Nyc Property Tax Bill

The New York City property tax system is a complex and essential aspect of the city's financial landscape. With one of the highest property tax rates in the nation, understanding how the system works and how to navigate it is crucial for both homeowners and businesses. This comprehensive guide aims to provide an in-depth analysis of the NYC property tax bill, shedding light on its components, calculations, and implications for taxpayers.

Unraveling the NYC Property Tax Bill

The NYC property tax bill is an annual levy imposed on real estate property owners within the five boroughs of New York City. It is a significant source of revenue for the city, funding various public services and infrastructure projects. The tax is based on the assessed value of the property, which is determined by the Department of Finance through a comprehensive assessment process.

Key Components of the NYC Property Tax Bill

The NYC property tax bill consists of several key components that contribute to the overall tax liability. These include:

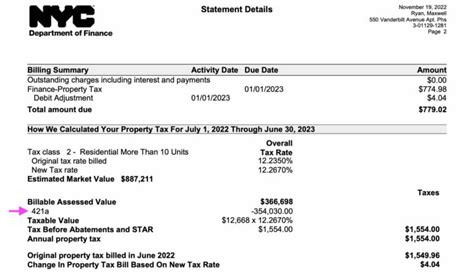

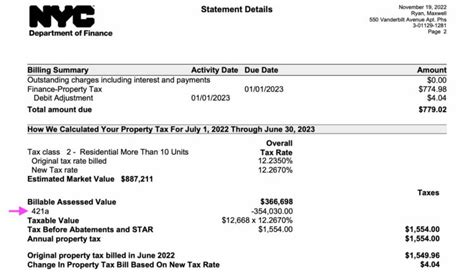

- Tax Rate: The tax rate is the percentage applied to the assessed value of the property to determine the tax amount. NYC has a complex tax rate structure, with different rates for various types of properties and districts. The tax rate is typically expressed as a percentage, such as 1.5% or 2.25%.

- Assessed Value: The assessed value is the value assigned to a property by the Department of Finance. It is based on factors like market value, improvements, and location. The assessed value is typically lower than the market value and is used as the basis for tax calculations.

- Exemptions and Credits: NYC offers various exemptions and credits to eligible taxpayers. These can reduce the taxable value of a property or provide a direct reduction in the tax bill. Common exemptions include the School Tax Relief (STAR) exemption for homeowners and the Commercial and Industrial Abatement Program (CIAP) for businesses.

- Taxable Value: The taxable value is the assessed value after applying any applicable exemptions or abatements. It is the amount on which the tax rate is applied to calculate the tax liability.

- Payment Options: NYC provides several payment options for property owners to settle their tax bills. These include online payments, direct debit, check payments, and payment plans for eligible taxpayers.

| Component | Description |

|---|---|

| Tax Rate | The percentage applied to the assessed value. |

| Assessed Value | The value assigned to the property by the Department of Finance. |

| Exemptions and Credits | Reductions in taxable value or direct tax bill reductions. |

| Taxable Value | The assessed value after applying exemptions, on which the tax rate is applied. |

| Payment Options | Various methods for taxpayers to pay their property taxes. |

Calculating the NYC Property Tax Bill

The calculation of the NYC property tax bill involves several steps. Here’s a simplified breakdown:

- Determine the Assessed Value of the property. This is based on the property's characteristics and market conditions.

- Apply any Exemptions or Abatements to the assessed value to arrive at the Taxable Value.

- Multiply the taxable value by the applicable Tax Rate to calculate the Gross Tax Amount.

- Subtract any Credits or Deductions from the gross tax amount to arrive at the Net Tax Bill.

The Department of Finance provides detailed instructions and calculators on their website to assist taxpayers in understanding their tax bill and calculating their liability.

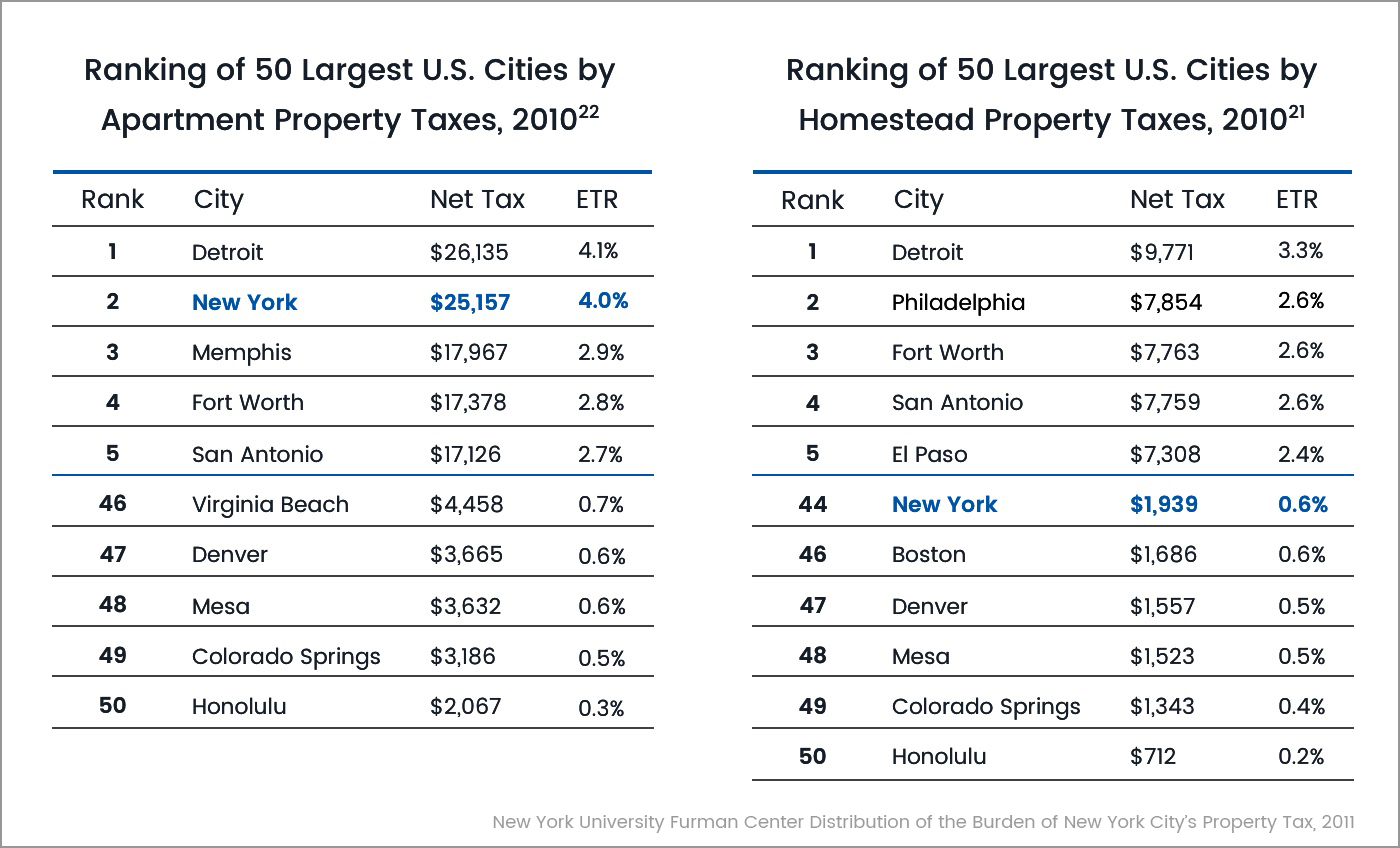

The Impact of NYC Property Taxes

The NYC property tax bill has significant implications for both homeowners and businesses. Here’s a deeper look at its impact on different stakeholders:

Homeowners

For homeowners in NYC, property taxes are a major expense. The tax bill can vary significantly based on factors like property value, location, and exemptions. Homeowners can benefit from programs like the STAR exemption, which provides a reduction in school taxes for owner-occupied primary residences.

Additionally, the property tax bill can influence a homeowner's financial planning. Understanding the tax liability can help individuals budget for their annual expenses and explore strategies to reduce their tax burden, such as appealing their assessed value or taking advantage of available exemptions.

Businesses

Businesses in NYC face a unique set of challenges when it comes to property taxes. The tax liability can vary widely depending on the type of business, location, and the specific tax district. Commercial properties often have higher tax rates than residential properties, impacting a business’s bottom line.

NYC offers various incentives and programs to attract and retain businesses, including the Commercial and Industrial Abatement Program (CIAP). This program provides tax abatements to eligible businesses, helping them reduce their tax burden and improve their financial competitiveness.

Real Estate Investors

Real estate investors in NYC must consider property taxes as a significant expense when evaluating investment opportunities. The tax liability can impact the cash flow and overall profitability of an investment property.

Investors often look for properties with lower tax burdens or explore strategies to minimize their tax liability, such as leveraging tax incentives, appealing assessed values, or structuring their investments to take advantage of certain tax benefits.

City Budget and Services

The revenue generated from NYC property taxes plays a critical role in funding the city’s budget and public services. It supports essential functions like education, public safety, transportation, and infrastructure development.

The property tax system's complexity and dynamic nature require careful management by the city government. Balancing the need for revenue with the impact on taxpayers is a delicate task, and it often involves a fine-tuning of tax rates, assessment methods, and exemption programs to ensure fairness and sustainability.

Navigating the NYC Property Tax Landscape

Understanding the NYC property tax bill is just the first step. Taxpayers can take several steps to navigate the complex tax landscape and optimize their tax liability:

- Stay Informed: Keep up-to-date with changes in tax rates, assessment methods, and exemption programs. The Department of Finance and other government agencies provide valuable resources and updates on their websites.

- Review Assessments: Regularly review your property's assessed value. If you believe the assessment is inaccurate, you can appeal it through the formal assessment review process.

- Explore Exemptions: Research and apply for applicable exemptions and credits. These can provide significant savings on your tax bill.

- Payment Plans: If you're facing financial difficulties, explore payment plan options offered by the Department of Finance. These plans can help you manage your tax liability over time.

- Seek Professional Advice: For complex situations or high-value properties, consider seeking advice from tax professionals or real estate attorneys. They can provide tailored strategies to optimize your tax liability.

A Case Study: Property Tax Appeal Process

Let’s take a closer look at the property tax appeal process through a real-life case study. Imagine a homeowner, Mr. Johnson, who receives a property tax bill that seems disproportionately high compared to his neighbors. After reviewing his assessment, he discovers that the Department of Finance has incorrectly classified his property as commercial, resulting in a higher tax rate.

Mr. Johnson decides to challenge the assessment through the formal appeal process. He gathers evidence, including recent sales data of similar properties in the area, to support his claim. He presents his case to the Tax Commission, providing detailed arguments and evidence to demonstrate that his property should be reclassified as residential.

After a thorough review, the Tax Commission agrees with Mr. Johnson's argument and reclassifies his property. This change results in a significant reduction in his tax bill, saving him thousands of dollars annually. The appeal process highlights the importance of staying informed, reviewing assessments, and taking action when necessary to protect your financial interests.

The Future of NYC Property Taxes

As NYC continues to evolve and adapt to changing economic and demographic conditions, the property tax system is likely to undergo further refinements. Here are some potential future developments:

- Assessment Reform: There may be ongoing efforts to improve the assessment process, ensuring fairness and accuracy. This could involve more frequent reassessments or the implementation of new technologies to enhance data collection and analysis.

- Tax Rate Adjustments: NYC may explore adjustments to tax rates to balance the need for revenue with the impact on taxpayers. This could involve targeted rate increases or decreases in specific districts or for certain types of properties.

- Exemption Expansion: To support specific sectors or encourage certain behaviors, the city may expand or introduce new exemptions. For example, there could be initiatives to provide tax incentives for green building practices or to support small businesses.

- Digital Transformation: The Department of Finance may continue to invest in digital technologies to streamline the tax payment and assessment processes. This could include online assessment tools, automated valuation models, and enhanced taxpayer portals for easier access to information and services.

The future of NYC property taxes is closely tied to the city's overall economic health and its commitment to fairness and sustainability. As the city adapts to new challenges and opportunities, the property tax system will likely play a pivotal role in shaping the financial landscape and supporting the needs of its residents and businesses.

How often are NYC property taxes assessed and billed?

+NYC property taxes are assessed annually, and the bills are typically mailed to property owners in the summer. The billing cycle may vary slightly for different types of properties, but the assessment process generally occurs every year.

Can I appeal my NYC property tax assessment?

+Yes, you have the right to appeal your property tax assessment if you believe it is inaccurate or unfair. The formal assessment review process allows you to challenge the assessed value and present your case to the Tax Commission. It’s important to gather evidence and prepare a strong argument to support your appeal.

Are there any exemptions or abatements available for NYC property taxes?

+Yes, NYC offers a range of exemptions and abatements to eligible taxpayers. These can reduce your taxable value or provide a direct reduction in your tax bill. Common exemptions include the School Tax Relief (STAR) exemption for homeowners and the Commercial and Industrial Abatement Program (CIAP) for businesses. It’s important to research and apply for any applicable exemptions to minimize your tax liability.

What payment options are available for NYC property taxes?

+NYC provides several payment options for property owners. These include online payments through the Department of Finance’s website, direct debit, check payments, and payment plans for eligible taxpayers. The city offers flexibility to ensure that taxpayers can settle their tax bills in a convenient and timely manner.

How can I stay informed about changes in NYC property taxes?

+Staying informed is crucial when it comes to NYC property taxes. You can subscribe to updates and newsletters from the Department of Finance and other relevant government agencies. Additionally, keeping an eye on local news and industry publications can provide valuable insights into tax rate changes, assessment methods, and exemption programs.