State Of Nm Income Tax

In the state of New Mexico, income tax is an essential aspect of the state's revenue generation, contributing significantly to the overall economic landscape. With a progressive tax structure, New Mexico's income tax system is designed to support the state's operations, services, and infrastructure. Understanding the intricacies of New Mexico's income tax is crucial for residents, businesses, and investors alike, as it provides insights into the state's financial health and the potential implications for individuals and enterprises.

New Mexico’s Progressive Income Tax Structure

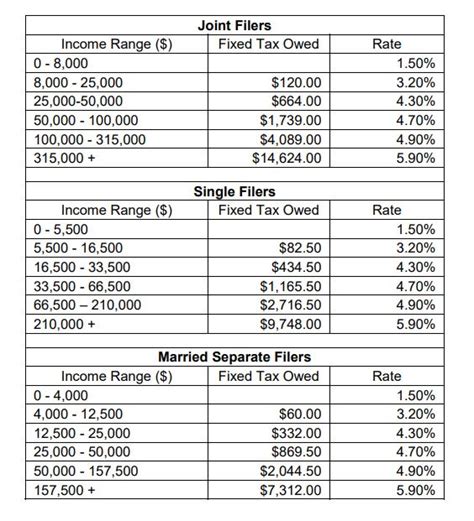

New Mexico employs a progressive income tax system, meaning that higher incomes are taxed at higher rates. This approach aims to ensure a fair distribution of tax burdens, allowing those with higher earnings to contribute proportionally more to the state’s revenue. The tax rates are categorized into income brackets, with each bracket having a specific tax rate associated with it.

| Income Bracket | Tax Rate |

|---|---|

| $0 - $5,500 | 2.25% |

| $5,501 - $11,000 | 3.25% |

| $11,001 - $16,000 | 4.75% |

| $16,001 - $21,000 | 5.25% |

| Over $21,000 | 5.9% |

This progressive structure ensures that individuals and families with lower incomes are taxed at lower rates, providing them with a more manageable financial burden. As incomes increase, so do the tax rates, allowing the state to collect more revenue from those who can afford to contribute more.

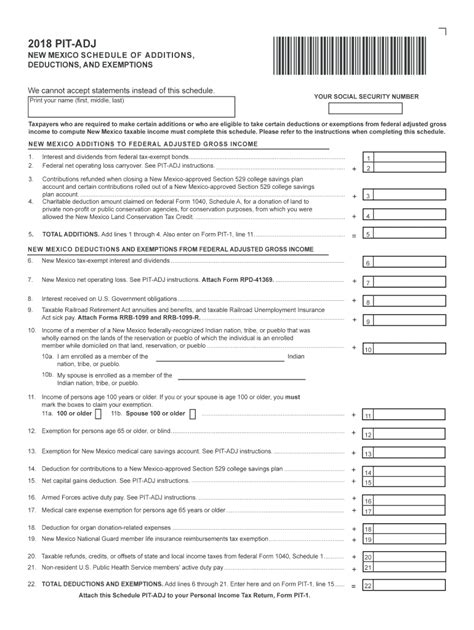

Filing Status and Deductions

New Mexico’s income tax system considers various filing statuses, including single, married filing jointly, married filing separately, and head of household. Each status has its own set of deductions and credits, allowing taxpayers to reduce their taxable income and potentially lower their overall tax liability.

For instance, taxpayers can claim deductions for medical expenses, charitable contributions, mortgage interest, and state and local taxes. Additionally, New Mexico offers various credits, such as the Working Family Tax Credit, which provides a refundable credit to low- and moderate-income families.

Impact on Individuals and Businesses

The income tax system in New Mexico has a direct impact on the financial well-being of individuals and the growth of businesses within the state. For individuals, understanding the tax brackets and available deductions is crucial for effective financial planning and tax management. By being aware of the tax structure, individuals can make informed decisions about their earnings, investments, and savings strategies.

Businesses, on the other hand, need to consider the state's income tax rates when making financial projections and strategic decisions. The income tax rates can influence business expansion plans, hiring practices, and overall profitability. Moreover, businesses may also be eligible for certain tax incentives and credits offered by the state, which can further impact their financial strategies.

Economic Development and Tax Incentives

New Mexico actively promotes economic development through various tax incentives and programs. The state offers tax credits for job creation, research and development, and investment in certain industries. These incentives are designed to attract businesses and encourage economic growth, ultimately leading to more job opportunities and a stronger state economy.

For instance, the New Mexico Film Production Tax Credit has been a significant driver of economic activity, attracting film and television productions to the state. This incentive program has not only brought in substantial revenue but has also boosted tourism and created numerous job opportunities in the entertainment industry.

Compliance and Filing Requirements

Understanding the compliance requirements is crucial for individuals and businesses operating in New Mexico. The state has specific deadlines for filing tax returns and making payments. Failure to meet these deadlines can result in penalties and interest charges.

For individuals, the filing deadline is typically April 15th, while for businesses, it may vary depending on the type of entity and the fiscal year-end. It's essential to stay informed about these deadlines and to ensure that all necessary tax forms and documentation are submitted accurately and on time.

Online Filing and Payment Options

New Mexico provides convenient online filing and payment options through its official website. Taxpayers can access their tax accounts, file returns, make payments, and track the status of their refunds or payments online. This digital platform simplifies the tax filing process and offers a user-friendly interface for both individuals and businesses.

Additionally, the state's tax agency provides resources and guidance to assist taxpayers in understanding their obligations and navigating the tax system. This includes publications, forms, and FAQs that address common questions and concerns related to income tax in New Mexico.

Future Outlook and Potential Changes

The income tax landscape in New Mexico is subject to change, influenced by economic conditions, legislative decisions, and the state’s financial needs. While the current progressive tax structure has been effective in generating revenue and supporting the state’s operations, future tax reforms could bring about modifications to the tax rates, brackets, or deductions.

The state's tax policies are often shaped by political ideologies and economic priorities. As such, taxpayers should stay informed about any proposed or enacted tax changes, as these can impact their financial planning and decision-making processes.

Potential Tax Reform Initiatives

New Mexico has seen discussions and proposals for tax reform in recent years. Some of these initiatives aim to simplify the tax code, reduce rates for certain income brackets, or introduce new tax credits and deductions to support specific industries or social causes.

For instance, there have been proposals to lower the top income tax rate or to introduce a flat tax rate structure. These reforms are aimed at making the tax system more competitive, encouraging economic growth, and potentially reducing the tax burden for certain taxpayers.

It's worth noting that tax reform initiatives may take time to implement and often require careful consideration and public consultation. As such, taxpayers should monitor these developments to understand how potential changes could impact their financial situations.

Conclusion: Navigating New Mexico’s Income Tax Landscape

New Mexico’s income tax system is a vital component of the state’s financial ecosystem, providing revenue for essential services and infrastructure. By understanding the progressive tax structure, filing requirements, and potential tax incentives, individuals and businesses can navigate the tax landscape effectively.

Staying informed about tax changes, utilizing online filing and payment options, and taking advantage of available deductions and credits can help taxpayers manage their financial obligations efficiently. As the state continues to evolve and adapt its tax policies, staying updated ensures that individuals and businesses can make well-informed decisions and contribute to the economic growth and prosperity of New Mexico.

What is the current tax rate for New Mexico’s highest income bracket?

+As of the most recent information, the tax rate for New Mexico’s highest income bracket is 5.9%.

Are there any tax incentives for businesses operating in New Mexico?

+Yes, New Mexico offers various tax incentives for businesses, including tax credits for job creation, research and development, and investment in specific industries. These incentives aim to attract businesses and drive economic growth.

How can I stay updated on potential tax changes in New Mexico?

+To stay informed about potential tax changes, you can regularly check the official websites of the New Mexico Taxation and Revenue Department and follow local news sources that cover tax-related topics. Additionally, tax professionals and industry associations often provide updates and analysis on tax reforms.