Montgomery County Md Property Tax

Montgomery County, located in the heart of Maryland, is renowned for its vibrant communities, diverse population, and thriving economy. However, alongside its many attractions, the county is also known for its relatively high property taxes. Property owners in Montgomery County face a unique tax system that can significantly impact their financial planning and overall cost of living.

This article aims to delve deep into the world of Montgomery County property taxes, providing an expert analysis and comprehensive guide to help residents and prospective homeowners navigate this complex topic. From understanding the tax rates and assessment processes to exploring relief options and strategic planning, we will cover every aspect to ensure you have the knowledge to make informed decisions about your property tax obligations.

Understanding Montgomery County Property Tax Rates

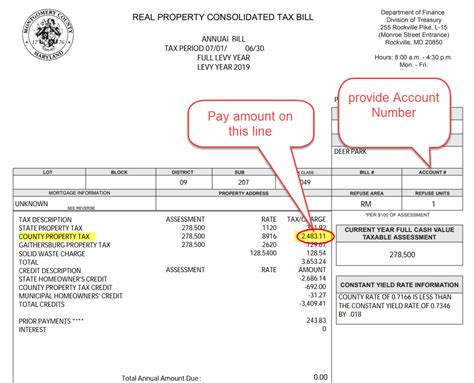

Montgomery County operates a comprehensive property tax system that consists of two primary components: the tax rate and the assessed value of your property.

Tax Rate Structure

The tax rate, also known as the mill rate, is established annually by the Montgomery County Council and is applied uniformly across the county. This rate is typically expressed in mills, where one mill equals one-tenth of a cent. For the 2023 fiscal year, the county's tax rate was set at 101.2 mills, which translates to $1.012 for every $1,000 of assessed value.

This tax rate is further divided into different categories, such as:

- Residential Tax Rate: This applies to homeowners and is often the most significant component of the tax bill.

- Commercial Tax Rate: Businesses and commercial property owners are subject to this rate.

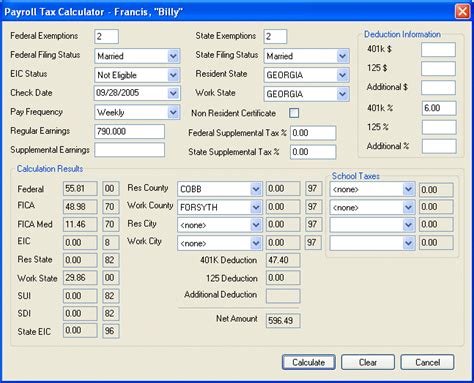

- Personal Property Tax Rate: This rate is applied to tangible personal property, such as vehicles and business equipment.

It's important to note that the tax rates can change annually, influenced by various factors including the county's budget needs, inflation, and property values.

Property Assessment Process

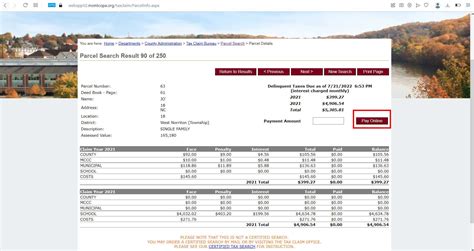

The assessed value of your property is determined by the Montgomery County Department of Finance. This department conducts regular assessments to ensure that property values are accurately reflected in the tax system.

Assessments are typically conducted every five years, with the next reassessment scheduled for 2024. During these reassessments, property values are adjusted to market rates, which can lead to significant changes in your property tax bill.

The Department of Finance employs a variety of methods to determine property values, including sales comparison, cost approach, and income approach. These methods ensure that properties are assessed fairly and consistently across the county.

Tax Bill Calculation

Your property tax bill is calculated by multiplying the assessed value of your property by the applicable tax rate. For instance, if your home has an assessed value of $400,000 and the residential tax rate is 101.2 mills, your annual property tax bill would be approximately $4,048 (rounded to the nearest dollar). This calculation provides a clear understanding of your tax obligations and helps in financial planning.

| Property Value | Tax Rate (Mills) | Estimated Annual Tax |

|---|---|---|

| $300,000 | 101.2 | $3,036 |

| $450,000 | 101.2 | $4,554 |

| $600,000 | 101.2 | $6,072 |

Property Tax Relief Programs

Montgomery County recognizes the financial burden that property taxes can place on its residents and offers a range of relief programs to assist homeowners. These programs aim to provide financial support and ensure that property ownership remains accessible to a diverse range of residents.

Homestead Tax Credit

The Homestead Tax Credit is a valuable program that offers a reduction in the assessed value of a homeowner's primary residence. This credit effectively lowers the property tax bill, providing significant savings for those who qualify.

To be eligible for the Homestead Tax Credit, homeowners must:

- Be a resident of Montgomery County.

- Own and occupy the property as their primary residence.

- Have a total household income below a specified threshold, which varies annually.

Once approved, homeowners receive a credit that reduces their assessed property value by up to $3,500 for the primary residence and $500 for each qualifying dependent. This credit is applied directly to the property tax bill, resulting in substantial savings.

Senior Citizen and Disabled Veteran Property Tax Credit

Montgomery County also offers a property tax credit specifically for senior citizens and disabled veterans. This credit aims to ease the financial burden of property ownership for these groups, ensuring they can continue to live comfortably in their homes.

To qualify for this credit, applicants must:

- Be a resident of Montgomery County.

- Be at least 65 years old (for senior citizen credit) or a disabled veteran.

- Have a total household income below a specified threshold, which varies annually.

- Own and occupy the property as their primary residence.

The credit amount is determined based on the assessed value of the property and can provide significant relief from property taxes. For example, a senior citizen with an assessed property value of $300,000 could receive a credit of up to $600, reducing their tax bill accordingly.

Other Relief Programs

Montgomery County also provides additional relief programs, including:

- Circuit Breaker Program: Offers a credit for homeowners whose property taxes exceed a certain percentage of their income.

- Disabled Person's Property Tax Relief: Provides a credit for disabled individuals who own and occupy their property.

- Agricultural Land Preservation Program: Offers tax incentives for landowners who preserve their land for agricultural use.

Strategic Planning for Property Tax Management

While property taxes in Montgomery County can be significant, there are strategic approaches homeowners can take to manage these expenses effectively.

Timely Payment and Discounts

Montgomery County offers a 2% discount if property taxes are paid in full by the first installment deadline, which typically falls in July. This discount can provide immediate savings and is a great incentive for timely payment.

Payment Plans and Options

For those who prefer to spread out their payments, Montgomery County offers flexible payment plans. Homeowners can choose to pay their property taxes in three installments or opt for a monthly payment plan, which can help manage cash flow and budget effectively.

Appealing Your Property Assessment

If you believe your property has been assessed at a value higher than its market value, you have the right to appeal. The appeals process is managed by the Montgomery County Property Tax Assessment Appeals Board, which provides a fair and impartial review of assessment disputes.

To initiate an appeal, homeowners should gather evidence, such as recent sales of similar properties, to support their claim. The appeals board will consider this evidence and make a determination on whether the assessment should be adjusted.

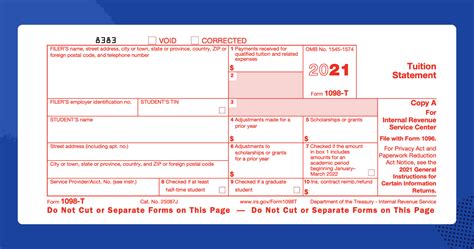

Tax Deductions and Credits

Homeowners can also explore federal and state tax deductions and credits related to property ownership. These can include deductions for mortgage interest, property taxes, and certain improvements made to the property. Consulting a tax professional can help identify these opportunities and maximize your tax savings.

Future Implications and Potential Changes

Montgomery County's property tax system is subject to ongoing review and potential changes, influenced by a variety of factors. These changes can impact tax rates, assessment processes, and relief programs, affecting the financial obligations of homeowners.

Budgetary Considerations

The county's annual budget plays a significant role in determining tax rates. As the county navigates economic challenges and adjusts its spending priorities, tax rates may be adjusted to align with budgetary needs. Residents should stay informed about these budgetary considerations to understand potential changes to their tax obligations.

Reassessment Impact

The upcoming 2024 reassessment will likely have a significant impact on property tax bills. As property values adjust to market rates, some homeowners may see an increase in their assessed values, leading to higher tax bills. Conversely, those with declining property values may see a reduction in their tax obligations.

Legislative Changes

Changes in state and local legislation can also impact the property tax system. For instance, amendments to tax laws or the introduction of new relief programs can provide additional support to homeowners. Staying informed about these legislative changes is crucial for understanding potential benefits and obligations.

Economic Factors

The county's economic health and real estate market trends can influence property values and, consequently, tax rates. During economic downturns, property values may decline, leading to lower tax bills. Conversely, a robust economy can drive property values up, resulting in higher tax obligations.

How often are property tax rates updated in Montgomery County?

+Property tax rates are typically updated annually by the Montgomery County Council to align with budgetary needs and other factors. These rates are set for the upcoming fiscal year.

What is the process for appealing a property assessment in Montgomery County?

+Homeowners can appeal their property assessment by gathering evidence, such as recent sales of similar properties, and submitting an appeal to the Montgomery County Property Tax Assessment Appeals Board. The board will review the evidence and make a determination.

Are there any tax incentives for green or energy-efficient improvements to my property?

+Yes, Montgomery County offers a variety of tax incentives for green and energy-efficient improvements. These can include credits for solar panel installations, energy-efficient appliances, and more. Consult the county’s Department of Environmental Protection for specific programs and requirements.

How can I stay informed about changes to property tax laws and relief programs in Montgomery County?

+You can stay informed by regularly checking the Montgomery County website, which provides updates on tax rates, assessment processes, and relief programs. Additionally, local news outlets and community organizations often cover these topics, providing valuable insights and updates.