Washington State Fuel Tax

The fuel tax is a significant aspect of a state's revenue stream and plays a crucial role in funding infrastructure development and maintenance. In Washington State, the fuel tax has a long history and continues to be a subject of interest for residents, policymakers, and industry stakeholders alike. This comprehensive article aims to delve into the intricacies of the Washington State Fuel Tax, exploring its history, current rates, distribution of funds, and its impact on the state's economy and transportation infrastructure.

A Historical Perspective on Washington’s Fuel Tax

The journey of Washington State’s fuel tax began in the early 20th century, when the state recognized the need for a dedicated revenue source to construct and maintain its growing network of roads and highways. In 1921, the state implemented its first fuel tax, levying a tax of 1 cent per gallon on gasoline sales. This marked the beginning of a revenue stream that would evolve and adapt over the decades to meet the changing transportation needs of the state.

As the years progressed, the fuel tax rate was adjusted multiple times to keep pace with inflation and rising construction and maintenance costs. Notable milestones in the history of Washington's fuel tax include the following:

- 1930s: The fuel tax rate was increased to 2 cents per gallon, providing much-needed revenue during the Great Depression.

- 1950s: The state experienced a boom in post-war infrastructure development, leading to further adjustments in the fuel tax rate to support these ambitious projects.

- 1980s: Washington State introduced a variable tax structure, where the tax rate fluctuated based on the wholesale price of gasoline. This ensured that the tax revenue remained consistent even as fuel prices fluctuated.

- 2000s: The state implemented a Motor Fuel Tax Account, a dedicated fund that receives a portion of the fuel tax revenue. This fund is specifically allocated for transportation projects, ensuring a stable source of funding for critical infrastructure initiatives.

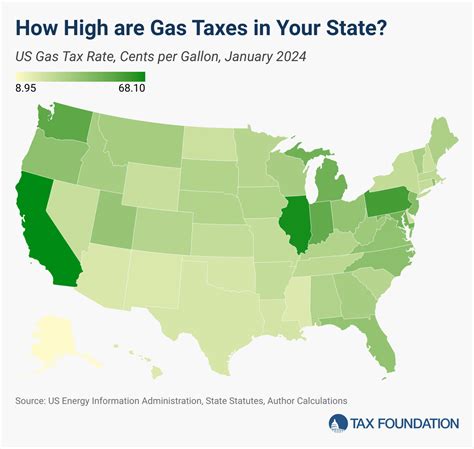

Today, Washington's fuel tax is a sophisticated system that considers various factors, including fuel type, wholesale prices, and environmental concerns, to determine the appropriate tax rate.

Current Fuel Tax Rates and Distribution

As of 2024, Washington State’s fuel tax rates are as follows:

| Fuel Type | Tax Rate |

|---|---|

| Gasoline | $0.4938 per gallon |

| Diesel | $0.6438 per gallon |

| Ethanol-Blended Fuels | $0.3738 per gallon |

| Biodiesel | $0.3038 per gallon |

These rates are subject to change annually, as the state adjusts the tax based on factors like inflation and the cost of maintaining and improving transportation infrastructure. The revenue generated from these fuel taxes is distributed among various funds and programs to support different aspects of transportation and environmental initiatives.

Distribution of Funds

Washington State has a comprehensive system for allocating fuel tax revenue. Here’s a breakdown of how the funds are typically distributed:

- State Road Fund: The majority of the fuel tax revenue goes into the State Road Fund, which is dedicated to the construction, maintenance, and improvement of state highways and roads. This fund supports projects ranging from pavement repairs to major bridge replacements.

- Motor Fuel Tax Account: A significant portion of the fuel tax revenue is allocated to the Motor Fuel Tax Account, which provides funding for various transportation projects. These projects include road and bridge improvements, public transportation initiatives, and bicycle and pedestrian infrastructure development.

- Local Road Fund: A smaller percentage of the fuel tax revenue is directed to the Local Road Fund. This fund assists local governments in maintaining and improving their local road networks, ensuring that every region of the state receives support for its transportation needs.

- Environmental Programs: Recognizing the environmental impact of transportation, Washington State allocates a portion of the fuel tax revenue to support environmental initiatives. These programs focus on reducing greenhouse gas emissions, promoting sustainable transportation options, and mitigating the environmental effects of infrastructure development.

Impact on Washington’s Economy and Infrastructure

The fuel tax plays a pivotal role in shaping Washington State’s economy and transportation infrastructure. Its impact can be observed across various sectors and has far-reaching consequences.

Economic Impact

The fuel tax is a significant revenue source for the state, generating billions of dollars annually. This revenue stream is crucial for funding transportation projects, which in turn stimulate economic growth. The construction and maintenance of roads create jobs, support local businesses, and facilitate the efficient movement of goods and services, contributing to the overall economic vitality of the state.

Additionally, the fuel tax revenue is often leveraged to attract private investments in transportation infrastructure, further boosting the state's economy. The stable funding source provided by the fuel tax gives confidence to investors and developers, encouraging them to participate in major transportation projects.

Infrastructure Development and Maintenance

The primary purpose of the fuel tax is to ensure the state’s transportation infrastructure remains in good condition. The revenue generated from fuel taxes is directed towards a wide range of infrastructure projects, including:

- Road resurfacing and repairs

- Bridge maintenance and replacement

- Expansion of highways and roads to accommodate growing traffic demands

- Construction of new roads in developing areas

- Improving public transportation systems, such as bus routes and light rail networks

- Developing bicycle lanes and pedestrian pathways to promote active transportation

By consistently investing in infrastructure, Washington State aims to enhance mobility, improve safety, and reduce traffic congestion. Well-maintained roads and efficient transportation networks contribute to a higher quality of life for residents and a more attractive business environment for companies considering relocation or expansion.

Future Implications and Potential Challenges

While Washington State’s fuel tax has been an effective tool for funding transportation infrastructure, it faces several challenges and considerations as the state moves forward.

Electric Vehicles and Fuel Tax Revenue

The growing adoption of electric vehicles (EVs) presents a unique challenge to fuel tax revenue. As more drivers transition to EVs, the demand for gasoline and diesel fuel decreases, leading to a potential decline in fuel tax revenue. This shift could impact the state’s ability to fund transportation projects in the long term.

To address this challenge, Washington State is exploring alternative funding mechanisms, such as road usage charges or vehicle miles traveled (VMT) fees, which would ensure a stable revenue stream regardless of the fuel type used. These innovative funding models aim to maintain a sustainable source of revenue for transportation infrastructure while accommodating the transition to electric and alternative fuel vehicles.

Environmental Sustainability and Transportation

Washington State is committed to environmental sustainability, and the fuel tax plays a role in promoting eco-friendly transportation options. A portion of the fuel tax revenue is dedicated to supporting electric vehicle infrastructure, encouraging the use of public transportation, and developing bicycle and pedestrian networks. These initiatives aim to reduce the state’s carbon footprint and improve air quality.

However, as the state continues to prioritize environmental sustainability, it must strike a balance between funding traditional infrastructure projects and supporting emerging sustainable transportation options. The challenge lies in ensuring that the transition to greener transportation does not compromise the maintenance and development of critical road networks.

Transportation Equity and Regional Development

The distribution of fuel tax revenue is designed to support transportation needs across the state. However, ensuring equitable access to transportation infrastructure in rural and underserved areas can be a challenge. Washington State must carefully allocate funds to address the unique needs of diverse regions, ensuring that all communities have adequate transportation options.

Conclusion

Washington State’s fuel tax is a dynamic and essential component of the state’s transportation funding system. Its historical evolution, current rates, and distribution of funds reflect the state’s commitment to maintaining a robust transportation network while adapting to changing economic and environmental realities. As the state navigates the challenges and opportunities presented by emerging technologies and sustainability goals, the fuel tax will continue to play a pivotal role in shaping Washington’s transportation landscape for years to come.

How often are Washington State’s fuel tax rates adjusted?

+Washington State’s fuel tax rates are typically adjusted annually to account for inflation and other economic factors. These adjustments ensure that the tax revenue remains sufficient to meet the state’s transportation funding needs.

What percentage of the fuel tax revenue is allocated to environmental programs?

+The allocation of fuel tax revenue to environmental programs varies depending on the state’s budget and priorities. However, as of 2024, approximately 10% of the fuel tax revenue is dedicated to supporting environmental initiatives related to transportation.

How does Washington State ensure that fuel tax revenue is used efficiently for transportation projects?

+Washington State has established a comprehensive system for allocating fuel tax revenue to various transportation funds and programs. This system ensures that funds are directed to the most critical and impactful projects, with regular audits and oversight to maintain transparency and efficiency.

Are there any plans to introduce alternative funding mechanisms for transportation infrastructure?

+Yes, Washington State is actively exploring alternative funding models, such as road usage charges and vehicle miles traveled (VMT) fees, to ensure a sustainable revenue stream for transportation infrastructure. These models aim to adapt to the changing transportation landscape and support the state’s sustainability goals.