Tax Lien Properties For Sale

Welcome to the world of tax lien properties, an intriguing and often lucrative segment of the real estate market. This market niche offers unique opportunities for investors and those looking for an alternative path to property ownership. Tax lien properties arise from a homeowner's failure to pay their property taxes, leading to a lien being placed on the property by the government. These liens can be bought by investors, who then have the potential to acquire the property if the original owner fails to redeem it.

Understanding Tax Lien Properties

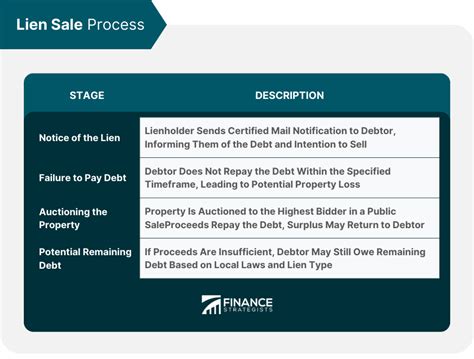

Tax lien properties are a result of a homeowner’s inability or unwillingness to pay their annual property taxes. When a homeowner misses their tax payment deadline, the local government or taxing authority issues a tax lien on the property. This lien acts as a legal claim on the property, allowing the government to collect the unpaid taxes. If the homeowner still fails to pay, the government has the right to sell the tax lien to interested investors.

Investors who purchase tax liens essentially lend money to the homeowner, with the tax lien serving as security. The investor then becomes the lien holder, and if the homeowner doesn't pay off the lien within a specified period, often called the redemption period, the investor can initiate the process to take ownership of the property. This ownership can be gained through a tax deed sale, which varies in process and timing depending on the state and local laws.

| State | Redemption Period | Deed Transfer Process |

|---|---|---|

| Florida | 2 years | After the redemption period, the lien holder can apply for a tax deed |

| Arizona | 1 year and 6 months | Tax lien sale followed by a deed transfer if the lien is not redeemed |

| California | Varies by county (typically 1-3 years) | Tax sale followed by a right to redeem. If not redeemed, a deed is issued to the highest bidder |

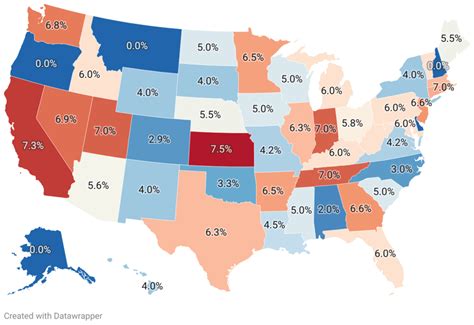

The process of buying tax lien properties can be complex and varies significantly from state to state. It's crucial for investors to understand the laws and regulations in the state where they are investing, as these can greatly impact the potential for profit and the level of risk involved.

The Appeal of Tax Lien Properties

So, what draws investors to tax lien properties? The primary allure is the potential for significant returns. When an investor purchases a tax lien, they pay the outstanding taxes plus any associated fees and interest. If the homeowner doesn’t redeem the property, the investor can acquire it for a fraction of its market value. This scenario offers the chance for substantial profits, especially if the property is located in a desirable area or has untapped potential.

Another advantage is the relatively low barrier to entry. Unlike traditional real estate investing, which often requires substantial capital and expertise, tax lien investing can be more accessible. Investors can participate in tax lien sales with relatively small amounts of capital, making it an attractive option for those with limited financial resources or those who are new to real estate investing.

Furthermore, tax lien properties provide an opportunity for investors to contribute to their communities. By purchasing tax liens, investors help local governments recover lost revenue, which can be vital for funding public services and infrastructure. It's a form of investment that serves a dual purpose: generating profits while also supporting local communities.

Real-Life Success Story

Consider the case of Emily, an investor who entered the tax lien market with a focus on Arizona properties. With a keen eye for value and a solid understanding of the state’s laws, Emily successfully bid on several tax liens. Over the course of a year, as homeowners failed to redeem their properties, Emily was able to take ownership of these homes, which were then sold at a significant profit. This success not only solidified her financial gains but also provided her with the confidence to expand her portfolio and further explore the world of tax lien investing.

The Risks and Challenges

While tax lien properties offer enticing opportunities, they also come with their fair share of risks and challenges. One of the primary concerns is the uncertainty surrounding the redemption period. During this time, the homeowner can still redeem the property, which means the investor’s money is tied up, and there’s no guarantee of a return. If the homeowner redeems, the investor gets their money back with interest, but they don’t gain ownership of the property.

Another risk is the potential for high competition. Tax lien sales often attract a lot of attention, especially in desirable areas, which can drive up the price of liens. This increased competition can reduce the potential for profit, especially for less experienced investors.

Additionally, investors must consider the condition of the property. Often, properties that have gone into tax lien status are in a state of disrepair or may have legal issues. Dealing with these issues can add significant costs and complexities to the investment process.

Expert Tips for Success

Research the property and its neighborhood. This includes understanding the local market, property values, and any potential issues with the property itself or the surrounding area.

Start small and build your experience. Tax lien investing can be complex, so it's wise to start with smaller investments and gradually increase your involvement as you learn the ins and outs of the process.

Diversify your portfolio. Spreading your investments across multiple properties and locations can help mitigate risks and provide a more stable investment strategy.

Future Outlook and Industry Insights

The tax lien market is expected to continue growing, especially as more investors become aware of its potential. With the increasing popularity of alternative investment strategies and the rising demand for affordable housing, tax lien properties are poised to remain a relevant and profitable niche in the real estate sector.

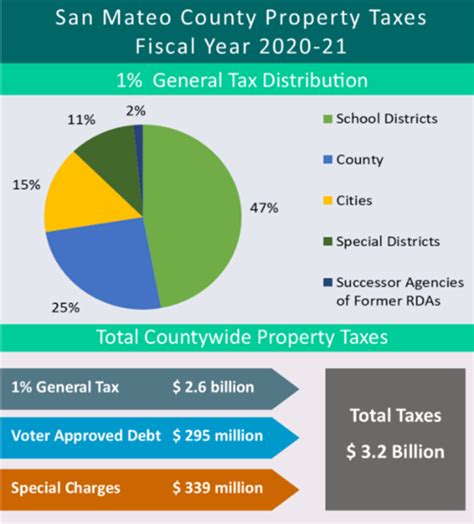

However, the future of this market is also tied to broader economic trends and policy changes. Factors such as interest rates, property tax rates, and government policies can significantly impact the tax lien market. For instance, rising interest rates can make tax lien investments more attractive due to the higher interest earned on liens. On the other hand, changes in tax policies or economic downturns can affect the number of properties entering the tax lien market.

Furthermore, technological advancements are playing a role in making the tax lien market more accessible and efficient. Online platforms and digital tools are making it easier for investors to research and participate in tax lien sales, which is expanding the investor base and increasing competition.

Industry Expert Perspective

“The tax lien market is an exciting frontier for real estate investors, offering unique challenges and rewards. While it requires a deep understanding of local laws and a certain level of comfort with risk, the potential for significant returns is undeniable. As we move forward, we can expect to see continued innovation and growth in this sector, making it an even more attractive investment option.”

- John Roberts, CEO of Tax Lien Investing Solutions

Conclusion

Tax lien properties present a fascinating and potentially lucrative opportunity in the real estate market. While they offer the allure of significant returns and an accessible entry point, they also come with their own set of challenges and risks. For those willing to navigate the complexities and do their due diligence, tax lien investing can be a rewarding and profitable venture.

Frequently Asked Questions

What is a tax lien property, and how does it differ from a tax deed property?

+A tax lien property is a property that has a tax lien placed on it due to the owner’s failure to pay property taxes. An investor can purchase this lien and, if the owner doesn’t pay off the lien within a specified period (redemption period), the investor can initiate the process to take ownership of the property. On the other hand, a tax deed property is one where the investor has already acquired ownership through a tax deed sale. This typically occurs after the redemption period has expired, and the investor can now legally claim the property as their own.

What happens if the homeowner redeems the property during the redemption period?

+If the homeowner redeems the property during the redemption period, the investor gets their money back, including any interest accrued. The homeowner pays off the lien, and the property returns to their ownership. The investor does not gain ownership of the property in this scenario.

Are there any guarantees of profit in tax lien investing?

+No, there are no guarantees in tax lien investing. While the potential for significant profits exists, especially if the property is located in a desirable area or has untapped potential, there are many factors that can influence the outcome. These include the condition of the property, local market conditions, and the homeowner’s ability to redeem the property. As with any investment, due diligence and a thorough understanding of the market and the specific property are essential.

What are some common mistakes to avoid in tax lien investing?

+One common mistake is not thoroughly researching the property and its neighborhood. It’s crucial to understand the local market, property values, and any potential issues with the property or the surrounding area. Another mistake is not diversifying your portfolio. Spreading your investments across multiple properties and locations can help mitigate risks and provide a more stable investment strategy. Additionally, not understanding the local laws and regulations can lead to significant issues, so it’s essential to research and understand the process in the state where you’re investing.