Spartanburg Tax Office

The Spartanburg Tax Office is an essential governmental entity located in the heart of Spartanburg County, South Carolina. It plays a crucial role in managing the financial affairs and taxation processes of the county, ensuring the smooth operation of various public services and infrastructure. This office is responsible for assessing property values, collecting taxes, and providing vital financial support to the local community. With a rich history dating back to the early 20th century, the Spartanburg Tax Office has evolved to meet the changing needs of the county's residents and businesses, adapting to modern tax laws and technological advancements.

A Historical Perspective

The establishment of the Spartanburg Tax Office can be traced back to 1907, when Spartanburg County, then a rapidly growing industrial center, recognized the need for a centralized tax collection and assessment system. The office’s initial mandate was to ensure fair and efficient taxation of the county’s burgeoning industrial and agricultural sectors. Over the decades, the office has undergone significant transformations, adapting to the changing economic landscape of Spartanburg County.

One of the most notable changes occurred in the 1960s, with the implementation of modern tax assessment techniques and the introduction of computerized systems. This era marked a significant shift towards efficiency and accuracy in tax collection. The office also played a pivotal role during the economic boom of the 1980s and 1990s, managing the surge in property values and ensuring that the county reaped the benefits of its growing industrial and commercial sectors.

Modern Day Operations

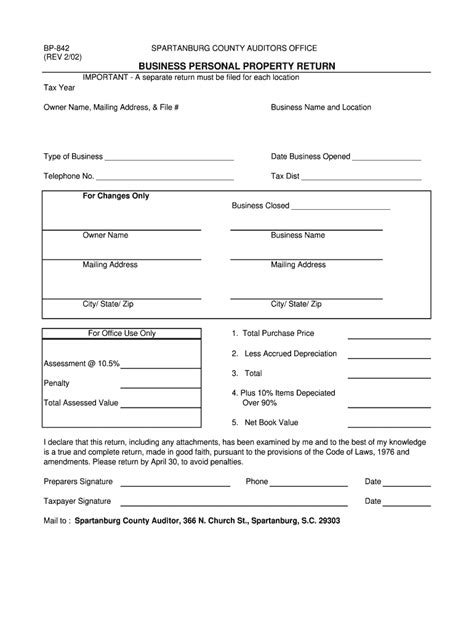

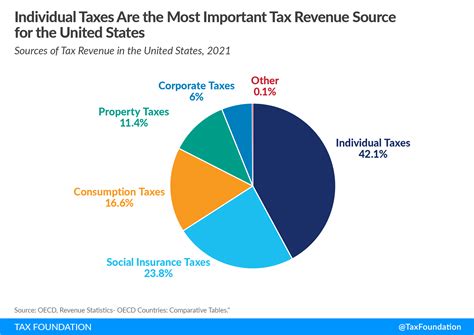

Today, the Spartanburg Tax Office continues to be a vital cog in the county’s financial machinery. It is responsible for the assessment and collection of various taxes, including property taxes, personal property taxes, and local option sales taxes. The office’s primary objective is to ensure that taxpayers understand their obligations and that the tax collection process is fair and transparent.

The office utilizes advanced technology to streamline its operations. This includes an online portal where taxpayers can access their tax information, make payments, and track the status of their accounts. The office also employs modern assessment techniques, ensuring that property values are accurately determined and that taxpayers are not overburdened with excessive tax liabilities.

Property Tax Assessment

Property tax assessment is a critical function of the Spartanburg Tax Office. The office employs a team of certified assessors who regularly review and update property values. This process ensures that the tax burden is distributed fairly among property owners, taking into account factors such as property improvements, market conditions, and local ordinances.

The office provides detailed information on the assessment process, including guidelines for taxpayers to understand their assessments and appeal if necessary. This transparency has been instrumental in building trust between the office and the community it serves.

Tax Collection and Payment Options

The Spartanburg Tax Office offers a range of payment options to accommodate different taxpayer needs. Taxpayers can pay their taxes in person at the office, by mail, or online through the office’s secure payment portal. The office also provides options for taxpayers to set up installment plans or request extensions under certain circumstances.

For taxpayers who require assistance, the office's staff is available to guide them through the payment process and answer any queries they may have. This personalized approach has been key to maintaining a positive relationship with taxpayers and ensuring timely tax collection.

| Tax Type | Collection Period |

|---|---|

| Property Taxes | January - April |

| Personal Property Taxes | July - September |

| Local Option Sales Taxes | Monthly |

Community Engagement and Outreach

The Spartanburg Tax Office understands the importance of community engagement and regularly interacts with taxpayers and local businesses. It organizes informational sessions and workshops to educate the public about tax laws, assessment processes, and payment options. These initiatives have been instrumental in reducing taxpayer confusion and promoting compliance.

The office also actively participates in community events, providing information booths and offering one-on-one consultations. This hands-on approach allows taxpayers to voice their concerns and receive personalized advice, fostering a sense of trust and understanding.

Future Prospects

Looking ahead, the Spartanburg Tax Office plans to continue modernizing its operations to keep pace with technological advancements. This includes further developing its online services and exploring innovative payment options to enhance convenience for taxpayers. The office also aims to enhance its data analytics capabilities to better predict tax trends and ensure efficient resource allocation.

Furthermore, the office is committed to fostering a culture of continuous learning and development among its staff. By investing in training and professional development, the office aims to ensure that its employees are equipped with the skills and knowledge necessary to provide exceptional service to the community.

In conclusion, the Spartanburg Tax Office stands as a vital component of Spartanburg County's administrative landscape. Through its commitment to fairness, transparency, and community engagement, the office ensures the smooth operation of the county's financial affairs, contributing to the overall growth and prosperity of the region.

What are the office hours of the Spartanburg Tax Office?

+

The Spartanburg Tax Office is open Monday to Friday from 8:30 a.m. to 5:00 p.m. These hours allow taxpayers to visit the office during standard business hours, ensuring accessibility for most residents.

How can I access my tax information online?

+

To access your tax information online, you need to visit the Spartanburg County website and navigate to the Tax Office’s online portal. Here, you can log in using your account details or create an account if you’re a new user. Once logged in, you’ll have access to your tax records, payment history, and other relevant information.

What happens if I miss the tax payment deadline?

+

If you miss the tax payment deadline, you may be subject to late fees and penalties, as specified by Spartanburg County tax laws. It’s important to note that late payments can impact your credit score and may lead to additional legal consequences. Therefore, it’s always advisable to make timely payments or contact the Tax Office to discuss potential payment arrangements.

How does the Spartanburg Tax Office determine property values for assessment purposes?

+

The Spartanburg Tax Office employs a team of certified assessors who use a combination of methods to determine property values. These methods include analyzing recent sales of similar properties, considering the property’s improvements and characteristics, and using computer-assisted mass appraisal techniques. The office aims to ensure that property values are fair and reflect the current market conditions.

What should I do if I disagree with my property tax assessment?

+

If you disagree with your property tax assessment, you have the right to appeal. The Spartanburg Tax Office provides a detailed appeals process, which typically involves submitting an appeal application and providing supporting documentation. It’s important to note that appeals must be made within a specified timeframe, so it’s crucial to act promptly if you wish to challenge your assessment.