State Of Washington Sales Tax

The State of Washington, known for its diverse landscapes, vibrant cities, and thriving industries, has a unique sales tax system that plays a significant role in its economic landscape. This article delves into the intricacies of the Washington sales tax, providing a comprehensive guide for businesses and individuals alike. We will explore the rates, regulations, exemptions, and practical considerations that make Washington's sales tax a key aspect of its fiscal policy.

Understanding Washington Sales Tax: A Comprehensive Guide

Washington's sales tax system is a vital component of its revenue generation, contributing to the state's infrastructure, education, and various public services. With a unique approach to taxation, Washington offers a dynamic environment for businesses and consumers. This guide aims to unravel the complexities, offering a detailed insight into how sales tax operates within the state.

Sales Tax Rates and Structure

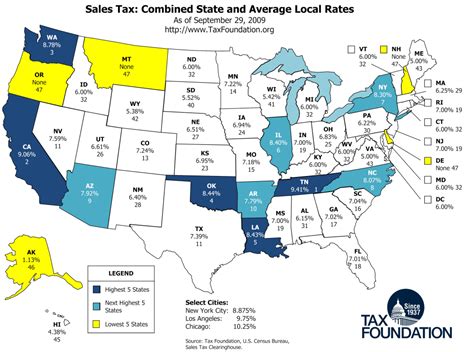

The sales tax rate in Washington is a composite of state, county, and city taxes, with each level of government imposing its own rate. As of 2023, the state sales tax rate stands at 6.5%, one of the higher rates in the country. However, it is important to note that this rate can vary depending on the specific location within the state. County and municipal governments have the authority to impose additional taxes, leading to a combined sales tax rate that can range from approximately 7.5% to 10% across the state.

For instance, in the bustling city of Seattle, the combined sales tax rate is 10.1%, consisting of the state tax (6.5%), a county tax (3.0%), and a city tax (0.6%). On the other hand, smaller towns like Omak have a lower combined rate of 7.5%, reflecting the varying tax landscapes across the state.

| Location | State Tax Rate | County Tax Rate | City Tax Rate | Combined Rate |

|---|---|---|---|---|

| Seattle | 6.5% | 3.0% | 0.6% | 10.1% |

| Tacoma | 6.5% | 2.0% | 1.0% | 9.5% |

| Spokane | 6.5% | 2.5% | 0.5% | 9.5% |

| Omak | 6.5% | 1.0% | 0% | 7.5% |

This variability in rates reflects the diverse fiscal needs and priorities of different regions within Washington, allowing local governments to generate revenue tailored to their specific requirements.

Taxable Items and Exemptions

Washington's sales tax applies to a wide range of goods and services, including clothing, electronics, groceries, and restaurant meals. However, the state also provides certain exemptions to promote economic development and support specific industries. For instance, unprepared food items, such as raw produce and bakery goods, are exempt from sales tax, providing a boost to local farmers and food producers.

Additionally, certain services are exempt from sales tax, such as professional services like accounting, legal advice, and healthcare. This encourages businesses to invest in these sectors and promotes access to essential services for Washington residents.

Washington also offers sales tax exemptions for specific groups, including Native American tribes and qualifying nonprofit organizations. These exemptions are designed to support indigenous communities and charitable endeavors, fostering a sense of social responsibility within the state's tax system.

Registration and Compliance for Businesses

Businesses operating within Washington, whether online or brick-and-mortar, are required to register with the Washington State Department of Revenue to obtain a Business License and a Sales Tax Permit. This process ensures that businesses comply with tax regulations and allows the state to track revenue effectively.

Once registered, businesses are responsible for collecting and remitting sales tax on behalf of the state. This involves implementing robust sales tax collection systems and ensuring accurate record-keeping. The state provides resources and guidelines to assist businesses in navigating this process, including Sales Tax Workshop programs and online tools for tax calculation and filing.

Compliance with sales tax regulations is crucial to avoid penalties and legal issues. The state conducts regular audits to ensure businesses are meeting their tax obligations, with potential consequences including fines, interest charges, and even business license suspension for non-compliance.

Sales Tax for E-Commerce and Online Businesses

With the rise of e-commerce, Washington has adapted its sales tax regulations to encompass online sales. This includes the requirement for out-of-state sellers to collect and remit sales tax if they meet certain thresholds of sales or transactions within the state. This policy, known as economic nexus, ensures that online businesses contribute to the state's revenue stream, regardless of their physical presence.

Washington provides resources and guidance for online businesses to navigate this process, including tools for Economic Nexus Self-Assessment and Sales Tax Calculator for accurate tax collection. Additionally, the state offers Sales Tax Exemption Certificate for businesses to claim exemption on purchases made for resale or business use, further simplifying the process for online retailers.

The Impact of Sales Tax on Consumer Behavior

Washington's sales tax rates can significantly influence consumer spending habits and business strategies. For instance, the higher sales tax rates in certain areas may encourage consumers to shop online or in neighboring states with lower tax rates, impacting local businesses. Conversely, lower tax rates can attract shoppers, boost local economies, and support small businesses.

Businesses, especially those in the retail sector, must consider sales tax rates when setting prices and marketing strategies. Offering competitive pricing or promoting tax-free periods can incentivize consumers and drive sales. Additionally, understanding the tax landscape can help businesses make informed decisions about expansion, with lower tax rate areas potentially offering more favorable conditions for growth.

Sales Tax and Economic Development

Washington's sales tax system is not only a revenue generator but also a tool for economic development. The state strategically utilizes tax exemptions and incentives to attract businesses and promote growth in targeted sectors. For instance, the Washington State Film Office offers sales tax exemptions for film and television productions, encouraging the growth of the entertainment industry within the state.

Similarly, the Washington State Department of Commerce provides sales tax incentives for businesses investing in renewable energy and clean technology, fostering the development of a sustainable economy. These targeted incentives not only attract investment but also create jobs and contribute to the state's long-term economic goals.

Future Trends and Implications

As Washington's economy continues to evolve, so too will its sales tax system. The state is likely to maintain its focus on using tax policy as a tool for economic development, with potential future initiatives including further incentives for green energy and technology, as well as continued support for local agriculture and small businesses.

The rise of e-commerce and online sales is also likely to shape future sales tax regulations, with ongoing efforts to ensure fair taxation for both online and traditional businesses. Additionally, Washington may explore further streamlining of tax collection processes, leveraging technology to make compliance more efficient and less burdensome for businesses.

Washington's sales tax system, with its unique structure and strategic exemptions, plays a pivotal role in the state's economy. By understanding and navigating this system, businesses and consumers can make informed decisions, contributing to the vibrant economic landscape of the Evergreen State.

What is the current state sales tax rate in Washington?

+As of 2023, the state sales tax rate in Washington is 6.5%.

Are there any sales tax holidays in Washington?

+No, Washington does not currently observe sales tax holidays. However, the state may introduce such initiatives in the future to stimulate consumer spending.

How does Washington handle sales tax for online purchases?

+Washington requires out-of-state sellers to collect and remit sales tax if they meet certain sales or transaction thresholds. This policy, known as economic nexus, ensures fair taxation for online businesses.