Polk County Property Taxes

Property taxes in Polk County, Florida, are an important consideration for both homeowners and businesses. These taxes contribute significantly to the local government's revenue, which is used to fund essential services such as public schools, road maintenance, and emergency services. Understanding the property tax system and its implications is crucial for individuals and organizations operating within Polk County.

The Fundamentals of Polk County Property Taxes

Polk County, like many other counties in Florida, employs a comprehensive system for assessing and collecting property taxes. The process begins with the Property Appraiser’s Office, which is responsible for determining the just value of each property within the county. This value, often referred to as the “assessed value”, forms the basis for calculating property taxes.

The assessed value of a property is not a static figure; it is subject to change annually based on various factors, including market conditions, improvements made to the property, and general economic trends. The Property Appraiser's Office conducts regular assessments to ensure that the assessed values remain accurate and fair.

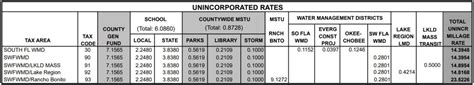

The Millage Rate and Tax Calculation

Once the assessed value of a property is determined, the Millage Rate comes into play. This rate, set by the local government, represents the amount of tax owed per thousand dollars of the assessed property value. For instance, if a property has an assessed value of 200,000 and the millage rate is 10 mills, the property owner would owe 2,000 in taxes (200,000 x 0.010 = 2,000). The millage rate is typically divided into two components: the ad valorem rate, which applies to all properties, and the non-ad valorem assessments, which are specific to certain properties and services.

| Millage Type | Rate (Mills) |

|---|---|

| Ad Valorem | 9.875 |

| Non-Ad Valorem | 0.320 |

The ad valorem rate is further divided among various entities within Polk County, including the county government, school districts, and special districts, each contributing a specific portion to the overall millage rate.

Exemptions and Discounts

Polk County offers a range of property tax exemptions to eligible individuals and organizations. These exemptions aim to reduce the tax burden on certain property owners, providing financial relief and encouraging specific activities or circumstances.

One of the most common exemptions is the Homestead Exemption, which is available to Florida residents who own and occupy their primary residence as their homestead. This exemption reduces the assessed value of the property, resulting in lower property taxes. Other exemptions include the Widow(er) Exemption, the Veterans' Exemption, and the Disability Exemption, each with its own set of eligibility criteria and benefits.

Additionally, Polk County provides discounts for early payment of property taxes. Homeowners who pay their taxes in full by a certain date, usually before the end of the grace period, can receive a discount of up to 4% on their tax bill. This incentive encourages timely payment and helps the county with its cash flow management.

Property Tax Due Dates and Payment Options

Property tax bills in Polk County are typically mailed to property owners in November, with a due date of March 31st of the following year. However, it’s important to note that the due date can vary slightly based on the calendar year and specific circumstances.

Polk County offers several payment options to accommodate different preferences and needs. Property owners can choose to pay their taxes in full by the due date or opt for a two-payment plan, where the first installment is due by March 31st and the second by September 30th. For those who prefer online transactions, the Polk County Tax Collector's Office provides an online payment portal, allowing taxpayers to pay securely and conveniently using a credit card or e-check.

Late Payment and Penalties

Failure to pay property taxes by the due date can result in late fees and additional penalties. A 3% late fee is applied to the total tax amount if the payment is not received by the due date. If the tax remains unpaid after a certain grace period, the county may initiate collection actions, including the imposition of interest and the potential for a tax certificate sale.

It's crucial for property owners to stay informed about their tax obligations and take advantage of the available payment options to avoid late fees and other penalties. The Polk County Tax Collector's Office provides detailed information and resources to assist taxpayers in understanding their responsibilities and options.

Appealing Property Assessments and Tax Values

Property owners in Polk County have the right to appeal their property assessments if they believe the assessed value is incorrect or unfair. The appeals process allows taxpayers to challenge the valuation set by the Property Appraiser’s Office, providing an opportunity to present evidence and arguments to support a lower assessed value.

The Appeal Process

To initiate an appeal, property owners must file a Petition for Administrative Hearing with the Property Appraiser’s Office within a specified timeframe, usually by a date in late February or early March. The petition should include detailed information about the property, the reasons for the appeal, and any supporting documentation. It’s important to provide compelling evidence to strengthen the case for a reduced assessment.

After the petition is filed, the Property Appraiser's Office will review the case and may schedule a hearing to gather additional information. The hearing provides an opportunity for both parties to present their arguments and evidence. It's advisable to consult with a tax professional or attorney who specializes in property tax appeals to ensure a strong and effective presentation.

Success Factors in Property Tax Appeals

Successful property tax appeals often hinge on the presentation of comprehensive and accurate data. This may include comparative market analyses, recent sales of similar properties, appraisals from independent experts, and detailed explanations of any unique circumstances affecting the property’s value.

It's crucial to approach the appeals process with a strategic mindset, focusing on the specific reasons why the assessed value should be reduced. Understanding the local real estate market, recent sales trends, and any unique features or challenges of the property can significantly strengthen the case.

Polk County’s Commitment to Transparency and Taxpayer Support

Polk County is dedicated to providing transparent and accessible information to its taxpayers. The Polk County Property Appraiser’s Office maintains a comprehensive website with resources and tools to assist property owners in understanding their assessments and tax obligations. This includes detailed property records, assessment history, and information on exemptions and appeals.

Additionally, the Polk County Tax Collector's Office offers a range of services to support taxpayers, including online account management, payment plans, and assistance with understanding tax bills and payment options. The office also provides resources for individuals facing financial hardship, offering guidance on potential relief options and resources.

Community Engagement and Outreach

Polk County recognizes the importance of engaging with its community to ensure a fair and equitable tax system. The county organizes public forums and town hall meetings to provide opportunities for taxpayers to voice their concerns, ask questions, and receive updates on tax-related matters. These events foster transparency and allow for open dialogue between taxpayers and county officials.

Furthermore, the county actively reaches out to vulnerable populations, such as seniors and individuals with disabilities, to ensure they are aware of available exemptions and assistance programs. This commitment to inclusivity and support demonstrates Polk County's dedication to serving its diverse community.

Future Outlook and Potential Reforms

As with any tax system, Polk County’s property tax framework is subject to ongoing evaluation and potential reforms. The county regularly assesses its processes and procedures to ensure fairness, efficiency, and compliance with changing laws and regulations.

Potential Reforms and Initiatives

One area of focus for potential reform is the assessment process. While Polk County’s Property Appraiser’s Office strives for accuracy and fairness, there are always opportunities for improvement. Ongoing efforts to enhance assessment methodologies, incorporate advanced technologies, and ensure consistent and transparent practices are vital to maintaining public trust.

Another area of consideration is the tax rate structure. While the current millage rate is set to provide sufficient revenue for essential county services, the county may explore alternative rate structures or consider adjustments to better align with changing economic conditions and community needs.

Additionally, Polk County may explore innovative initiatives to enhance taxpayer services and engagement. This could include the implementation of advanced technologies for online account management, the expansion of payment options to include digital wallets and cryptocurrencies, and the development of interactive tools to assist taxpayers in understanding their assessments and tax obligations.

Conclusion: Navigating Polk County Property Taxes

Polk County’s property tax system, while comprehensive and well-established, is subject to constant evolution and improvement. By understanding the assessment process, tax calculation methods, and available exemptions, property owners can effectively manage their tax obligations and take advantage of opportunities for savings and relief.

The county's commitment to transparency, taxpayer support, and community engagement is a testament to its dedication to ensuring a fair and efficient tax system. As the county continues to adapt and innovate, taxpayers can expect a system that remains responsive to their needs and contributes to the overall well-being of the community.

When are property taxes due in Polk County, Florida?

+

Property taxes in Polk County are typically due by March 31st of each year. However, it’s important to check with the Polk County Tax Collector’s Office for the exact due date, as it can vary slightly from year to year.

How can I pay my property taxes in Polk County?

+

Polk County offers several payment options. You can pay your taxes in full by the due date, or you can opt for a two-payment plan. Online payments are also available through the Polk County Tax Collector’s Office website. Additionally, you can pay in person at the Tax Collector’s Office or by mail.

Are there any exemptions or discounts available for property taxes in Polk County?

+

Yes, Polk County offers a range of property tax exemptions and discounts. Common exemptions include the Homestead Exemption, Widow(er) Exemption, Veterans’ Exemption, and Disability Exemption. Additionally, early payment of taxes by a certain date can result in a discount of up to 4% on the total tax amount.

How can I appeal my property assessment in Polk County?

+

To appeal your property assessment, you must file a Petition for Administrative Hearing with the Property Appraiser’s Office within a specified timeframe. It’s advisable to gather supporting evidence, such as comparative market analyses and appraisals, to strengthen your case. Consult with a tax professional or attorney for guidance.

What resources are available for taxpayers in Polk County?

+

Polk County provides various resources to assist taxpayers. The Property Appraiser’s Office and the Tax Collector’s Office both maintain informative websites with property records, assessment history, and tax payment information. Additionally, the county organizes public forums and town hall meetings to engage with taxpayers and provide updates.