Butler County Ohio Property Tax

Butler County, nestled in the southwestern corner of Ohio, is renowned for its vibrant communities, rich history, and thriving economy. With a diverse landscape that ranges from bustling urban centers to picturesque rural areas, the county offers a unique blend of charm and opportunity. One of the most significant financial considerations for residents and businesses alike is the property tax system, which plays a crucial role in the county's economic fabric. This comprehensive guide delves into the intricacies of Butler County's property tax landscape, shedding light on its assessment process, tax rates, and the various factors that influence property valuations.

Understanding the Property Tax Landscape in Butler County

Property taxes are a primary source of revenue for local governments, including counties, cities, and school districts. In Butler County, these taxes are integral to funding essential services such as education, public safety, infrastructure development, and more. The process of assessing and collecting property taxes is a complex yet crucial mechanism that ensures the county’s financial stability and sustainability.

Property Tax Assessment: A Step-by-Step Process

The journey of a property through the tax assessment process in Butler County is meticulous and transparent. It begins with the identification of each taxable property by the Butler County Auditor’s Office, followed by a detailed inspection and evaluation. This assessment process involves the following key steps:

- Property Identification: The Auditor's Office maintains a comprehensive database of all taxable properties in the county. This includes residential, commercial, agricultural, and industrial properties.

- Physical Inspection: Trained assessors conduct periodic physical inspections of properties to verify their condition, structural integrity, and any recent improvements or modifications.

- Data Collection: During the inspection, assessors gather vital information such as the property's size, number of rooms, age, construction materials, and any unique features that could impact its value.

- Market Analysis: The assessment team conducts thorough market research to determine the fair market value of properties. This involves analyzing recent sales of comparable properties, considering factors like location, size, and condition.

- Valuation: Using the collected data and market analysis, the Auditor's Office assigns a taxable value to each property. This value serves as the basis for calculating the property tax due.

It's important to note that property assessments are conducted regularly, typically every three years, to ensure that property values remain up-to-date and accurate. This process is vital for maintaining fairness and equity in the tax system.

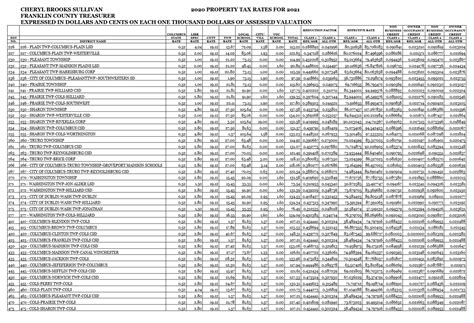

Property Tax Rates: Unraveling the Numbers

The property tax rate in Butler County is determined by a combination of factors, including the budget requirements of local governments and the assessed value of properties. This rate is expressed in mills, with one mill representing 1 of tax for every 1,000 of assessed property value.

For instance, if a property is assessed at $200,000 and the tax rate is 25 mills, the annual property tax due would be calculated as follows:

| Property Value | $200,000 |

|---|---|

| Tax Rate (in mills) | 25 |

| Annual Property Tax | $5,000 |

It's crucial to understand that the tax rate can vary across different jurisdictions within the county. For example, the tax rate for a property located in the city of Hamilton might differ from that of a property in a rural township.

Factors Influencing Property Valuation

The valuation of a property in Butler County is influenced by a myriad of factors, each playing a unique role in determining its assessed value. Here are some key considerations:

- Location: Properties located in desirable neighborhoods or close to amenities often command higher values.

- Property Type: Residential, commercial, and industrial properties are assessed differently, taking into account their unique characteristics and market demands.

- Size and Condition: The size of a property, including its square footage and lot size, along with its overall condition, significantly impact its valuation.

- Improvements and Upgrades: Recent renovations, additions, or improvements can increase a property's value, especially if they enhance its functionality or aesthetic appeal.

- Market Trends: The real estate market's overall health and trends, such as supply and demand dynamics, can influence property values.

Exploring the Impact of Property Taxes on Local Communities

Property taxes are not merely a financial obligation for Butler County residents; they are a vital investment in the community’s future. The revenue generated from these taxes is funneled back into the local economy, supporting critical infrastructure projects, enhancing public services, and driving economic growth.

Investing in Education: A Priority for Property Tax Revenue

One of the most significant beneficiaries of property tax revenue in Butler County is the education sector. Schools and educational institutions rely heavily on these funds to provide quality education, maintain facilities, and offer a range of programs and extracurricular activities. A substantial portion of the property tax revenue is allocated to local school districts, ensuring that every child has access to a robust and inclusive learning environment.

For instance, the Hamilton City School District, one of the largest in the county, receives a significant portion of its operating budget from property taxes. This funding supports a wide range of initiatives, including:

- Hiring qualified teachers and staff

- Maintaining and upgrading school facilities

- Providing advanced technology and resources for students

- Implementing innovative teaching methods and curriculum development

- Offering extracurricular activities and sports programs

By investing in education through property taxes, Butler County ensures that its future generations are equipped with the knowledge and skills necessary to thrive in a rapidly evolving world.

Infrastructure Development: Building a Stronger Community

Property taxes also play a pivotal role in the development and maintenance of critical infrastructure in Butler County. These funds are utilized to improve roads, bridges, public transportation systems, and utilities, enhancing the overall quality of life for residents and businesses alike. Well-maintained infrastructure not only improves connectivity and accessibility but also attracts investment and fosters economic growth.

Consider the example of the Butler County Engineer's Office, which oversees the construction and maintenance of county roads and bridges. Property tax revenue provides a significant portion of the funding required for these projects, ensuring that the county's transportation network remains efficient and safe. This, in turn, benefits commuters, businesses, and emergency services, contributing to the overall economic vitality of the region.

Supporting Public Safety and Emergency Services

A substantial portion of property tax revenue in Butler County is allocated to public safety and emergency services, ensuring the well-being and security of its residents. These funds support a range of vital services, including police departments, fire stations, emergency medical services, and more.

For instance, the Hamilton Police Department, one of the largest law enforcement agencies in the county, relies on property tax revenue to maintain a robust presence and provide essential services to the community. This funding enables the department to:

- Hire and train highly skilled officers

- Acquire modern equipment and technology for effective policing

- Implement community outreach and engagement programs

- Respond swiftly to emergencies and maintain public safety

By investing in public safety, Butler County fosters a sense of security and trust among its residents, creating an environment where individuals and businesses can thrive.

Enhancing Community Amenities and Services

Beyond education, infrastructure, and public safety, property tax revenue in Butler County is directed towards enhancing a wide array of community amenities and services. These funds support the development and maintenance of parks, recreational facilities, libraries, cultural centers, and other public spaces, enriching the lives of residents and promoting a sense of community.

Take, for example, the Butler County Parks District, which manages and maintains a network of parks and recreational areas across the county. Property tax revenue provides a significant portion of the funding required for these parks, ensuring that residents have access to green spaces, hiking trails, sports facilities, and other recreational opportunities. This investment not only promotes physical health and well-being but also fosters a sense of community engagement and pride.

Strategies for Effective Property Tax Management

Navigating the complexities of property taxes in Butler County can be challenging, but with the right strategies and resources, property owners can ensure they are paying their fair share while also protecting their financial interests. Here are some expert tips and insights to help navigate the property tax landscape:

Stay Informed: Understanding Your Property Assessment

One of the most crucial aspects of effective property tax management is staying informed about your property’s assessment. The Butler County Auditor’s Office provides detailed information on property assessments, including the assessed value, tax rate, and the calculation of your annual property tax liability. Regularly reviewing this information ensures that you are aware of any changes or discrepancies, allowing you to take prompt action if necessary.

Appeal Process: Ensuring Fair Assessment

If you believe that your property’s assessed value is inaccurate or unfair, the Butler County Auditor’s Office provides a detailed appeals process. This process allows property owners to challenge their assessment and seek a more accurate valuation. It’s essential to gather supporting evidence, such as recent sales of comparable properties, to strengthen your case. The appeals process ensures that property owners have a fair and transparent avenue to address any concerns regarding their property’s valuation.

Tax Incentives and Exemptions: Maximizing Savings

Butler County offers a range of tax incentives and exemptions that can help property owners reduce their tax burden. These incentives may include homestead exemptions for primary residences, agricultural land tax reductions, or incentives for energy-efficient improvements. Staying informed about these opportunities and understanding the eligibility criteria can help property owners take advantage of these savings, ensuring they pay only what is necessary.

Working with Tax Professionals: Expert Guidance

Navigating the complexities of property taxes can be challenging, especially for those who are not familiar with the process or the local regulations. Engaging the services of a tax professional, such as a certified public accountant (CPA) or a tax consultant, can provide valuable expertise and guidance. These professionals can help property owners understand their tax obligations, identify potential savings opportunities, and ensure compliance with all relevant laws and regulations.

Stay Updated: Monitoring Tax Rate Changes

Property tax rates in Butler County can change periodically, influenced by a variety of factors such as budget requirements and market conditions. Staying updated on any changes in the tax rate is crucial for property owners to accurately estimate their tax liabilities. The Butler County Auditor’s Office and local government websites provide regular updates on tax rate changes, ensuring that property owners have access to the latest information.

Looking Ahead: The Future of Property Taxes in Butler County

As Butler County continues to evolve and grow, the role of property taxes in shaping its future cannot be overstated. These taxes are a vital engine of economic development, funding critical initiatives that drive the county forward. As we look ahead, several key trends and considerations will shape the future of property taxes in Butler County.

Sustainable Funding for Education and Infrastructure

One of the primary focuses for the future of property taxes in Butler County is ensuring sustainable funding for education and infrastructure development. As the county’s population grows and diversifies, the demand for high-quality education and well-maintained infrastructure will only increase. Property taxes will continue to play a pivotal role in meeting these demands, supporting initiatives that enhance the county’s educational institutions, transportation networks, and public facilities.

Adapting to Changing Economic Realities

The economic landscape is constantly evolving, and Butler County must adapt its property tax system to reflect these changes. This includes staying responsive to market trends, ensuring that property assessments remain accurate and fair, and exploring innovative funding mechanisms to address emerging needs. By staying agile and forward-thinking, the county can continue to provide essential services while also promoting economic growth and development.

Embracing Technology and Data-Driven Assessments

In an increasingly digital world, technology and data analytics are transforming the way property assessments are conducted. Butler County is well-positioned to leverage these advancements, improving the efficiency and accuracy of its assessment processes. By adopting cutting-edge technologies, the county can streamline property evaluations, enhance transparency, and ensure that property owners receive fair and consistent assessments.

Community Engagement and Transparency

Effective property tax management is not just a matter of numbers and regulations; it also requires strong community engagement and transparency. Butler County can foster a culture of trust and collaboration by actively involving residents and businesses in the tax assessment and budgeting processes. Open dialogue and accessible information empower property owners to understand their tax obligations and contribute to the county’s fiscal planning, fostering a sense of shared responsibility and ownership.

Conclusion: A Vibrant Future Fueled by Property Taxes

Property taxes are more than just a financial obligation for Butler County residents; they are a vital investment in the community’s present and future. As the county continues to thrive and grow, the revenue generated from these taxes will remain a cornerstone of its economic success. By staying informed, engaged, and proactive, property owners can ensure that their contributions are channeled effectively, supporting initiatives that enhance the quality of life for all residents.

The future of Butler County is bright, and with a robust and equitable property tax system, the county is well-equipped to meet the challenges and opportunities that lie ahead. Together, we can build a vibrant, prosperous community, fueled by the collective efforts and contributions of its residents.

How often are properties reassessed for tax purposes in Butler County, Ohio?

+Properties in Butler County are typically reassessed every three years. This ensures that property values remain up-to-date and reflect market trends and changes.

What is the role of the Butler County Auditor’s Office in the property tax assessment process?

+The Butler County Auditor’s Office is responsible for identifying taxable properties, conducting physical inspections, collecting data, analyzing market trends, and ultimately determining the taxable value of each property. They play a crucial role in ensuring the accuracy and fairness of the assessment process.

How can property owners appeal their assessed value if they believe it is inaccurate?

+Property owners who wish to appeal their assessed value can follow the detailed appeals process provided by the Butler County Auditor’s Office. This process typically involves submitting an appeal application, providing supporting evidence, and attending a hearing to present their case.

What are some common tax incentives or exemptions available to property owners in Butler County?

+Butler County offers a range of tax incentives and exemptions, including homestead exemptions for primary residences, agricultural land tax reductions, and incentives for energy-efficient improvements. Property owners can explore these opportunities to reduce their tax burden and save on their property taxes.

How can property owners stay informed about changes in tax rates and assessments in Butler County?

+Property owners can stay informed about tax rate changes and assessment updates by regularly visiting the Butler County Auditor’s Office website, subscribing to their newsletter, or following their social media channels. These sources provide timely updates and important announcements related to property taxes.