Sales Tax In Nashville Tn

In Nashville, Tennessee, sales tax is an important aspect of doing business and managing personal finances. It is a tax levied on the sale of goods and services and is an essential revenue stream for the state and local governments. Nashville's sales tax structure, like many other jurisdictions, is unique and can impact both consumers and businesses. This article aims to provide a comprehensive guide to understanding and navigating the sales tax landscape in Nashville, TN.

The Sales Tax System in Nashville

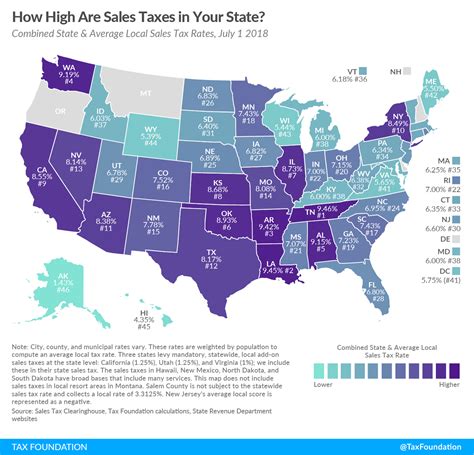

Nashville’s sales tax system is a combination of state, county, and city taxes, each with its own rates and regulations. This multi-layered structure can make it challenging to comprehend for residents and businesses alike. The state sales tax in Tennessee is set at a rate of 7%, which serves as the foundation for the overall sales tax rate in Nashville.

County Sales Tax

Davidson County, where Nashville is located, adds an additional 2.25% to the state sales tax, bringing the total to 9.25%. This county tax is applied uniformly across all jurisdictions within Davidson County.

City Sales Tax

Nashville, as a city within Davidson County, has the authority to impose its own sales tax. Currently, the city of Nashville applies an extra 2.5% sales tax, resulting in a combined state, county, and city sales tax rate of 11.75% for purchases made within the city limits.

| Taxing Jurisdiction | Sales Tax Rate |

|---|---|

| State of Tennessee | 7% |

| Davidson County | 2.25% |

| City of Nashville | 2.5% |

Impact on Businesses

Businesses operating in Nashville have a crucial role in managing and collecting sales tax. They are responsible for accurately calculating and remitting the appropriate sales tax to the Tennessee Department of Revenue. This process involves understanding the applicable tax rates, ensuring proper tax collection on each sale, and maintaining detailed records.

Sales Tax Registration

Any business selling taxable goods or services in Nashville must register with the Tennessee Department of Revenue to obtain a Sales and Use Tax Registration Certificate. This certificate authorizes the business to collect and remit sales tax on behalf of the state and local governments.

Sales Tax Collection and Remittance

Businesses are required to collect sales tax at the point of sale, ensuring the correct tax rate is applied based on the location of the business and the customer. The collected sales tax must be remitted to the Tennessee Department of Revenue on a regular basis, typically quarterly or monthly, depending on the business’s sales volume.

Sales Tax Exemptions

While most goods and services are subject to sales tax, there are certain exemptions in Nashville. These include purchases made by government entities, non-profit organizations, and certain types of goods, such as prescription medications and food items intended for home consumption. Businesses must be aware of these exemptions and properly identify and document exempt sales.

Impact on Consumers

For consumers in Nashville, sales tax is an additional cost to consider when making purchases. It is important for residents to understand the sales tax rates to make informed decisions about their spending and budgeting.

Calculating Sales Tax

To calculate the sales tax on a purchase, simply multiply the total cost of the item by the applicable sales tax rate. For example, if you purchase an item for 100 in Nashville, the sales tax would be calculated as follows: 100 x 0.1175 = 11.75. This means the total cost of the item, including sales tax, would be 111.75.

Sales Tax on Online Purchases

With the rise of e-commerce, it’s important to note that sales tax is also applicable to online purchases. When shopping online, businesses are required to collect and remit sales tax based on the shipping destination. This means that if you purchase an item online and have it shipped to Nashville, the appropriate sales tax rate will be applied.

Sales Tax Refunds

In certain cases, consumers may be eligible for sales tax refunds. This can occur when a business mistakenly charges sales tax on an exempt item or when a consumer purchases an item and later returns it. In such cases, the business is responsible for refunding the sales tax to the customer.

Sales Tax Compliance and Audits

The Tennessee Department of Revenue regularly conducts audits to ensure businesses are compliant with sales tax regulations. These audits involve reviewing a business’s sales records, tax returns, and other financial documents to verify the accuracy of sales tax calculations and remittances.

Penalties for Non-Compliance

Businesses found to be non-compliant with sales tax regulations can face penalties, including fines, interest charges, and even criminal prosecution in severe cases. It is crucial for businesses to maintain accurate records, calculate sales tax correctly, and remit taxes in a timely manner to avoid these penalties.

Sales Tax Software and Services

To simplify the process of sales tax management, many businesses utilize sales tax software and services. These tools help automate sales tax calculations, ensure compliance with changing tax rates and regulations, and streamline the tax remittance process. By investing in these technologies, businesses can reduce the risk of errors and save time on sales tax administration.

Future of Sales Tax in Nashville

The sales tax landscape in Nashville is subject to change, influenced by economic trends, political decisions, and technological advancements. While it is challenging to predict the exact future of sales tax rates, there are several factors to consider.

Economic Impact

The current sales tax rate in Nashville has a significant impact on the local economy. It affects consumer spending, business operations, and the overall financial health of the city. As the economy evolves, there may be discussions about adjusting the sales tax rate to stimulate economic growth or address budget concerns.

Legislative Changes

The Tennessee legislature has the authority to modify the state sales tax rate. While it is difficult to predict legislative actions, any changes to the state sales tax rate would have a cascading effect on the overall sales tax rates in Nashville and other jurisdictions within the state.

Technological Advancements

The rise of e-commerce and online sales has prompted discussions about the fair taxation of online purchases. As technology continues to advance, there may be efforts to streamline the sales tax system to ensure equitable taxation of online and offline sales. This could involve changes to the way sales tax is calculated and collected, particularly for businesses with a significant online presence.

Conclusion

Understanding and navigating the sales tax system in Nashville is crucial for both businesses and consumers. The city’s unique sales tax structure, comprising state, county, and city taxes, can impact financial decisions and operations. By staying informed about sales tax rates, exemptions, and compliance requirements, businesses and individuals can make informed choices and ensure compliance with the law.

What happens if a business fails to register for sales tax in Nashville?

+Businesses operating in Nashville without a valid Sales and Use Tax Registration Certificate may face significant penalties, including fines and interest charges. In some cases, the Tennessee Department of Revenue may impose criminal penalties for willful non-compliance. It is crucial for businesses to register and obtain the necessary certificate to avoid these consequences.

Are there any sales tax holidays in Nashville?

+Nashville, along with the rest of Tennessee, currently does not observe sales tax holidays. However, the state has previously held sales tax holidays for specific items, such as school supplies and energy-efficient appliances. These holidays are typically announced by the state government and provide temporary relief from sales tax for qualifying purchases.

How can businesses stay updated on sales tax rate changes in Nashville?

+Businesses can stay informed about sales tax rate changes by subscribing to notifications from the Tennessee Department of Revenue. The department provides updates on its website and through email notifications. Additionally, businesses can consult tax professionals or utilize sales tax software that automatically incorporates rate changes.