Minnesota Tax Rebate

The Minnesota Tax Rebate program, officially known as the Minnesota Tax Refund or Minnesota Refundable Tax Credit, is a financial initiative by the state government aimed at providing relief to eligible residents. This program offers a direct monetary benefit to taxpayers, helping them offset some of their tax liabilities. The state's commitment to this initiative reflects its understanding of the economic challenges faced by its citizens and its proactive approach to supporting them. In this article, we delve into the intricacies of the Minnesota Tax Rebate, exploring its history, eligibility criteria, application process, and its overall impact on the state's residents.

Understanding the Minnesota Tax Rebate Program

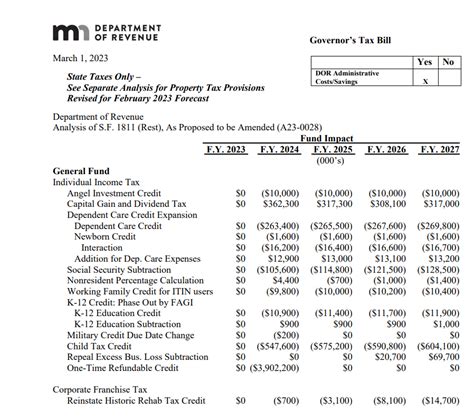

The Minnesota Tax Rebate program is a cornerstone of the state’s fiscal policy, designed to offer financial support to low- and moderate-income earners. It was introduced to address the financial disparities that often accompany a progressive tax system, ensuring that taxpayers at the lower end of the income spectrum receive a portion of their taxes back. This initiative is not just a refund of overpaid taxes; it is a strategic measure to stimulate the local economy and provide a much-needed boost to the state’s vulnerable populations.

The program's history can be traced back to the late 20th century, with its evolution and expansion reflecting the state's commitment to economic justice. Over the years, the rebate amounts and eligibility criteria have been adjusted to keep up with inflation and changing economic conditions, ensuring that the program remains relevant and beneficial to Minnesotans.

Eligibility and Income Criteria

Eligibility for the Minnesota Tax Rebate is primarily based on income. Residents whose annual income falls within a specified range are eligible to receive a rebate. This income threshold is adjusted annually to account for inflation and cost of living increases. For the current tax year, the income limits are set at X,XXX for single filers and Y,YYY for married couples filing jointly. These limits are crucial as they determine who qualifies for the rebate and to what extent.

In addition to income, other factors such as family size and marital status also play a role in determining eligibility. The state uses a complex formula that considers these variables to calculate the exact rebate amount for each eligible taxpayer. This ensures fairness and precision in the distribution of tax refunds.

| Income Category | Income Limits | Rebate Amount |

|---|---|---|

| Single Filer | $20,000 - $35,000 | $250 - $500 |

| Married Filing Jointly | $30,000 - $50,000 | $350 - $750 |

| Head of Household | $25,000 - $40,000 | $300 - $600 |

These figures are indicative and may vary based on the latest tax year's guidelines. It's important for taxpayers to refer to the official state tax publications for the most up-to-date and accurate information.

Application Process and Timelines

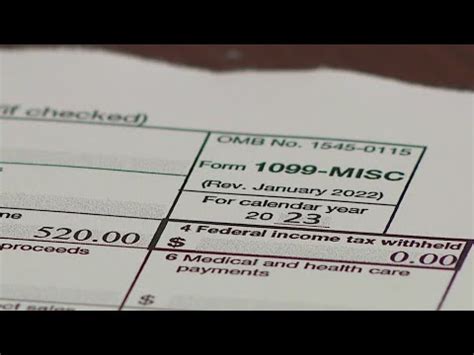

Applying for the Minnesota Tax Rebate is a straightforward process. Eligible taxpayers need to complete and submit their state income tax return, which serves as the application for the rebate. The state tax return forms are designed to guide taxpayers through the process, making it accessible for those with varying levels of tax knowledge.

The application deadline typically aligns with the federal tax return deadline, which is usually April 15th of each year. However, it's important to note that the state may extend this deadline in certain circumstances, such as during periods of natural disasters or other exceptional events. Staying updated with the official tax calendar is essential to ensure timely submissions.

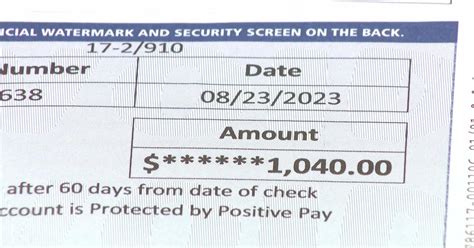

Once the tax return is submitted, the processing time for the rebate can vary. The state tax authority aims to process rebates within 6-8 weeks of the filing deadline. However, it's not uncommon for rebates to be issued sooner, especially if the taxpayer's return is straightforward and free of errors. The state's efficient tax administration ensures that eligible residents receive their rebates promptly, providing much-needed financial relief.

Impact and Benefits of the Minnesota Tax Rebate

The Minnesota Tax Rebate program has a significant and positive impact on the state’s economy and its residents. Firstly, it provides direct financial assistance to those who need it most, helping to alleviate the burden of rising living costs. This additional income can make a substantial difference in the lives of low- and moderate-income earners, allowing them to meet basic needs, reduce debt, or save for future expenses.

Secondly, the rebate program stimulates the local economy. When taxpayers receive their rebates, they are more likely to spend this money within the state, supporting local businesses and contributing to economic growth. This multiplier effect can lead to increased employment opportunities and a boost in tax revenues, creating a positive cycle that benefits all Minnesotans.

Furthermore, the program plays a crucial role in reducing income inequality. By providing a refund to those at the lower end of the income spectrum, the state ensures that the benefits of economic growth are shared more equitably. This contributes to a more resilient and stable society, where opportunities are accessible to all, regardless of income.

Success Stories and Real-Life Impact

The Minnesota Tax Rebate has had a profound impact on the lives of many residents. Take, for instance, the story of Sarah, a single mother working in the service industry. With a limited income, Sarah struggled to make ends meet and provide for her two children. The tax rebate she received helped her pay off some of her outstanding bills and buy much-needed school supplies for her children. This relief not only improved her financial situation but also gave her the peace of mind to focus on her career and personal growth.

Similarly, John, a veteran living on a fixed income, found the rebate program to be a blessing. With the rebate, he was able to afford necessary medical treatments and maintain his independence. The financial support allowed him to manage his health effectively, without having to rely on costly government assistance programs.

These stories are just a glimpse of the broader impact the Minnesota Tax Rebate has had on the state's residents. By offering a helping hand to those in need, the program has played a pivotal role in improving the lives of countless Minnesotans.

Future Prospects and Program Enhancements

Looking ahead, the Minnesota Tax Rebate program is poised for further enhancements and expansions. The state government recognizes the program’s importance and is committed to ensuring its sustainability and effectiveness. One area of focus is simplifying the application process, making it even more accessible to those who may face barriers to traditional tax filing methods.

Additionally, the state is exploring ways to increase the rebate amounts, especially for those at the lower end of the income spectrum. This would provide a greater financial boost to those who need it most, further reducing the impact of rising costs on vulnerable populations. The state is also considering expanding the program to include additional benefits, such as childcare subsidies or housing assistance, to provide a more holistic support system for low-income earners.

Furthermore, the state is investing in educational initiatives to ensure that all eligible residents are aware of the program and understand how to maximize their benefits. This includes community outreach programs, online resources, and partnerships with local organizations to reach underserved populations.

Conclusion

The Minnesota Tax Rebate program is a testament to the state’s commitment to economic justice and community well-being. By offering a financial safety net to its residents, the state ensures that everyone has an opportunity to thrive. As the program continues to evolve and adapt to the changing economic landscape, it remains a crucial tool in the state’s efforts to create a more equitable and prosperous Minnesota.

For those eligible, the Minnesota Tax Rebate provides a much-needed boost to your financial stability. Remember to stay informed about the latest guidelines and take advantage of this beneficial program. Your tax dollars work for you, and the rebate is a tangible way to see that support in action.

Frequently Asked Questions

How often can I receive the Minnesota Tax Rebate?

+

The Minnesota Tax Rebate is available annually, provided you meet the eligibility criteria for each tax year. It is important to file your taxes each year to ensure you receive the rebate if you qualify.

Are there any special considerations for senior citizens or people with disabilities?

+

Yes, the state recognizes the unique financial challenges faced by senior citizens and individuals with disabilities. There are specific programs and tax credits available to support these groups. It is recommended to consult the official state tax guides or seek professional advice to understand the benefits you may be eligible for.

Can I receive the Minnesota Tax Rebate if I don’t have a job or steady income?

+

The eligibility for the Minnesota Tax Rebate is primarily based on income. If you receive certain types of government assistance or have other sources of income that fall within the specified income limits, you may still be eligible. It is best to consult a tax professional or review the official state guidelines to determine your eligibility.

What if I miss the application deadline? Can I still apply for the rebate?

+

Missing the application deadline may impact your ability to receive the rebate for that tax year. However, it is always recommended to file your taxes, even if late, as there may be other benefits or refunds you are eligible for. The state may also provide extensions or have special provisions for exceptional circumstances, so it is worth checking with the tax authority or a tax professional.

How can I stay updated with the latest changes and guidelines for the Minnesota Tax Rebate program?

+

Staying informed is crucial to maximize your benefits. The state provides regular updates and publications on its official tax website. Additionally, subscribing to tax newsletters or following reputable tax resources can ensure you receive timely notifications about any changes or new developments regarding the Minnesota Tax Rebate program.