Knoxville Property Tax

Welcome to Knoxville, a vibrant city nestled in the heart of Tennessee, where the rolling hills meet the vibrant urban landscape. As a resident or potential homeowner in this thriving community, understanding the ins and outs of property taxes is essential. In this comprehensive guide, we will delve into the intricacies of Knoxville property taxes, exploring the factors that influence tax rates, the assessment process, and the various strategies to manage your tax obligations effectively.

Unraveling the Knoxville Property Tax Landscape

Knoxville, with its diverse neighborhoods and thriving economy, offers a unique property tax environment. The city’s property tax system is designed to support local infrastructure, education, and community development, making it a crucial aspect of civic responsibility. Here, we will break down the complexities, ensuring you have a clear understanding of your financial obligations as a Knoxville property owner.

Factors Influencing Property Tax Rates

The property tax rates in Knoxville are determined by a combination of factors, each playing a significant role in the overall tax assessment. These include:

- Property Value: The assessed value of your property is a key determinant. Knoxville employs a comprehensive assessment process to ensure fairness and accuracy. Properties are valued based on their market value, taking into account factors like location, size, improvements, and recent sales data.

- Tax Districts and Rates: Knoxville is divided into different tax districts, each with its own tax rate. These rates are set by local governing bodies, such as the city council and county commission. Understanding which tax district your property falls into is essential for accurate tax estimation.

- Assessed Value vs. Taxable Value: It’s important to distinguish between the assessed value and the taxable value of your property. The assessed value is determined by the assessment process, while the taxable value may be subject to exemptions or caps, influencing the final tax amount.

- Taxable Property Types: Different types of properties, such as residential, commercial, and industrial, may have varying tax rates. Knoxville’s tax structure takes into account the unique characteristics and uses of each property type.

- Tax Relief Programs: Knoxville offers various tax relief programs to support eligible homeowners. These programs can provide reductions or exemptions based on factors like age, income, or veteran status. Staying informed about these programs can help you take advantage of potential savings.

By understanding these factors, you can better estimate your property tax obligations and plan your finances accordingly. Let's explore each aspect in more detail to gain a comprehensive understanding of the Knoxville property tax landscape.

The Property Assessment Process: A Step-by-Step Guide

The property assessment process is a crucial component of the Knoxville property tax system. It ensures that property values are accurately determined, providing a fair basis for tax calculations. Here’s a step-by-step breakdown of how the assessment process works:

- Data Collection: Assessors gather comprehensive data about each property in Knoxville. This includes details such as property dimensions, construction type, improvements, and recent sales of similar properties. Accurate data collection is essential for a precise assessment.

- Physical Inspection: In some cases, assessors may conduct physical inspections of properties. These inspections help verify the information collected and ensure that the property’s characteristics align with the data on record.

- Valuation Methodology: Knoxville employs various valuation methods to determine property values. These methods include the cost approach, income approach, and sales comparison approach. Assessors consider factors like replacement cost, rental income potential, and recent property sales to arrive at an accurate valuation.

- Market Analysis: Assessors analyze the local real estate market to understand prevailing property values. This market analysis ensures that assessments are in line with the current trends and conditions in the Knoxville real estate market.

- Assessment Notification: Once the assessment process is complete, property owners receive a notification detailing the assessed value of their property. This notification provides an opportunity for property owners to review the assessment and address any concerns or discrepancies.

- Appeal Process: If a property owner believes the assessed value is inaccurate, they have the right to appeal. Knoxville provides a fair and transparent appeal process, allowing property owners to present their case and potentially adjust the assessed value.

- Final Assessment: After any appeals have been resolved, the final assessed value is determined. This value serves as the basis for calculating property taxes, ensuring that tax obligations are fair and aligned with the property’s actual value.

Understanding the assessment process empowers property owners to actively participate in the system, ensuring accuracy and fairness. Let's delve deeper into each step to gain a comprehensive understanding of how property values are determined in Knoxville.

Strategies for Effective Property Tax Management

Managing your property taxes in Knoxville requires a proactive approach. Here are some strategies to help you navigate the tax landscape effectively:

- Stay Informed: Keep yourself updated on tax rates, assessment processes, and any changes in the Knoxville property tax system. Attend local meetings, follow official announcements, and engage with community resources to stay informed.

- Understand Your Assessment: Carefully review your property assessment notification. Verify that the details, such as property dimensions and improvements, are accurate. If you have any concerns, reach out to the assessor’s office for clarification.

- Consider Tax Relief Options: Explore the various tax relief programs offered by Knoxville. These programs can provide significant savings, especially for eligible homeowners. Research the criteria and requirements to determine if you qualify.

- Appeal if Necessary: If you believe your property’s assessed value is inaccurate, don’t hesitate to appeal. The appeal process is designed to ensure fairness and accuracy. Gather supporting evidence and present your case effectively to increase your chances of a successful appeal.

- Utilize Online Tools: Knoxville provides online resources to help property owners manage their tax obligations. These tools can include tax calculators, assessment lookup tools, and payment portals. Leverage these resources to estimate your taxes, track your payments, and stay organized.

- Plan Your Budget: Property taxes are a significant expense, so it’s essential to plan your budget accordingly. Include tax payments in your financial planning to ensure you have the necessary funds available when due.

- Engage with Tax Professionals: Consider seeking advice from tax professionals or accountants who specialize in property taxes. They can provide expert guidance, help you navigate complex tax scenarios, and ensure you’re taking advantage of all available tax benefits.

By implementing these strategies, you can effectively manage your property taxes, ensuring compliance and maximizing potential savings. Remember, a proactive approach to tax management is key to a smooth and stress-free experience.

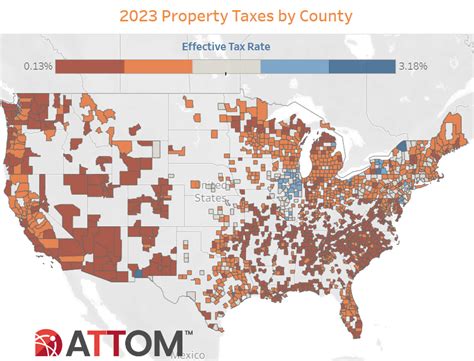

A Comparative Analysis: Knoxville vs. Other Cities

To gain a broader perspective, let’s compare Knoxville’s property tax landscape with that of other cities. This analysis will provide insights into how Knoxville’s tax system stacks up against other municipalities and help you understand the unique characteristics of the local tax environment.

| City | Average Property Tax Rate | Assessment Frequency | Notable Tax Features |

|---|---|---|---|

| Knoxville | 1.50% (based on assessed value) | Annual | Offers various tax relief programs, including homestead exemptions and veteran discounts. |

| Nashville | 2.25% (based on appraised value) | Every 4 years | Provides tax breaks for historic properties and offers a partial exemption for certain improvements. |

| Memphis | 1.10% (based on assessed value) | Annual | Has a progressive tax rate structure, with higher rates for higher-valued properties. |

| Chattanooga | 1.35% (based on assessed value) | Every 3 years | Offers a “greenbelt” program, providing tax benefits for landowners who maintain open spaces. |

| Atlanta | 1.75% (based on fair market value) | Annual | Has a homestead exemption, which reduces the taxable value for primary residences. |

This comparative analysis highlights the variations in tax rates, assessment frequencies, and unique tax features across different cities. It demonstrates how Knoxville's tax system, with its emphasis on annual assessments and a range of tax relief programs, fits into the broader context of municipal tax landscapes.

Future Implications and Trends in Knoxville Property Taxes

As Knoxville continues to evolve and grow, the property tax landscape is also subject to change. Here are some key future implications and trends to consider:

- Population Growth: Knoxville’s population is projected to increase, which may lead to a higher demand for services and infrastructure. This could potentially impact tax rates as the city works to meet the needs of a growing community.

- Economic Development: Knoxville’s focus on economic growth and development may influence tax policies. Incentives for business investment and job creation could shape tax structures, potentially offering benefits to certain sectors or industries.

- Infrastructure Projects: Major infrastructure projects, such as road improvements or public transportation initiatives, may require additional funding. Property taxes could play a role in financing these projects, impacting tax rates in the future.

- Tax Reform: Ongoing discussions about tax reform at the state and local levels could impact Knoxville’s property tax system. Changes in tax structures, exemptions, or assessment processes may occur, affecting how property taxes are calculated and collected.

- Community Engagement: Knoxville’s commitment to community engagement and transparency may influence tax policies. Resident feedback and involvement in decision-making processes could shape tax initiatives, ensuring they align with the needs and priorities of the community.

Staying informed about these future implications and trends will help you navigate potential changes in the Knoxville property tax landscape. Being proactive and engaged in community discussions can ensure your voice is heard and your interests are considered as the city's tax policies evolve.

How often are property assessments conducted in Knoxville?

+Property assessments in Knoxville are conducted annually. This ensures that property values are up-to-date and reflect any changes or improvements made to the property.

What are the deadlines for paying property taxes in Knoxville?

+Property taxes in Knoxville are due twice a year, typically in January and July. Late payments may incur penalties and interest, so it’s important to stay on top of the payment schedule.

Can I appeal my property assessment if I believe it’s inaccurate?

+Absolutely! Knoxville provides a fair and transparent appeal process. If you disagree with your property assessment, you can file an appeal within a specified timeframe. The appeal process allows you to present evidence and arguments to support your case.

Are there any tax relief programs available for Knoxville homeowners?

+Yes, Knoxville offers several tax relief programs to support eligible homeowners. These programs include homestead exemptions, which reduce the taxable value of your primary residence, and veteran discounts, providing tax savings for qualifying veterans.

How can I stay updated on changes in Knoxville’s property tax system?

+To stay informed, attend local government meetings, follow official announcements, and engage with community resources. Additionally, subscribe to newsletters or alerts from the city’s tax office to receive updates directly.