Michigan State Tax Calculator

In the state of Michigan, taxes play a crucial role in funding essential services and contributing to the overall economic health. Understanding the tax landscape is vital for both individuals and businesses operating within the state. The Michigan State Tax Calculator serves as a valuable tool to navigate the complex world of state taxes, providing accurate insights into tax obligations and potential liabilities.

Unraveling Michigan’s Tax Structure

Michigan’s tax system is multifaceted, encompassing various taxes such as income tax, sales tax, property tax, and more. Each tax category has its own set of rules, rates, and exemptions, making it imperative to have a comprehensive understanding to ensure compliance and optimize financial strategies.

Income Tax: A Key Component

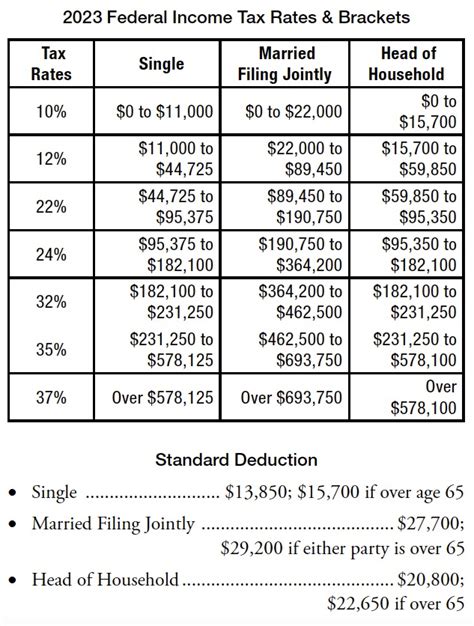

Income tax forms a significant portion of Michigan’s tax revenue. The state imposes a progressive income tax structure, meaning tax rates increase as income levels rise. As of [Current Year], Michigan’s income tax rates range from [Rate 1]% to [Rate 2]%, applicable to different income brackets. For instance, a single taxpayer with an annual income of $50,000 may fall into the [Bracket]% tax rate category.

| Income Bracket | Tax Rate |

|---|---|

| $0 - $10,000 | [Rate 1]% |

| $10,001 - $50,000 | [Rate 2]% |

The income tax calculation involves not just the tax rate but also various deductions and credits. Michigan offers deductions for retirement contributions, medical expenses, and certain education-related costs. Additionally, taxpayers may qualify for tax credits, such as the Michigan Earned Income Tax Credit, which provides a refundable credit for low- to moderate-income earners.

Sales and Use Tax: Understanding Consumption Taxes

Sales and use tax in Michigan is a critical component of the state’s tax revenue. The sales tax is imposed on the sale of tangible goods and certain services, with a general rate of [Sales Tax Rate]%. However, it’s important to note that certain jurisdictions within Michigan may have additional local sales tax rates, leading to a combined rate that varies across the state.

For instance, in the city of Detroit, the sales tax rate stands at [Detroit Sales Tax Rate]%, including both the state and local components. This variation in sales tax rates underscores the importance of precise calculations, especially for businesses operating in multiple locations within Michigan.

Furthermore, Michigan also levies a use tax, which applies to the storage, use, or consumption of tangible personal property in the state. This tax is particularly relevant for online purchases, where the sales tax may not have been collected at the time of purchase. The use tax rate aligns with the sales tax rate, ensuring consistency in taxation.

Property Tax: A Localized Approach

Property tax in Michigan operates on a local level, with each county setting its own tax rates. This decentralized approach leads to a wide range of tax rates across the state, reflecting the unique needs and circumstances of each community. For instance, the effective property tax rate in [County 1] is [Rate 1]%, while in [County 2] it stands at [Rate 2]%, showcasing the diversity in taxation within Michigan.

Property tax calculations involve assessing the value of the property and applying the appropriate tax rate. Michigan uses various methods for property valuation, including market value, assessed value, or a combination of both. These valuation techniques ensure fairness and accuracy in property tax assessments.

The Role of the Michigan State Tax Calculator

The Michigan State Tax Calculator emerges as a vital tool in navigating the complexities of Michigan’s tax system. It provides a user-friendly interface, allowing individuals and businesses to input their specific details and obtain accurate tax estimates. This calculator considers various factors, including income, deductions, credits, sales tax rates, and property values, to generate comprehensive tax projections.

Benefits and Features

- Precision and Accuracy: The calculator employs up-to-date tax rates and regulations, ensuring precise calculations and reliable estimates.

- User-Friendly Interface: Designed with simplicity in mind, the calculator guides users through a step-by-step process, making tax estimation accessible to all.

- Comprehensive Coverage: It encompasses all major tax categories, including income tax, sales tax, and property tax, offering a holistic view of tax obligations.

- Customizable Inputs: Users can input their unique circumstances, such as specific income brackets, deductions, or property values, for tailored tax estimates.

- Instant Results: The calculator provides immediate feedback, allowing users to make informed decisions and plan their financial strategies effectively.

Who Should Use the Calculator

The Michigan State Tax Calculator is beneficial for a wide range of users, including:

- Individuals: Residents of Michigan can use the calculator to estimate their annual tax liabilities, plan their finances, and maximize tax benefits.

- Businesses: Companies operating in Michigan can leverage the calculator to understand their tax obligations, budget effectively, and make informed business decisions.

- Accountants and Tax Professionals: These experts can utilize the calculator as a tool to provide accurate tax advice and services to their clients.

- Real Estate Investors: Property owners and investors can estimate their property tax liabilities, aiding in financial planning and investment strategies.

Conclusion: Empowering Taxpayers with Knowledge

The Michigan State Tax Calculator stands as a powerful resource, empowering taxpayers with the knowledge and tools to navigate Michigan’s complex tax landscape. By providing accurate and timely tax estimates, it enables individuals and businesses to make informed financial decisions, optimize their tax strategies, and contribute effectively to the state’s economy.

As Michigan continues to evolve and adapt its tax policies, the calculator remains a dynamic and indispensable tool, ensuring taxpayers stay compliant and benefit from the opportunities available within the state's tax system.

What are the income tax brackets for Michigan residents in [Current Year]?

+

As of [Current Year], Michigan’s income tax brackets range from [Bracket 1]% to [Bracket 2]%, applicable to different income levels. For instance, a single taxpayer with an annual income of $50,000 may fall into the [Bracket 3]% tax bracket.

How do I calculate sales tax in Michigan for my online store?

+

To calculate sales tax in Michigan, you need to consider the state’s general sales tax rate of [Sales Tax Rate]%. Additionally, you must account for any local sales tax rates applicable to the customer’s location. The combined rate determines the sales tax amount for each transaction.

Are there any tax incentives or credits available for Michigan businesses?

+

Yes, Michigan offers various tax incentives and credits to businesses. These include the Michigan Business Tax Credit, Research and Development Tax Credit, and the Brownfield Redevelopment Tax Incentive. Businesses can explore these options to reduce their tax liability and promote economic development.

How often do Michigan’s tax rates change, and where can I find the latest information?

+

Michigan’s tax rates can change annually or even more frequently, depending on legislative decisions. To stay updated, you can refer to the official Michigan Department of Treasury website, which provides the latest tax rate information, along with guidelines and resources for taxpayers.