San Diego Retail Tax

In the vibrant city of San Diego, California, the retail landscape thrives with a diverse range of businesses, from bustling shopping malls to unique local boutiques. One aspect that impacts both retailers and consumers alike is the San Diego Retail Tax. This guide aims to demystify the intricacies of this tax, providing a detailed overview to ensure a clear understanding of its implications.

The Nature of the San Diego Retail Tax

The San Diego Retail Tax is a critical component of the city’s revenue generation strategy, contributing significantly to the overall economic health of the region. It is a sales tax specifically applied to retail transactions, adding a certain percentage to the purchase price of goods and services. This tax is an essential part of the city’s fiscal framework, supporting various public services and infrastructure projects.

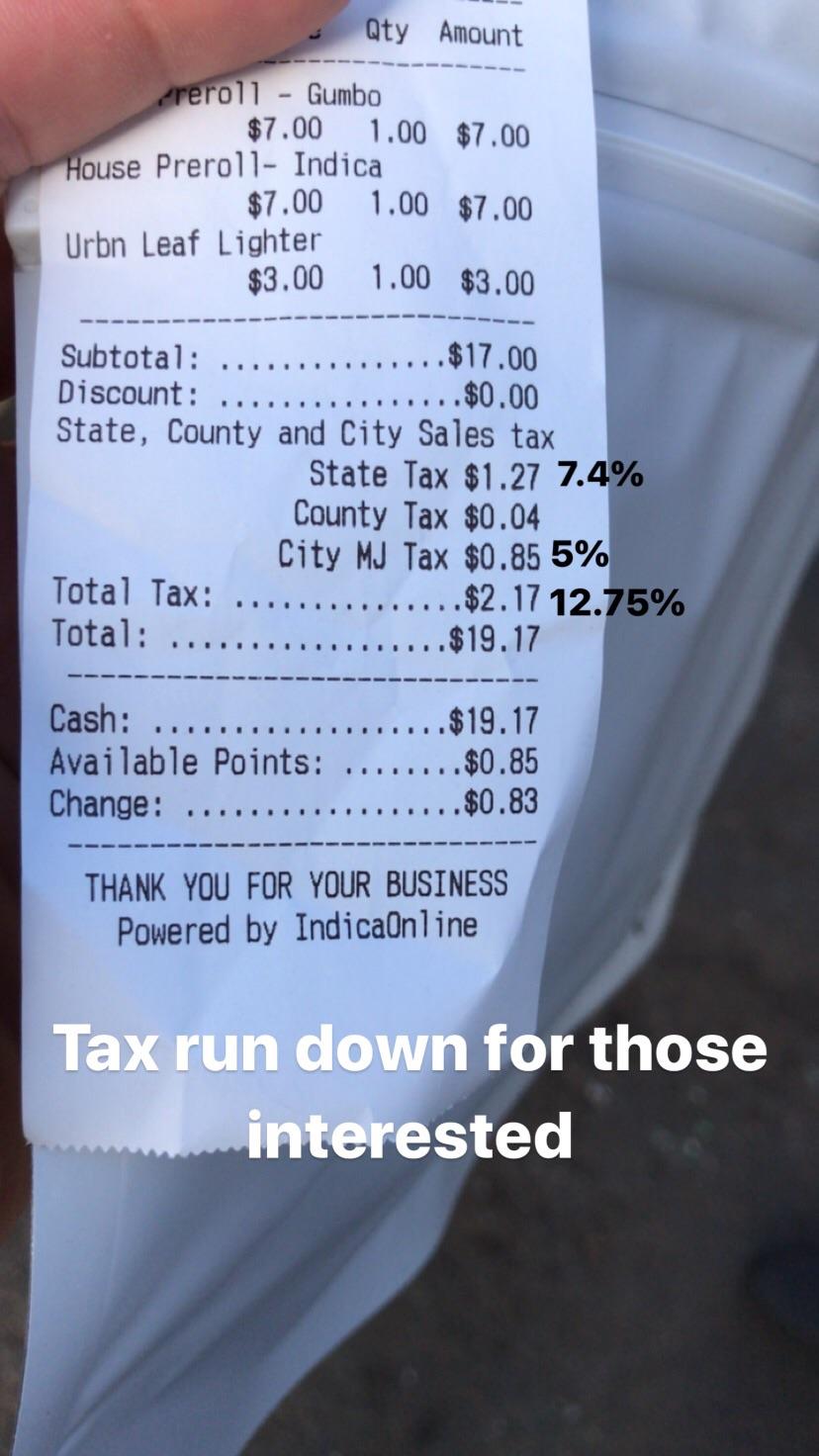

The San Diego Retail Tax is structured as a cumulative tax, meaning it is levied on top of other taxes, such as the state sales tax and any applicable district taxes. This cumulative nature can result in a higher overall tax burden for consumers, especially when multiple tax jurisdictions overlap.

Key Components of the San Diego Retail Tax

- Base Tax Rate: The base rate for the San Diego Retail Tax is set at 8.75%, which is the standard California state sales tax rate. This rate is applicable to most retail transactions within the city. - District Add-ons: In addition to the base rate, there may be district-specific add-ons. For instance, the city of San Diego has authorized certain districts to impose additional taxes to support specific initiatives or projects. These add-ons can range from 0.5% to 2.5%, depending on the district. - Exemptions: Not all goods and services are subject to the San Diego Retail Tax. Certain items, such as prescription medications, most groceries, and some services, are exempt from this tax. It’s important for businesses and consumers to understand these exemptions to ensure compliance and take advantage of tax-free purchases.Impact on Retailers and Consumers

The San Diego Retail Tax has a direct impact on both retailers and consumers, influencing their strategies, choices, and experiences.

Retailers

For retailers, the San Diego Retail Tax is a critical consideration in their financial planning and pricing strategies. Here’s how it affects them: - Pricing Strategies: Retailers must incorporate the tax into their pricing strategies to ensure competitiveness while maintaining profitability. This often involves setting prices to absorb a portion of the tax or passing it on to consumers. - Compliance and Administration: Retailers are responsible for collecting and remitting the San Diego Retail Tax to the appropriate tax authorities. This involves accurate record-keeping, timely reporting, and compliance with tax regulations to avoid penalties. - Impact on Margins: The tax can significantly affect a retailer’s profit margins, especially for businesses with narrow margins. Strategies to mitigate this impact may include negotiating better terms with suppliers or exploring ways to increase operational efficiency.Consumers

Consumers in San Diego are also affected by the retail tax, as it directly influences their purchasing decisions and overall shopping experience: - Price Transparency: Consumers need to be aware of the tax to make informed purchasing decisions. Clear price transparency, including the breakdown of taxes, is essential for building trust and ensuring consumers understand the total cost of their purchases. - Budgeting and Planning: The tax can impact consumers’ budgeting and financial planning. Understanding the tax rates and exemptions can help consumers make more strategic purchasing decisions and plan their spending effectively. - Online Shopping Considerations: With the rise of e-commerce, consumers now have the option to shop from retailers outside of San Diego, which may have different tax rates. This can lead to a preference for online shopping to avoid higher tax burdens.Implementation and Compliance

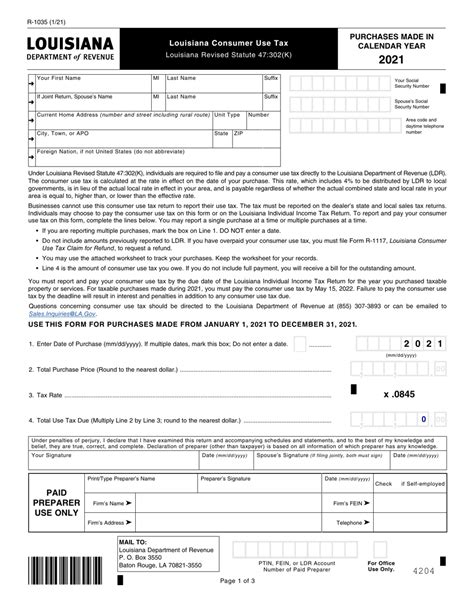

The San Diego Retail Tax is administered by the California Department of Tax and Fee Administration (CDTFA), which provides guidance and resources for businesses and consumers to ensure compliance.Registration and Reporting

- Registration: Retail businesses operating in San Diego are required to register with the CDTFA to obtain a Seller’s Permit. This permit allows them to collect and remit sales tax on behalf of the state. - Reporting: Retailers must file sales tax returns periodically, typically quarterly, to report the tax collected from customers. These returns are due by the last day of the month following the reporting period. - Payment: Along with the sales tax return, retailers must remit the collected tax to the CDTFA. Late payments or non-compliance can result in penalties and interest charges.Audits and Penalties

The CDTFA conducts audits to ensure compliance with sales tax regulations. Audits may be triggered by various factors, including random selection, consumer complaints, or suspicious activities. Non-compliance can lead to significant penalties, including fines, interest charges, and even legal action in severe cases.Future Outlook and Potential Changes

The San Diego Retail Tax, like any other tax structure, is subject to potential changes and modifications over time. These changes can be influenced by various factors, including economic conditions, political decisions, and public sentiment.Potential Tax Rate Adjustments

The base tax rate of 8.75% may be subject to future adjustments. While this rate has remained stable for several years, economic factors and the need for additional revenue could prompt discussions about increasing the rate. On the other hand, there may also be pressure to reduce the tax rate to boost economic growth and consumer spending.Tax Reform and Simplification

There have been ongoing discussions about simplifying the tax structure in California, including the San Diego Retail Tax. This could involve consolidating various tax jurisdictions or streamlining tax rates to reduce complexity for businesses and consumers. Such reforms aim to improve tax administration efficiency and enhance compliance.Online Sales Tax Collection

With the growing importance of e-commerce, there is an increasing focus on collecting sales tax from online retailers. Currently, there are ongoing efforts to ensure that online retailers, especially those from out-of-state, collect and remit sales tax to the appropriate tax jurisdictions. This trend is likely to continue, ensuring a more level playing field for local businesses and generating additional revenue for the city.| Tax Component | Description |

|---|---|

| Base Tax Rate | Standard California state sales tax rate of 8.75% |

| District Add-ons | Additional taxes authorized by specific districts, ranging from 0.5% to 2.5% |

| Exemptions | Certain goods and services, like prescription medications and most groceries, are exempt from the tax |

What happens if a retailer fails to collect or remit the San Diego Retail Tax?

+Retailers are legally obligated to collect and remit the San Diego Retail Tax. Failure to do so can result in penalties, interest charges, and potential legal action. The California Department of Tax and Fee Administration (CDTFA) has the authority to impose these penalties and may also require the retailer to pay the tax that should have been collected.

Are there any tax incentives or breaks for certain types of businesses in San Diego?

+Yes, San Diego offers various tax incentives and breaks to promote specific industries or support certain business activities. These incentives can include tax credits, reduced tax rates, or even tax holidays for specific sectors. It’s important for businesses to stay informed about these opportunities and consult with tax professionals to take advantage of any applicable benefits.

How often do retailers need to file sales tax returns in San Diego?

+Retailers typically file sales tax returns on a quarterly basis. However, the filing frequency can vary based on the size and revenue of the business. Larger businesses with significant sales may be required to file more frequently, such as monthly or semi-annually. It’s essential for retailers to understand their filing obligations and ensure timely submissions to avoid penalties.