Sales Tax In Georgia

Sales tax in Georgia is a crucial aspect of the state's revenue system, impacting businesses and consumers alike. With a unique structure and varying rates across counties, understanding the intricacies of sales tax in Georgia is essential for both local and national businesses operating within its borders. This article aims to provide a comprehensive guide, delving into the specifics of sales tax laws, rates, and their implications.

Understanding Georgia’s Sales Tax Structure

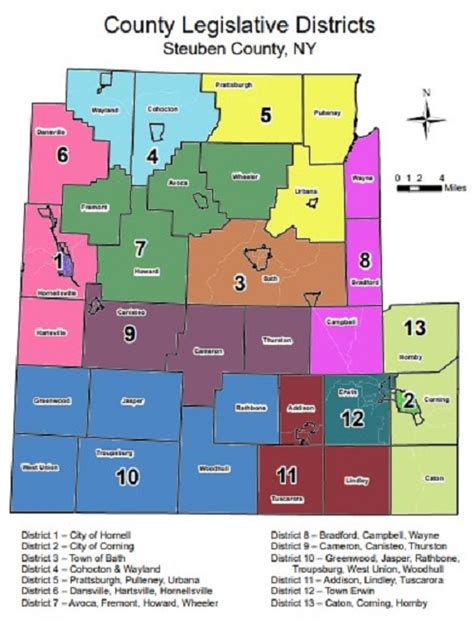

Georgia’s sales tax system is a complex interplay of state, county, and city taxes, often referred to as a triple tax system. At the state level, a 4% sales tax is uniformly applied across the state. However, it is the addition of local taxes that adds complexity and diversity to the system.

Local Sales Taxes

Counties and municipalities in Georgia have the authority to impose their own sales taxes, creating a diverse landscape of tax rates. As of [current year], there are [X] counties and [Y] municipalities that have enacted local sales taxes, with rates ranging from [lowest rate]% to [highest rate]%. These local taxes are typically used to fund specific projects or initiatives within the community, such as infrastructure development or educational programs.

For instance, Fulton County, home to Atlanta, imposes an additional 3% sales tax, bringing the total sales tax rate to 7% within the county. Similarly, Gwinnett County has a 1% local sales tax, making the total sales tax rate 5% for businesses and consumers in that area.

| County/Municipality | Local Sales Tax Rate | Total Sales Tax Rate |

|---|---|---|

| Fulton County | 3% | 7% |

| Gwinnett County | 1% | 5% |

| ... (continue with other counties/municipalities) | ... | ... |

Sales Tax Exemptions and Special Considerations

While the sales tax structure in Georgia is straightforward for most goods and services, there are several exemptions and special considerations that businesses and consumers should be aware of.

Exempt Goods and Services

Certain goods and services are exempt from sales tax in Georgia. These include:

- Prescription medications: Medications dispensed on prescription are tax-exempt, but over-the-counter medications are subject to sales tax.

- Groceries: Basic food items for home consumption are exempt, but prepared foods and certain non-essential grocery items may be taxable.

- Educational materials: Textbooks, school supplies, and certain educational resources are exempt from sales tax.

- Agricultural equipment: Machinery and equipment used in farming and agriculture are exempt, provided they are used directly in agricultural production.

Special Tax Districts

In addition to county and municipal taxes, certain areas in Georgia have been designated as special tax districts. These districts often have additional sales taxes to fund specific projects or initiatives. For example, the MARTA district, which serves the Atlanta metropolitan area, imposes an additional 1% sales tax to support public transportation.

Sales Tax Compliance and Reporting

Ensuring compliance with Georgia’s sales tax laws is a critical aspect of doing business in the state. Businesses are required to register with the Georgia Department of Revenue and obtain a sales and use tax certificate. This certificate allows businesses to collect and remit sales tax to the state and local authorities.

Sales Tax Remittance

Businesses must remit sales tax to the state and local authorities on a regular basis. The frequency of remittance depends on the business’s sales volume and can range from monthly to quarterly filings. It’s crucial for businesses to maintain accurate records of sales transactions and calculate the appropriate tax amounts to avoid penalties and interest.

Audit and Enforcement

The Georgia Department of Revenue has the authority to conduct audits to ensure compliance with sales tax laws. During an audit, businesses may be required to provide detailed records of sales transactions, tax calculations, and remittances. Non-compliance can result in penalties, interest charges, and even criminal prosecution in severe cases.

Impact on Businesses and Consumers

Georgia’s sales tax structure has a significant impact on both businesses and consumers. For businesses, understanding and managing sales tax obligations is crucial for financial planning and maintaining competitive pricing strategies. Accurate tax calculations and remittances ensure compliance and avoid legal issues.

Pricing Strategies

Businesses operating in multiple counties or municipalities with different sales tax rates must carefully consider their pricing strategies. They may choose to absorb the additional tax costs or pass them on to consumers. This decision can impact their competitive positioning and consumer perception.

Consumer Behavior

Consumers, on the other hand, must be aware of the varying sales tax rates across the state. While it may not significantly impact their purchasing decisions for essential goods and services, it can influence choices for larger purchases, such as electronics or vehicles. Consumers may choose to shop in areas with lower tax rates or consider online purchases to avoid sales tax altogether.

Future Implications and Trends

Georgia’s sales tax system is subject to ongoing legislative changes and economic trends. While the state’s overall sales tax rate has remained relatively stable, local tax rates have shown fluctuations based on community needs and initiatives.

Potential Changes

As Georgia continues to develop and grow, there may be proposals to adjust the state’s sales tax rate or implement new special tax districts to fund specific projects. Additionally, changes in the national economy or tax policies could influence the state’s approach to sales taxation.

Technology and Sales Tax

Advancements in technology, particularly in e-commerce and digital platforms, have presented new challenges and opportunities for sales tax collection and compliance. Georgia, like many other states, is navigating the complexities of taxing online sales and ensuring fair competition between brick-and-mortar and online businesses.

How often do businesses need to remit sales tax in Georgia?

+The frequency of sales tax remittance depends on the business’s sales volume. Businesses with high sales volumes may be required to remit taxes monthly, while those with lower sales may remit quarterly. It’s important for businesses to understand their sales tax obligations and file accordingly.

Are there any penalties for non-compliance with sales tax laws in Georgia?

+Yes, non-compliance with sales tax laws can result in penalties and interest charges. In severe cases, businesses may face criminal prosecution. It’s crucial for businesses to stay informed about their sales tax obligations and maintain accurate records to avoid these consequences.

How do sales tax rates impact consumer behavior in Georgia?

+Sales tax rates can influence consumer behavior, particularly for larger purchases. Consumers may compare prices across different counties or consider online purchases to avoid sales tax. Businesses should consider these factors when setting their pricing strategies to remain competitive.