Mn Property Tax Rebate

The Minnesota Property Tax Rebate, also known as the Property Tax Refund, is a vital program designed to provide financial relief to eligible Minnesota homeowners and renters. This program, which has been in place for several decades, offers a much-needed boost to homeowners and renters, helping them manage their property tax burdens. As property taxes can be a significant financial strain, especially for those on fixed incomes, this rebate program plays a crucial role in supporting Minnesota's residents.

Understanding the Property Tax Rebate

The Property Tax Refund program is a direct initiative of the Minnesota Department of Revenue. Its primary objective is to alleviate the financial burden of property taxes, which are used to fund local services and infrastructure. The program achieves this by providing a refund, or rebate, to eligible individuals based on their income and the property taxes they’ve paid.

The rebate amount is calculated based on a percentage of the property taxes paid. This percentage increases as the homeowner's or renter's income decreases, ensuring that those who need it most receive a higher refund. For example, for the 2022 tax year, eligible homeowners could receive up to 40% of their property taxes back, while renters could get up to 35% of their rent back, up to certain limits.

Eligibility Criteria

To be eligible for the Property Tax Refund, individuals must meet certain criteria. These include being a Minnesota resident, owning or renting a home in Minnesota, and having a household income below a certain threshold. The income limit is adjusted annually to keep pace with inflation and changes in the cost of living. For the 2022 tax year, the income limit for homeowners was 134,470, while for renters, it was 74,710.

It's important to note that the income limit is for the entire household, not just the individual applying for the refund. This means that if you have a spouse or other dependents living with you, their income is included in the total household income calculation.

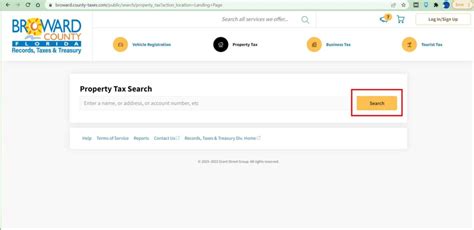

Application Process

Applying for the Property Tax Refund is relatively straightforward. Homeowners and renters can apply using Form M1PR, which is available on the Minnesota Department of Revenue website. The form requires basic information such as name, address, income, and property tax or rent details. It’s crucial to ensure that all information provided is accurate and up-to-date to avoid delays or denials.

The application deadline varies each year, typically falling around the end of the calendar year or early in the new year. It's essential to submit your application before the deadline to ensure your eligibility for the current tax year.

Impact and Benefits

The Property Tax Refund program has a significant positive impact on the lives of many Minnesotans. By reducing the financial burden of property taxes, the program helps to maintain the affordability of homeownership and rental housing. This, in turn, contributes to the stability of communities across the state.

For seniors and individuals on fixed incomes, the rebate can be a crucial supplement to their income, allowing them to better manage their finances and maintain their standard of living. For younger homeowners and renters, the refund can provide much-needed financial relief, helping them save for other expenses or investments.

| Year | Homeowner Rebate Limit | Renter Rebate Limit |

|---|---|---|

| 2022 | $890 | $695 |

| 2021 | $840 | $665 |

| 2020 | $800 | $640 |

The program also encourages community participation and civic engagement. By ensuring that property taxes remain manageable, the Property Tax Refund program promotes the sense of belonging and community spirit, which are essential for a healthy society.

Special Considerations

While the Property Tax Refund program is designed to be inclusive, there are certain scenarios where additional considerations may apply. For instance, individuals who are disabled, blind, or over the age of 65 may be eligible for a higher refund amount, as their income limits are higher than those for standard homeowners and renters.

Additionally, individuals who own more than one property or rent multiple homes may have their refund calculated differently. In such cases, it's important to carefully review the instructions and guidelines provided by the Minnesota Department of Revenue to ensure accurate calculation and compliance with the program's rules.

Future Outlook

Looking ahead, the Property Tax Refund program is expected to continue playing a vital role in supporting Minnesota’s residents. As property taxes and the cost of living continue to rise, the program’s importance will only grow. The state government recognizes this and has committed to maintaining and improving the program to ensure its effectiveness.

One area of focus for the future is simplifying the application process. The Minnesota Department of Revenue is exploring ways to make the application form more user-friendly and accessible, especially for those who may not be tech-savvy or have limited access to technology. This includes potential partnerships with community organizations and local governments to provide assistance and support during the application process.

Additionally, efforts are being made to increase awareness about the program, especially among those who may not be familiar with it. This includes targeted outreach to specific communities, such as seniors, people with disabilities, and those with limited English proficiency.

Expanding Eligibility

Another key aspect of the program’s future is the potential expansion of eligibility criteria. The state government is considering proposals to increase the income limits for homeowners and renters, ensuring that more Minnesotans can benefit from the program. This could involve adjusting the income thresholds annually based on the cost of living, rather than the current system which only adjusts for inflation.

Furthermore, there are discussions about including additional types of housing in the program, such as manufactured homes and co-ops. This would provide relief to a wider range of Minnesota residents and ensure that the program remains relevant and inclusive.

Conclusion

The Minnesota Property Tax Rebate, or Property Tax Refund program, is a vital initiative that provides financial relief to eligible homeowners and renters across the state. By reducing the burden of property taxes, the program helps to maintain the affordability of housing and promote community stability. With ongoing improvements and expansions, the program is well-positioned to continue supporting Minnesota’s residents for years to come.

How often can I apply for the Property Tax Refund?

+You can apply for the Property Tax Refund annually, as long as you meet the eligibility criteria for each tax year.

Are there any other similar programs in Minnesota?

+Yes, Minnesota offers other programs to help with property taxes, such as the Property Tax Deferral Program for seniors and disabled individuals, and the Homestead Credit program.

Can I apply for the refund if I own multiple properties?

+Yes, but the refund calculation will be different. You’ll need to include information about all your properties and ensure you meet the eligibility criteria for each.