J David Tax Law

Welcome to the comprehensive guide on J David Tax Law, a leading tax law firm specializing in tax resolution and compliance. In this expert-level article, we will delve into the world of tax law, exploring the firm's services, its approach to complex tax matters, and the impact it has had on countless clients facing tax-related challenges. With a focus on SEO optimization and an engaging writing style, we aim to provide an informative and insightful journey through the realm of tax law.

Navigating the Complexities of Tax Law with J David Tax Law

J David Tax Law is a renowned legal firm dedicated to assisting individuals and businesses in navigating the intricate landscape of tax laws and regulations. Founded by David Johnson, a renowned tax attorney with over two decades of experience, the firm has established itself as a trusted advocate for taxpayers seeking expert guidance and representation.

Tax law is an intricate and ever-evolving field, requiring a deep understanding of legal intricacies and a strategic approach to resolving tax-related issues. J David Tax Law excels in this domain, offering a comprehensive range of services tailored to meet the diverse needs of its clients. From tax planning and compliance to dispute resolution and litigation, the firm provides a holistic approach to tax law, ensuring that clients receive personalized attention and effective solutions.

Tax Planning and Compliance: A Proactive Approach

One of the key strengths of J David Tax Law is its proactive approach to tax planning and compliance. The firm recognizes that effective tax management begins with a thorough understanding of a client's financial situation and goals. By conducting comprehensive assessments, the tax attorneys at J David Tax Law develop customized tax strategies that optimize tax liabilities and ensure compliance with relevant tax laws.

For individuals, this may involve strategic tax planning for income, investments, and estate planning. For businesses, the firm offers expert guidance on corporate tax structures, international tax considerations, and tax-efficient business operations. By staying abreast of the latest tax laws and regulations, J David Tax Law provides its clients with the peace of mind that comes with proactive tax planning.

| Service | Description |

|---|---|

| Individual Tax Planning | Customized tax strategies for personal financial goals. |

| Business Tax Consulting | Expert advice on corporate tax structures and international tax considerations. |

| Estate and Gift Tax Planning | Strategic planning to minimize tax liabilities for estate transfers and gifts. |

By offering this range of tax planning services, J David Tax Law empowers its clients to make informed financial decisions, optimize their tax positions, and avoid potential pitfalls associated with non-compliance.

Tax Resolution: Expertise in Navigating Complex Disputes

When tax disputes arise, J David Tax Law's expertise in tax resolution becomes invaluable. The firm has a proven track record of successfully representing clients in a wide range of tax-related matters, including audits, tax controversies, and tax litigation.

Audits can be a stressful and intimidating experience for taxpayers. J David Tax Law's tax attorneys have extensive experience in handling IRS and state tax audits, providing clients with expert representation and guidance throughout the process. By thoroughly reviewing financial records and identifying potential areas of concern, the firm works diligently to resolve audit issues and minimize tax liabilities.

In cases where tax controversies escalate, J David Tax Law's attorneys possess the knowledge and skills to negotiate with tax authorities and advocate for their clients' rights. Whether it's challenging tax assessments, requesting penalty abatement, or appealing tax court decisions, the firm's tax resolution team is dedicated to protecting its clients' interests and achieving favorable outcomes.

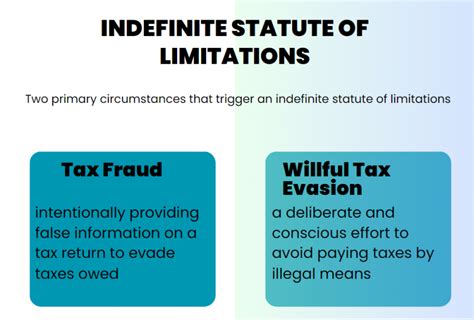

Tax Litigation: Aggressive Representation in Court

Tax litigation is a complex and high-stakes arena, requiring a deep understanding of tax law and courtroom strategy. J David Tax Law's tax attorneys are experienced litigators, possessing the skills and knowledge to represent clients in tax-related lawsuits. Whether it's a dispute over tax assessments, tax fraud allegations, or other tax-related legal matters, the firm's litigators are prepared to aggressively defend their clients' rights and interests.

The firm's tax litigation services include preparing and filing legal documents, conducting thorough research, and presenting compelling arguments in court. By leveraging their extensive knowledge of tax law and procedural rules, J David Tax Law's attorneys strive to achieve the best possible outcomes for their clients, whether it's a favorable settlement or a successful court verdict.

International Tax Services: A Global Perspective

In today's interconnected world, international tax considerations play a crucial role in business operations and personal financial planning. J David Tax Law recognizes the complexities of international tax laws and provides specialized services to address the unique needs of clients with global connections.

The firm's international tax team offers expert guidance on cross-border tax issues, including foreign income reporting, offshore account compliance, and international tax treaties. Whether it's a multinational corporation seeking tax optimization strategies or an individual with foreign investment interests, J David Tax Law provides comprehensive advice and representation to ensure compliance with international tax laws.

Education and Resources: Empowering Clients with Knowledge

At J David Tax Law, education is a cornerstone of their practice. The firm believes in empowering clients with the knowledge and tools they need to make informed decisions regarding their tax obligations. To this end, J David Tax Law offers a range of educational resources, including informative blog posts, webinars, and workshops, to help clients stay updated on the latest tax laws and regulations.

Additionally, the firm provides access to tax calculators, tax guides, and other useful tools to assist clients in understanding their tax liabilities and planning accordingly. By promoting tax literacy and providing accessible resources, J David Tax Law aims to foster a culture of tax awareness and compliance among its clients.

Conclusion: Navigating the Tax Landscape with Confidence

J David Tax Law stands as a beacon of expertise and advocacy in the complex world of tax law. Through its comprehensive range of services, from proactive tax planning to aggressive tax litigation, the firm has established itself as a trusted partner for individuals and businesses seeking expert guidance and representation.

With a team of highly skilled tax attorneys and a commitment to staying at the forefront of tax law developments, J David Tax Law provides clients with the confidence and peace of mind they need to navigate the intricate tax landscape. Whether facing a tax dispute, seeking strategic tax planning advice, or addressing international tax considerations, J David Tax Law is dedicated to delivering exceptional legal services and achieving favorable outcomes for its clients.

How can J David Tax Law assist with tax planning for small businesses?

+J David Tax Law provides expert guidance on tax-efficient business structures, deductions, and credits to help small businesses optimize their tax positions and ensure compliance with relevant tax laws.

What sets J David Tax Law apart from other tax law firms?

+J David Tax Law stands out for its comprehensive approach to tax law, combining expert tax planning, resolution, and litigation services. The firm’s attorneys have a deep understanding of tax laws and regulations, enabling them to provide tailored solutions to meet clients’ unique needs.

How can I schedule a consultation with J David Tax Law?

+To schedule a consultation, you can visit the firm’s website, jdavidtaxlaw.com, and fill out the contact form or call their office directly. The firm’s team will promptly respond to your inquiry and guide you through the consultation process.