Steuben County Tax Map

Welcome to our comprehensive guide on the Steuben County Tax Map, an essential resource for property owners, investors, and anyone interested in understanding the intricate details of real estate in this region. The Steuben County Tax Map is a valuable tool that provides crucial information about properties within the county, aiding in decision-making processes and offering insights into the local real estate market.

Unveiling the Steuben County Tax Map: A Comprehensive Guide

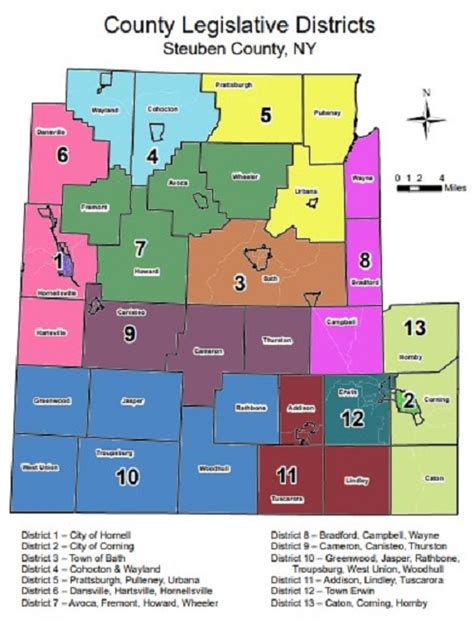

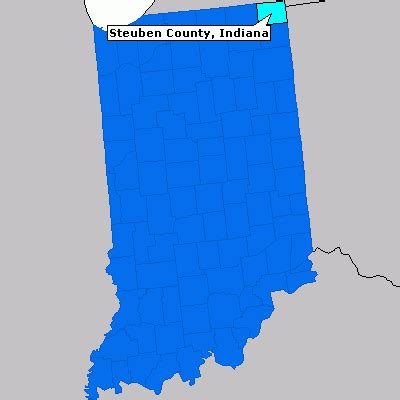

Steuben County, nestled in the heart of New York State, boasts a diverse landscape ranging from picturesque lakeside communities to vibrant urban centers. The tax map plays a pivotal role in managing this diverse real estate landscape, offering a wealth of information that empowers stakeholders to make informed decisions.

What is the Steuben County Tax Map?

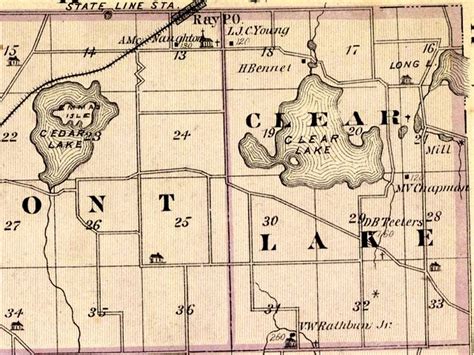

The Steuben County Tax Map is an official, detailed cartographic representation of all properties within the county. It serves as a vital resource for assessing and managing real estate, providing a visual representation of each parcel of land and its associated details. The map is a critical tool for property owners, real estate professionals, and government entities alike, offering a transparent and standardized view of the county’s real estate landscape.

Each property on the map is uniquely identified, with specific details such as parcel number, property lines, and legal descriptions. This information is essential for a wide range of purposes, including property assessments, tax calculations, land development, and legal transactions.

Key Features and Benefits of the Steuben County Tax Map

The Steuben County Tax Map offers a multitude of features and benefits, making it an indispensable resource for anyone dealing with real estate in the region.

- Accurate Property Identification: The map provides precise details about each property, ensuring accurate identification and reducing the risk of errors in transactions and assessments.

- Visual Representation: By offering a visual layout of properties, the tax map enhances understanding of the spatial relationships between different parcels, facilitating better planning and decision-making.

- Detailed Property Information: Beyond basic identification, the map includes essential details such as property dimensions, zoning classifications, and special assessments, providing a comprehensive overview of each parcel.

- Historical Data: The tax map often includes historical records, allowing users to track changes in property ownership, development, and assessments over time. This feature is invaluable for long-term planning and research.

- Online Accessibility: In many cases, the Steuben County Tax Map is accessible online, providing convenient access to property information for both residents and remote stakeholders. This digital accessibility streamlines research and transactions.

Using the Steuben County Tax Map: A Practical Guide

Whether you’re a homeowner, investor, or real estate professional, understanding how to navigate and utilize the Steuben County Tax Map is essential for making informed decisions.

Researching Property Details

Start by locating the property of interest on the tax map. Using the parcel number or address, you can access detailed information about the property, including its dimensions, zoning, and any associated restrictions or assessments. This information is crucial for evaluating the potential of a property, whether for purchase, development, or investment.

Understanding Property Assessments

The tax map is closely tied to property assessments, which determine the value of a property for tax purposes. By understanding the assessment process and the factors that influence property values, you can gain insights into the financial implications of owning or investing in a particular property. This knowledge is vital for budgeting and financial planning.

Navigating Zoning and Land Use

Zoning regulations play a significant role in determining the permissible uses of a property. The Steuben County Tax Map often includes zoning information, allowing users to quickly assess the zoning classification of a property. This feature is especially useful for developers and investors looking to identify potential development opportunities or understand the limitations of a particular parcel.

Tracking Property History

The tax map’s historical records provide a unique perspective on the evolution of properties over time. By reviewing past assessments, ownership changes, and development projects, you can gain insights into the stability and potential of a property. This historical context is invaluable for making long-term investment decisions and understanding the local real estate market trends.

| Property Feature | Description |

|---|---|

| Parcel Number | A unique identifier for each property, facilitating precise identification and record-keeping. |

| Property Lines | Visual representation of the boundaries of a property, aiding in understanding spatial relationships. |

| Zoning Classification | Designates the permitted uses and restrictions for a property, impacting development potential. |

| Special Assessments | Details any additional charges or levies associated with a property, influencing its overall financial implications. |

Exploring Real-World Applications: Steuben County Tax Map in Action

To illustrate the practical applications of the Steuben County Tax Map, let’s delve into a few real-world scenarios and explore how this resource can be leveraged for different purposes.

Scenario 1: Homeownership and Property Management

Imagine you’re a homeowner in Steuben County, and you’ve received a notice about an upcoming property assessment. To understand the implications of this assessment, you turn to the tax map. By locating your property, you can access detailed information about your parcel, including its dimensions, zoning classification, and any special assessments.

With this knowledge, you can engage in informed discussions with assessors, ensuring that your property is valued accurately and fairly. Additionally, the tax map's historical data allows you to track changes in your property's value over time, providing valuable insights for financial planning and home improvement projects.

Scenario 2: Real Estate Investment and Development

As a real estate investor, you’re always on the lookout for promising development opportunities. The Steuben County Tax Map becomes your go-to resource for identifying vacant or underutilized parcels with development potential. By filtering properties based on zoning classifications and assessing their dimensions, you can quickly identify sites suitable for your projects.

Moreover, the tax map's historical records provide insights into past development trends and market fluctuations, aiding in risk assessment and investment strategy formulation. This comprehensive view of the real estate landscape enables you to make well-informed decisions, optimizing your investment returns.

Scenario 3: Legal and Property Dispute Resolution

In the event of a property dispute, the Steuben County Tax Map becomes a critical tool for establishing boundaries and resolving conflicts. Accurate property identification and precise parcel delineation on the tax map can be instrumental in settling boundary disputes, ensuring fair resolutions, and maintaining good neighborly relations.

Additionally, the map's legal descriptions and historical records can provide crucial evidence in legal proceedings, aiding in the resolution of complex property-related cases. The transparency and accuracy of the tax map make it an invaluable resource for legal professionals and property owners alike.

The Future of Real Estate: Steuben County Tax Map Innovations

As technology continues to advance, the Steuben County Tax Map is evolving to meet the changing needs of the real estate industry. Here’s a glimpse into the future of this essential resource.

Digital Integration and Accessibility

With the increasing adoption of digital technologies, the Steuben County Tax Map is expected to become even more accessible and user-friendly. Online platforms will offer enhanced search functionalities, allowing users to locate properties and access detailed information with ease. Interactive maps and data visualization tools will further enhance the user experience, making complex data more digestible and actionable.

Integration of Advanced Data Analytics

Advanced data analytics and machine learning algorithms will revolutionize the way the tax map is utilized. By analyzing vast datasets, these technologies can identify patterns and trends, providing valuable insights for property owners, investors, and government entities. Predictive analytics can forecast property values, assess market risks, and optimize investment strategies, taking real estate decision-making to new heights.

Enhanced Collaboration and Data Sharing

The future of the Steuben County Tax Map lies in its ability to facilitate collaboration and data sharing among various stakeholders. Integrated platforms will enable seamless information exchange between government departments, real estate professionals, and property owners. This collaboration will streamline processes, improve efficiency, and enhance the overall user experience, fostering a more transparent and efficient real estate ecosystem.

How often is the Steuben County Tax Map updated?

+The Steuben County Tax Map is typically updated on an annual basis to reflect changes in property ownership, development, and assessments. However, in certain cases, such as significant development projects or boundary adjustments, updates may be made more frequently.

Can I access the Steuben County Tax Map online?

+Yes, the Steuben County Tax Map is often made available online through the county's official website or dedicated real estate platforms. This digital accessibility allows users to access property information conveniently from anywhere.

What information can I find on the Steuben County Tax Map?

+The tax map provides a wealth of information, including parcel numbers, property dimensions, zoning classifications, special assessments, and historical records. This comprehensive data empowers users to make informed decisions about properties.

How does the Steuben County Tax Map impact property assessments?

+The tax map is a critical resource for property assessors, as it provides detailed information about each property. Assessors use this data to determine the value of properties for tax purposes, ensuring fairness and accuracy in the assessment process.

Can the Steuben County Tax Map be used for legal purposes?

+Absolutely. The tax map's precise property identification and historical records make it an invaluable resource for legal professionals and property owners in resolving disputes, establishing boundaries, and providing evidence in legal proceedings.

In conclusion, the Steuben County Tax Map is a dynamic and indispensable tool for navigating the complex world of real estate. Its comprehensive data, visual representation, and evolving digital integration make it a powerful resource for property owners, investors, and professionals alike. As technology continues to advance, the tax map will play an even more significant role in shaping the future of real estate in Steuben County and beyond.