Import Tax Calculator

In the world of international trade and online shopping, import taxes and customs duties are an inevitable part of the process. Understanding and calculating these fees accurately is crucial for both businesses and individuals engaged in cross-border transactions. This comprehensive guide delves into the intricacies of import tax calculations, offering a detailed insight into the factors, methods, and tools that empower you to navigate the complexities of customs fees with confidence.

As the global marketplace continues to expand, so does the need for efficient and transparent tax calculations. Whether you're an importer seeking to optimize your supply chain or an individual eager to understand the costs associated with international purchases, this article aims to provide an in-depth understanding of import tax calculations, shedding light on the variables that impact these fees and introducing practical tools to facilitate accurate estimations.

Understanding the Fundamentals of Import Taxes

Import taxes, also known as customs duties, are levied on goods brought into a country from abroad. These taxes are a crucial source of revenue for governments and are also used to protect domestic industries and maintain fair competition in the local market. The calculation of import taxes involves a complex interplay of various factors, each of which can significantly impact the final amount owed.

Key Factors Influencing Import Tax Calculations

-

Country of Origin: The country where the goods were manufactured or produced plays a pivotal role. Different countries may have varying tax rates and policies, making the country of origin a critical factor in tax calculations.

-

Product Type: The nature of the goods being imported is another crucial determinant. Certain products, such as luxury items or those deemed sensitive by the importing country, may be subject to higher tax rates.

-

Value of the Goods: The declared value of the imported items is a primary consideration. Typically, a higher value results in a higher tax liability.

-

Importing Country's Tariff Structure: Each country has its own tariff schedule, which outlines the tax rates applicable to different types of goods. Understanding this schedule is essential for accurate tax calculations.

-

Import Quotas and Restrictions: Some countries impose limits on the quantity or value of specific goods that can be imported. Exceeding these quotas may trigger additional taxes or penalties.

-

Trade Agreements and Preferences: International trade agreements and preferential arrangements can significantly impact import tax rates. For instance, goods originating from countries with free trade agreements may benefit from reduced or zero tax rates.

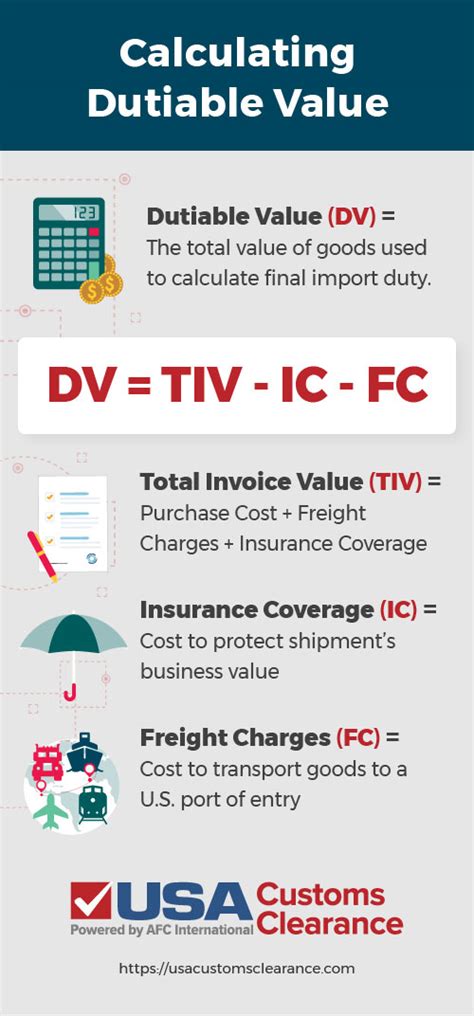

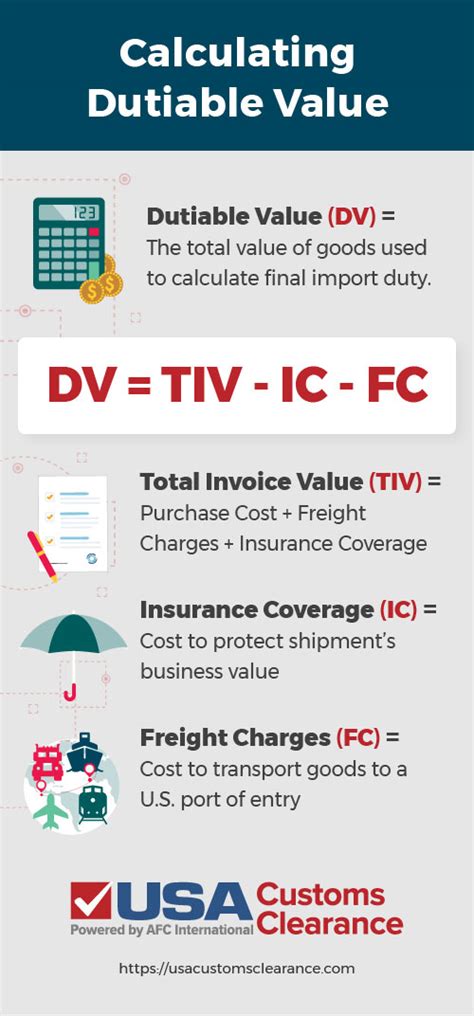

Methods for Calculating Import Taxes

The calculation of import taxes can vary depending on the country and the specific goods being imported. Here are some common methods used for import tax calculations:

-

Ad Valorem Tax: This is a tax calculated as a percentage of the value of the goods. It is typically applied to most imported products and is a straightforward method for determining tax liability.

-

Specific Duty: In this method, a fixed amount of tax is levied per unit of the imported goods. For instance, a specific duty might be $10 per kilogram of a particular product.

-

Compound Tax: Some countries use a combination of ad valorem and specific duty taxes. This method can be more complex but allows for a nuanced approach to tax calculation.

-

Minimum Value Tax: Certain countries impose a minimum value tax, which means that even if the value of the goods is low, a minimum tax amount is applied.

-

Free Trade Zones and Duty-Free Imports: In some cases, goods imported into designated free trade zones or from specific countries may be eligible for reduced or zero tax rates. Understanding these special zones and agreements is crucial for accurate tax calculations.

Exploring Advanced Tools for Import Tax Calculation

While understanding the fundamentals is essential, having access to advanced tools can significantly streamline the import tax calculation process. These tools leverage the latest technologies and data to provide accurate and efficient tax estimations, ensuring that businesses and individuals can make informed decisions about their international transactions.

Online Import Tax Calculators

Online import tax calculators are web-based tools that allow users to input information about their imports, such as the country of origin, product type, and value, and receive an estimated tax calculation. These calculators are often free and provide a quick and convenient way to estimate import taxes. While they may not account for every nuance of a country's tariff structure, they offer a valuable starting point for tax estimation.

Customs Broker Services

Customs brokers are experts in international trade and customs regulations. They can provide comprehensive support for import tax calculations, ensuring compliance with all relevant laws and regulations. Customs brokers have access to up-to-date information on tariff rates and can assist with the entire import process, from declaration to payment of duties.

Trade Compliance Software

Trade compliance software is designed to manage all aspects of international trade, including import tax calculations. These software solutions offer a more comprehensive approach, integrating various aspects of the import process, such as product classification, tariff lookup, and tax calculation. They can be particularly useful for businesses that frequently engage in international trade.

AI-Powered Tax Calculation Tools

Artificial intelligence (AI) is revolutionizing the import tax calculation landscape. AI-powered tools can analyze vast amounts of data, including historical trade data, current tariff rates, and market trends, to provide highly accurate tax estimates. These tools often incorporate machine learning algorithms that improve their accuracy over time, making them a powerful resource for businesses and individuals alike.

Case Studies: Real-World Applications of Import Tax Calculation

To illustrate the practical application of import tax calculation, let's explore a few real-world scenarios:

Scenario 1: Importing Electronics from Asia

A tech startup based in the United States wants to import a large shipment of electronic components from a manufacturer in China. The startup uses an online import tax calculator to estimate the duties and taxes for this shipment. The calculator considers the product type (electronics), the country of origin (China), and the declared value of the goods. Based on this information, the calculator estimates a total tax liability of $20,000 for the shipment.

Scenario 2: International E-commerce Seller

An online retailer based in the European Union sells a variety of products to customers worldwide. To ensure accurate tax calculations for international orders, the retailer utilizes a trade compliance software solution. This software integrates with the retailer's e-commerce platform, automatically calculating and applying the appropriate import taxes based on the destination country and product type. This streamlined approach enhances customer satisfaction and compliance.

Scenario 3: Importing Luxury Goods

A luxury fashion brand plans to import a collection of high-end accessories from Italy to the United Kingdom. Given the nature of the goods and the complex tariff structure of the UK, the brand engages the services of a customs broker. The broker provides expert guidance on the applicable tax rates, ensures compliance with UK regulations, and facilitates the entire import process, including tax payment.

Future Implications and Trends in Import Tax Calculation

As technology advances and global trade becomes increasingly complex, the landscape of import tax calculation is poised for significant evolution. Here are some key trends and future implications to consider:

-

AI and Machine Learning: The integration of AI and machine learning into import tax calculation tools will continue to enhance accuracy and efficiency. These technologies can analyze vast datasets and adapt to changing trade patterns, ensuring up-to-date tax calculations.

-

Blockchain Technology: Blockchain has the potential to revolutionize customs processes, including tax calculation. By providing a secure and transparent ledger for international trade transactions, blockchain can streamline tax calculations and enhance trust between trading partners.

-

Automation and Integration: The future of import tax calculation lies in seamless automation and integration with other aspects of the import process. From product classification to tax payment, the entire process can be streamlined, reducing errors and delays.

-

Regulatory Changes: With evolving trade policies and potential changes in international trade agreements, import tax calculation tools will need to adapt to stay current. Staying informed about regulatory changes is crucial for accurate tax calculations.

-

Sustainability and Ethical Considerations: As sustainability and ethical practices gain prominence in global trade, import tax calculation tools may need to incorporate these factors. For instance, goods with sustainable or ethical certifications may be eligible for reduced tax rates in certain jurisdictions.

Conclusion: Empowering Global Trade with Accurate Tax Calculations

In the complex world of international trade, accurate import tax calculations are a cornerstone of success. Whether you're a business looking to optimize your supply chain or an individual curious about the costs of international purchases, understanding and utilizing the right tools for tax calculations is essential. From the fundamentals of import taxes to the advanced technologies shaping the future of tax calculation, this guide has provided a comprehensive overview of the key considerations.

By leveraging the knowledge and tools presented here, you can navigate the complexities of import taxes with confidence. Whether it's utilizing online calculators, engaging customs brokers, or investing in trade compliance software, the path to accurate tax calculations is now clearer and more accessible than ever. As global trade continues to evolve, staying informed and adaptable will be key to success in the international marketplace.

How do I determine the country of origin for my imported goods?

+The country of origin is typically determined by the place where the goods were last substantially transformed. This can be identified through factors like manufacturing, assembly, or significant processing. Official documents, such as a Certificate of Origin, can also help establish the country of origin.

Are there any ways to reduce or avoid import taxes?

+Yes, there are several strategies. One approach is to take advantage of trade agreements and preferences that offer reduced or zero tax rates. Additionally, proper product classification and accurate valuation can help minimize tax liabilities. It’s important to consult with customs experts or use advanced tax calculation tools to explore these options.

What happens if I under-declare the value of my imported goods?

+Under-declaring the value of imported goods can lead to penalties and additional taxes. Customs authorities have the right to investigate and adjust the declared value, which may result in higher tax liabilities. It’s crucial to provide accurate and honest declarations to avoid legal issues.

How often do import tax rates change, and how can I stay updated?

+Import tax rates can change periodically due to various factors, including economic policies, international agreements, and trade negotiations. To stay updated, it’s advisable to regularly check official government websites, subscribe to trade newsletters, and utilize reliable import tax calculation tools that provide real-time updates.