Volusia County Real Estate Taxes

Welcome to a comprehensive guide exploring the intricacies of Volusia County's real estate taxes. This article will delve into the various aspects of property taxation in this vibrant Florida county, providing valuable insights for homeowners, investors, and anyone interested in understanding the financial obligations associated with owning property in Volusia County.

Understanding Volusia County’s Real Estate Tax Structure

Volusia County, known for its stunning beaches, vibrant culture, and thriving communities, imposes real estate taxes to fund essential public services and infrastructure. The tax system is designed to ensure fair contributions from property owners, supporting the county’s growth and development. Let’s break down the key components and considerations surrounding Volusia County’s real estate taxes.

Taxable Value Assessment

The foundation of real estate taxation in Volusia County lies in the determination of taxable value. The property appraiser’s office assesses each property annually, considering factors such as location, improvements, and market conditions. This process ensures that the taxable value accurately reflects the property’s worth, providing a fair basis for tax calculations.

For instance, a newly constructed luxury home in the Daytona Beach area may attract a higher taxable value due to its premium features and location, whereas an older, more modest property in a suburban neighborhood may have a lower assessed value.

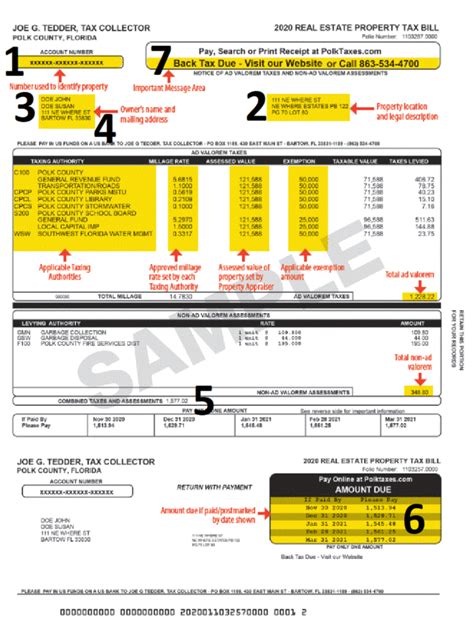

Millage Rates and Tax Calculation

Volusia County utilizes a millage rate system to determine the tax amount. A mill is equivalent to one-tenth of a cent, and the millage rate represents the tax rate per dollar of assessed property value. This rate is set annually by the county’s Board of County Commissioners, taking into account the revenue needs of various taxing authorities within the county.

To illustrate, if the millage rate is set at 10 mills, and a property has an assessed value of $200,000, the annual tax liability would be calculated as follows: $200,000 x 0.010 = $2,000. This means the property owner would be responsible for paying $2,000 in real estate taxes for that year.

| Property Type | Assessed Value | Millage Rate | Estimated Annual Tax |

|---|---|---|---|

| Residential Home | $300,000 | 10.20 mills | $3,060 |

| Commercial Property | $500,000 | 12.00 mills | $6,000 |

| Vacant Land | $150,000 | 8.50 mills | $1,275 |

Tax Exemptions and Discounts

Volusia County offers various tax exemptions and discounts to eligible property owners, providing relief and encouraging specific types of investments. These exemptions include:

- Homestead Exemption: Volusia County residents who own and occupy their primary residence may qualify for a homestead exemption, reducing the taxable value of their property. This exemption is particularly beneficial for long-term residents and can significantly lower their annual tax liability.

- Senior Exemption: Property owners aged 65 or older may be eligible for an additional exemption, further reducing their taxable value. This incentive promotes homeownership among seniors and helps them manage their financial obligations.

- Military Exemption: Active-duty military personnel and veterans can apply for exemptions based on their service. These exemptions recognize the sacrifices made by our armed forces and provide financial support to those who have served our nation.

- Agricultural Exemption: Property used for agricultural purposes may qualify for a reduced assessment, encouraging farming and ranching activities in the county.

Tax Payment Options and Deadlines

Volusia County provides several convenient options for property owners to pay their real estate taxes. Taxpayers can choose to pay in full by the deadline or opt for a convenient payment plan. The county accepts various payment methods, including online payments, credit card transactions, and traditional check or money order payments.

It's important for property owners to be aware of the tax deadlines to avoid penalties and interest. The tax year in Volusia County runs from January 1st to December 31st, with tax bills typically mailed out in November. Property owners have until March 31st of the following year to pay their taxes without incurring penalties. However, it's advisable to pay promptly to avoid any potential late fees.

Appealing Tax Assessments

If a property owner believes that their assessed value is inaccurate or unfair, they have the right to appeal the assessment. Volusia County provides a formal process for property owners to challenge their taxable value, ensuring a fair and transparent system. The Property Appraiser’s Office offers guidance and resources to assist property owners throughout the appeal process.

Impact on the Local Economy

Volusia County’s real estate taxes play a vital role in supporting the local economy and community development. The revenue generated from these taxes funds essential services such as education, public safety, infrastructure maintenance, and social services. By investing in these areas, the county fosters a thriving environment that attracts businesses, creates jobs, and enhances the overall quality of life for its residents.

Future Outlook and Potential Changes

As Volusia County continues to grow and evolve, its real estate tax system may undergo changes to adapt to emerging needs and trends. The county’s leadership and taxing authorities regularly review and assess the tax structure to ensure fairness, efficiency, and sustainability. Property owners can expect ongoing improvements and adjustments to keep pace with the dynamic real estate market and changing community demands.

Stay informed about potential changes by following local news, attending public meetings, and engaging with community leaders. Being proactive and knowledgeable about real estate tax matters can help property owners make informed decisions and effectively manage their financial obligations.

Conclusion

Understanding Volusia County’s real estate tax system is crucial for property owners and investors alike. By familiarizing themselves with the assessment process, tax calculation methods, and available exemptions, individuals can navigate the financial aspects of property ownership with confidence. The county’s commitment to fairness, transparency, and community support ensures that real estate taxes contribute to a vibrant and prosperous Volusia County.

When are real estate tax bills typically mailed out in Volusia County?

+Real estate tax bills in Volusia County are typically mailed out in November of each year.

What is the deadline for paying real estate taxes without incurring penalties?

+Property owners have until March 31st of the following year to pay their taxes without facing penalties or interest.

Are there any tax relief programs available for low-income homeowners in Volusia County?

+Yes, Volusia County offers the Save Our Homes program, which provides additional tax relief for eligible low-income homeowners. This program helps ensure that homeowners can continue to afford their properties and maintain their quality of life.

How often are property assessments conducted in Volusia County?

+Property assessments in Volusia County are conducted annually to ensure that the taxable value of each property remains accurate and up-to-date.

Can property owners appeal their assessed value if they believe it is inaccurate?

+Absolutely! Volusia County provides a formal process for property owners to appeal their assessed value. The Property Appraiser’s Office offers guidance and resources to assist in the appeal process, ensuring fairness and transparency.