Car Sales Tax Calculator

Welcome to our comprehensive guide on the world of car sales tax calculation. This article will delve into the intricacies of this often-complex topic, providing you with an in-depth understanding of how car sales tax works, why it's important, and how to calculate it accurately. Whether you're a car enthusiast, a business owner, or simply someone looking to buy a new vehicle, this guide will equip you with the knowledge to navigate the world of car sales tax with confidence.

Understanding Car Sales Tax

Car sales tax is a crucial component of the automotive industry, impacting both buyers and sellers. It is a mandatory tax levied by government authorities on the purchase of vehicles, and it plays a significant role in generating revenue for various public services and infrastructure development. Understanding car sales tax is essential to ensure compliance with legal requirements and to make informed financial decisions when buying or selling a vehicle.

The calculation of car sales tax involves several factors, including the purchase price of the vehicle, the jurisdiction's tax rate, and any applicable exemptions or deductions. These factors can vary greatly depending on the location and the specific circumstances of the transaction. In this article, we will explore these variables in detail and provide you with the tools to calculate car sales tax accurately for your specific situation.

Key Factors Influencing Car Sales Tax

1. Geographic Location

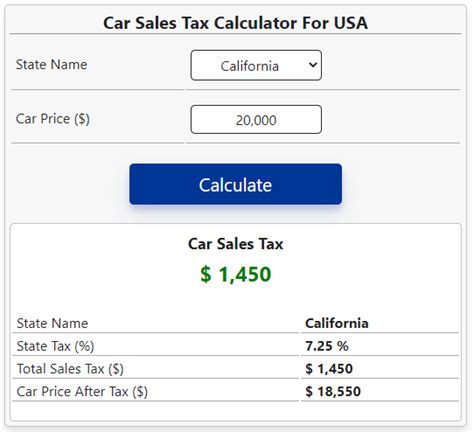

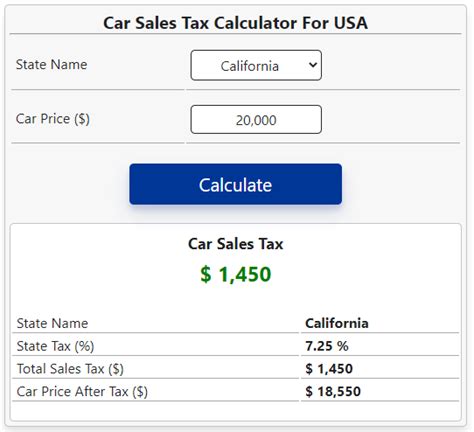

The geographic location of the vehicle purchase is a critical factor in determining the applicable sales tax. Each state, county, or city may have its own unique tax rates and regulations. For instance, California has a state sales tax rate of 7.25%, but this can be higher or lower depending on the specific county. New York, on the other hand, has a state sales tax rate of 4%, but like California, local taxes can significantly increase the overall tax burden.

| State | Sales Tax Rate |

|---|---|

| California | 7.25% |

| New York | 4% |

| Texas | 6.25% |

| Florida | 6% |

2. Vehicle Purchase Price

The purchase price of the vehicle is another key factor in car sales tax calculation. This price typically includes the base price of the car, any additional features or upgrades, and dealer preparation costs. It is important to note that sales tax is often calculated based on the total purchase price, including any applicable fees and taxes. For example, if a car’s base price is 30,000 and it has a 2,000 destination fee, the sales tax calculation will be based on the total of $32,000.

3. Taxable Value of the Vehicle

In some jurisdictions, the taxable value of the vehicle may be adjusted based on certain factors. For instance, some states offer tax deductions or exemptions for specific types of vehicles, such as electric or hybrid cars. These incentives are designed to promote environmentally friendly transportation options and can significantly reduce the overall sales tax liability. It’s crucial to understand these adjustments to ensure accurate tax calculations.

4. Special Considerations: Trade-Ins and Rebates

When trading in an old vehicle or receiving a rebate on a new purchase, these factors can impact the sales tax calculation. In some cases, the trade-in value can be subtracted from the purchase price of the new vehicle, thereby reducing the taxable amount. Similarly, rebates or discounts can also affect the final taxable value. It’s essential to understand how these transactions are treated in your specific jurisdiction to ensure accurate tax assessments.

Calculating Car Sales Tax: A Step-by-Step Guide

Step 1: Determine the Applicable Tax Rate

Start by identifying the tax rate applicable to your location. This rate can be found on official government websites or through local tax authorities. Ensure you’re referring to the most recent and accurate information to avoid miscalculations.

Step 2: Calculate the Taxable Value

Determine the taxable value of the vehicle by considering the purchase price, any applicable fees, and potential deductions or exemptions. This value will serve as the base for your sales tax calculation.

Step 3: Apply the Tax Rate

Multiply the taxable value by the applicable tax rate. This will give you the sales tax amount you owe. For example, if the taxable value is 35,000 and the tax rate is 6%, the sales tax would be calculated as follows: 35,000 x 0.06 = $2,100.

Step 4: Consider Additional Fees and Taxes

In some cases, there may be additional fees or taxes, such as registration fees or luxury taxes, that are not included in the sales tax calculation. Be sure to add these to your final total to get a complete picture of your financial obligation.

Real-World Example: Calculating Sales Tax for a New Car Purchase

Let’s walk through an example to better understand the process. Imagine you’re purchasing a new car in Washington State, which has a sales tax rate of 6.5%. The car’s base price is 40,000, and it has a 1,500 destination fee. You also qualify for a $500 tax deduction due to the car’s fuel-efficient engine.

First, calculate the taxable value: $40,000 (base price) + $1,500 (destination fee) - $500 (tax deduction) = $41,000.

Next, apply the tax rate: $41,000 x 0.065 (6.5%) = $2,665.

So, your sales tax liability for this purchase would be $2,665.

Common Misconceptions and Pitfalls to Avoid

While calculating car sales tax may seem straightforward, there are several common misconceptions and pitfalls that can lead to errors. Here are some key points to keep in mind:

-

Tax Rates: Always refer to official sources for tax rates. Rates can change, and relying on outdated information can result in inaccurate calculations.

-

Deductions and Exemptions: Be aware of any potential deductions or exemptions you may qualify for. Failing to consider these can lead to overpaying sales tax.

-

Fees and Additional Taxes: Don't forget to account for other fees and taxes that may not be included in the sales tax calculation.

-

Trade-Ins and Rebates: Understand how these transactions impact your taxable value to ensure accurate calculations.

The Impact of Car Sales Tax on the Automotive Industry

Car sales tax plays a significant role in the automotive industry, influencing consumer behavior, dealer operations, and government revenue generation. For consumers, it can be a substantial financial consideration when purchasing a vehicle. Dealers must also navigate the complexities of sales tax to ensure compliance and maintain competitive pricing. From a governmental perspective, car sales tax is a critical source of revenue, funding public services and infrastructure projects.

Future Trends and Developments

As the automotive industry evolves, so too will the landscape of car sales tax. With the rise of electric vehicles and autonomous driving technologies, new tax policies and incentives may emerge to encourage the adoption of these innovative technologies. Additionally, with the increasing digitization of transactions, sales tax calculation and collection processes may become more streamlined and efficient.

Conclusion: Empowering Informed Decisions

Understanding car sales tax is essential for anyone involved in the automotive industry, whether as a buyer, seller, or industry professional. By providing a comprehensive guide to car sales tax calculation, we aim to empower you with the knowledge to make informed decisions, ensure compliance with tax regulations, and navigate the financial complexities of vehicle purchases with confidence. Remember, accurate sales tax calculations are not only a legal requirement but also a critical component of financial planning and business operations in the automotive sector.

Can I negotiate the sales tax on my vehicle purchase?

+Sales tax is a mandatory levy set by government authorities and cannot be negotiated. However, you can negotiate the purchase price of the vehicle, which will directly impact the sales tax amount.

Are there any ways to reduce my sales tax liability when buying a car?

+Yes, certain states offer tax deductions or exemptions for specific types of vehicles, such as electric or hybrid cars. Additionally, trading in an old vehicle or receiving rebates can also reduce your taxable value.

How often do sales tax rates change, and where can I find the most up-to-date information?

+Sales tax rates can change periodically, typically at the beginning of a new fiscal year. To find the most current rates, refer to official government websites or contact your local tax authority.