City Of Phoenix Arizona Sales Tax

Welcome to the City of Phoenix, Arizona, where sales tax regulations play a significant role in the local economy. The sales tax system in Phoenix, like in many other cities, is designed to generate revenue for the government and support various public services. Understanding the intricacies of sales tax is crucial for businesses and consumers alike. This comprehensive guide aims to delve into the specifics of the City of Phoenix's sales tax structure, providing an in-depth analysis of the rates, applicability, and potential impacts on the local business landscape.

Unraveling the Sales Tax Structure in Phoenix, Arizona

The sales tax system in Phoenix is a complex interplay of state, county, and city taxes, each contributing to the overall tax rate. As of [insert most recent data available], the total sales tax rate in Phoenix stands at [percentage], comprising the following components:

| Tax Type | Rate |

|---|---|

| State Sales Tax | [percentage] |

| Maricopa County Tax | [percentage] |

| City of Phoenix Tax | [percentage] |

| Special District Taxes | [percentage] |

The state sales tax is a consistent rate applied across Arizona, while the county and city taxes vary based on the location of the transaction. Special district taxes are additional levies imposed by specific governmental entities for funding targeted projects or services.

Understanding the Impact on Businesses

For businesses operating in Phoenix, sales tax regulations can have a substantial influence on financial planning and consumer behavior. Higher sales tax rates can lead to increased overhead costs for businesses, which may be passed on to consumers in the form of higher prices. This, in turn, can impact consumer purchasing power and influence shopping behavior.

To illustrate, let's consider a hypothetical scenario. A small business owner, Jane, operates a retail store in Phoenix. With the current sales tax rate at [percentage], she calculates that for every $100 of sales, her business pays approximately $[amount] in sales tax. This tax liability directly affects her profitability and pricing strategy.

Sales Tax Exemptions and Special Considerations

While the sales tax rate in Phoenix may seem straightforward, it's important to note that certain goods and services are exempt from sales tax. These exemptions can vary based on state and local laws. For instance, in Arizona, some common exemptions include:

- Groceries and food items

- Prescription medications

- Certain agricultural products

- Residential rent

- Educational services

Additionally, there may be specific exemptions or tax incentives offered to promote certain industries or activities. For instance, the state of Arizona provides tax credits and incentives for renewable energy projects and film production.

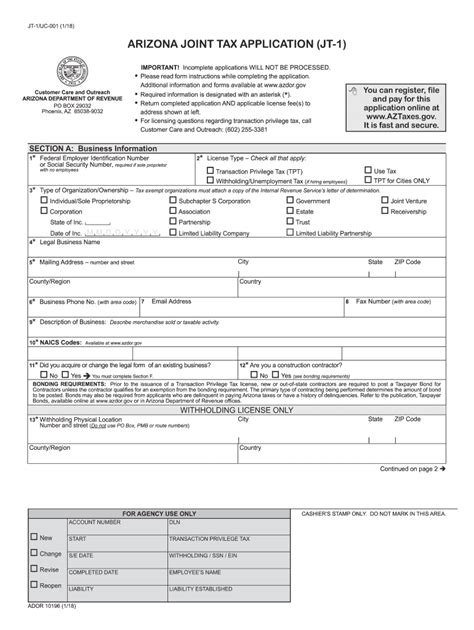

Compliance and Reporting Requirements

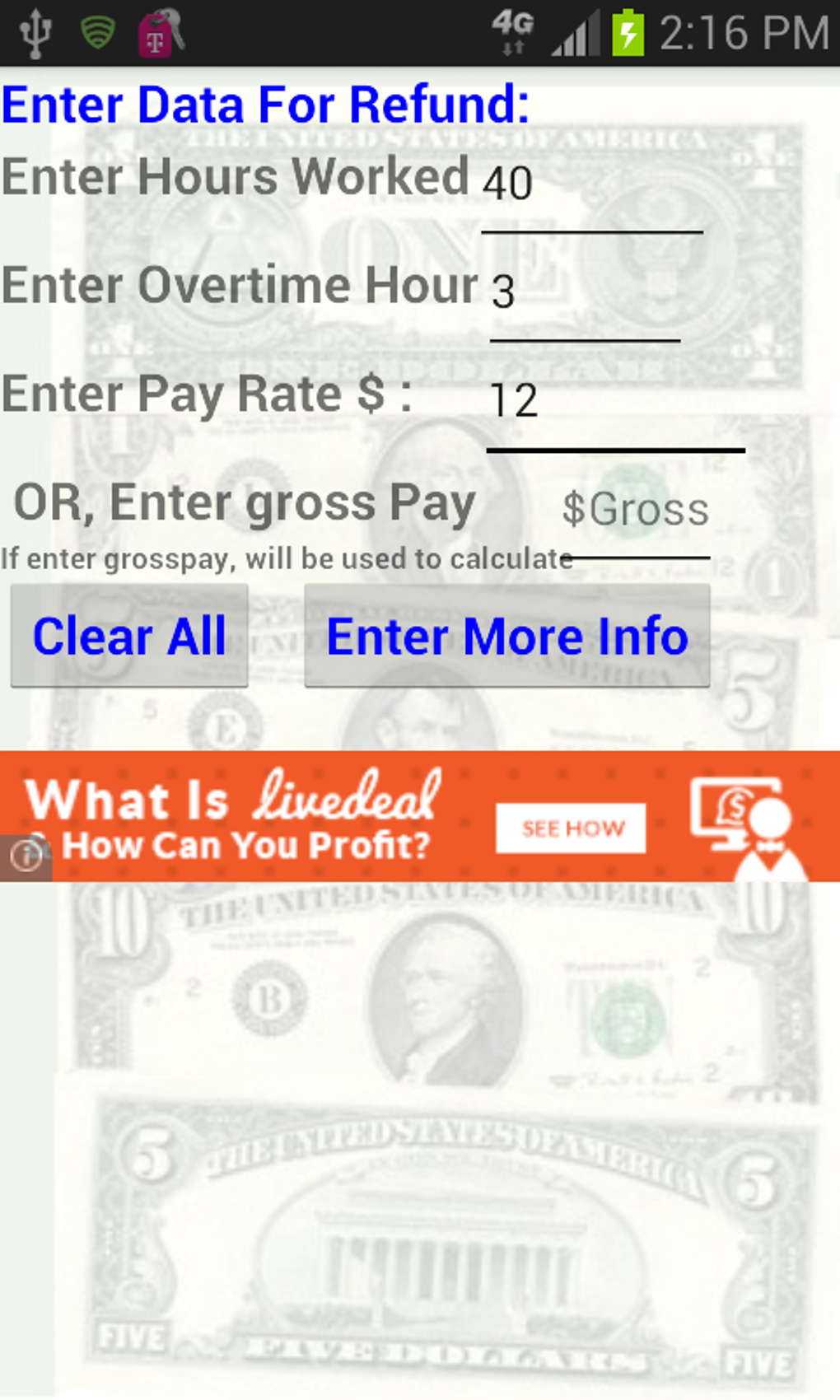

Sales tax compliance is a critical aspect for businesses operating in Phoenix. Failure to comply with sales tax regulations can lead to substantial penalties and legal repercussions. Businesses are typically required to:

- Register for a sales tax permit with the Arizona Department of Revenue.

- Collect the appropriate sales tax from customers based on the location of the transaction.

- Remit the collected sales tax to the appropriate taxing authorities on a regular basis (often monthly or quarterly).

- Maintain accurate records of sales transactions and tax collections for audit purposes.

The Role of Technology in Sales Tax Compliance

With the increasing complexity of sales tax regulations, many businesses are turning to technology solutions to streamline their compliance processes. Sales tax automation software can help businesses calculate the correct tax rates, file returns, and manage their tax liabilities more efficiently. These tools can integrate with existing accounting and e-commerce platforms, reducing the risk of errors and simplifying the overall tax compliance process.

The Future of Sales Tax in Phoenix

The sales tax landscape in Phoenix, like in many cities, is subject to change. Proposed legislative reforms, economic shifts, and changing consumer trends can all influence future sales tax rates and regulations. For instance, discussions around expanding the sales tax base or introducing new tax exemptions are not uncommon in Arizona's political landscape.

Furthermore, the increasing popularity of e-commerce and online sales presents unique challenges and opportunities for sales tax collection. As more transactions occur online, the attribution of sales to specific jurisdictions becomes more complex, impacting the distribution of tax revenue. The City of Phoenix, along with other municipalities, will need to adapt their sales tax regulations to accommodate these evolving trends.

In conclusion, understanding the sales tax system in Phoenix is vital for both businesses and consumers. It influences pricing strategies, consumer behavior, and the overall economic landscape of the city. By staying informed and compliant with sales tax regulations, businesses can navigate this complex environment effectively, contributing to the prosperity of the City of Phoenix.

How often do sales tax rates change in Phoenix?

+Sales tax rates in Phoenix, like in many other cities, can change periodically. These changes are often the result of legislative actions or adjustments made by the governing bodies. While there is no set schedule for rate changes, it’s essential for businesses and consumers to stay updated on any proposed or enacted changes.

Are there any tools available to help businesses calculate sales tax accurately?

+Yes, there are several sales tax calculation tools and software available that can assist businesses in determining the correct sales tax rate for their transactions. These tools often consider the location of the sale, applicable exemptions, and any special district taxes. Some popular options include [list a few relevant tools or software]

What happens if a business fails to comply with sales tax regulations in Phoenix?

+Non-compliance with sales tax regulations can result in significant penalties and legal consequences. Businesses may face fines, interest charges, and even criminal prosecution in severe cases. It’s crucial for businesses to understand their sales tax obligations and seek professional advice if needed.

Are there any upcoming changes to the sales tax system in Phoenix that businesses should be aware of?

+While it’s difficult to predict future changes with certainty, there are ongoing discussions and proposals related to sales tax reform in Arizona. Businesses should stay informed through reliable sources and consult with tax professionals to understand potential impacts on their operations.