Income Tax Indiana

Indiana's income tax system is an essential component of the state's revenue structure, playing a crucial role in funding various public services and initiatives. This article delves into the specifics of Indiana's income tax, exploring its rates, brackets, and how it impacts taxpayers and the state's economy. With a comprehensive understanding of Indiana's income tax system, taxpayers can make more informed decisions and plan their financial strategies effectively.

Understanding Indiana’s Income Tax Structure

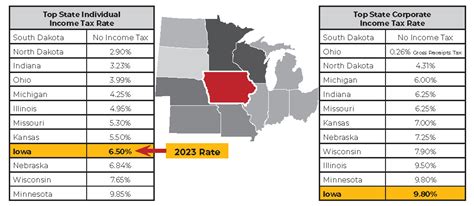

Indiana imposes a flat income tax rate on its residents and non-residents with income sourced from the state. This flat rate structure differs from many other states that employ a progressive tax system with varying rates for different income brackets. As of my last update in January 2023, Indiana’s flat income tax rate stands at 3.23%, which applies to all taxable income, including wages, salaries, and business profits.

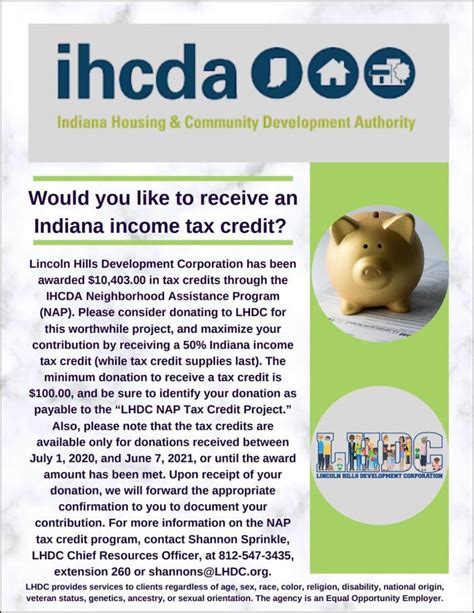

While the flat rate system is straightforward, it's important to note that Indiana also offers various tax credits and deductions that can reduce the amount of tax owed. These provisions aim to provide relief to taxpayers, especially those with lower incomes or specific circumstances.

One notable tax credit is the Hoosier Homeowners Property Tax Deduction Credit, which provides a deduction of up to $3,000 for eligible homeowners who meet certain income and residency requirements. This credit helps reduce the tax burden for homeowners and encourages homeownership in the state.

Filing Status and Income Brackets

Indiana’s income tax system considers various filing statuses, including single, married filing jointly, married filing separately, and head of household. The state’s income brackets are adjusted annually to account for inflation and changes in the cost of living. These adjustments ensure that taxpayers are not unfairly impacted by rising prices.

For the 2023 tax year, the income brackets for Indiana's flat tax rate are as follows:

| Filing Status | Income Bracket |

|---|---|

| Single | $10,000 - $25,000 |

| Married Filing Jointly | $20,000 - $50,000 |

| Married Filing Separately | $10,000 - $25,000 |

| Head of Household | $15,000 - $37,500 |

It's important to note that these brackets are for illustrative purposes only and may not reflect the most recent tax year's thresholds. Taxpayers should refer to the official Indiana Department of Revenue website for the most up-to-date information.

Tax Filing and Payment Options

Indiana provides taxpayers with several options for filing their income tax returns and making payments. The state’s Department of Revenue offers both online and offline methods to ensure accessibility and convenience for all taxpayers.

Online Filing and Payment

The Indiana Department of Revenue’s website, IN.gov/DOR, provides a user-friendly interface for taxpayers to file their returns electronically. The online filing system, known as INtax, allows taxpayers to submit their returns securely and receive real-time status updates. Taxpayers can also make payments through INtax using various payment methods, including credit cards, debit cards, and electronic checks.

Paper Filing and Payment

For taxpayers who prefer traditional methods, Indiana accepts paper tax returns. Taxpayers can download and print the appropriate tax forms from the DOR website or request them by mail. Once the completed forms are ready, taxpayers can mail them to the designated address along with their payment, if applicable.

Payment Plans and Installment Agreements

Indiana understands that taxpayers may face financial challenges and offers payment plans for those who cannot pay their taxes in full. Taxpayers can apply for an installment agreement, allowing them to pay their taxes over time with interest. The DOR evaluates each application on a case-by-case basis, considering the taxpayer’s financial situation and ability to make regular payments.

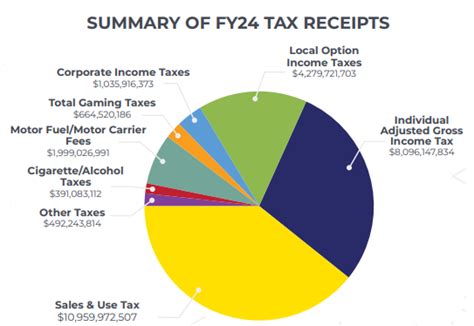

Income Tax Impact on the State’s Economy

Indiana’s income tax system has a significant impact on the state’s economy, influencing investment, business growth, and overall economic development. The flat tax rate provides a predictable and stable environment for businesses and investors, encouraging economic activity and job creation.

Attracting Businesses and Investors

Indiana’s flat tax rate is often seen as a competitive advantage, as it simplifies tax compliance and reduces the administrative burden for businesses. This simplicity, coupled with a low tax rate, makes Indiana an attractive destination for businesses looking to expand or relocate. A stable and predictable tax environment can lead to increased investment, job opportunities, and economic growth.

Economic Development and Job Creation

The revenue generated from income taxes plays a vital role in funding various economic development initiatives. These funds support infrastructure projects, education, healthcare, and other essential services that contribute to the state’s overall prosperity. By investing in these areas, Indiana creates an environment conducive to business growth and attracts talent, further strengthening its economy.

Impact on Taxpayers

For individual taxpayers, Indiana’s flat tax rate provides simplicity and ease of compliance. Taxpayers can quickly calculate their tax liability and plan their financial strategies accordingly. Additionally, the availability of tax credits and deductions ensures that taxpayers, especially those with lower incomes, can receive some relief and maintain their financial well-being.

Future Outlook and Potential Changes

As Indiana’s economy evolves and tax policies are subject to ongoing review, there may be potential changes to the state’s income tax system. While the flat tax rate has served Indiana well, there are ongoing debates about the fairness and effectiveness of such a system. Some argue for a progressive tax structure, believing it would provide more equitable distribution of tax burdens.

Furthermore, as remote work and digital nomads become more common, states may need to reconsider their tax policies to adapt to these changes. Indiana, like many other states, may need to address issues related to residency and sourcing income to ensure a fair and efficient tax system.

It's essential for taxpayers and businesses to stay informed about any potential changes to Indiana's tax laws. The state's Department of Revenue regularly provides updates and resources to help taxpayers navigate these changes effectively.

What is the current income tax rate in Indiana?

+As of my last update in January 2023, Indiana’s flat income tax rate is 3.23%.

Are there any tax credits or deductions available in Indiana?

+Yes, Indiana offers various tax credits and deductions, including the Hoosier Homeowners Property Tax Deduction Credit, which provides a deduction for eligible homeowners.

How can I file my income tax return in Indiana?

+Indiana provides online filing through the INtax system and accepts paper tax returns. Taxpayers can choose the method that suits them best.

What if I cannot pay my taxes in full?

+Indiana offers payment plans and installment agreements for taxpayers who cannot pay their taxes in full. These options allow taxpayers to pay their taxes over time with interest.

How does Indiana’s income tax system impact the state’s economy?

+Indiana’s flat tax rate attracts businesses and investors, leading to economic growth and job creation. The revenue generated from income taxes funds essential services and infrastructure projects.