Roth Vs After Tax 401K

When it comes to retirement planning, understanding the different types of retirement accounts and their unique features is crucial. Two prominent options that often spark debate are the Roth 401(k) and the after-tax 401(k), both offering distinct advantages and considerations. This comprehensive guide aims to delve into the intricacies of these accounts, exploring their mechanics, tax implications, and suitability for various retirement scenarios.

Unraveling the Roth 401(k) Advantage

The Roth 401(k) has gained significant popularity in recent years, appealing to those seeking flexibility and tax-efficient growth. Here’s a closer look at its key attributes:

Tax-Free Growth and Withdrawals

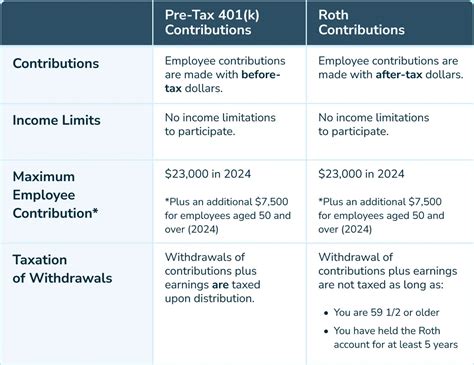

One of the most attractive features of a Roth 401(k) is the potential for tax-free growth. Contributions to a Roth account are made with after-tax dollars, meaning the money has already been taxed. However, the earnings and withdrawals in retirement are tax-free, providing a significant advantage for long-term investors.

Imagine an investor contributes $6,000 annually to their Roth 401(k) for 30 years. Assuming an average annual return of 8%, the account could grow to over $600,000 by retirement. With tax-free withdrawals, this investor could potentially enjoy a substantial income stream without the burden of taxes.

| Roth 401(k) Benefits | Key Advantages |

|---|---|

| Tax-Free Withdrawals | No taxes on earnings or withdrawals in retirement |

| Flexibility | Suitable for those expecting higher tax brackets in retirement |

| Contribution Limits | Higher contribution limits than traditional 401(k)s |

Income Tax Bracket Considerations

The decision to opt for a Roth 401(k) often hinges on an individual’s current and expected future income tax brackets. If you’re in a lower tax bracket now and expect to be in a higher bracket in retirement, the Roth 401(k) can be an excellent choice. This strategy allows you to pay taxes on your contributions upfront when your income is lower, and then enjoy tax-free withdrawals when your income (and tax rate) is higher.

Exploring the After-Tax 401(k) Option

The after-tax 401(k), also known as the Roth in-plan conversion, offers an alternative strategy for retirement savings. While it shares some similarities with the Roth 401(k), there are distinct differences in its mechanics and tax implications.

After-Tax Contributions and Conversions

In an after-tax 401(k) scenario, contributions are made with after-tax dollars, similar to a Roth 401(k). However, the key difference lies in the conversion process. You can elect to convert a portion or all of your traditional pre-tax 401(k) balance into an after-tax account within the same plan. This conversion is taxable, meaning you’ll owe taxes on the amount converted.

For instance, if you have a traditional 401(k) balance of $200,000 and choose to convert $50,000 into an after-tax account, you'll pay taxes on that $50,000 during the year of conversion. The remaining $150,000 will continue to grow tax-deferred in your traditional 401(k) account.

Benefits and Trade-offs

The after-tax 401(k) provides a flexibility to tailor your retirement savings strategy. By converting a portion of your traditional 401(k) to an after-tax account, you can diversify your tax exposure in retirement. This strategy is particularly beneficial for those seeking to manage their tax liability and ensure a more stable income stream.

However, it's essential to consider the tax implications of the conversion. The taxable event can significantly impact your cash flow and tax bracket for the year. It's advisable to consult a financial advisor to understand the potential impact and ensure it aligns with your overall financial goals.

| After-Tax 401(k) Pros and Cons | |

|---|---|

| Pros | Flexibility to manage tax exposure in retirement |

| Potential for tax-free withdrawals from converted funds | |

| Cons | Taxable event during the conversion process |

| Requires careful planning to manage tax liability |

Maximizing Your Retirement Strategy

When deciding between a Roth 401(k) and an after-tax 401(k), it’s crucial to consider your individual financial circumstances, including your income, tax bracket, and retirement goals. Here are some key factors to guide your decision-making process:

Current vs. Future Tax Bracket

Assess your current tax bracket and project your future tax bracket in retirement. If you’re in a lower tax bracket now and expect to be in a higher bracket later, a Roth 401(k) may be more advantageous. Conversely, if your tax bracket is expected to remain relatively stable, an after-tax 401(k) conversion can offer flexibility.

Time Horizon and Market Conditions

Consider your investment horizon and the potential for market growth. The Roth 401(k) shines when you have a long-term investment perspective and anticipate significant market gains. On the other hand, the after-tax 401(k) conversion can be a strategic move to lock in tax benefits during favorable market conditions.

Retirement Income Planning

Evaluate your desired retirement income and the sources of income you’ll rely on. The Roth 401(k) provides tax-free income in retirement, which can be a significant advantage. However, if you have other sources of income, the after-tax 401(k) can offer diversity in tax treatment, potentially reducing your overall tax liability.

Employer Match and Fees

Don’t overlook the employer match and fees associated with each account type. Ensure you maximize any employer contributions, as these are essentially free money towards your retirement. Additionally, be mindful of any fees that may impact the growth of your retirement savings.

Frequently Asked Questions

Can I have both a Roth 401(k) and an after-tax 401(k)?

+

Yes, some employers offer the flexibility to have both types of accounts. This can be a strategic approach to diversify your retirement savings and manage your tax liability.

Are there any income limits for contributing to a Roth 401(k)?

+

Income limits apply to Roth 401(k) contributions. For 2023, the income phase-out range is between 68,000 and 78,000 for single filers and between 103,000 and 113,000 for married couples filing jointly. If your income exceeds these limits, you may not be able to make Roth contributions.

What are the tax implications of an after-tax 401(k) conversion?

+

An after-tax 401(k) conversion triggers a taxable event. You’ll owe taxes on the amount converted, which can impact your cash flow and tax bracket for the year. It’s essential to consider this when planning your conversion strategy.

Can I convert my entire traditional 401(k) to an after-tax account?

+

Yes, you can elect to convert all or a portion of your traditional 401(k) to an after-tax account. The decision depends on your tax planning strategy and the desired balance between tax-deferred and tax-free retirement income.

Understanding the nuances of retirement accounts is essential for a secure and comfortable retirement. The Roth 401(k) and after-tax 401(k) offer unique advantages, and the choice between them should be tailored to your individual financial circumstances and goals. By carefully considering tax brackets, investment horizons, and retirement income planning, you can make informed decisions to maximize your retirement savings and ensure a financially stable future.