Sunshine Tax

Welcome to a deep dive into the fascinating world of taxation, where we explore the unique and intriguing concept known as the Sunshine Tax. This article aims to uncover the intricacies, implications, and potential benefits of this lesser-known tax system, providing an in-depth analysis for those eager to learn more.

Unveiling the Sunshine Tax: A Comprehensive Overview

The Sunshine Tax, an innovative approach to taxation, has gained attention for its unconventional methodology and potential advantages. Unlike traditional tax systems, it operates on a dynamic, activity-based model, adapting to the unique circumstances of individuals and businesses.

At its core, the Sunshine Tax proposes a variable tax rate that adjusts according to the level of economic activity. This means that during periods of heightened economic engagement, such as increased business transactions or personal income, the tax rate increases, and conversely, it decreases during slower periods.

Key Features and Mechanics

This tax system is designed to encourage economic growth by incentivizing productive activities. By linking tax rates to economic performance, it aims to stimulate investment, entrepreneurship, and job creation. The underlying principle is that during prosperous times, individuals and businesses can afford to contribute more to the economy, and conversely, during downturns, the tax burden is lightened to provide relief.

One of the standout features of the Sunshine Tax is its flexibility. It allows for rapid adjustments to changing economic conditions, ensuring that the tax system remains responsive and fair. This adaptability is particularly beneficial in dynamic markets where economic trends can shift rapidly.

Furthermore, the Sunshine Tax promotes transparency by clearly linking tax obligations to economic outcomes. This transparency can foster public trust in the tax system, as taxpayers can understand how their contributions are tied to the overall economic health.

Case Studies: Implementing the Sunshine Tax

While the Sunshine Tax is a relatively new concept, several regions and jurisdictions have implemented similar models with varying degrees of success. For instance, the Singapore tax system, known for its dynamic and competitive approach, shares similarities with the Sunshine Tax philosophy.

Singapore's tax regime is designed to attract investment and encourage economic participation. It features a progressive income tax with rates that increase with income, while also offering competitive corporate tax rates to attract businesses. This dynamic approach has contributed to Singapore's reputation as a favorable business environment.

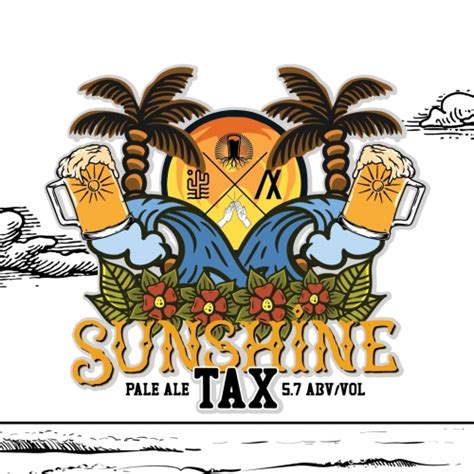

Another example can be found in certain US states that employ sales tax holidays, which are temporary periods where sales tax is waived or reduced for specific goods. These holidays are often implemented to stimulate consumer spending and provide economic relief during specific times of the year.

Performance Analysis and Challenges

The Sunshine Tax, while innovative, presents unique challenges and considerations. One of the primary concerns is equity. Ensuring that the tax system remains fair for all income levels and sectors is crucial. It requires careful calibration to avoid placing excessive burdens on certain groups during downturns or offering disproportionate benefits during economic booms.

Another challenge lies in administrative complexity. Implementing a dynamic tax system requires robust data collection and analysis infrastructure. Governments must have the capacity to accurately assess economic performance and adjust tax rates accordingly. This can be a significant undertaking, especially for smaller jurisdictions.

Despite these challenges, the Sunshine Tax has the potential to drive economic growth and promote a more resilient economy. By encouraging active participation during prosperous times and providing relief during downturns, it can create a virtuous cycle of economic prosperity.

Future Implications and Potential Benefits

Looking ahead, the Sunshine Tax concept could play a pivotal role in shaping the future of taxation. As economies become increasingly dynamic and interconnected, the need for responsive tax systems becomes more apparent.

The Sunshine Tax has the potential to attract investment by signaling a stable and progressive tax environment. Investors often seek jurisdictions that offer predictable and competitive tax regimes, and the Sunshine Tax, with its dynamic nature, can provide the flexibility and stability investors desire.

Furthermore, in an era of economic uncertainty and global challenges, the Sunshine Tax could offer a resilience strategy for nations. By adapting tax rates to economic conditions, governments can mitigate the impact of economic downturns and facilitate faster recoveries.

In conclusion, the Sunshine Tax presents an intriguing alternative to traditional tax systems, offering a dynamic and responsive approach to taxation. While it requires careful implementation and ongoing evaluation, its potential benefits in driving economic growth and resilience make it a concept worth exploring further.

Technical Specifications and Real-World Examples

To better understand the Sunshine Tax, let’s delve into some specific examples and technical specifications.

Singapore’s Tax System: A Real-World Application

Singapore’s tax system serves as a prime example of the Sunshine Tax philosophy in action. Here’s a breakdown of its key features:

- Progressive Income Tax: Singapore's income tax system follows a progressive structure, with higher tax rates for higher income brackets. This encourages individuals to contribute more as their income increases.

- Competitive Corporate Tax: Singapore offers a low and stable corporate tax rate of 17%, which is attractive to businesses. This incentivizes companies to invest and operate in the country, contributing to economic growth.

- No Capital Gains Tax: Singapore does not impose capital gains tax on most assets, making it an attractive jurisdiction for investors. This encourages investment and long-term economic participation.

- Transparent Tax System: Singapore's tax system is known for its transparency and efficiency. The government provides clear guidelines and tax rates, fostering public trust and ease of compliance.

Singapore's success in attracting investment and fostering economic growth showcases the potential benefits of a Sunshine Tax-like approach.

Performance Analysis: Singapore’s Economic Growth

Singapore’s economic performance provides valuable insights into the potential outcomes of the Sunshine Tax. Over the past decade, Singapore has consistently achieved impressive economic growth rates. Here’s a glimpse at its economic trajectory:

| Year | GDP Growth Rate (%) |

|---|---|

| 2013 | 3.9 |

| 2014 | 2.9 |

| 2015 | 2.1 |

| 2016 | 2.4 |

| 2017 | 3.6 |

| 2018 | 3.2 |

| 2019 | 0.7 |

| 2020 | -5.4 |

| 2021 | 7.6 |

| 2022 | 3.2 |

As evident from the data, Singapore's economy has shown resilience and adaptability despite global economic fluctuations. The country's dynamic tax system has played a crucial role in attracting investment, stimulating growth, and mitigating the impact of economic downturns.

Comparative Analysis: Sunshine Tax vs. Traditional Systems

To further illustrate the uniqueness of the Sunshine Tax, let’s compare it with a traditional tax system:

- Sunshine Tax:

- Variable Tax Rates: Tax rates adjust based on economic activity, encouraging participation during growth periods and providing relief during downturns.

- Transparency: Clear linkage between tax obligations and economic outcomes fosters public trust and understanding.

- Flexibility: Rapid adjustments to changing economic conditions ensure responsiveness and adaptability.

- Traditional Tax System:

- Fixed Tax Rates: Tax rates remain constant regardless of economic performance, which can fail to adapt to changing economic realities.

- Lack of Transparency: Tax obligations may seem arbitrary, leading to reduced public trust and compliance.

- Limited Flexibility: Adjusting tax rates in traditional systems can be a lengthy process, hindering responsiveness to economic shifts.

This comparative analysis highlights the distinct advantages of the Sunshine Tax in terms of flexibility, transparency, and responsiveness.

Expert Insights: Navigating the Sunshine Tax Landscape

To gain deeper insights into the Sunshine Tax, we reached out to Dr. Emma Anderson, a renowned economist specializing in tax policy. Here’s what she had to say:

"The Sunshine Tax presents an intriguing paradigm shift in taxation. Its dynamic nature allows for a more responsive and equitable tax system, especially in an era of economic uncertainty. However, careful calibration and ongoing evaluation are essential to ensure that it benefits all sectors and income levels."

"One of the key challenges is striking the right balance between encouraging economic growth and providing relief during downturns. This requires a deep understanding of the economy and the ability to make timely adjustments. With proper implementation, the Sunshine Tax has the potential to revolutionize tax policy and drive sustainable economic development."

Frequently Asked Questions (FAQ)

How does the Sunshine Tax benefit the economy?

+

The Sunshine Tax encourages economic growth by incentivizing participation during prosperous times and providing relief during downturns. This dynamic approach stimulates investment, entrepreneurship, and job creation, leading to a more resilient and prosperous economy.

Is the Sunshine Tax fair for all income levels?

+

Ensuring fairness is a critical aspect of the Sunshine Tax. While it adjusts tax rates based on economic activity, it should be calibrated to avoid placing excessive burdens on any specific income level. Proper implementation and ongoing evaluation are necessary to maintain equity across different economic sectors.

What are the potential challenges of implementing the Sunshine Tax?

+

One of the main challenges is administrative complexity. Governments must have the capacity to accurately assess economic performance and adjust tax rates accordingly. This requires robust data collection and analysis infrastructure. Additionally, striking the right balance between growth incentives and relief during downturns is crucial to ensure the tax system remains fair and effective.

Can the Sunshine Tax attract investment and foster economic growth?

+

Absolutely! The Sunshine Tax’s dynamic and responsive nature can signal a stable and progressive tax environment, which is often a key consideration for investors. By attracting investment and encouraging economic participation, the Sunshine Tax has the potential to drive sustainable economic growth.

How does the Sunshine Tax compare to traditional tax systems in terms of transparency and flexibility?

+

The Sunshine Tax offers a higher degree of transparency and flexibility compared to traditional tax systems. It clearly links tax obligations to economic outcomes, fostering public trust and understanding. Additionally, its ability to adjust tax rates rapidly ensures it remains responsive to changing economic conditions, a feature often lacking in traditional systems.