Dupage County Property Tax

When it comes to property ownership and associated expenses, understanding the intricacies of property taxes is essential. In DuPage County, Illinois, property taxes play a significant role in funding various local services and initiatives. This comprehensive guide will delve into the world of DuPage County property taxes, exploring the assessment process, tax rates, exemptions, and the impact these taxes have on homeowners and the community as a whole.

The Fundamentals of DuPage County Property Taxes

DuPage County, located in the heart of the Chicago metropolitan area, boasts a vibrant real estate market and a diverse range of residential and commercial properties. The county’s property tax system is designed to ensure a fair and equitable distribution of tax responsibilities among property owners.

Property taxes in DuPage County are levied annually and are calculated based on the assessed value of each property. The assessment process involves several key steps, beginning with the evaluation of each property by the DuPage County Assessor's Office. This office is responsible for determining the fair market value of all taxable properties within the county.

The Assessment Process: A Closer Look

The DuPage County Assessor’s Office employs a systematic approach to assess properties. Here’s an overview of the key steps in the assessment process:

- Data Collection: Assessor’s staff members physically inspect each property, gathering data on factors such as size, age, improvements, and recent sales in the area.

- Data Analysis: The collected data is meticulously analyzed to determine the property’s fair market value. This value is influenced by various factors, including recent property sales, neighborhood trends, and economic conditions.

- Assessment Notices: Once the assessment process is complete, property owners receive an assessment notice detailing the assessed value of their property. This notice serves as a crucial document for understanding the basis of the subsequent property tax calculation.

It's important to note that property owners have the right to appeal their assessed value if they believe it is inaccurate or inconsistent with similar properties in the area. The appeal process provides an opportunity for homeowners to ensure fairness and accuracy in the assessment process.

Understanding DuPage County Tax Rates

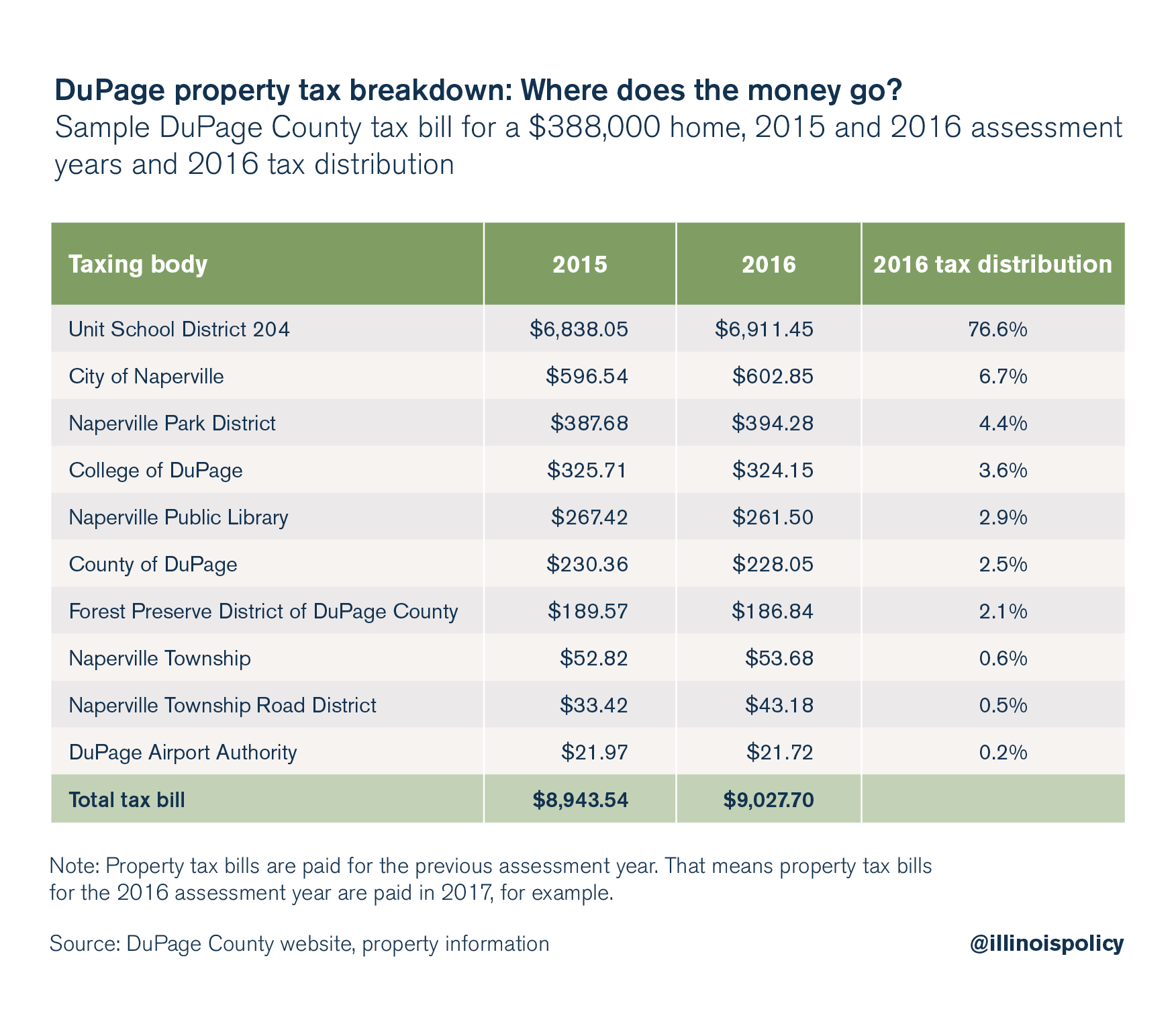

After the assessment process is complete and the assessed value of a property is determined, the property tax calculation comes into play. In DuPage County, property taxes are calculated by applying a tax rate to the assessed value. This tax rate is determined by various taxing bodies, including the county government, local municipalities, school districts, and special purpose districts.

The tax rate is typically expressed as a percentage and can vary significantly depending on the location of the property and the services provided by the taxing bodies. For instance, properties located in areas with well-funded school districts or extensive municipal services may have higher tax rates to support these services.

To illustrate, let's consider an example. Suppose a homeowner in DuPage County has a property with an assessed value of $300,000. If the applicable tax rate is 2.5%, the annual property tax for this property would be calculated as follows:

| Assessed Value | Tax Rate | Annual Property Tax |

|---|---|---|

| $300,000 | 2.5% | $7,500 |

This calculation highlights the direct relationship between the assessed value of a property and the resulting property tax liability. It's worth noting that tax rates can change annually, influenced by factors such as budget requirements and changes in state or local legislation.

The Impact of Tax Rates on Property Owners

The tax rates in DuPage County have a significant impact on property owners. Higher tax rates can lead to increased financial obligations for homeowners, impacting their overall cost of living and financial planning. On the other hand, well-managed tax rates can ensure the sustainable funding of essential services, contributing to the overall quality of life in the county.

For instance, consider a scenario where a homeowner experiences a significant increase in their property's assessed value due to a booming real estate market. If the tax rate remains constant, the homeowner's property tax liability will increase proportionally, potentially straining their finances. However, if the taxing bodies exercise prudent fiscal management and keep tax rates in check, the impact on homeowners can be mitigated.

Exemptions and Relief for DuPage County Property Owners

DuPage County recognizes the importance of providing relief and exemptions to certain property owners, aiming to ease the financial burden of property taxes. Various exemptions and relief programs are available to eligible homeowners, offering reduced tax liabilities or even complete exemption from certain property taxes.

Homestead Exemptions

One of the most common exemptions in DuPage County is the homestead exemption. This exemption applies to homeowners who use their property as their primary residence. By claiming the homestead exemption, eligible homeowners can reduce their property’s assessed value, resulting in lower property taxes.

For example, suppose a homeowner in DuPage County qualifies for a homestead exemption worth $5,000. This exemption would be applied to their property's assessed value, reducing the taxable value and subsequently lowering their annual property tax liability. Homestead exemptions provide a significant financial benefit to homeowners, especially those on fixed incomes or facing financial challenges.

Senior Citizen Exemptions

DuPage County also offers exemptions specifically tailored to senior citizens. The Senior Citizen Homestead Exemption provides eligible seniors with an additional reduction in their property’s assessed value, further easing their tax burden. This exemption recognizes the unique financial circumstances many seniors face and aims to provide relief during their retirement years.

To illustrate, consider a senior homeowner in DuPage County who qualifies for both the standard homestead exemption and the Senior Citizen Homestead Exemption. By combining these exemptions, the homeowner can achieve a substantial reduction in their property's taxable value, resulting in significantly lower property taxes. These exemptions empower seniors to maintain their independence and continue residing in their cherished homes.

Other Relief Programs

In addition to homestead and senior citizen exemptions, DuPage County offers various other relief programs. These programs include:

- Veteran’s Exemptions: Recognizing the service and sacrifice of veterans, DuPage County provides exemptions for eligible veterans, reducing their property tax obligations.

- Disability Exemptions: Certain disabilities may qualify homeowners for exemptions, ensuring financial relief for those facing unique challenges.

- Low-Income Relief: DuPage County offers programs to assist low-income homeowners with their property tax obligations, providing much-needed support to vulnerable communities.

These exemptions and relief programs demonstrate DuPage County's commitment to supporting its residents and ensuring that property taxes remain manageable for all property owners.

The Role of Property Taxes in Community Development

Property taxes play a vital role in the development and maintenance of communities within DuPage County. The revenue generated from property taxes is allocated to fund a wide range of essential services and infrastructure projects, directly benefiting residents and contributing to the overall well-being of the community.

Funding for Education

One of the primary beneficiaries of property tax revenue is the education sector. DuPage County’s school districts rely heavily on property taxes to fund their operations, including teacher salaries, curriculum development, and the maintenance of school facilities. By investing in education, property taxes contribute to the academic success and future prosperity of the county’s youth.

For instance, consider a local elementary school in DuPage County. Property taxes collected from the surrounding neighborhood provide the necessary funding for the school's daily operations, allowing for the hiring of qualified teachers, the implementation of innovative teaching methods, and the maintenance of a safe and stimulating learning environment.

Supporting Public Safety and Infrastructure

Property taxes also support critical public safety services, such as police and fire departments. These services ensure the safety and security of residents, protecting them from potential threats and emergencies. Additionally, property taxes contribute to the development and maintenance of essential infrastructure, including roads, bridges, and public transportation systems.

Imagine a bustling commercial district in DuPage County. Property taxes collected from businesses and residents in the area contribute to the maintenance and improvement of local roads, ensuring smooth traffic flow and efficient transportation for commuters and businesses alike. This investment in infrastructure not only enhances the quality of life for residents but also attracts businesses and investors to the area.

Community Initiatives and Programs

Beyond the funding of essential services, property taxes also support various community initiatives and programs. These initiatives encompass a wide range of areas, including arts and culture, recreation, and social services. By allocating a portion of property tax revenue to these initiatives, DuPage County fosters a vibrant and inclusive community.

For example, consider a local arts festival in DuPage County. Property taxes provide funding for this festival, allowing for the organization of diverse artistic performances, workshops, and exhibitions. This support not only enriches the cultural landscape of the county but also attracts visitors, boosting the local economy and enhancing the overall quality of life for residents.

Conclusion: Navigating DuPage County Property Taxes

DuPage County property taxes are a complex but essential aspect of homeownership. Understanding the assessment process, tax rates, exemptions, and the role of property taxes in community development empowers homeowners to make informed decisions and actively participate in the local tax system.

By staying informed about tax rates, exemptions, and relief programs, property owners can effectively manage their financial obligations and contribute to the vibrant and thriving community of DuPage County. The interplay between property taxes and community development underscores the importance of a well-managed tax system, ensuring the sustainable growth and prosperity of the county.

How often are property taxes assessed in DuPage County?

+Property taxes in DuPage County are assessed annually. The assessment process typically occurs in the spring, and property owners receive assessment notices detailing the assessed value of their property.

Can I appeal my property’s assessed value if I disagree with it?

+Yes, property owners have the right to appeal their assessed value if they believe it is inaccurate or inconsistent with similar properties in the area. The appeal process is outlined by the DuPage County Assessor’s Office, and homeowners should follow the specified procedures to initiate an appeal.

What is the average tax rate in DuPage County?

+The average tax rate in DuPage County can vary depending on the location of the property and the services provided by the taxing bodies. It’s essential to review the specific tax rates applicable to your property to understand your tax obligations accurately.

Are there any exemptions or relief programs for senior citizens in DuPage County?

+Yes, DuPage County offers specific exemptions for senior citizens, including the Senior Citizen Homestead Exemption. This exemption provides eligible seniors with a reduction in their property’s assessed value, resulting in lower property taxes. It’s advisable to consult the DuPage County Assessor’s Office or a tax professional for more information on senior citizen exemptions.