Tax Calculator Nc

Welcome to an in-depth exploration of the North Carolina tax landscape, with a focus on the tax calculator tool. This guide aims to provide a comprehensive understanding of the tax system in the Tar Heel State and how it affects individuals and businesses. Whether you're a resident, a new business owner, or simply curious about NC's tax structure, this article will offer valuable insights and practical information.

Understanding North Carolina’s Tax System

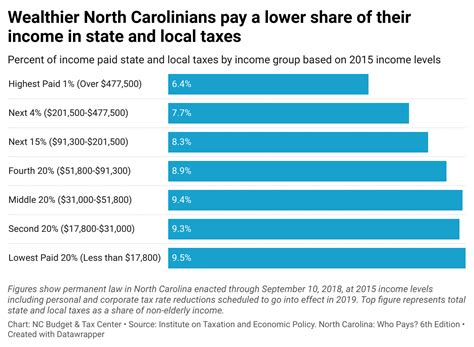

North Carolina, like all U.S. states, has its own unique tax system, which consists of a combination of income taxes, sales taxes, property taxes, and various other levies. The state uses these taxes to fund essential services, infrastructure, and public programs. Understanding this tax system is crucial for both personal financial planning and business operations.

The Tar Heel State's tax system is generally considered fair and balanced, with a focus on simplicity and predictability. This makes it relatively easier for individuals and businesses to navigate and plan their tax obligations. However, with any tax system, there are complexities and nuances that require careful consideration.

Income Taxes in North Carolina

North Carolina imposes a progressive income tax on individual residents and businesses. This means that the tax rate increases as taxable income increases. For the 2023 tax year, there are six income tax brackets, with rates ranging from 5.25% to 5.75% for individuals and 5.75% for corporations.

Here's a breakdown of the income tax brackets for individuals:

| Tax Bracket | Taxable Income Range | Tax Rate |

|---|---|---|

| 1 | Up to $10,500 | 5.25% |

| 2 | $10,501 - $21,000 | 5.375% |

| 3 | $21,001 - $57,500 | 5.5% |

| 4 | $57,501 - $115,000 | 5.625% |

| 5 | $115,001 - $270,000 | 5.675% |

| 6 | Over $270,000 | 5.75% |

For corporations, the flat tax rate of 5.75% applies to all taxable income. North Carolina also offers tax credits and deductions that can help reduce the tax burden for both individuals and businesses.

Sales and Use Taxes

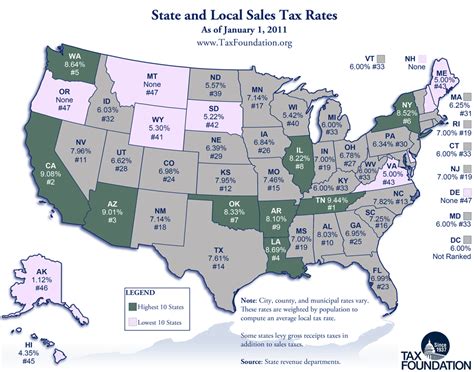

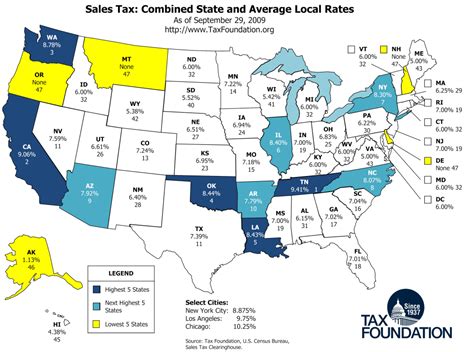

In addition to income taxes, North Carolina levies a statewide sales and use tax of 4.75%. This tax applies to the sale or purchase of tangible personal property and certain services. However, the total sales tax rate can vary depending on the location, as counties and cities can impose additional sales taxes.

For instance, the city of Charlotte has a local sales tax rate of 2%, bringing the total sales tax rate to 6.75% within city limits. It's important for businesses and consumers to be aware of these local variations.

Property Taxes

North Carolina has a uniform property tax system that applies to all real and personal property within the state. The property tax rate is determined by the local government and can vary significantly from one county to another. On average, the property tax rate in NC ranges from 0.4% to 1.5%, with the average effective property tax rate being around 0.7%.

Property taxes are calculated based on the assessed value of the property and the tax rate set by the local government. It's important for property owners to understand the assessment process and their rights when it comes to property taxes.

The Role of the Tax Calculator

Given the complexity of the North Carolina tax system, having a reliable tax calculator is invaluable. This tool allows individuals and businesses to estimate their tax liabilities with a high degree of accuracy. It takes into account various factors, such as income, deductions, credits, and applicable tax rates, to provide a comprehensive tax estimate.

Using a tax calculator can help in several ways:

- Financial Planning: It allows individuals to plan their finances more effectively by understanding their potential tax obligations.

- Business Operations: Businesses can use the calculator to estimate their tax liability, which is crucial for budgeting and financial forecasting.

- Compliance: By providing accurate estimates, the tax calculator ensures that individuals and businesses remain compliant with North Carolina's tax laws.

- Comparative Analysis: The calculator can help compare tax liabilities across different scenarios, aiding in decision-making processes.

Features of a Robust Tax Calculator

A robust tax calculator should offer a range of features to cater to the diverse needs of users. These features might include:

- Income Tax Calculation: The ability to input various sources of income and apply the appropriate tax brackets.

- Deduction and Credit Application: A comprehensive list of applicable deductions and credits to reduce tax liability.

- Sales Tax Calculator: A feature to estimate sales tax liabilities for businesses, accounting for state and local rates.

- Property Tax Estimator: A tool to calculate property tax based on the assessed value and local tax rates.

- Scenario Analysis: The option to input different variables and compare tax outcomes for various scenarios.

- Compliance Alerts: Notifications or reminders about upcoming tax deadlines and potential compliance issues.

Real-World Applications

The tax calculator finds applications in various real-world scenarios. Here are a few examples:

Individual Tax Planning

John, a resident of Raleigh, wants to plan his finances for the upcoming year. He uses the tax calculator to estimate his income tax liability. By inputting his expected income, deductions, and credits, he can get a clear picture of how much tax he might owe or be refunded. This helps him budget effectively and plan for any potential tax payments.

Business Tax Compliance

Carolina Coffee Co., a local coffee roaster and retailer, needs to estimate its sales tax liability for the next quarter. The business uses the tax calculator to input its sales figures and the applicable sales tax rates. This helps them set aside the necessary funds for tax payments and ensures they remain compliant with North Carolina’s tax laws.

Property Tax Assessment

The city of Durham is considering a property tax rate increase. Before implementing any changes, the city uses a tax calculator to assess the potential impact on taxpayers. By inputting the proposed tax rate and the assessed values of properties, they can estimate the additional tax burden on residents and businesses, aiding in the decision-making process.

Future Implications

The tax landscape in North Carolina, like in any state, is subject to change. The state’s tax policies can be influenced by various factors, including economic conditions, political ideologies, and public sentiment. Here are some potential future implications:

- Tax Rate Adjustments: The state might consider adjusting tax rates, either to increase revenue or to provide tax relief to residents and businesses.

- Tax Reform: There could be proposals for tax reform, aiming to simplify the tax system or introduce new tax structures.

- Expansion of Tax Credits and Deductions: The state might expand or introduce new tax credits and deductions to encourage certain behaviors or support specific industries.

- Technology Integration: With the advancement of technology, the tax calculator and other tax-related tools might become even more sophisticated and user-friendly.

Staying Informed

Given the potential for change, it’s essential for individuals and businesses to stay informed about tax updates and reforms. This can be done by regularly checking official government websites, subscribing to tax-related newsletters, or engaging with tax professionals who can provide timely advice and insights.

Conclusion

Understanding North Carolina’s tax system and leveraging the power of a tax calculator are crucial steps toward effective financial planning and compliance. Whether you’re an individual taxpayer or a business owner, having a clear understanding of your tax obligations and utilizing the right tools can make a significant difference in your financial journey. Stay informed, plan wisely, and make the most of the Tar Heel State’s tax system.

How accurate are tax calculators?

+Tax calculators are designed to be highly accurate, but their precision depends on the quality of the data inputted. It’s crucial to provide accurate and up-to-date information to get the most reliable results.

Are there any free tax calculators available for North Carolina residents?

+Yes, there are several free tax calculator tools available online. These tools often provide a basic estimation of tax liabilities and can be a great starting point for financial planning.

How often should I use a tax calculator for my business?

+It’s recommended to use a tax calculator regularly, especially when there are significant changes in your business operations or tax laws. Quarterly or biannual estimates can help ensure compliance and accurate financial planning.

Can I rely solely on a tax calculator for my tax planning and compliance needs?

+While tax calculators are valuable tools, it’s always advisable to consult with a tax professional for personalized advice and guidance. They can provide insights into your specific tax situation and ensure you’re taking advantage of all applicable deductions and credits.