Home Tax Calculator

Welcome to our comprehensive guide on understanding and managing home taxes. In the world of property ownership, tax calculations can be a complex and often confusing process. We aim to demystify this topic, providing you with an expert overview of the key factors that impact your home tax obligations. From the essential variables that influence your tax liability to the latest tools and strategies for efficient calculation, this article will empower you to navigate the intricacies of home tax calculations with confidence.

Unraveling the Complexity of Home Tax Calculations

When it comes to determining your home tax liability, a multitude of factors come into play. These variables can significantly impact the final amount you owe, making it crucial to understand and account for each of them accurately. Let’s delve into the key aspects that contribute to the complexity of home tax calculations.

Property Assessment and Valuation

One of the fundamental aspects of home tax calculations is the assessment and valuation of your property. Tax authorities typically conduct regular assessments to determine the market value of your home. This value serves as the basis for calculating property taxes, which are a significant component of your overall home tax obligations. The assessment process involves considering various factors, such as:

- Location: Properties in desirable neighborhoods or areas with high demand often have higher assessed values.

- Size and Features: The size of your home, including the number of rooms, bathrooms, and any unique features like a pool or garage, can impact its value.

- Age and Condition: Older homes may require more maintenance and have lower values, while newer properties are often valued higher.

- Comparable Sales: Tax assessors compare your property to similar homes that have recently sold in your area to determine a fair market value.

It's important to note that property assessments are not always accurate, and you may have the right to appeal if you believe your home's value has been overestimated.

Tax Rates and Assessments

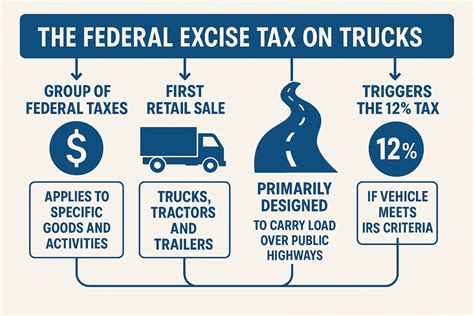

The tax rates applied to your property’s assessed value are another critical factor in home tax calculations. These rates can vary significantly depending on your location and the type of property you own. Here’s a breakdown of the key considerations:

- Local Taxes: Property taxes are often levied by local governments, including cities, counties, and school districts. Each jurisdiction sets its own tax rates, which can result in significant variations across different areas.

- State Taxes: Some states also impose property taxes, which are typically in addition to local taxes. These state taxes can further increase your overall tax liability.

- Special Assessments: In certain cases, your property may be subject to special assessments, which are additional charges for specific services or improvements in your area. These assessments can be for infrastructure projects, environmental initiatives, or other community developments.

Understanding the tax rates and any special assessments applicable to your property is essential for accurately calculating your home tax obligations.

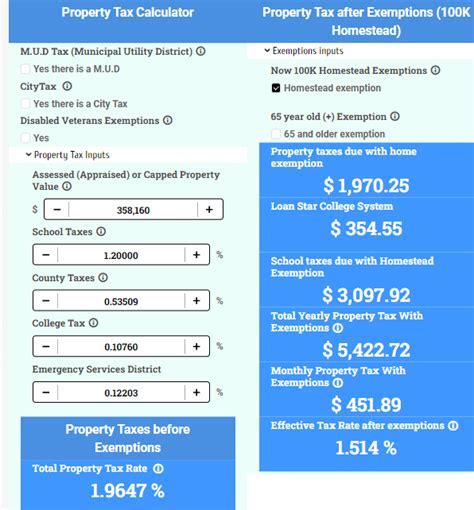

Exemptions and Deductions

Home tax calculations are not solely based on the assessed value of your property and applicable tax rates. Numerous exemptions and deductions can reduce your overall tax liability. These incentives are designed to encourage specific behaviors or support certain groups of taxpayers. Here are some common exemptions and deductions you may be eligible for:

- Homestead Exemption: Many states offer a homestead exemption, which reduces the taxable value of your primary residence. This exemption provides a financial benefit to homeowners, making it more affordable to own a home.

- Senior Citizen Discounts: Some areas provide tax discounts or exemptions for homeowners who are senior citizens. These incentives aim to support older adults by reducing their property tax burden.

- Veteran Benefits: Veterans and active-duty military personnel may be eligible for property tax exemptions or discounts as a way to recognize and support their service.

- Energy Efficiency Incentives: Certain jurisdictions offer tax credits or deductions for homeowners who invest in energy-efficient upgrades or renewable energy systems. These incentives promote sustainable practices and can significantly reduce your tax liability.

It's crucial to research and understand the specific exemptions and deductions available in your area to ensure you take full advantage of any applicable benefits.

Leveraging Advanced Tools for Accurate Calculations

In today’s digital age, numerous advanced tools and resources are available to simplify the process of calculating home taxes. These tools can provide accurate estimates, help you understand the impact of different variables, and even assist in filing your tax returns. Here’s an overview of some of the most useful resources:

Online Tax Calculators

Numerous websites offer online tax calculators specifically designed for home tax calculations. These calculators allow you to input your property’s assessed value, applicable tax rates, and any relevant exemptions or deductions to generate an estimated tax liability. While these tools provide a quick and convenient way to estimate your taxes, it’s important to verify the accuracy of the information they use.

Real Estate Assessment Databases

Many local governments and real estate agencies maintain databases of assessed property values for public access. These databases can provide valuable insights into the assessed values of properties in your area, allowing you to compare your home’s assessment with similar properties. This information can help you identify potential inaccuracies or discrepancies in your own property’s assessment.

Tax Preparation Software

If you prefer a more comprehensive approach, tax preparation software can be an excellent resource for calculating your home taxes. These programs often integrate with your financial information, allowing you to input details about your property, applicable tax rates, and any relevant exemptions. They can generate accurate estimates of your tax liability and even assist in filing your tax returns.

Professional Tax Advisors

For complex tax situations or if you prefer a more personalized approach, consulting a professional tax advisor can be beneficial. These experts have in-depth knowledge of tax laws and regulations, and they can provide tailored advice based on your specific circumstances. While their services may come at a cost, they can offer valuable insights and ensure you optimize your tax strategy.

Optimizing Your Home Tax Strategy

Understanding the intricacies of home tax calculations is just the first step. To truly optimize your tax strategy, it’s essential to explore strategies that can reduce your tax liability and maximize your financial benefits. Here are some key considerations:

Stay Informed About Local Tax Changes

Tax laws and regulations can evolve over time, so it’s crucial to stay informed about any changes that may impact your home tax obligations. Keep an eye on local news and government announcements regarding tax rates, assessments, and any new exemptions or deductions that may become available.

Consider Home Improvements

Strategic home improvements can not only enhance the value and appeal of your property but also potentially reduce your tax liability. Certain improvements, such as energy-efficient upgrades or adding renewable energy systems, may qualify for tax credits or deductions. Research the specific incentives available in your area and consult with professionals to ensure you make informed decisions.

Review Your Property Assessment

Regularly reviewing your property assessment is essential to ensure its accuracy. If you believe your home’s assessed value is higher than its actual market value, you may have grounds to appeal. Appealing an assessment can be a complex process, but it may result in a reduced tax liability if successful.

Explore Tax-Efficient Ownership Structures

If you’re considering purchasing a new home or investing in real estate, it’s worth exploring different ownership structures that may offer tax advantages. For example, certain types of trusts or limited liability companies (LLCs) can provide tax benefits, such as reduced tax rates or the ability to pass on assets to heirs more efficiently.

Utilize Home Office Deductions

If you work from home, you may be eligible for home office deductions. These deductions allow you to deduct a portion of your home expenses, such as mortgage interest, property taxes, and utilities, based on the percentage of your home used for business purposes. Consult with a tax professional to understand the specific requirements and maximize your deductions.

Future Trends and Considerations

As technology continues to advance and tax laws evolve, the landscape of home tax calculations is likely to undergo further transformations. Here are some key trends and considerations to keep in mind:

Automation and AI in Tax Calculations

The integration of automation and artificial intelligence (AI) in tax calculations is expected to become more prevalent. AI-powered tools can analyze vast amounts of data, including property assessments, tax rates, and market trends, to provide more accurate and efficient tax estimates. These technologies can also assist in identifying potential errors or discrepancies in tax calculations.

Digital Property Assessments

The rise of digital property assessments is another trend to watch. As more real estate agencies and government bodies digitize their property assessment processes, it will become easier for homeowners to access and review their assessments online. This increased transparency can empower homeowners to identify and address any inaccuracies more efficiently.

Changing Tax Laws and Policies

Tax laws and policies are subject to change, often influenced by economic conditions and government priorities. It’s essential to stay updated on any proposed or implemented changes that may impact your home tax obligations. Keep an eye on local and national news, and consider consulting with tax professionals to understand how these changes may affect your tax strategy.

Green Initiatives and Tax Incentives

As sustainability becomes an increasingly important global priority, governments and organizations are likely to introduce more tax incentives for green initiatives. These incentives may include tax credits for energy-efficient upgrades, renewable energy systems, and other environmentally friendly practices. Staying informed about these initiatives can help you take advantage of any applicable tax benefits.

International Tax Considerations

For those with international property holdings or investments, understanding the tax implications of owning property in different countries is crucial. Each country has its own tax laws and regulations, and it’s essential to navigate these complexities to optimize your tax strategy. Consider seeking advice from tax professionals with expertise in international tax matters.

How often should I review my property assessment?

+It’s a good practice to review your property assessment annually, especially if you believe there have been significant changes to your property or the local market. Regular reviews can help you identify potential discrepancies and ensure you’re not overpaying in taxes.

Are there any tax benefits for energy-efficient homes?

+Yes, many jurisdictions offer tax incentives for energy-efficient homes. These incentives can include tax credits, deductions, or even rebates for implementing energy-saving measures or installing renewable energy systems. Check with your local government or a tax professional to understand the specific benefits available in your area.

What is the process for appealing a property assessment?

+The process for appealing a property assessment varies by jurisdiction. Generally, it involves submitting a formal appeal to the tax assessment office, providing evidence to support your claim, and potentially attending a hearing. It’s advisable to consult with a tax professional or seek guidance from your local government to ensure you follow the correct procedures.