Unlocking the Mystery: What Is the Tax Levy Definition?

Tax levies have long stood as a formidable pillar within the architecture of government fiscal policy—an instrument wielded to enforce revenue collection by compelling property owners, wage earners, and institutions to fulfill their financial obligations. Yet, beyond the familiar terminology exists a labyrinth of legal, economic, and procedural nuances defining what precisely a tax levy embodies. Unraveling this complexity requires not merely surface-level understanding but a deep dive into the legal frameworks, historical evolution, and practical ramifications that govern its deployment. This article aims to demystify the concept, arguing that a clear and precise comprehension of "tax levy" is indispensable for stakeholders—from policymakers and legal practitioners to taxpayers and financial advisors—particularly in a climate where fiscal transparency and equitable enforcement are increasingly scrutinized.

Defining the Tax Levy: Core Principles and Legal Foundations

At its essence, a tax levy is a process authorized by law through which a government entity, typically tax authorities such as the Internal Revenue Service (IRS) in the United States or equivalent agencies globally, enforces the collection of overdue taxes. Unlike mandatory tax assessments, which are merely charges levied based on income, property, or transactions, a levy signifies a specific enforcement action—often immediate and coercive—that seizes property, bank accounts, wages, or other assets to satisfy unpaid tax liabilities.

Legal Underpinnings of Tax Levy Authority

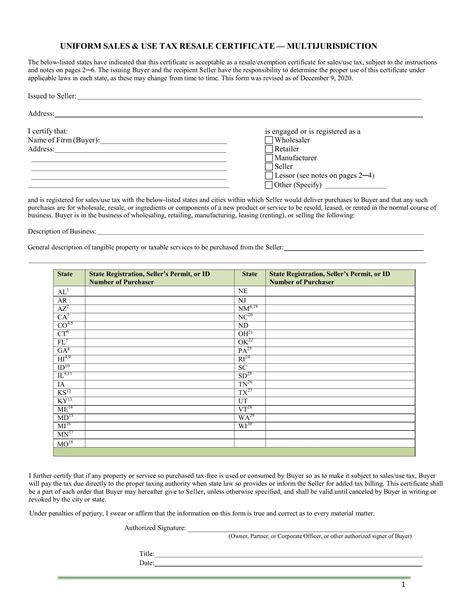

The legal basis for tax levies is rooted in statutes that delineate the scope, procedure, and limitations of enforcement actions. In the U.S., the authority is primarily enshrined in the Internal Revenue Code (IRC), particularly sections such as 26 U.S. Code § 6331, which outlines the IRS’s power to levy upon tax debtors’ property. These laws specify that a levy can be enacted only after certain procedural steps—notice, demand for payment, and opportunities to contest—are satisfied, emphasizing the importance of legality and due process.

| Relevant Category | Substantive Data |

|---|---|

| Legal Statute | 26 U.S. Code § 6331, which authorizes periodic and indefinite levies for unpaid taxes |

| Procedural Requirements | Notice of lien, issuance of levy, and opportunity for taxpayer’s hearing or appeal |

| Asset Seizure Assistance | Wage garnishment, bank account levies, seizure of property, and other enforcement measures |

Distinctions: Tax Levy Versus Tax Lien and Other Enforcement Tools

A key aspect of understanding the tax levy definition lies in differentiating it from related concepts such as tax liens, garnishments, or seizures. While a lien is a legal claim or security interest against property to ensure future payment, a levy typically involves actual asset seizure and immediate collection. Clarifying this distinction helps in grasping the procedural urgency and legal scope associated with a levy.

Tax Lien: The Precursory Security Interest

A tax lien attaches to property to secure the government’s claim but does not necessarily involve seizure. It serves as a public notice that taxes are owed and can impair the taxpayer’s ability to sell or refinance property. Activating a levy, however, signifies a more aggressive step—an actual countermeasure to recover due taxes through seizure.

Enforcement Tools and Their Practical Implications

Beyond levies, government agencies utilize instruments like garnishments and asset seizures. Yet, the levy remains the most direct enforcement tool, often precipitated after attempts at voluntary compliance fail. Its legal definition is thus critical for understanding enforcement limits, taxpayer rights, and procedural safeguards.

| Relevant Category | Substantive Data |

|---|---|

| Enforcement Action | Actual seizure of assets or income through court order or administrative process |

| Legal Consequence | Immediate reduction of the taxpayer’s assets to pay overdue taxes |

| Due Process | Notification, opportunity for hearing, and legal challenge rights preserved |

The Evolution and Contemporary Significance of Tax Levy Definitions

The concept of tax levy has evolved significantly, reflecting changes in economic policy, legal interpretations, and technological capabilities. Historically, medieval tax collection relied heavily on direct coercion, with subsequent legal reforms formalizing and constraining governmental powers to prevent abuses. Today, digital banking and rapid communication have transformed levies into swift, precise enforcement tools, raising complex questions about privacy, proportionality, and taxpayer rights.

Historical Context and Legal Reforms

In early taxation systems, levies often involved outright confiscation without due process, prompting reforms in the 19th and 20th centuries aimed at balancing tax enforcement efficiency with individual liberties. Legislation like the IRC has incorporated procedural safeguards ensuring that levies are not arbitrary but guided by statutes, notice requirements, and appeal rights.

Modern Challenges and Debates

In contemporary practice, the definition of a tax levy must accommodate innovations like automated wage garnishments and electronic fund transfers. There is ongoing debate about the scope and limits of these tools—should there be caps on levy amounts? How transparent must the process be? These debates hinge on a precise understanding of what constitutes a levy, making the legal clarity of the term more relevant than ever.

| Relevant Category | Data and Context |

|---|---|

| Technological Impact | Digital enforcement mechanisms can execute levies nationwide within minutes, emphasizing the need for robust legal frameworks |

| Legal Challenges | Taxpayers often contest levies on grounds of procedural violations or disputes over owed amounts, highlighting the importance of legal clarity |

| Policy Implication | Clear statutory definitions help prevent abuse and protect taxpayer rights in an increasingly automated enforcement environment |

Implications for Stakeholders: Toward Transparent and Just Tax Enforcement

Understanding the tax levy definition is more than academic; it dictates legal compliance, taxpayer protections, and enforcement efficacy. Governments must ensure their statutes align with constitutional principles, while taxpayers need clarity to defend their rights. Legal advisors, in turn, rely on a comprehensive grasp of the term to navigate disputes, craft compliant procedures, or advocate reforms.

Policy Recommendations and Best Practices

For policymakers, establishing unambiguous statutory language and transparent processes regarding levies safeguards both efficiency and fairness. Technology audits, robust hearing procedures, and clear documentation can help maintain public trust. For taxpayers, awareness of procedural rights can prevent unjust asset seizures and foster voluntary compliance initiatives that reduce enforcement costs.

Future Outlook and Research Directions

Ongoing research emphasizes integrating legal clarity with technological innovations—like blockchain-tracked levy transactions or AI-driven enforcement—to enhance transparency and accountability. As fiscal demands grow and enforcement mechanisms evolve, continuously refining the definition will be essential to uphold the rule of law and public confidence.

What is the legal basis for a tax levy?

+The legal foundation for a tax levy in the U.S. derives from statutes like 26 U.S. Code § 6331, which delineate procedural steps, permissible actions, and safeguards ensuring lawful enforcement by tax authorities.

How does a levy differ from a tax lien?

+A tax lien is a legal claim or security interest against property to secure unpaid taxes, whereas a levy involves actual seizure or collection of assets for immediate payment.

What rights do taxpayers have during a levy process?

+Taxpayers have rights to notice, dispute the levy, request a hearing, and seek relief if the levy was improperly executed, ensuring procedural fairness and legal recourse.