Excise Tax Washington

Welcome to our comprehensive guide on Excise Tax in Washington State. Excise taxes play a crucial role in the revenue generation and economic policies of states, and Washington is no exception. This article aims to provide an in-depth exploration of excise taxes in Washington, shedding light on their purpose, types, implications, and their significance in the state's economic landscape.

Understanding Excise Tax in Washington

In the context of Washington State, an excise tax refers to a tax levied on the sale or production of specific goods, services, or activities. Unlike sales taxes, which are typically applied to the total value of a transaction, excise taxes are usually levied as a fixed amount or a percentage of the price of a particular item or service. These taxes are often referred to as “sin taxes” due to their common application on goods like alcohol, tobacco, and gasoline, which are considered harmful or undesirable.

The primary purpose of excise taxes in Washington, as in many other states, is to generate revenue for specific purposes. These taxes are typically earmarked for particular projects or funds, ensuring that the revenue is directed towards specific goals rather than being allocated to the general fund. This targeted approach allows for more efficient and transparent management of public finances.

Types of Excise Taxes in Washington

Washington State has a range of excise taxes, each designed to target a specific sector or activity. Some of the most prominent excise taxes in the state include:

Fuel Excise Tax

One of the most well-known excise taxes in Washington is the Fuel Excise Tax, which is applied to the sale of gasoline and other motor fuels. This tax is crucial for funding transportation infrastructure projects, including road construction, maintenance, and public transit systems. The revenue generated from this tax ensures that Washington’s transportation network remains well-maintained and accessible.

Tobacco Excise Tax

The Tobacco Excise Tax is another significant source of revenue in Washington. This tax is levied on the sale of cigarettes, chewing tobacco, and other tobacco products. The primary goal of this tax is to discourage tobacco use, improve public health, and generate funds for tobacco prevention and cessation programs. The tax also contributes to the state’s general fund, providing resources for various public services.

Alcohol Excise Tax

Washington also imposes an excise tax on alcoholic beverages, including beer, wine, and spirits. This tax is designed to generate revenue for specific purposes, such as alcohol education and prevention programs. Additionally, the tax serves as a means to control and regulate the consumption of alcohol, aligning with the state’s public health objectives.

Timber Excise Tax

The Timber Excise Tax is unique to Washington, given its extensive forest resources. This tax is applied to the harvest of timber, with the revenue generated being used to fund forest management, fire protection, and other related initiatives. The tax ensures that Washington’s valuable forest lands are well-managed and maintained for future generations.

Other Excise Taxes

Washington has a range of other excise taxes, including taxes on aviation fuel, motor vehicle sales, and even soft drinks. Each of these taxes serves a specific purpose, whether it’s funding infrastructure, promoting public health, or supporting environmental initiatives.

The Impact and Implications of Excise Taxes

Excise taxes in Washington have a significant impact on the state’s economy and its residents. While these taxes generate substantial revenue for the state, they also have implications for businesses and consumers.

Revenue Generation and Economic Impact

The revenue generated from excise taxes is a critical component of Washington’s overall budget. These taxes provide a stable and reliable source of income, allowing the state to fund essential services and infrastructure projects. For example, the Fuel Excise Tax contributes significantly to the state’s transportation budget, ensuring that roads and bridges are well-maintained and that public transit systems are accessible and efficient.

Additionally, excise taxes can encourage economic development by funding initiatives that support businesses and job creation. For instance, revenue from the Timber Excise Tax can be used to promote sustainable forest management practices, which in turn can benefit the timber industry and related businesses.

Impact on Businesses and Consumers

While excise taxes are essential for generating revenue, they can also have an impact on businesses and consumers. For businesses, these taxes can increase the cost of doing business, especially in industries that are heavily taxed, such as tobacco or alcohol. However, it’s important to note that these taxes can also serve as a form of regulation, encouraging businesses to adopt more sustainable or healthier practices.

For consumers, excise taxes can increase the cost of goods and services. For example, the Fuel Excise Tax can lead to higher prices at the pump, impacting commuters and businesses that rely on transportation. Similarly, the Tobacco and Alcohol Excise Taxes can make these products more expensive, potentially discouraging their use.

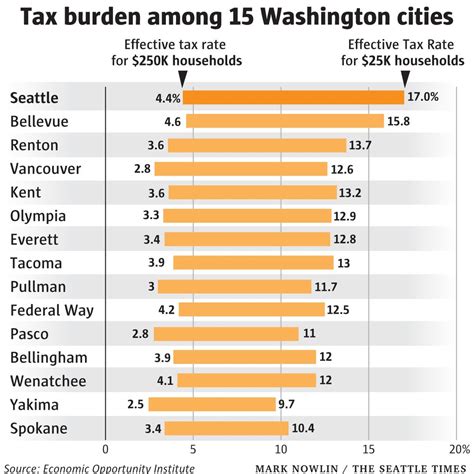

Equity and Social Justice Considerations

Excise taxes also raise important equity and social justice considerations. These taxes can disproportionately impact low-income individuals and communities, as they may spend a higher proportion of their income on taxed goods or services. Additionally, the regressive nature of some excise taxes can widen income inequality.

To address these concerns, Washington has implemented measures such as tax credits and exemptions for certain low-income households. These initiatives aim to mitigate the impact of excise taxes on vulnerable populations and promote social equity.

Excise Tax Administration and Compliance

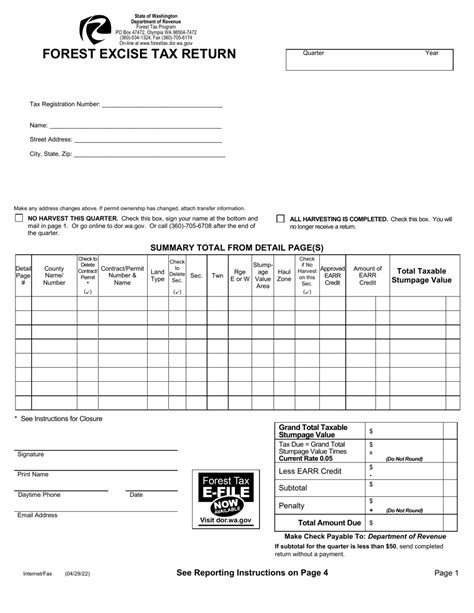

The administration and compliance of excise taxes in Washington are overseen by the Washington State Department of Revenue. This department is responsible for collecting and enforcing excise taxes, ensuring that businesses and individuals comply with the state’s tax laws.

Registration and Reporting

Businesses that engage in activities subject to excise taxes are required to register with the Department of Revenue. This registration process ensures that businesses understand their tax obligations and can accurately report and pay their excise taxes. The Department provides resources and guidance to help businesses navigate the registration and reporting process.

Audit and Enforcement

The Department of Revenue conducts audits to ensure compliance with excise tax laws. These audits can involve reviewing tax returns, examining financial records, and conducting on-site inspections. The Department has the authority to impose penalties and interest for non-compliance, and in severe cases, criminal charges may be pursued.

Exemptions and Credits

Washington offers various exemptions and tax credits to certain businesses and individuals. These exemptions and credits can reduce the tax burden on specific industries or individuals, promoting fairness and equity in the tax system. For example, some low-income households may be eligible for tax credits to offset the impact of excise taxes on essential goods and services.

The Future of Excise Taxes in Washington

As Washington’s economy and population continue to evolve, the role of excise taxes is likely to change as well. The state’s policymakers and revenue officials will need to adapt and innovate to ensure that excise taxes remain effective and equitable.

Policy Considerations

Policy decisions regarding excise taxes will need to balance the need for revenue generation with the potential impacts on businesses and consumers. As the state’s economy diversifies, policymakers may consider expanding or modifying existing excise taxes to align with emerging industries and trends. For example, with the rise of electric vehicles, the future of the Fuel Excise Tax may need to be reevaluated.

Technological Advances

Technological advancements can also play a role in the future of excise taxes. For instance, the implementation of electronic excise tax reporting and payment systems can streamline the process for businesses and improve efficiency for the Department of Revenue. Additionally, data analytics and artificial intelligence can enhance audit processes, identifying potential non-compliance more accurately and efficiently.

Community Engagement and Education

Engaging with communities and educating the public about excise taxes is essential for building trust and understanding. Transparency in how excise tax revenue is allocated and utilized can help ensure that taxpayers feel their contributions are being used effectively and fairly. Public education campaigns can also promote awareness about the purpose and impact of these taxes, fostering a sense of shared responsibility.

Conclusion

Excise taxes are a critical component of Washington State’s revenue generation and economic policies. These taxes serve multiple purposes, from funding essential services and infrastructure to promoting public health and environmental initiatives. While excise taxes can have implications for businesses and consumers, they also provide a stable source of revenue for the state and can encourage economic development.

As Washington continues to evolve, the role of excise taxes will need to adapt to meet the changing needs of the state's residents and businesses. By balancing revenue generation with equity and social justice considerations, and by embracing technological advancements and community engagement, Washington can ensure that its excise tax system remains effective, fair, and sustainable for years to come.

What is the current rate of the Fuel Excise Tax in Washington State?

+As of my last update in January 2023, the Fuel Excise Tax rate in Washington is 49.4 cents per gallon for gasoline and 52.8 cents per gallon for diesel fuel. These rates are subject to change, so it’s advisable to check with the Washington State Department of Revenue for the most current information.

How often are excise tax rates reviewed and updated in Washington?

+Excise tax rates in Washington are typically reviewed and updated on an as-needed basis. This means that the rates can change when there are significant changes in the cost of providing services or when there are legislative changes. The Department of Revenue works closely with policymakers to ensure that tax rates remain fair and effective.

Are there any exemptions or credits available for businesses or individuals regarding excise taxes in Washington?

+Yes, Washington offers various exemptions and tax credits related to excise taxes. For example, there are exemptions for certain agricultural and timber activities, and low-income households may be eligible for tax credits to offset the impact of excise taxes. It’s essential to consult the Department of Revenue’s website or seek professional advice to understand the specific exemptions and credits available.