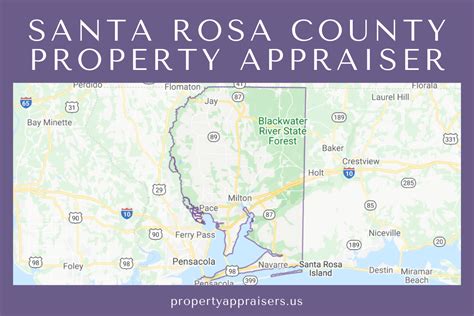

Santa Rosa County Property Tax

Santa Rosa County, nestled along the Florida Panhandle's picturesque coastline, is a vibrant community that offers its residents a unique blend of natural beauty and a strong sense of community. As with any thriving locality, understanding the intricacies of its property tax system is essential for both current and prospective residents. This article delves deep into the world of Santa Rosa County's property taxes, shedding light on the processes, rates, and implications for property owners in this beautiful part of the Sunshine State.

Understanding Santa Rosa County’s Property Tax System

The property tax system in Santa Rosa County is a crucial component of the local economy, providing a significant source of revenue for the county government and its various services. Property taxes are an essential form of taxation in the United States, and Santa Rosa County, like many other counties, relies on this revenue to fund vital services such as public education, law enforcement, infrastructure development, and more.

Property taxes in Santa Rosa County are determined through a systematic process that takes into account the assessed value of the property and the tax rate set by the local government. This value is not static; it can change annually based on factors such as improvements to the property, changes in the real estate market, or adjustments made by the county's property appraiser.

Property Appraisal and Assessment

The journey towards understanding one’s property tax bill begins with the appraisal and assessment process. In Santa Rosa County, the Property Appraiser’s Office is responsible for determining the just value of all real and personal property within the county. This value, also known as the assessed value, is not the same as the market value of the property.

The assessed value is determined using various methods, including cost approach, sales comparison approach, and income approach. These methods take into account factors such as the property's location, size, age, condition, and any recent improvements. Once the assessed value is established, it is multiplied by the county's millage rate to arrive at the property tax amount.

Property owners in Santa Rosa County receive a Truth in Millage (TRIM) notice annually, which details the assessed value of their property, any exemptions they may be eligible for, and the calculated tax amount. This notice is an essential tool for property owners to understand their tax liability and make informed decisions regarding their property.

| Assessment Year | Millage Rate |

|---|---|

| 2022 | 10.75 |

| 2021 | 10.75 |

| 2020 | 10.75 |

Property Tax Rates and Exemptions

The property tax rate, often referred to as the millage rate, is a critical factor in determining the property tax amount. In Santa Rosa County, the millage rate is set annually by the Board of County Commissioners, taking into consideration the county’s budget requirements and the need to provide essential services to its residents.

The millage rate is expressed in mills, with one mill representing one-tenth of a dollar per $1,000 of assessed property value. For instance, a millage rate of 10 mills would equate to $10 in property tax for every $1,000 of assessed value. The millage rate in Santa Rosa County has remained consistent at 10.75 mills for the past few years, which includes various taxes for county operations, schools, and other special districts.

However, property owners in Santa Rosa County are not without relief. The county offers several exemptions that can reduce the taxable value of their property, thereby lowering their tax liability. These exemptions include homestead exemptions, which provide a reduction in taxable value for primary residences, and various other exemptions for seniors, veterans, and agricultural lands.

For instance, the standard homestead exemption in Santa Rosa County is $25,000, which means that the first $25,000 of a homeowner's property value is exempt from taxation. This can result in significant savings for property owners, especially in areas with higher property values.

The Impact of Property Taxes on Santa Rosa County Residents

Property taxes are a significant financial obligation for homeowners in Santa Rosa County. While the county’s property tax rates are relatively stable, the assessed value of properties can fluctuate, impacting the overall tax liability. For homeowners, understanding the factors that influence their property’s assessed value is crucial in managing their financial responsibilities.

Factors Influencing Property Value and Taxes

The assessed value of a property in Santa Rosa County is influenced by various factors, many of which are beyond the control of the property owner. These factors include the real estate market, economic conditions, and the county’s overall financial situation. For instance, a thriving real estate market can lead to an increase in property values, resulting in higher tax assessments.

Additionally, improvements made to a property, such as renovations or additions, can also impact the assessed value. Property owners should be aware that any changes they make to their property could potentially lead to an increase in their property taxes. It is essential to consult with the Property Appraiser's Office or a qualified real estate professional to understand how these improvements might affect their tax liability.

On the other hand, certain events or circumstances can lead to a decrease in property value and, consequently, lower property taxes. Economic downturns, natural disasters, or changes in zoning regulations could negatively impact property values. In such cases, property owners may be eligible for a reduction in their assessed value, which could result in tax savings.

Strategies for Managing Property Taxes

Managing property taxes in Santa Rosa County requires a proactive approach. Property owners can take several steps to ensure they are not overpaying on their taxes and to maximize any available exemptions or deductions.

Firstly, staying informed about the county's property tax system and the factors that influence tax assessments is crucial. Property owners should familiarize themselves with the assessment process, the various exemptions available, and the timeline for appealing assessed values.

Secondly, regular maintenance and upkeep of the property can help ensure that the assessed value accurately reflects the property's condition. This includes addressing any structural issues, maintaining the property's curb appeal, and keeping up with necessary repairs. A well-maintained property is more likely to maintain or even increase its value over time, which can positively impact its assessed value.

Lastly, property owners should consider seeking professional advice. A qualified tax advisor or accountant can provide valuable insights into tax strategies and help identify any potential tax savings. They can also assist in understanding the implications of property improvements or changes in ownership, ensuring that property owners are fully aware of the tax consequences of their decisions.

The Future of Property Taxes in Santa Rosa County

The future of property taxes in Santa Rosa County is closely tied to the county’s economic growth and development. As the county continues to attract new residents and businesses, the demand for services and infrastructure is likely to increase, potentially leading to changes in the property tax landscape.

Economic Growth and Tax Revenues

Santa Rosa County’s vibrant economy, driven by tourism, aerospace, and military industries, is a significant factor in its property tax revenues. As the county’s economic growth continues, it is likely to see an increase in property values, which could lead to higher tax assessments. This increased revenue can be a double-edged sword, as it provides the county with the financial resources to invest in infrastructure and services, but it also increases the tax burden on property owners.

To balance the needs of its residents and the county's economic growth, Santa Rosa County may need to explore innovative solutions. This could include diversifying its revenue streams, investing in cost-saving measures, and exploring alternative funding sources for essential services. By doing so, the county can ensure that its property tax system remains sustainable and equitable for all residents.

Potential Changes and Improvements

Looking ahead, there are several potential changes and improvements that could impact the property tax system in Santa Rosa County. One area of focus could be the assessment process itself. Advancements in technology and data analytics could lead to more efficient and accurate assessments, ensuring that property values are fair and reflective of the current market.

Additionally, the county could consider expanding its exemption programs to provide further relief to residents. For instance, implementing a senior freeze program, where eligible seniors' property taxes are frozen at a certain value, could provide much-needed financial stability for older residents. Similarly, increasing the homestead exemption or introducing new exemptions for certain types of properties could make homeownership more affordable and encourage economic development.

Lastly, the county could explore ways to enhance transparency and communication around property taxes. This could include providing more detailed information to property owners about their tax assessments, hosting educational workshops, and improving the online resources available to residents. By fostering a better understanding of the property tax system, the county can build trust and ensure that residents feel empowered to manage their financial obligations.

How are property taxes calculated in Santa Rosa County?

+Property taxes in Santa Rosa County are calculated by multiplying the assessed value of the property by the millage rate set by the local government. The assessed value is determined by the Property Appraiser’s Office and takes into account various factors such as location, size, and improvements. The millage rate is expressed in mills, with one mill representing one-tenth of a dollar per $1,000 of assessed value.

What is the current millage rate in Santa Rosa County?

+The current millage rate in Santa Rosa County is 10.75 mills, which has remained consistent for the past few years. This rate includes various taxes for county operations, schools, and other special districts.

Are there any exemptions available for property taxes in Santa Rosa County?

+Yes, Santa Rosa County offers several exemptions that can reduce the taxable value of a property, thereby lowering the tax liability. These include homestead exemptions, which provide a reduction in taxable value for primary residences, and various other exemptions for seniors, veterans, and agricultural lands.

How can property owners appeal their assessed value in Santa Rosa County?

+Property owners who believe their assessed value is inaccurate can appeal to the Value Adjustment Board (VAB). The VAB is an independent body that hears and decides on property value appeals. Property owners must file a petition with the VAB within a specific timeline, typically between late February and early April. It is advisable to consult with the Property Appraiser’s Office for guidance on the appeal process.

What are the potential impacts of economic growth on property taxes in Santa Rosa County?

+Economic growth in Santa Rosa County can lead to an increase in property values, resulting in higher tax assessments. While this provides the county with additional revenue to invest in services and infrastructure, it also increases the tax burden on property owners. The county may need to explore strategies to balance economic growth with the needs of its residents, potentially including diversifying revenue streams and enhancing exemption programs.