tax rates for income tax. For example, Colorado and Pennsylvania have a flat tax rate of 3.07% for personal income tax. These states provide a microcosm for studying the effects of flat taxes within a federal system.

While these states have achieved tax simplicity, they also face the challenge of balancing their budgets and providing essential services, especially in regions with diverse income levels.

Conclusion: A Balancing Act

In conclusion, a proportional tax system, with its simplicity and uniformity, offers an intriguing approach to taxation. However, its implementation requires careful consideration of a nation’s unique economic, social, and political landscape. As we’ve seen, the real-world applications of flat taxes provide valuable lessons on the trade-offs between efficiency, fairness, and revenue generation.

As we navigate the complex world of taxation, understanding systems like proportional tax is crucial for informed decision-making and policy development.

What are the advantages of a proportional tax system?

+A proportional tax system offers simplicity and transparency in tax calculations. It ensures that everyone pays the same rate, regardless of income, which can be seen as fair and easy to understand. This system also provides stability in tax revenue for governments.

Are there any countries with a pure proportional tax system?

+While pure proportional tax systems are less common globally, countries like Estonia and some U.S. states have implemented flat tax rates. These provide real-world examples for studying the effects of such systems.

How does a proportional tax system impact income inequality?

+Proportional tax systems, with their flat rate structure, can be seen as favoring those with higher incomes. As the tax rate remains constant, higher-income earners pay a smaller percentage of their income in taxes compared to lower-income individuals. This can exacerbate income inequality if not accompanied by other social welfare measures.