Franklin County Ohio Sales Tax

In Franklin County, Ohio, sales tax is an essential aspect of the local economy, impacting both residents and businesses. This article aims to delve into the intricacies of Franklin County's sales tax, providing a comprehensive guide to understanding its rates, regulations, and implications. By exploring the county's unique tax landscape, we can gain insights into how it influences consumer behavior, business strategies, and the overall economic health of the region.

Understanding Franklin County’s Sales Tax Structure

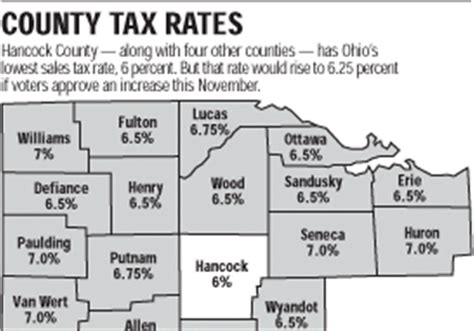

Franklin County, like many other counties in Ohio, operates under a combined state and local sales tax system. This means that the sales tax rate is a combination of the state-level tax and any additional local taxes imposed by the county and municipal governments. As of my last update in January 2023, the sales tax landscape in Franklin County is as follows:

| Tax Jurisdiction | Sales Tax Rate |

|---|---|

| Ohio State | 5.75% |

| Franklin County | 1.25% |

| Columbus City | 1.5% |

| Total Sales Tax Rate | 8.5% |

The state of Ohio imposes a base sales tax rate of 5.75%, which is consistent across the state. However, Franklin County adds an additional 1.25% to this rate, bringing the county-level tax to 7%. Furthermore, within the county, the city of Columbus has its own local tax of 1.5%, resulting in a total sales tax rate of 8.5% for purchases made within the city limits.

Sales Tax Exemptions and Special Considerations

It’s important to note that certain items and services are exempt from sales tax in Franklin County. These exemptions vary depending on the nature of the transaction and the items involved. For example, most groceries, prescription medications, and non-prepared food items are generally exempt from sales tax. Additionally, there are specific exemptions for certain industries, such as manufacturing and agriculture, to encourage economic growth in these sectors.

Furthermore, Franklin County offers tax incentives and abatements to attract and retain businesses. These incentives can take the form of reduced tax rates for specific industries or tax breaks for businesses that meet certain criteria, such as job creation or investment in the community. These measures aim to stimulate economic development and make the county more competitive in attracting new businesses.

The Impact of Sales Tax on Businesses and Consumers

The sales tax rate in Franklin County has a significant impact on both businesses and consumers. For businesses, especially those in the retail sector, the sales tax rate can influence pricing strategies, profit margins, and overall competitiveness. A higher sales tax rate may encourage businesses to adjust their pricing to maintain profitability, which can, in turn, impact consumer behavior.

Consumers, on the other hand, are directly affected by the sales tax rate. A higher sales tax rate can make purchases more expensive, potentially influencing shopping habits and spending patterns. Consumers may opt to make larger purchases online or in neighboring counties with lower sales tax rates to save money. This behavior can have a ripple effect on local businesses, impacting their revenue and market share.

Strategies for Businesses to Navigate Sales Tax Challenges

To mitigate the impact of sales tax on their operations, businesses in Franklin County employ various strategies. Some businesses absorb the sales tax into their pricing, presenting a consistent and straightforward price to consumers. Others may choose to pass on the tax to the consumer, displaying the sales tax as a separate line item on the receipt. This transparency can help build trust with consumers and maintain a competitive advantage.

Additionally, businesses can leverage technology to streamline sales tax compliance. Utilizing sales tax automation software can help businesses stay updated with the latest tax rates, exemptions, and regulations, ensuring accurate tax calculations and timely filings. This not only reduces the risk of non-compliance but also frees up valuable time and resources for businesses to focus on their core operations.

Franklin County’s Sales Tax: A Case Study

To illustrate the impact of sales tax on businesses and consumers, let’s consider a case study of a local retail store in Franklin County, Ohio. “The Shop,” as we’ll call it, specializes in selling electronics and appliances. With the county’s sales tax rate at 8.5%, the store’s management must carefully consider their pricing strategies to remain competitive.

The Shop's owners decide to adopt a hybrid pricing strategy. They offer a limited number of deeply discounted products, absorbing the sales tax to provide a compelling offer to price-conscious consumers. For the majority of their products, they choose to pass on the sales tax to the customer, displaying the tax amount separately on the receipt. This strategy allows them to maintain profitability while still offering competitive prices.

However, the impact of sales tax goes beyond pricing. The Shop's management also recognizes the potential for consumers to shop online or in neighboring counties with lower tax rates. To counter this, they invest in building a strong online presence, offering convenient delivery and installation services, and providing excellent customer support. By enhancing the overall shopping experience, they aim to encourage customer loyalty and mitigate the impact of sales tax on their business.

The Role of Local Government in Shaping Sales Tax Policies

The local government of Franklin County plays a crucial role in shaping sales tax policies and their implementation. The county commissioners, in collaboration with state authorities, determine the additional tax rate imposed at the county level. This decision-making process involves considering the economic needs and goals of the county, such as funding infrastructure projects, supporting public services, and attracting new businesses.

Furthermore, the local government works closely with businesses and community stakeholders to ensure that sales tax policies are fair and beneficial to all parties involved. They provide resources and guidance to help businesses understand and comply with the tax regulations, organize community forums to gather feedback, and continuously evaluate the impact of sales tax on the local economy. By fostering open communication and collaboration, the local government aims to create a sustainable and prosperous business environment in Franklin County.

Future Outlook and Potential Changes

As Franklin County continues to evolve economically, the sales tax landscape may also undergo changes. The county’s leadership and local businesses must stay agile and adapt to shifting market dynamics and consumer preferences. Here are some potential future developments and their implications:

- E-commerce Growth: With the increasing popularity of online shopping, Franklin County may need to adapt its sales tax policies to effectively tax e-commerce transactions. This could involve implementing a sales tax on online purchases or finding innovative ways to collect and manage these taxes.

- Tax Incentives for Economic Development: To attract and retain businesses, the county may explore offering more tax incentives and abatements. These incentives could be tailored to specific industries or geographic areas, encouraging economic growth and job creation.

- Tax Simplification: Complex tax systems can be a challenge for both businesses and consumers. Franklin County could consider simplifying its sales tax structure, potentially consolidating different tax rates or streamlining tax exemptions to make compliance easier and more efficient.

Staying informed about these potential changes and their impact is crucial for businesses and consumers alike. By understanding the evolving sales tax landscape, stakeholders can make informed decisions and adapt their strategies to thrive in the dynamic economic environment of Franklin County.

How often are sales tax rates updated in Franklin County, Ohio?

+

Sales tax rates in Franklin County, Ohio, are typically updated annually to align with state and local tax policies. These updates often occur at the beginning of the fiscal year or after significant legislative changes. It’s important for businesses and consumers to stay informed about any rate changes to ensure compliance and accurate pricing.

Are there any online resources to help calculate sales tax in Franklin County?

+

Yes, there are several online tools and calculators available to assist with sales tax calculations in Franklin County. These resources can help businesses and individuals quickly determine the applicable tax rate for their purchases or transactions. It’s recommended to use reputable sources to ensure accurate results.

How can businesses stay compliant with sales tax regulations in Franklin County?

+

Businesses can ensure compliance with sales tax regulations in Franklin County by staying updated with the latest tax rates, exemptions, and filing requirements. Utilizing sales tax automation software, seeking professional guidance, and regularly reviewing tax records can help businesses maintain compliance and avoid penalties.