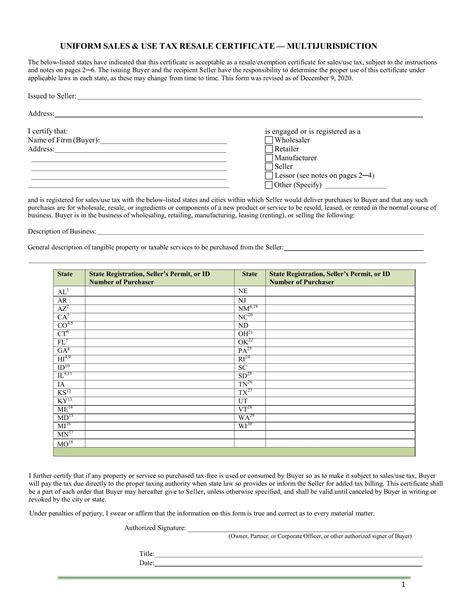

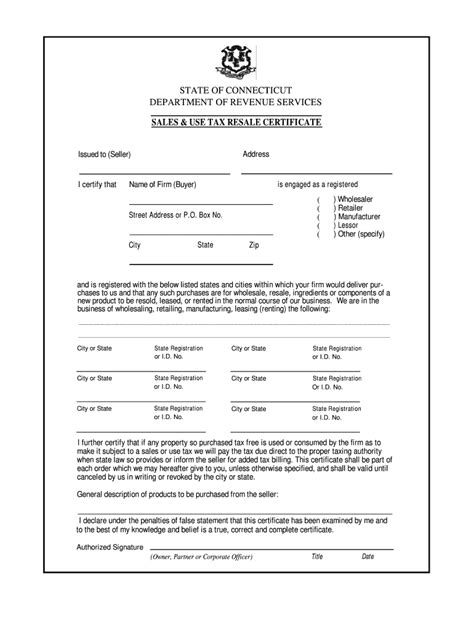

Sales Tax Certificate

The Sales Tax Certificate, also known as a Seller's Permit or Resale Certificate, is a crucial document for businesses engaged in retail sales. It serves as an authorization granted by a state's tax authority, empowering businesses to collect and remit sales tax on behalf of the government. In this comprehensive guide, we will delve into the intricacies of the Sales Tax Certificate, exploring its purpose, requirements, and its significance in the realm of retail taxation.

Understanding the Sales Tax Certificate

The Sales Tax Certificate is a legal document that establishes a business’s authority to engage in taxable sales activities within a specific jurisdiction. It is issued by the state’s tax department and acts as a license to collect and remit sales tax to the government. This certificate ensures that businesses operating within the state comply with the tax regulations and fulfill their fiscal obligations.

The primary objective of the Sales Tax Certificate is to streamline the tax collection process and facilitate the accurate remittance of sales tax revenue to the state. By obtaining this certificate, businesses can demonstrate their commitment to tax compliance and avoid potential legal repercussions associated with non-compliance.

Eligibility and Requirements

To be eligible for a Sales Tax Certificate, a business must meet certain criteria and fulfill specific requirements set forth by the state’s tax authority. Here are some common prerequisites:

- Business Registration: Businesses must first register their entity with the state's business registry. This step ensures that the business is legally recognized and authorized to operate within the state.

- Tax Identification Number (TIN): Obtaining a TIN, such as an Employer Identification Number (EIN) or a unique tax registration number, is often a prerequisite for applying for a Sales Tax Certificate. This number identifies the business for tax purposes.

- Application Process: Businesses must complete and submit an application form provided by the state's tax department. The application typically requires details about the business, its ownership, location, and the nature of its operations.

- Tax Compliance: Businesses are expected to maintain tax compliance throughout their operations. This includes filing accurate tax returns, paying taxes on time, and keeping proper records of sales and tax collections.

- Bonding (in some cases): In certain states or for specific types of businesses, a bond may be required as a financial guarantee to ensure tax compliance. This bond protects the state's interest in case of non-payment or tax evasion.

Benefits and Advantages of the Sales Tax Certificate

Obtaining a Sales Tax Certificate offers several benefits and advantages to businesses operating in the retail sector:

- Legitimacy and Compliance: A Sales Tax Certificate provides legal legitimacy to a business's sales activities. It demonstrates that the business is authorized to collect and remit sales tax, ensuring compliance with state tax laws.

- Simplified Tax Collection: With a Sales Tax Certificate, businesses can efficiently collect sales tax from customers at the point of sale. This streamlines the tax collection process and reduces the administrative burden on both the business and the state.

- Avoidance of Double Taxation: The Sales Tax Certificate allows businesses to purchase goods for resale without paying sales tax on those purchases. This exemption ensures that the tax is only applied once, at the final point of sale to the end consumer.

- Improved Cash Flow: By collecting sales tax from customers, businesses can enhance their cash flow. The collected tax can be used to cover other business expenses or reinvested in the company's growth.

- Enhanced Business Reputation: Compliance with tax regulations and the possession of a Sales Tax Certificate can boost a business's reputation and credibility. It demonstrates a commitment to ethical business practices and responsible tax management.

Real-World Example: Case Study of a Retail Business

Consider the example of ABC Retailers, a successful clothing store chain operating in multiple states. ABC Retailers recognized the importance of obtaining Sales Tax Certificates for each state in which they conducted business. By securing these certificates, they ensured compliance with local tax laws and avoided potential penalties.

The process of obtaining Sales Tax Certificates involved registering their business entities in each state, applying for the certificates, and providing the necessary documentation. ABC Retailers maintained meticulous records of their sales transactions and tax collections, enabling them to file accurate tax returns and remit the collected sales tax to the respective state authorities.

By adhering to the requirements and maintaining tax compliance, ABC Retailers not only avoided legal issues but also gained a competitive edge. Their commitment to tax compliance and the possession of valid Sales Tax Certificates enhanced their reputation among customers and stakeholders, contributing to their overall success in the retail industry.

| State | Sales Tax Rate | ABC Retailers' Compliance |

|---|---|---|

| California | 7.25% | Obtained Sales Tax Certificate and complied with state regulations. |

| Texas | 6.25% | Registered with the state and collected sales tax accurately. |

| New York | 8.875% | Maintained tax records and remitted sales tax on time. |

Future Implications and Trends

As the retail industry continues to evolve, the role of the Sales Tax Certificate is likely to adapt to changing tax landscapes and technological advancements. Here are some future implications and trends to consider:

- Online Sales and E-Commerce: With the growth of online retail, states are increasingly focusing on taxing e-commerce transactions. Sales Tax Certificates may become even more critical for online businesses to ensure compliance with remote sales tax regulations.

- Simplification of Tax Collection: States may explore ways to streamline the tax collection process further. This could involve implementing more efficient technologies, such as electronic filing and payment systems, to reduce administrative burdens on businesses.

- Data-Driven Tax Administration: Tax authorities are increasingly leveraging data analytics to enhance tax compliance and enforcement. Businesses with Sales Tax Certificates may benefit from more accurate and efficient tax administration processes.

- Regional Tax Harmonization: Efforts to harmonize tax rates and regulations across states or regions may gain momentum. This could simplify the process of obtaining Sales Tax Certificates and ensure a more uniform tax environment for businesses operating across multiple jurisdictions.

- Emerging Technologies: The integration of technologies like blockchain and artificial intelligence in tax administration could revolutionize the way Sales Tax Certificates are managed and monitored. These technologies may enhance transparency, efficiency, and security in tax compliance.

Conclusion

The Sales Tax Certificate is a vital component of a business’s tax compliance strategy, particularly in the retail industry. By obtaining this certificate, businesses demonstrate their commitment to ethical practices and ensure they are operating within the boundaries of state tax laws. As the retail landscape continues to evolve, staying informed about tax regulations and maintaining compliance through Sales Tax Certificates will remain crucial for businesses seeking success and sustainability.

How long is a Sales Tax Certificate valid for?

+Sales Tax Certificates are typically valid for a specific period, often ranging from one to five years. Businesses must renew their certificates before the expiration date to maintain their validity and tax compliance.

What happens if a business operates without a Sales Tax Certificate?

+Operating without a Sales Tax Certificate can result in severe penalties, including fines, interest, and even revocation of business licenses. Non-compliance may also lead to legal repercussions and damage to the business’s reputation.

Can a business apply for a Sales Tax Certificate online?

+Yes, many states offer online application processes for Sales Tax Certificates. This streamlines the application procedure and provides businesses with a convenient and efficient way to obtain their certificates.