Latino Tax: Unlocking the Hidden Income Potential of the Latino Community

When it comes to understanding the landscape of personal finance within the Latino community—so vibrant, diverse, and historically underrepresented—there’s a quiet revolution happening. It isn’t shouted from rooftops, but instead, bubbling beneath the surface, this movement to unlock hidden income potential, to optimize tax strategies, and to leverage financial systems to elevate earning power. Latinx families, entrepreneurs, professionals—they’re all negotiating a web of cultural, legal, and economic factors that shape their financial realities. And at the center of this shift is the concept of “Latino Tax”: a complex, often overlooked avenue that, if navigated precisely, could redefine financial futures for countless families and small business owners.

Understanding the Dynamics of Latino Income and Taxation

Fundamentally, the Latino community’s economic profile is nuanced—it’s not monolithic. According to data from the U.S. Census Bureau and Pew Research, Latinos represent a growing segment of the economy, with a combined household income surpassing 1.7 trillion annually and a median household income around 56,000 as of 2023. Still, within that, significant disparities persist, with many under the poverty line or navigating a precarious financial existence. But more importantly, their income streams—whether from gig work, small businesses, or remittances—are often structured in ways that leave untapped tax efficiencies on the table.

For decades, a lack of targeted financial literacy programs and culturally tailored tax education has meant that many Latinx individuals miss out on tax deductions, credits, and incentives explicitly designed to bolster their income potential. It’s a systemic gap—methods in traditional tax planning often neglect the specific economic behaviors and legal considerations of the community, especially those engaged in informal work or operating small, family-run businesses. Recognizing this, a nuanced approach to Latino tax strategies must incorporate cultural competence, language accessibility, and an understanding of the entrepreneurial spirit that motivates many within the community.

The Role of Small Businesses and Self-Employment

Small businesses form the backbone of many Latino households. A 2022 report by the Small Business Administration indicates that Latino entrepreneurs are one of the fastest-growing groups of small business owners—up by nearly 20% over the past five years, reaching approximately 4.65 million businesses. These ventures, often rooted in cultural traditions or family heritage, serve as both income sources and community pillars, yet their tax realities are complex. Self-employment taxes, payroll considerations, and eligibility for SBA programs are all intertwined with how effectively entrepreneurs can plan and optimize their tax filings.

Moreover, the informal economy—rife with cash transactions and less formal record-keeping—becomes a hurdle to maximizing deductions. This unbanked or underbanked segment is notorious for missing tax credits like the Earned Income Tax Credit (EITC), which can significantly boost net income. The challenge is crafting strategies that work within their operating realities while encouraging transparency and formalization.

| Relevant Category | Substantive Data |

|---|---|

| Number of Latino Small Businesses | Approximately 4.65 million as of 2022 |

| Growth Rate of Latino Entrepreneurs | Up 20% over five years |

| Median Income of Latino Households | $56,000 (2023) |

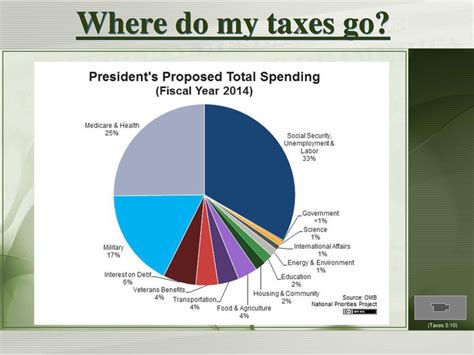

Tax Credits and Incentives That Are Game Changers

When digging into the specifics of Latino tax potential, certain credits shine brighter than others. The Earned Income Tax Credit (EITC) remains a formidable tool—a refund boost for low-to-moderate-income working families. Its value surges especially for families with children, frequently overlooked in communities where informal employment discards official records, thus missing this opportunity. According to IRS data, approximately 20% of eligible Latino families do not file for this credit, leaving significant income on the table.

Beyond EITC, the Child Tax Credit (CTC), the Additional Child Tax Credit, and the Saver’s Credit can add layers of benefit. Moreover, newer initiatives like the Child and Dependent Care Credit serve dual purposes—supporting working families and reducing overall tax burdens—yet many small-scale entrepreneurs or gig workers remain unaware of how to claim these efficiently.

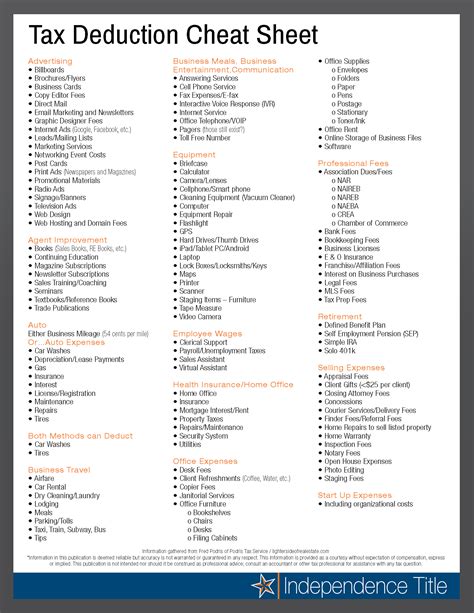

Leveraging Business-Specific Tax Strategies

Business structures—LLCs, S-corporations, sole proprietorships—carry their own sets of tax implications. For Latinos operating small or family businesses, choosing the right structure isn’t just about liability—it’s an optimization issue. For example, electing S-corp status can mitigate self-employment taxes, increasing net income, but requires adequate record-keeping and a nuanced understanding of IRS rules.

This intersection of business and personal taxes necessitates targeted consulting. Many Latinx entrepreneurs benefit from partnerships with bilingual tax professionals who understand the cultural context of business growth, and have a deep knowledge of available deductions: supplies, transportation, home office spaces, and even educational expenses that can legitimately reduce taxable income.

| Relevant Category | Substantive Data |

|---|---|

| Tax Savings Potential | Up to 30% through strategic structure and deductions |

| Common Deductions Used | Business supplies, vehicle expenses, home office |

| Rate of Formalization | Approx. 35% of small businesses are officially registered |

Language, Accessibility, and Education: Breaking Barriers

Despite the opportunities, one persistent challenge remains—accessibility. Language barriers hinder understanding and navigating the tax system. The IRS offers some resources in Spanish, but the reach remains limited—many communities depend on local community centers, nonprofits, or bilingual tax preparers. There’s a growing need for culturally competent, multilingual financial literacy programs that teach basics like record-keeping, credit building, and reporting income accurately.

Addressing this requires more than translation—it involves cultural translation. For instance, teaching about the importance of formal banking, explaining how tracking cash flows can unlock credits, and demystifying complex forms in a relatable manner could be transformative. There's also a role for digital tools—mobile apps designed with language preferences and cultural sensitivities to guide users through tax filing processes step-by-step.

Potential for Digital Innovation in Latino Tax Services

The rise of fintech and AI-driven tax software offers promising avenues. Startups focusing on Hispanic communities—offering bilingual interfaces, simplified workflows, and real-time assistance—are closing gaps. But adoption hinges on trust, which in turn depends on transparency, cultural resonance, and affordability. An effective digital ecosystem could empower millions to better comprehend and leverage the Latino tax landscape, turning what’s often seen as a burden into a strategic advantage.

| Relevant Category | Substantive Data |

|---|---|

| Digital Tool Adoption Rate | 15-20% with growth projections of 10% annually |

| Community Engagement | 60% of users prefer bilingual, culturally relevant platforms |

| Impact Potential for Income Boost | Estimated 15-20% increase in usable income post-adoption |

Conclusion: Charting a Path Forward

The journey toward unlocking the true income potential of the Latino community through LatintoTax strategies isn’t simply about compliance—it’s about empowerment. It’s about bridging gaps in literacy, accessibility, and opportunity, weaving together cultural authenticity with technical precision. As the community continues to grow, so does the collective capacity to harness these financial tools effectively. With increasingly sophisticated resources, innovative digital platforms, and a culturally competent approach by tax professionals and policymakers alike, the horizon looks promising. Unlocking these hidden income streams isn’t just a matter of numbers; it’s about transforming lives and strengthening the economic fabric from within.

What are the most common missed tax credits for Latino families?

+Many Latino families overlook credits like the Earned Income Tax Credit (EITC) and Child Tax Credits due to lack of awareness or language barriers, which can significantly boost after-tax income if claimed correctly.

How can small Latino entrepreneurs optimize their tax filings?

+Choosing the appropriate business structure, maintaining detailed records, claiming all eligible deductions, and consulting with bilingual tax professionals familiar with community-specific needs are key steps toward optimization.

What role do digital tools play in facilitating Latino tax literacy?

+Mobile apps and online platforms tailored for Spanish speakers and culturally relevant workflows can simplify tax navigation and increase engagement, ultimately enabling more community members to maximize their income potential through legal and efficient means.