Virginia Tax Payments

Managing taxes efficiently is a crucial aspect of financial well-being, and understanding the ins and outs of tax payments is essential for individuals and businesses alike. This comprehensive guide will delve into the world of Virginia tax payments, exploring the various types, due dates, and payment methods, all while offering expert insights and practical tips.

Understanding Virginia’s Tax Landscape

The Commonwealth of Virginia has a diverse tax system, catering to the needs of its residents and businesses. From income taxes to sales and use taxes, understanding the nuances of each type is vital for accurate and timely payments.

Income Taxes: A Pillar of Virginia’s Tax System

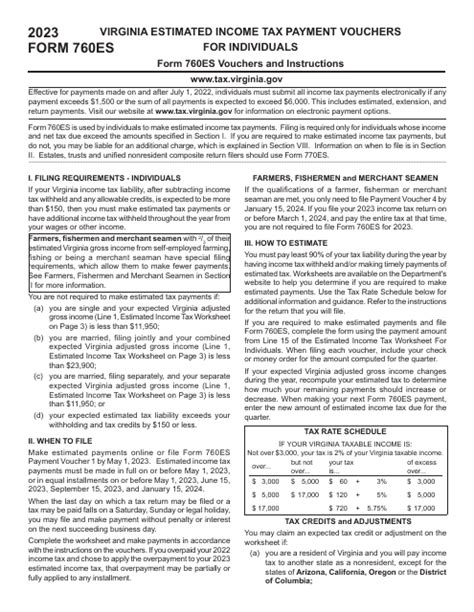

Virginia operates on a progressive income tax system, meaning the tax rate increases as income rises. The state’s income tax rates are categorized into brackets, with taxpayers paying a specific rate based on their taxable income. For the tax year 2023, these brackets are as follows:

| Taxable Income Bracket | Tax Rate |

|---|---|

| $0 - $3,000 | 2.0% |

| $3,001 - $5,000 | 3.0% |

| $5,001 - $17,000 | 5.0% |

| $17,001 - $22,500 | 5.75% |

| $22,501 and above | 5.75% |

These rates are applicable to both individuals and corporations, with the latter having the option to deduct certain expenses before calculating their taxable income.

Virginia also offers a Standard Deduction, which reduces the taxable income for individuals who do not itemize their deductions. For the tax year 2023, the standard deduction is $4,000 for single filers and $8,000 for joint filers.

Sales and Use Taxes: Impacting Daily Transactions

Sales and use taxes are a significant source of revenue for Virginia, and they play a crucial role in the state’s economy. The sales tax is a percentage added to the price of goods and services sold to consumers, while the use tax is applicable to items purchased from out-of-state vendors and brought into Virginia for use.

The current sales and use tax rate in Virginia is 4.3%, with an additional 1% local tax in most jurisdictions. This means that most purchases within the state are subject to a total tax rate of 5.3%. However, certain items like groceries, prescription drugs, and non-prepared food are exempt from sales tax, offering relief to consumers.

Additionally, Virginia offers Sales Tax Holidays during specific periods, usually around back-to-school season and energy-efficient appliance purchases. During these holidays, certain items are exempt from sales tax, providing a temporary boost to consumers' purchasing power.

Property Taxes: A Local Focus

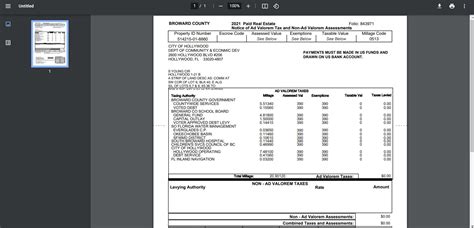

Property taxes in Virginia are assessed and collected at the local level, with rates varying across cities, counties, and towns. These taxes fund essential services like schools, emergency services, and infrastructure maintenance.

The average effective property tax rate in Virginia is 0.86%, based on the median home value of $263,500. This means that, on average, a homeowner in Virginia pays around $2,262 in property taxes annually. However, it's important to note that these rates can vary significantly, with some areas having rates as low as 0.5% and others as high as 1.5%.

Property tax bills are typically mailed to homeowners in late summer or early fall, with the due date set by the local government. Late payments often incur penalties and interest, so staying informed about local tax deadlines is crucial.

Navigating Virginia’s Tax Payment Processes

Understanding the types of taxes is just the first step; knowing how and when to pay them is equally important. Virginia offers various payment methods and due dates to cater to different taxpayer needs.

Electronic Payment Options: Convenience and Security

Virginia provides multiple electronic payment options, offering convenience and security to taxpayers. These options include:

- e-Check: Allows taxpayers to pay using their checking or savings account information, with no additional fees.

- Credit/Debit Card: Offers the flexibility to pay using major credit cards, but with a small convenience fee.

- Electronic Funds Transfer (EFT): A direct transfer from a taxpayer's account, ideal for larger payments and businesses.

These electronic methods are secure, fast, and can be accessed 24/7, making them a preferred choice for many taxpayers. Additionally, they often provide instant confirmation of payment, reducing the chances of late fees.

Due Dates and Late Payment Penalties

Understanding the due dates for Virginia taxes is crucial to avoid late payment penalties and interest. Here are some key dates to remember:

- Income Taxes: The due date for filing and paying income taxes is typically April 15th of the year following the tax year. For example, taxes for the 2023 tax year are due on April 15, 2024.

- Sales and Use Taxes: These taxes are generally due monthly or quarterly, depending on the taxpayer's filing frequency. The due date is typically the 20th of the month following the reporting period.

- Property Taxes: Due dates vary by locality, but they are typically in the fall, with a second installment due in the spring. Late payments often incur penalties and interest, so it's essential to stay informed about local deadlines.

Late payment penalties in Virginia can be substantial, often accruing at a rate of 10% of the unpaid tax for each month the tax remains unpaid, up to a maximum of 50%. Interest also accrues on the unpaid tax at a rate of 0.5% per month, or 6% annually.

Payment Plans and Tax Relief Options

Virginia understands that taxpayers may face financial difficulties, and offers several payment plans and tax relief options to help those in need.

- Installment Payment Agreements: Taxpayers can set up installment plans to pay their taxes over time. These plans are available for both income and sales taxes, and interest is charged on the unpaid balance.

- Offer in Compromise: This option allows taxpayers to settle their tax debt for less than the full amount owed. It's typically reserved for those facing financial hardship and is subject to certain conditions.

- Penalty Abatement: In certain circumstances, Virginia may waive or reduce late payment penalties. This is usually considered on a case-by-case basis and is not guaranteed.

It's important to note that these options are subject to eligibility criteria and may require additional documentation. Consulting with a tax professional can help navigate these options effectively.

Expert Insights and Strategies

Now that we’ve covered the basics of Virginia tax payments, let’s delve into some expert insights and strategies to optimize your tax experience.

Maximizing Deductions and Credits

Virginia offers a range of deductions and credits that can significantly reduce your tax liability. Some key deductions and credits to consider include:

- Virginia Resident Income Tax Credit: This credit is available to residents who pay income tax to another state. It helps reduce the Virginia income tax liability for those who work out-of-state but reside in Virginia.

- Child and Dependent Care Credit: If you incur expenses for childcare or dependent care, you may be eligible for this credit. It can help offset the cost of care while you work or attend school.

- Homeowner's Tax Relief: Virginia offers several tax relief programs for homeowners, including the Land Preservation Tax Credit and the Home Rehabilitation Tax Credit. These credits can help offset the cost of certain home improvements and land preservation efforts.

It's crucial to review your eligibility for these deductions and credits annually, as they can change based on your income, family status, and other factors.

Filing Tips and Resources

To ensure a smooth filing process, here are some tips and resources to consider:

- Use Tax Software: Investing in reputable tax software can simplify the filing process and help you identify deductions and credits you may be eligible for. Many software programs offer step-by-step guidance and error-checking to ensure accuracy.

- Consult a Professional: If you have complex tax situations or are unsure about your eligibility for certain deductions, consulting a certified tax professional can provide valuable guidance. They can help maximize your tax savings and ensure compliance.

- Stay Informed: Tax laws and regulations can change annually. Staying updated on these changes can help you adjust your tax strategy accordingly. The Virginia Department of Taxation's website is a great resource for the latest tax information and forms.

Long-Term Tax Planning

Tax planning is not just about the current year; it’s a long-term strategy. Here are some considerations for effective long-term tax planning:

- Review Your Withholdings: Regularly review your W-4 form to ensure your withholdings align with your tax situation. Adjusting your withholdings can help you avoid a large tax bill at the end of the year or receive a larger refund if desired.

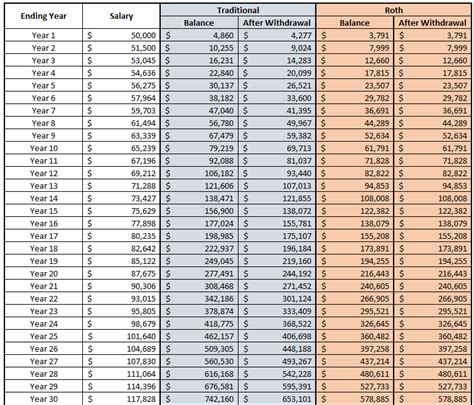

- Maximize Retirement Contributions: Contributing to tax-advantaged retirement accounts like 401(k)s and IRAs can reduce your taxable income and provide long-term growth potential. Consider maximizing your contributions to take full advantage of these benefits.

- Explore Investment Strategies: Certain investments, like municipal bonds, can provide tax-free income. Exploring these options can help reduce your taxable income and potentially save on taxes.

By implementing these strategies and staying informed about tax changes, you can optimize your tax payments and potentially reduce your overall tax burden.

Frequently Asked Questions

How can I estimate my Virginia income tax liability before filing?

+The Virginia Department of Taxation provides an Income Tax Calculator on their website. This tool allows you to estimate your tax liability based on your income, deductions, and credits. It’s a useful way to get a rough estimate before filing your tax return.

Are there any tax incentives for renewable energy projects in Virginia?

+Yes, Virginia offers several tax incentives for renewable energy projects. These include the Virginia Residential Renewable Energy Tax Credit and the Business Renewable Energy Tax Credit. These credits can help offset the cost of installing renewable energy systems like solar panels and wind turbines.

Can I file my Virginia taxes electronically without using a tax software program?

+Yes, you can file your Virginia taxes electronically without using tax software. The Virginia Department of Taxation offers an online filing system that guides you through the process step by step. This option is free and secure, and it eliminates the need for paper filing.

What happens if I miss the deadline to pay my Virginia taxes?

+If you miss the deadline to pay your Virginia taxes, you may be subject to late payment penalties and interest. The penalty for late payment is typically 10% of the unpaid tax for each month the tax remains unpaid, up to a maximum of 50%. Interest also accrues at a rate of 0.5% per month, or 6% annually.

Are there any tax breaks for military personnel stationed in Virginia?

+Yes, Virginia offers several tax breaks for military personnel. These include the Military Income Tax Deduction, which allows active-duty military personnel to deduct certain military allowances from their Virginia taxable income. There’s also the Military Spouse Residency Relief Act, which can help military spouses maintain their residency in their home state for tax purposes.

Remember, this guide provides a comprehensive overview of Virginia tax payments, but it’s always recommended to consult with a tax professional for personalized advice and to stay updated with the latest tax regulations.