Sales Tax In Mississippi

In the United States, sales tax is a crucial component of the state's revenue generation and is an essential aspect of doing business. Mississippi, known for its vibrant economy and diverse industries, has a unique sales tax system that businesses and consumers alike should understand. This article aims to provide an in-depth analysis of sales tax in Mississippi, covering its history, rates, exemptions, and implications for businesses and consumers.

The History and Evolution of Sales Tax in Mississippi

Sales tax in Mississippi has a rich history that dates back to the early 20th century. The state first introduced a sales tax in 1932, during the Great Depression, as a means to generate revenue and support the state’s financial needs. Initially, the tax rate was set at a modest 2%, making it one of the lowest in the nation.

Over the years, Mississippi has witnessed significant economic growth and development, leading to a gradual increase in its sales tax rates. As the state's needs evolved, so did its tax policies. Today, Mississippi's sales tax structure is a complex interplay of state, county, and municipal taxes, each with its own rates and regulations.

One notable aspect of Mississippi's sales tax history is its frequent adjustments to accommodate economic changes and support specific industries. For instance, in the early 2000s, the state introduced a sales tax holiday, providing a tax-free period for back-to-school shopping. This initiative aimed to boost consumer spending and support local businesses during a critical retail period.

Understanding Mississippi’s Sales Tax Rates

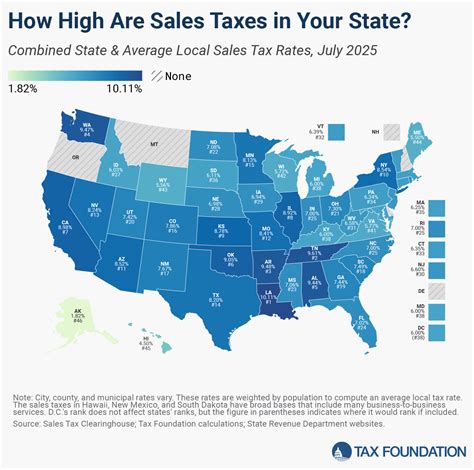

Mississippi’s sales tax is a combination of state, county, and municipal taxes, resulting in varying rates across the state. The state sales tax rate stands at 7%, which is relatively competitive compared to other states in the region.

However, it's the local sales taxes that add complexity to Mississippi's sales tax landscape. Each of Mississippi's 82 counties has the authority to levy its own sales tax, with rates ranging from 1% to 3%. These local taxes are often used to fund specific projects or initiatives within the county, such as infrastructure development or education programs.

| County | Local Sales Tax Rate |

|---|---|

| Adams County | 2% |

| Lafayette County | 3% |

| Jackson County | 1.5% |

| Hinds County | 2.5% |

Additionally, certain municipalities within these counties may also impose their own sales taxes, resulting in even higher rates in specific areas. For instance, the city of Jackson, the state capital, has a local sales tax rate of 2%, bringing the total sales tax rate within the city to 9%, one of the highest in the state.

Exemptions and Special Considerations

Like many other states, Mississippi offers a range of sales tax exemptions to encourage certain behaviors or support specific industries. These exemptions can significantly impact the total sales tax liability for businesses and consumers.

Food and Grocery Exemptions

One notable exemption in Mississippi is the groceries exemption. Unlike some states that tax groceries, Mississippi exempts most food items from sales tax. This exemption is a significant benefit for consumers, especially those with lower incomes, as it reduces the overall cost of living.

However, it's important to note that not all food items are exempt. Prepared foods, such as those purchased from a restaurant or a hot food counter, are subject to sales tax. This distinction is crucial for businesses in the food industry to understand, as it can impact their pricing strategies and consumer expectations.

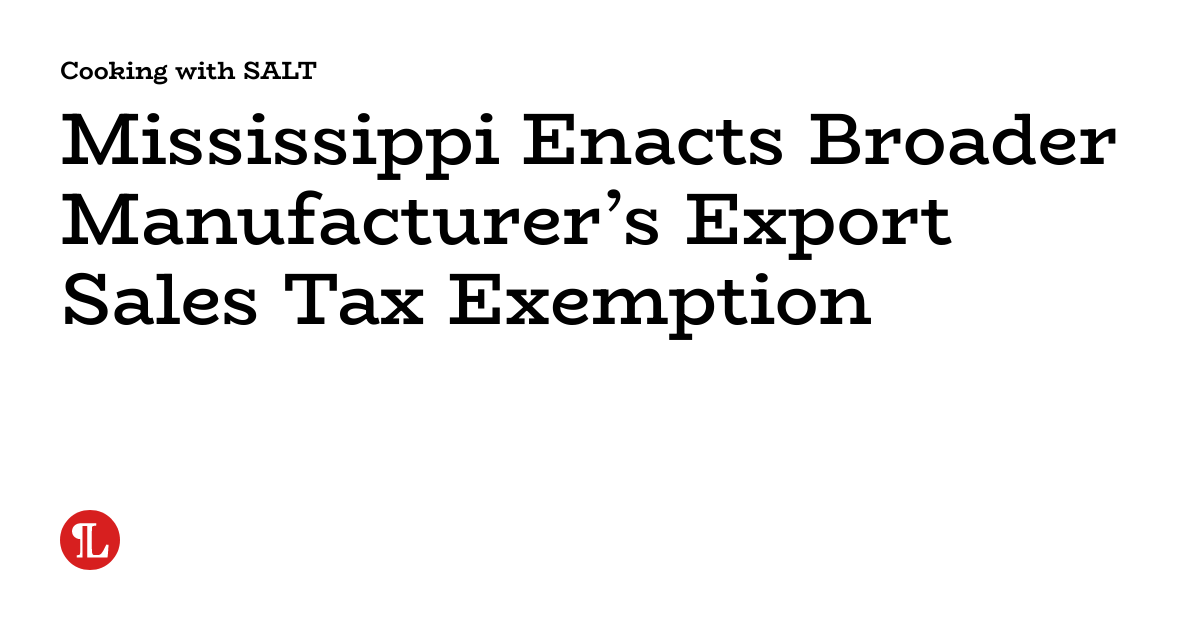

Manufacturing and Industrial Exemptions

Mississippi also offers a range of exemptions to support its manufacturing and industrial sectors. These exemptions are designed to encourage investment and job creation in these industries, which are vital to the state’s economy.

For instance, manufacturing machinery and equipment are exempt from sales tax, providing a significant cost advantage for manufacturers operating in Mississippi. Similarly, certain raw materials used in the manufacturing process are exempt, reducing the overall cost of production for these businesses.

Other Exemptions

Mississippi also exempts various other items from sales tax, including:

- Prescription medications

- Agricultural equipment and supplies

- Residential utilities (such as electricity, gas, and water)

- Certain services, including legal and medical services

Compliance and Collection: The Role of Businesses

For businesses operating in Mississippi, understanding and complying with the state’s sales tax regulations is crucial. Failure to do so can result in penalties, interest, and damage to the business’s reputation.

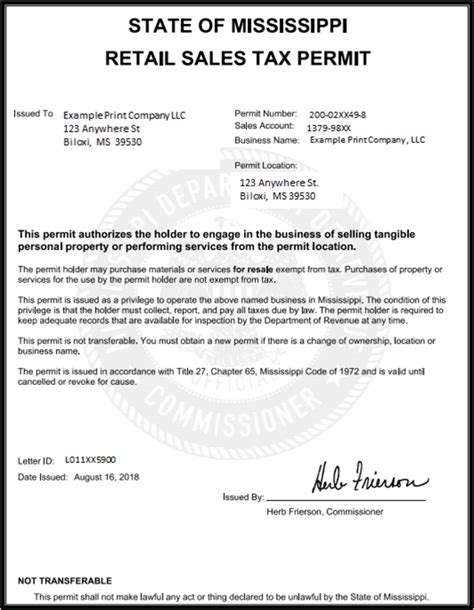

Businesses are responsible for collecting and remitting sales tax to the appropriate tax authorities. This process involves registering with the Mississippi Department of Revenue, obtaining a sales tax permit, and accurately calculating and collecting sales tax on taxable transactions.

To ensure compliance, businesses should consider using sales tax automation tools. These tools can help businesses calculate and collect sales tax accurately, based on the specific rates applicable to each transaction. This not only reduces the risk of errors but also streamlines the tax collection process, freeing up resources for other critical business functions.

Impact on Businesses and Consumers

Mississippi’s sales tax structure has a significant impact on both businesses and consumers within the state.

Businesses

For businesses, particularly those with operations across multiple counties, understanding and managing varying sales tax rates is a complex task. However, a comprehensive understanding of these rates can also provide strategic advantages. For instance, businesses may consider locating their operations in counties with lower sales tax rates to reduce their overall tax burden.

Additionally, businesses should be aware of the exemptions available to them. By understanding which items are exempt from sales tax, businesses can optimize their pricing strategies and potentially pass on savings to consumers, thereby enhancing their competitive advantage in the market.

Consumers

Consumers in Mississippi benefit from the state’s sales tax structure in several ways. The groceries exemption, for instance, reduces the cost of living, particularly for lower-income households. Similarly, the varying local sales tax rates can provide opportunities for consumers to make informed choices about where to shop, potentially saving money by shopping in areas with lower tax rates.

However, it's important for consumers to be aware of the total sales tax rate applicable to their purchases, especially when making significant purchases. Understanding the tax implications can help consumers budget effectively and make informed buying decisions.

Conclusion: A Complex but Manageable Tax System

Mississippi’s sales tax system is a complex interplay of state, county, and municipal taxes, each with its own rates and regulations. While this complexity may pose challenges for businesses and consumers, it also offers opportunities for strategic decision-making and cost savings.

By understanding Mississippi's sales tax structure, businesses can ensure compliance, optimize their tax liabilities, and make informed decisions about their operations within the state. Consumers, too, can leverage this knowledge to make savvy purchasing decisions and take advantage of the state's exemptions and varying tax rates.

As Mississippi's economy continues to evolve, its sales tax system will likely undergo further adjustments to meet the state's changing needs. Staying informed about these changes will be crucial for both businesses and consumers to navigate the state's tax landscape effectively.

What is the overall sales tax rate in Mississippi, including state and local taxes?

+

The overall sales tax rate in Mississippi can vary depending on the location. The state sales tax rate is 7%, and local taxes can add up to 3%, resulting in a maximum combined rate of 10%. However, it’s essential to check the specific rates for the county and municipality where the purchase is made.

Are there any special sales tax holidays in Mississippi?

+

Yes, Mississippi has traditionally held sales tax holidays, typically around back-to-school and hurricane preparedness periods. These holidays allow consumers to purchase certain items, such as school supplies and emergency preparedness items, without paying sales tax. The specific dates and eligible items vary each year.

How often are sales tax rates updated in Mississippi?

+

Sales tax rates in Mississippi are not updated frequently. However, changes can occur when new legislation is passed or if local governments decide to adjust their tax rates. It’s recommended to check for updates annually, especially if you have a business with significant sales tax liabilities.