Sales Tax Reno Nv

Sales tax is an essential aspect of doing business in any jurisdiction, and it plays a significant role in the economic landscape of Reno, Nevada. Understanding the intricacies of sales tax in this vibrant city is crucial for businesses and consumers alike. In this comprehensive guide, we will delve into the world of sales tax in Reno, exploring its rates, regulations, and the impact it has on the local economy.

Unraveling the Sales Tax Structure in Reno, Nevada

Reno, often dubbed the "Biggest Little City in the World," boasts a unique sales tax system that combines both state and local tax rates. This combination creates a dynamic tax landscape that influences the city's business climate and consumer spending habits.

At the state level, Nevada imposes a 6.85% sales and use tax rate. This uniform state tax is applicable across all counties and municipalities, providing a consistent base for businesses to operate within the state.

However, it is the local tax rates that add a layer of complexity to the sales tax structure in Reno. The city of Reno imposes an additional 2.50% sales and use tax, bringing the total sales tax rate to 9.35% within the city limits. This local tax is specifically designated to fund various municipal services and infrastructure projects, contributing to the vibrant development of the city.

Beyond the city limits, sales tax rates can vary depending on the jurisdiction. For instance, in Washoe County, which encompasses Reno and its surrounding areas, the sales tax rate stands at 7.85%, including the state and county tax components. This slight variation showcases the importance of understanding the specific tax rates applicable to different regions within Nevada.

A Comparative Analysis of Sales Tax Rates

To put the sales tax rates in Reno into perspective, it is beneficial to compare them with other prominent cities in the region and across the country.

| City | Sales Tax Rate |

|---|---|

| Reno, NV | 9.35% |

| Las Vegas, NV | 8.25% |

| Phoenix, AZ | 8.10% |

| Los Angeles, CA | 9.50% |

| Denver, CO | 7.62% |

As evident from the table, Reno's sales tax rate is competitive when compared to other major cities in the Western United States. This rate structure not only contributes to the city's fiscal health but also influences the pricing strategies of businesses and the purchasing decisions of consumers.

The Impact of Sales Tax on Reno's Economy

Sales tax plays a pivotal role in shaping Reno's economic landscape. The revenue generated from sales tax contributes significantly to the city's budget, funding essential services such as education, public safety, infrastructure development, and more.

For businesses, the sales tax structure can influence their operating costs and pricing strategies. Companies operating within Reno's city limits must factor in the 2.50% local tax rate when setting prices for their goods and services. This additional tax can impact their competitive positioning and overall profitability.

From a consumer perspective, the sales tax rate can influence purchasing behavior. While some consumers may be price-sensitive and consider the tax rate when making purchasing decisions, others may view Reno's vibrant attractions, entertainment offerings, and overall quality of life as justifying the higher sales tax rate.

Additionally, the sales tax structure in Reno has implications for online retailers and e-commerce businesses. With the rise of online shopping, the collection and remittance of sales tax have become increasingly complex. Businesses must navigate the nuances of sales tax laws, ensuring compliance with both state and local regulations to avoid legal consequences.

Navigating Sales Tax Compliance in Reno

Compliance with sales tax regulations is a critical aspect of doing business in Reno. Businesses must adhere to the intricate sales tax laws to avoid legal issues and ensure a smooth operational environment.

For starters, businesses must register with the Nevada Department of Taxation to obtain a sales and use tax permit. This permit allows them to collect and remit sales tax on taxable goods and services sold within the state.

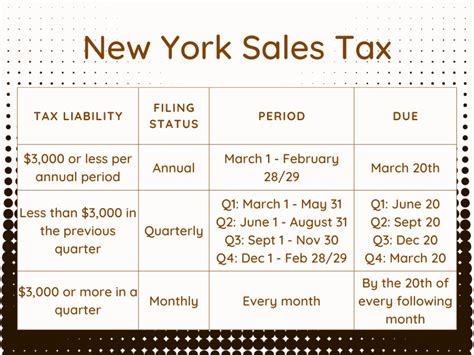

The frequency of sales tax filings and payments depends on the business's tax liability. Typically, businesses with higher sales volumes are required to file and pay sales tax more frequently, such as monthly or quarterly. Smaller businesses with lower sales may be allowed to file and pay on an annual basis.

Accurate record-keeping is essential for sales tax compliance. Businesses must maintain detailed records of all sales transactions, including the applicable tax rates, to ensure accurate reporting and compliance. This includes keeping track of exempt sales, such as those made to qualified resellers or purchases made by tax-exempt entities.

Sales Tax Exemptions and Special Considerations

While sales tax is generally applicable to most goods and services, there are certain exemptions and special considerations in Reno that businesses and consumers should be aware of.

For instance, certain goods, such as prescription medications and medical devices, are exempt from sales tax in Nevada. This exemption provides relief to consumers and businesses operating in the healthcare sector, reducing the overall tax burden on essential medical supplies.

Additionally, Nevada offers tax incentives and abatements to certain industries to promote economic development. These incentives can take various forms, such as reduced tax rates or tax holidays, and are often targeted towards specific sectors, such as manufacturing or renewable energy.

Understanding these exemptions and incentives is crucial for businesses operating in Reno, as it can significantly impact their tax liability and overall financial health.

The Future of Sales Tax in Reno: Trends and Innovations

The sales tax landscape in Reno is continually evolving, influenced by technological advancements, economic trends, and changing consumer behaviors.

One notable trend is the increasing adoption of online sales tax collection and remittance systems. As e-commerce continues to grow, businesses are turning to automated sales tax software to ensure accurate and efficient tax compliance. These systems streamline the sales tax calculation and reporting process, reducing the administrative burden on businesses.

Furthermore, the rise of remote work and the gig economy has prompted discussions around the collection of sales tax on digital goods and services. As more transactions move online, the question of tax jurisdiction and compliance becomes increasingly complex. Reno, like many other cities, is likely to witness ongoing debates and policy changes surrounding the taxation of digital transactions.

Another area of focus for Reno's sales tax system is the potential for tax reforms and modernization. As the city's economy evolves, there may be calls for adjustments to the tax structure to better align with the needs of businesses and consumers. This could involve reevaluating tax rates, exploring new revenue streams, or implementing measures to simplify the tax system for improved efficiency and fairness.

Conclusion: Embracing the Complexities of Sales Tax in Reno

Sales tax in Reno, Nevada, is a dynamic and intricate component of the city's economic fabric. From its unique combination of state and local tax rates to the impact it has on businesses and consumers, understanding the sales tax landscape is crucial for all stakeholders.

By navigating the complexities of sales tax compliance, businesses can operate within the legal framework while contributing to the city's fiscal health. Meanwhile, consumers can make informed purchasing decisions, taking into account the sales tax rate and the overall value proposition of Reno's attractions and amenities.

As Reno continues to thrive and evolve, its sales tax system will undoubtedly play a pivotal role in shaping the city's future. Whether it's through technological advancements, policy reforms, or economic incentives, the sales tax structure will remain a key factor in Reno's economic growth and sustainability.

What are the sales tax rates for specific counties in Nevada?

+Sales tax rates can vary by county in Nevada. For instance, in Washoe County, which includes Reno, the sales tax rate is 7.85%. Clark County, which includes Las Vegas, has a slightly lower rate at 7.75%. It’s important to check the specific rates for each county to ensure accurate compliance.

How often do businesses need to file and pay sales tax in Reno?

+The frequency of sales tax filings and payments depends on the business’s tax liability. Typically, businesses with higher sales volumes are required to file and pay more frequently, such as monthly or quarterly. Smaller businesses may be allowed to file and pay on an annual basis.

Are there any sales tax holidays in Nevada?

+Yes, Nevada does observe sales tax holidays. These are designated periods when certain items, such as school supplies or energy-efficient appliances, are exempt from sales tax. The dates and eligible items for sales tax holidays vary, so it’s important to stay updated with the state’s tax calendar.

How can businesses ensure accurate sales tax compliance in Reno?

+Businesses can ensure accurate sales tax compliance by registering with the Nevada Department of Taxation, obtaining a sales and use tax permit, and maintaining detailed records of all sales transactions. Utilizing automated sales tax software can also help streamline the compliance process.