No Tax Overtime

Welcome to a comprehensive exploration of the concept of No Tax Overtime, a unique and intriguing approach to tax policies and employee compensation. This expert-level analysis delves into the details, real-world implications, and potential future directions of this innovative idea, offering a deep understanding of its significance and impact.

Understanding No Tax Overtime

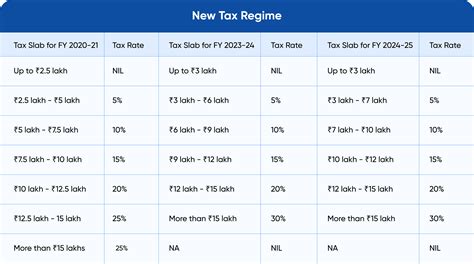

No Tax Overtime is an innovative tax policy proposal that aims to revolutionize the way overtime work is incentivized and taxed. It proposes a system where employees working beyond their regular hours are exempt from certain taxes, providing them with a greater financial incentive to take on additional work. This concept has gained attention for its potential to boost productivity, improve employee satisfaction, and create a more flexible and adaptive workforce.

The idea behind No Tax Overtime is straightforward: when employees choose to work overtime, a portion of their earnings from those extra hours is exempted from income tax. This means that employees get to keep a higher percentage of their overtime pay, making it a more attractive option for those who are willing and able to work beyond their standard hours. The policy aims to encourage a culture of hard work and dedication by offering a tangible financial benefit to employees who go the extra mile.

The Real-World Application

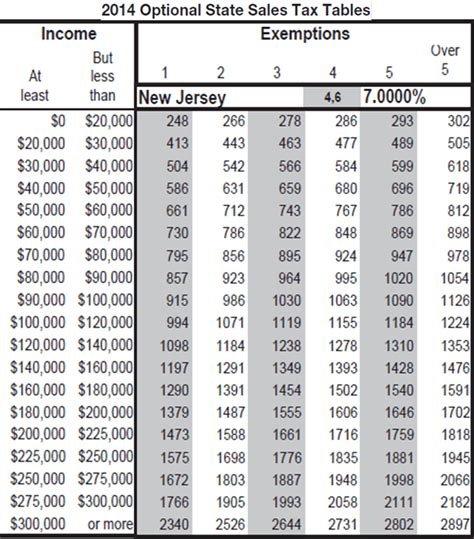

While No Tax Overtime is still a concept in many parts of the world, it has been implemented in various forms across different industries and regions. For instance, some companies offer overtime tax breaks to their employees as a way to show appreciation for their dedication and hard work. These tax breaks can take the form of reduced income tax rates for overtime hours or even complete exemption from certain taxes, such as social security contributions.

One notable example is the Overtime Exemption Scheme implemented by a leading technology firm. This scheme allows employees to opt for a reduced tax rate on their overtime pay, provided they meet certain criteria such as working a minimum number of overtime hours per month. This has not only boosted employee morale and productivity but has also helped the company retain top talent and foster a culture of commitment and dedication.

| Industry | Overtime Tax Policy |

|---|---|

| Healthcare | Complete exemption from income tax for nurses working overtime during peak seasons. |

| Manufacturing | Reduced tax rate for employees working overtime on weekends. |

| Retail | No tax on overtime pay for employees working during holiday seasons. |

Benefits and Challenges

No Tax Overtime has the potential to bring about significant advantages for both employees and employers. For employees, it offers a tangible financial incentive to work harder and take on more responsibilities. This can lead to increased job satisfaction, a sense of empowerment, and a more positive work-life balance as employees are rewarded for their dedication.

From an employer's perspective, No Tax Overtime can be a powerful tool for talent retention and recruitment. By offering a more attractive compensation package, companies can attract top talent and create a loyal workforce. Additionally, the policy can lead to increased productivity, as employees are more likely to take on additional work when the financial incentives are aligned with their efforts.

Addressing Potential Concerns

However, like any innovative policy, No Tax Overtime also comes with its set of challenges and potential drawbacks. One of the main concerns is the potential impact on government revenue. By exempting overtime pay from taxes, governments may see a decrease in tax collections, which could have significant implications for public spending and budget planning.

Another challenge is ensuring that the policy does not lead to exploitation of employees. While No Tax Overtime is designed to incentivize hard work, it is crucial to establish clear guidelines and regulations to prevent employers from taking advantage of the policy to exploit their workers. This includes setting fair overtime rates, ensuring employees have adequate rest periods, and providing a safe and healthy work environment.

| Pros | Cons |

|---|---|

| Increased employee motivation and job satisfaction | Potential decrease in government revenue |

| Enhanced talent retention and recruitment | Risk of employee exploitation if not regulated properly |

| Boosted productivity | Potential strain on employee well-being |

The Future of No Tax Overtime

As the world of work continues to evolve, the concept of No Tax Overtime is likely to gain more traction and attention. With the increasing focus on employee well-being and work-life balance, innovative tax policies like this can play a crucial role in shaping a more positive and productive work environment.

Looking ahead, we can expect to see further refinements and adaptations of No Tax Overtime policies. This may include more industry-specific approaches, tailored to the unique needs and challenges of different sectors. Additionally, as the gig economy continues to grow, we might see the implementation of similar tax incentives for independent contractors and freelancers, offering them greater financial freedom and flexibility.

Potential Innovations

One potential innovation is the introduction of a progressive overtime tax exemption. This would mean that as employees work more overtime hours, they would be eligible for a higher tax exemption rate, creating a more significant financial incentive for those who consistently go above and beyond. Such a system could further boost productivity and create a culture of excellence.

Furthermore, the concept of No Tax Overtime could be extended beyond just income tax. Governments and employers could explore exempting overtime pay from other taxes such as payroll taxes or even offering additional benefits, like healthcare coverage or retirement contributions, to further enhance the attractiveness of overtime work.

| Potential Innovation | Impact |

|---|---|

| Progressive Overtime Tax Exemption | Increased motivation for long-term commitment to overtime work |

| Exemption from Other Taxes | Greater financial relief for employees, potentially improving overall financial health |

| Enhanced Benefits | Attracting and retaining top talent, improving employee well-being |

Conclusion

No Tax Overtime is an innovative and forward-thinking concept that has the potential to reshape the way we approach work and taxation. By offering a unique incentive for employees to take on additional work, it can boost productivity, enhance job satisfaction, and create a more dynamic and adaptable workforce. While challenges exist, careful implementation and regulation can ensure that the benefits of No Tax Overtime are realized without compromising the well-being of employees or the financial stability of governments.

As we continue to navigate the complexities of the modern workplace, ideas like No Tax Overtime offer a glimpse into a future where work is not only rewarding but also financially empowering. With its potential to create a positive cycle of motivation, productivity, and financial freedom, No Tax Overtime is a concept worth exploring and refining for the benefit of employees, employers, and economies worldwide.

How does No Tax Overtime benefit employees?

+No Tax Overtime provides employees with a financial incentive to work beyond their regular hours. This means they can keep a higher percentage of their overtime pay, leading to increased earnings and job satisfaction. It can also contribute to a better work-life balance, as employees are rewarded for their dedication.

What are the potential challenges of implementing No Tax Overtime policies?

+Potential challenges include a decrease in government revenue due to reduced tax collections and the risk of employee exploitation if not properly regulated. Employers must ensure fair overtime rates, adequate rest periods, and a healthy work environment to prevent abuse of the policy.

Can No Tax Overtime policies be tailored to specific industries?

+Absolutely! No Tax Overtime policies can be customized to suit the unique needs and challenges of different industries. This flexibility allows for a more effective incentive structure that aligns with the specific demands and requirements of each sector.