Walton County Florida Property Tax

Property taxes are an essential aspect of local governance and funding, playing a significant role in the development and maintenance of communities. In Walton County, Florida, property taxes contribute to the economic landscape and impact both residents and businesses. This article delves into the intricacies of Walton County's property tax system, exploring its assessment process, rates, exemptions, and the various factors influencing tax liabilities.

Understanding Property Tax Assessments in Walton County

The property tax assessment process in Walton County begins with an evaluation of each property’s market value. The Walton County Property Appraiser’s Office is responsible for this task, utilizing various methods to determine the value of both residential and commercial properties. These methods include sales comparison, cost approach, and income capitalization, ensuring an accurate reflection of the property’s worth.

Once the property's value is established, it is then subject to a millage rate, which is determined annually by the county's Board of County Commissioners. The millage rate represents the tax rate per thousand dollars of the assessed value. For instance, if a property has an assessed value of $200,000 and the millage rate is set at 5 mills, the property owner would owe $1,000 in property taxes ($200,000 x 0.005 = $1,000). It's important to note that the millage rate can vary from year to year, impacting the property tax liabilities of Walton County residents.

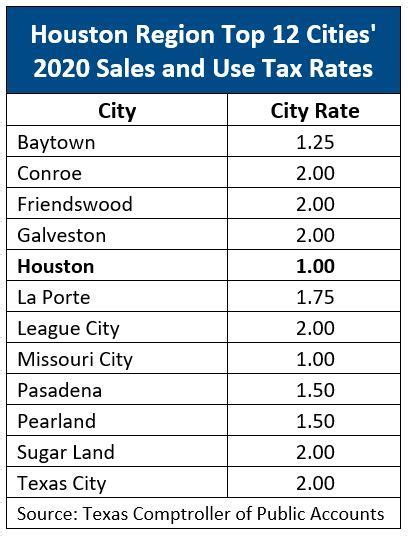

| Assessment Year | Millage Rate |

|---|---|

| 2023 | 4.9734 |

| 2022 | 4.9949 |

| 2021 | 5.0579 |

Walton County also offers various property tax exemptions to eligible homeowners. These exemptions can reduce the assessed value of a property, resulting in lower tax liabilities. Some of the notable exemptions include the Homestead Exemption, which provides a $25,000 reduction in the assessed value for primary residences, and the Widow/Widower Exemption, which offers a $500 reduction for those who have lost their spouse.

Property Tax Exemptions in Walton County

Beyond the Homestead and Widow/Widower Exemptions, Walton County provides several other property tax exemptions to cater to diverse homeowner needs. These include:

- Total and Permanent Disability Exemption: Grants a $5,000 reduction in assessed value for homeowners who are totally and permanently disabled.

- Additional Homestead Exemption for Seniors: Provides an extra $25,000 reduction in assessed value for homeowners aged 65 and older.

- Disabled Veteran Exemption: Offers a $5,000 reduction for veterans with service-connected disabilities.

- Armed Forces Exemption: Grants a $5,000 reduction for active-duty military personnel.

- Low-Income Senior Exemption: Provides a $50,000 reduction for seniors with limited incomes.

Factors Influencing Property Tax Liabilities

Several factors beyond the assessed value and millage rate can impact a property owner’s tax liability in Walton County. One such factor is the classification of the property. Properties are typically classified as either residential, commercial, or agricultural, with each category subject to different tax rates and assessment methods. For instance, agricultural properties often benefit from lower tax rates and specialized valuation methods, which can significantly reduce tax liabilities for landowners.

Additionally, special assessment districts within Walton County can also influence property tax bills. These districts, established for specific purposes like infrastructure development or maintenance, can levy additional taxes on properties within their boundaries. Examples include fire districts, mosquito control districts, and community development districts. These special assessments are in addition to the standard property taxes and can vary based on the services provided and the specific needs of the district.

Property Tax Appeals and Disputes

In instances where property owners disagree with their assessed value or tax liability, Walton County provides a formal appeals process. This process allows homeowners to challenge their property’s assessed value, millage rate, or other tax-related issues. The first step is often to contact the Property Appraiser’s Office to discuss the concerns and potentially resolve the issue administratively.

If the issue persists, homeowners can file a formal petition with the Value Adjustment Board (VAB). The VAB is an independent body that hears appeals and makes decisions on property tax matters. Homeowners must provide evidence and arguments to support their case, and the VAB will then determine if the assessed value or tax liability should be adjusted.

It's important for property owners to understand the timeline and requirements for filing a property tax appeal. Late or incomplete filings can result in the appeal being dismissed, so it's crucial to gather the necessary information and submit the petition within the specified timeframe.

The Impact of Property Taxes on Walton County’s Economy

Property taxes play a pivotal role in funding various aspects of Walton County’s economy and infrastructure. These taxes contribute to the county’s general fund, which is utilized for essential services such as law enforcement, fire protection, and emergency management. Additionally, property taxes support specific programs and initiatives, including education, healthcare, and social services.

For instance, a portion of the property taxes collected goes towards funding the Walton County School District. This funding is vital for maintaining and improving schools, hiring and retaining quality teachers, and providing educational resources to students. Similarly, property taxes also contribute to healthcare facilities, ensuring the availability of essential medical services to residents.

The economic impact of property taxes extends beyond these immediate services. The revenue generated also supports infrastructure development and maintenance, which can attract businesses and stimulate economic growth. Well-maintained roads, bridges, and other public facilities enhance the county's appeal for potential investors and residents, fostering a positive economic cycle.

Conclusion: Navigating Walton County’s Property Tax Landscape

Walton County’s property tax system is a complex but crucial component of the local economy and governance. Understanding the assessment process, millage rates, exemptions, and factors influencing tax liabilities empowers homeowners and businesses to make informed decisions and navigate the property tax landscape effectively.

By staying informed about property tax matters, Walton County residents can ensure they are taking advantage of all available exemptions, accurately calculating their tax liabilities, and utilizing the appeals process when necessary. This proactive approach not only ensures compliance with tax regulations but also contributes to the overall well-being and economic stability of the county.

How often are property taxes assessed in Walton County?

+Property taxes in Walton County are assessed annually. The assessment is based on the property’s market value as of January 1st of the current tax year. This means that the assessed value, and consequently the property tax liability, can change from year to year.

Are there any online resources to estimate property tax liabilities in Walton County?

+Yes, the Walton County Property Appraiser’s Office provides an online parcel search tool that allows homeowners to estimate their property tax liabilities. This tool provides information on the assessed value, millage rate, and estimated taxes based on the current tax year’s data.

What is the deadline for paying property taxes in Walton County?

+Property taxes in Walton County are due by March 31st of each year. If the amount due is not paid by this date, the property becomes subject to a tax certificate sale, which can result in additional fees and penalties.

Can I pay my property taxes online in Walton County?

+Yes, Walton County offers an online payment portal for property taxes. Homeowners can create an account, view their tax bills, and make payments securely online. This service provides convenience and flexibility for managing property tax liabilities.

What happens if I don’t pay my property taxes in Walton County?

+Failure to pay property taxes in Walton County can lead to significant consequences. The property may be subject to a tax certificate sale, where the county sells the tax certificate to a third party, who then has the right to collect the unpaid taxes plus interest and penalties. If the taxes remain unpaid, the property could eventually be sold at a tax deed sale, resulting in the loss of ownership.