Contra Costa County Sales Tax

Sales tax is an integral part of any jurisdiction's revenue generation and economic management. In the United States, sales tax rates vary across states and counties, providing a unique and often complex landscape for consumers and businesses alike. This article delves into the specifics of sales tax in Contra Costa County, California, offering a comprehensive understanding of its rates, applications, and implications.

Understanding Sales Tax in Contra Costa County

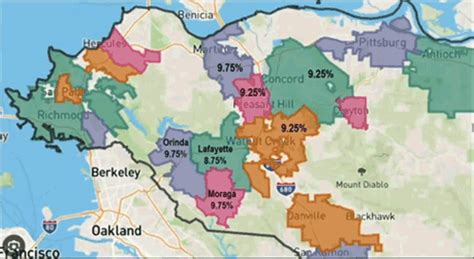

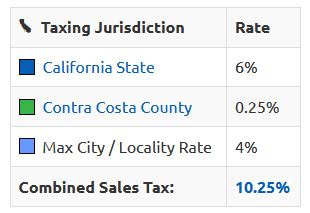

Contra Costa County, nestled in the eastern region of the San Francisco Bay Area, California, operates under a multi-tiered sales tax system. This system consists of a combination of state, county, and city sales taxes, each contributing to the overall tax rate applicable to various goods and services.

State Sales Tax

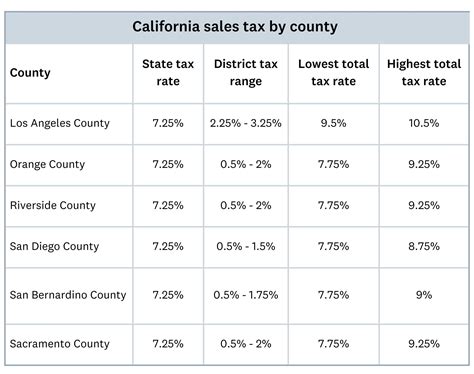

California imposes a statewide sales and use tax rate of 7.25%. This rate applies uniformly across the state and forms the foundation of the sales tax structure in Contra Costa County.

County Sales Tax

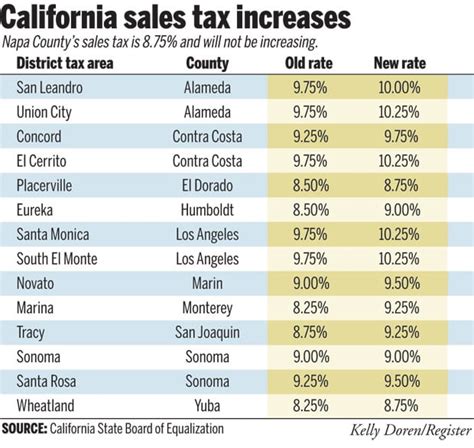

Contra Costa County adds a countywide sales tax of 0.50% to the state rate, bringing the total county sales tax to 7.75%. This additional tax revenue supports essential county services and infrastructure development.

City Sales Taxes

Several cities within Contra Costa County have their own local sales taxes, adding further complexity to the sales tax landscape. These city-specific taxes range from 0.50% to 1.00%, depending on the municipality. Cities like Antioch, Brentwood, and Martinez have opted for a 1.00% local sales tax, while others like Richmond and San Pablo apply a 0.50% tax.

| City | Local Sales Tax |

|---|---|

| Antioch | 1.00% |

| Brentwood | 1.00% |

| Martinez | 1.00% |

| Richmond | 0.50% |

| San Pablo | 0.50% |

These local sales taxes are typically used to fund city-specific projects, community initiatives, and public services.

Taxable Items and Exemptions

Sales tax in Contra Costa County applies to most retail sales of tangible personal property and certain services. This includes items like clothing, electronics, furniture, and groceries. However, there are exceptions and exemptions to the sales tax. For instance, groceries are generally exempt from state sales tax but may be subject to city-specific sales taxes.

Certain items, such as prescription drugs, certain medical devices, and over-the-counter medications, are exempt from sales tax under California law. Additionally, purchases made by tax-exempt entities, like non-profit organizations and government agencies, are typically exempt from sales tax.

Compliance and Reporting

Businesses operating in Contra Costa County are responsible for collecting, reporting, and remitting the appropriate sales taxes to the California Department of Tax and Fee Administration (CDTFA). This involves accurate record-keeping, proper tax calculation, and timely tax return filings.

The CDTFA provides resources and guidance to help businesses navigate the sales tax landscape, including registration processes, tax rate lookup tools, and compliance assistance programs.

Sales Tax Registration and Permits

Businesses engaged in taxable activities within Contra Costa County must obtain a Seller’s Permit from the CDTFA. This permit authorizes the business to collect and remit sales tax. The registration process involves providing business details, estimated tax liabilities, and other relevant information to the CDTFA.

Sales Tax Calculation and Remittance

Businesses are required to calculate the sales tax on each taxable transaction, applying the appropriate tax rate based on the location of the sale. The sales tax collected is then remitted to the CDTFA on a periodic basis, typically monthly or quarterly, depending on the business’s sales volume.

Impact on Consumers and Businesses

The multi-tiered sales tax structure in Contra Costa County can have significant implications for both consumers and businesses.

Consumer Perspective

For consumers, understanding the sales tax rates in Contra Costa County is crucial for making informed purchasing decisions. The varying tax rates across cities can lead to differences in the final prices of goods and services, influencing shopping behaviors and preferences.

Additionally, consumers should be aware of the taxability of specific items and potential exemptions to avoid surprises at the point of sale. For instance, knowing that groceries are exempt from state sales tax but may be subject to local taxes can impact where and how consumers choose to shop.

Business Considerations

Businesses operating in Contra Costa County must navigate the complex sales tax landscape to ensure compliance and maintain competitive pricing strategies. This involves accurate tax calculation, proper tax rate application, and efficient tax reporting and remittance processes.

Moreover, businesses should consider the impact of sales tax on their pricing strategies. With varying tax rates across cities, businesses may need to adjust their pricing to remain competitive within their respective markets. For instance, a business in a city with a higher local sales tax may need to adjust its pricing to remain competitive with similar businesses in neighboring cities with lower tax rates.

Future Implications and Trends

The sales tax landscape in Contra Costa County is dynamic and subject to change. Here are some potential future implications and trends to consider:

Potential Tax Rate Adjustments

Sales tax rates in Contra Costa County, and California as a whole, are subject to change based on various factors, including economic conditions, legislative decisions, and public policy initiatives. Cities and the county may adjust their sales tax rates to address budget shortfalls or fund specific projects.

E-commerce and Remote Sales

The rise of e-commerce and remote sales has presented unique challenges for sales tax collection and compliance. Businesses operating online must ensure they are collecting and remitting the appropriate sales taxes, regardless of the customer’s location. This can be particularly complex for businesses with customers across multiple jurisdictions, including Contra Costa County.

Sales Tax Simplification Efforts

There have been ongoing efforts at the state and national levels to simplify the sales tax system and address the challenges posed by e-commerce. These efforts aim to create a more uniform and streamlined sales tax structure, potentially reducing the administrative burden on businesses and improving compliance.

Impact of Economic Trends

Economic trends and fluctuations can influence sales tax revenue and the need for tax adjustments. For instance, during economic downturns, sales tax revenue may decline, prompting cities and the county to consider tax rate increases to maintain revenue streams. Conversely, during economic booms, cities and the county may have more flexibility to reduce tax rates or explore other revenue sources.

Conclusion

Understanding the intricacies of sales tax in Contra Costa County is crucial for both consumers and businesses. The multi-tiered sales tax system, with its combination of state, county, and city taxes, presents a complex landscape that requires careful navigation. By staying informed about sales tax rates, exemptions, and compliance requirements, consumers and businesses can make informed decisions and navigate the sales tax landscape effectively.

How often do sales tax rates change in Contra Costa County?

+Sales tax rates in Contra Costa County can change periodically, typically as a result of legislative decisions or public policy initiatives. While the state sales tax rate remains relatively stable, county and city sales tax rates may fluctuate more frequently to address budgetary needs or fund specific projects.

Are there any online resources to help businesses calculate and remit sales tax accurately?

+Yes, the California Department of Tax and Fee Administration (CDTFA) provides various online tools and resources to assist businesses with sales tax calculation and compliance. These include tax rate lookup tools, sales tax calculators, and guides on registration, tax collection, and remittance processes.

What happens if a business fails to collect or remit sales tax correctly?

+Businesses that fail to collect or remit sales tax correctly may face penalties and interest charges from the CDTFA. These penalties can be significant, and repeated violations can lead to more severe consequences, including revocation of the business’s Seller’s Permit.