Portland Arts Tax

The Portland Arts Tax is a unique initiative that has garnered attention and sparked conversations within the arts community and beyond. Implemented in 2012, this tax levy is a groundbreaking approach to funding arts and culture in Portland, Oregon. In this article, we will delve into the intricacies of the Portland Arts Tax, exploring its origins, impact, and the ongoing discussions surrounding its effectiveness and future.

The Birth of a Revolutionary Idea

The Portland Arts Tax was born out of a vision to foster a vibrant and accessible arts scene in the city. Proposed by then-Mayor Sam Adams as part of his Rose City Blueprint, the tax aimed to address the funding challenges faced by local arts organizations and individual artists.

The idea was simple yet ambitious: by levying a small tax on Portland residents, the city could generate a dedicated fund to support arts programs, initiatives, and artists themselves. This marked a departure from traditional funding models, which often rely heavily on grants and philanthropic contributions.

Key Provisions of the Arts Tax

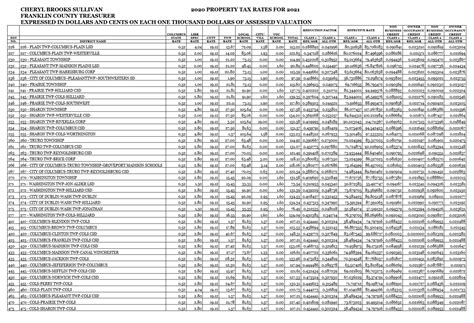

The tax is levied annually on individuals aged 18 and older who reside within the city limits of Portland. The initial rate was set at $35, with exemptions and waivers available for low-income individuals and certain qualifying circumstances.

One of the tax's innovative features is its focus on individual responsibility. Residents are required to self-report their income and pay the tax directly to the city. This approach, while unique, has faced scrutiny and sparked debates about compliance and enforcement.

| Exemptions and Waivers | Eligibility |

|---|---|

| Low-income individuals | Residents with an annual household income below $1,000 |

| Full-time students | Individuals enrolled in an accredited educational institution |

| Active-duty military | Members of the armed forces stationed in Portland |

Funding Arts and Culture in Portland

Since its inception, the Portland Arts Tax has played a significant role in supporting a wide range of arts initiatives and organizations. The funds generated through the tax are distributed through a competitive grant process, ensuring that a diverse array of artistic endeavors receive support.

Impact on Local Arts Organizations

The tax has been a lifeline for many small arts organizations and community arts programs. Grants from the Arts Tax fund have enabled these entities to expand their reach, develop new programs, and engage with a broader audience. From theater groups to dance studios and visual arts centers, the tax has provided much-needed financial stability.

For example, the Portland Art Museum has utilized Arts Tax funds to enhance its educational programming, offering free admission days and developing interactive exhibits for families. Similarly, the Portland Opera has been able to expand its outreach initiatives, bringing opera performances to underserved communities and schools.

Individual Artist Support

In addition to organizational grants, a portion of the Arts Tax revenue is allocated directly to individual artists. This support has been instrumental in fostering creativity and providing artists with the means to pursue their craft.

Through the Artist Relief Fund, artists can apply for grants to cover expenses related to their artistic practice, such as studio rentals, materials, and professional development opportunities. This fund has empowered artists to take risks, explore new mediums, and collaborate with fellow creatives.

| Grant Amounts | Purpose |

|---|---|

| $1,000 | General operating support for arts organizations |

| $500 | Individual artist grants for professional development |

| $250 | Community arts projects and events |

Challenges and Controversies

Despite its noble intentions and positive impacts, the Portland Arts Tax has not been without its share of challenges and controversies.

Compliance and Enforcement

One of the primary concerns surrounding the tax is the issue of compliance. With the onus on individuals to self-report and pay the tax, there have been questions about the accuracy of reporting and the potential for non-compliance.

The city has implemented various measures to promote compliance, including public awareness campaigns and simplified payment processes. However, the nature of the tax makes it challenging to enforce, particularly for individuals who may not have a clear understanding of their tax obligations.

Equity and Accessibility

While the tax aims to promote equity in the arts, there are ongoing discussions about whether it adequately addresses issues of accessibility and inclusivity. Some critics argue that the tax disproportionately impacts lower-income residents, who may struggle to afford the levy despite exemptions.

Additionally, there are concerns about the distribution of funds and whether they reach the most vulnerable and underrepresented communities. Advocates for arts equity have called for a more targeted approach to ensure that the tax benefits are felt across the entire arts ecosystem.

Future Prospects and Innovations

As Portland continues to evolve as a cultural hub, the future of the Arts Tax remains a topic of interest and discussion. Here are some potential avenues for growth and improvement:

Expanding Revenue Streams

To address concerns about the tax’s impact on lower-income residents, there have been proposals to explore alternative revenue streams. These could include partnerships with businesses, corporate sponsorships, or even a small percentage of the city’s tourism tax.

By diversifying the funding sources, the tax could become more sustainable and less reliant on individual resident contributions.

Enhancing Equity Measures

Efforts to promote equity and accessibility in the arts could be strengthened by implementing targeted initiatives. This might involve creating dedicated funds for specific underserved communities, such as immigrant artists or artists of color.

Additionally, exploring partnerships with community organizations and cultural centers could help ensure that the benefits of the tax reach a wider audience.

Community Engagement

Engaging the community in the decision-making process for Arts Tax funding could lead to more transparent and inclusive outcomes. This could involve public forums, online surveys, and collaborative workshops to gather input on funding priorities.

By involving residents in the allocation of tax funds, the city can foster a sense of ownership and ensure that the arts reflect the diverse interests and needs of Portland's population.

Conclusion

The Portland Arts Tax stands as a bold experiment in arts funding, demonstrating the city’s commitment to supporting its vibrant cultural scene. While it has faced challenges and criticisms, the tax has also sparked important conversations about the role of art in society and the responsibility of communities to nurture and sustain it.

As Portland continues to evolve, the Arts Tax will undoubtedly remain a key component of the city's cultural fabric. With ongoing dialogue and a commitment to innovation, the tax has the potential to evolve and adapt, ensuring that the arts thrive and remain accessible to all.

How does the Portland Arts Tax compare to other arts funding models in the US?

+The Portland Arts Tax is unique in its approach, as it relies primarily on individual resident contributions rather than government or corporate funding. While some cities have dedicated arts funding through local government budgets, Portland’s model is more akin to a voluntary contribution system with exemptions.

What percentage of Portland residents pay the Arts Tax annually?

+According to recent data, approximately 80% of eligible residents pay the Arts Tax each year. This compliance rate is relatively high compared to other self-reported taxes, indicating a strong commitment to supporting the arts within the community.

How can individuals and organizations apply for Arts Tax grants?

+Applications for Arts Tax grants are typically made available through the Regional Arts & Culture Council (RACC), which administers the funding process. The RACC website provides detailed information on eligibility criteria, application deadlines, and guidelines for both organizations and individual artists.