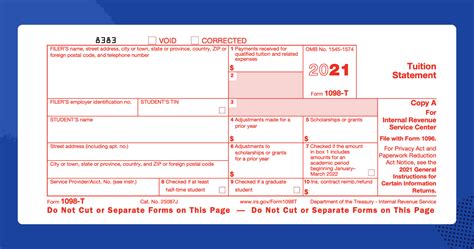

Tuition Tax Form

In the complex landscape of financial planning and education funding, understanding the intricacies of tuition tax forms is crucial. These documents play a pivotal role in navigating the tax implications associated with educational expenses. This comprehensive guide aims to unravel the mysteries of tuition tax forms, offering a detailed exploration of their purpose, requirements, and benefits.

Unraveling the Tuition Tax Form: A Comprehensive Guide

The tuition tax form, an essential component of the education funding process, provides individuals and families with an avenue to claim tax credits, deductions, or refunds related to educational expenses. This guide delves into the specifics of these forms, offering a roadmap for maximizing financial benefits while minimizing tax burdens.

The Purpose and Benefits of Tuition Tax Forms

Tuition tax forms serve as a vital tool for individuals seeking to offset the substantial costs of education. By accurately reporting educational expenses, taxpayers can leverage various tax benefits designed to support education pursuits. These benefits take several forms, including tax credits, deductions, and even potential refunds, which can significantly impact an individual's financial situation.

One of the primary advantages of tuition tax forms is the opportunity to claim tax credits. Tax credits directly reduce the amount of tax an individual owes, making them highly valuable. For instance, the American Opportunity Tax Credit offers a credit of up to $2,500 for qualified higher education expenses for each eligible student in a family. This credit can be claimed for the first four years of post-secondary education, providing significant financial relief.

Additionally, tuition tax forms allow taxpayers to claim deductions for qualified education expenses. These deductions can reduce the amount of income subject to tax, resulting in a lower tax liability. For example, the Tuition and Fees Deduction allows taxpayers to deduct up to $4,000 in qualified education expenses, providing a valuable tax break for many students and their families.

Furthermore, tuition tax forms are instrumental in claiming tax refunds. If an individual or family has overpaid their taxes due to educational expenses, they can use these forms to claim a refund. This can provide much-needed financial relief, especially for those facing the high costs of education.

| Tuition Tax Form Benefits | Description |

|---|---|

| Tax Credits | Directly reduce the amount of tax owed, with credits like the American Opportunity Tax Credit offering up to $2,500 per eligible student. |

| Deductions | Lower the taxable income, such as with the Tuition and Fees Deduction, allowing for a reduction of up to $4,000 in qualified expenses. |

| Tax Refunds | Claim overpaid taxes due to educational expenses, providing financial relief and a potential boost to personal finances. |

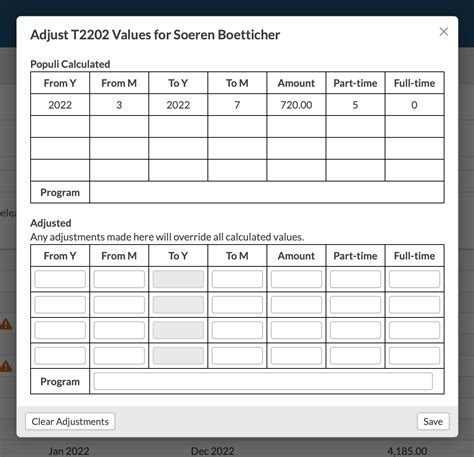

Key Components of Tuition Tax Forms

Tuition tax forms encompass a range of essential elements that taxpayers must understand to navigate the process effectively. These forms typically require detailed information about the taxpayer, the educational institution, and the specific expenses incurred.

When filling out tuition tax forms, individuals should be prepared to provide personal details such as their name, address, Social Security number, and filing status. Additionally, they will need to furnish information about the educational institution, including its name, location, and federal tax identification number. This ensures that the tax authority can verify the legitimacy of the claimed expenses.

One of the critical aspects of tuition tax forms is the accurate reporting of educational expenses. These expenses can include tuition and fees, books and supplies, equipment, and even certain room and board costs. Taxpayers should retain receipts and documentation to support these expenses, as they may be subject to audit by the tax authority.

Furthermore, tuition tax forms often require individuals to specify the student's relationship to the taxpayer. This information is crucial for determining eligibility for certain tax benefits, as some credits and deductions are limited to expenses for a taxpayer's dependent students.

| Key Components of Tuition Tax Forms | Description |

|---|---|

| Personal Information | Name, address, Social Security number, and filing status of the taxpayer. |

| Educational Institution Details | Name, location, and federal tax ID of the educational institution. |

| Educational Expenses | Tuition, fees, books, supplies, equipment, and qualifying room and board costs. |

| Student Relationship | Relationship of the student to the taxpayer, such as dependent or independent. |

Maximizing Benefits: Strategies and Considerations

To make the most of tuition tax forms and the associated benefits, taxpayers should consider several strategic approaches and best practices. These strategies can help ensure that individuals maximize their financial gains while minimizing the risk of errors or discrepancies.

First and foremost, it is crucial to maintain meticulous records of all educational expenses. This includes retaining receipts, invoices, and any other documentation that supports the claimed expenses. By keeping these records organized, taxpayers can easily verify their expenses if questioned by the tax authority.

Additionally, taxpayers should be aware of the eligibility criteria for various tax credits and deductions. For example, the Lifetime Learning Credit is available to individuals pursuing courses to acquire or improve job skills, while the American Opportunity Tax Credit is specifically for undergraduate students. Understanding these criteria can help taxpayers choose the most advantageous credits and deductions for their situation.

Taxpayers should also consider the timing of their educational expenses. Some tax credits and deductions have income limits, and taxpayers may benefit from adjusting their income levels to maximize their eligibility. For instance, taxpayers may choose to time their educational expenses to fall within a year when their income is lower, increasing the potential tax savings.

Furthermore, taxpayers should explore the option of claiming education expenses on their taxes even if they do not itemize deductions. The Tuition and Fees Deduction, for instance, is available to taxpayers who take the standard deduction, providing a valuable opportunity to reduce their taxable income.

Future Implications and Trends

The landscape of tuition tax forms and education funding is dynamic, with ongoing policy changes and evolving trends. Staying abreast of these developments is crucial for taxpayers to ensure they continue to access the most advantageous tax benefits.

One notable trend is the increasing focus on simplifying the process of claiming education tax benefits. Tax authorities are working to streamline the forms and guidelines to make them more user-friendly and accessible. This shift is aimed at reducing the complexity often associated with these forms, making it easier for taxpayers to navigate the process and maximize their financial gains.

Additionally, there is a growing emphasis on making education funding more inclusive and accessible. Policy makers are exploring ways to expand the availability of tax credits and deductions to a broader range of taxpayers, particularly those from lower-income backgrounds. This shift aims to ensure that financial barriers do not prevent individuals from pursuing education and acquiring valuable skills.

Furthermore, with the increasing cost of education, there is a rising demand for more substantial tax benefits. Tax authorities and policy makers are likely to respond to this demand by exploring new initiatives and expanding existing programs to provide greater financial support for educational pursuits.

In conclusion, tuition tax forms play a pivotal role in the financial planning of education, offering a range of benefits that can significantly impact an individual's financial situation. By understanding the purpose, requirements, and strategies associated with these forms, taxpayers can maximize their financial gains and minimize tax burdens. As the landscape of education funding continues to evolve, staying informed about the latest trends and developments will be crucial for taxpayers to make the most of these opportunities.

Can I claim tax benefits for education expenses if I don’t have a student in my family?

+While specific eligibility criteria vary depending on the tax credit or deduction, many benefits are available to individuals pursuing their own education or the education of a spouse or dependent. For instance, the Lifetime Learning Credit is not limited to students and can be claimed by individuals pursuing job-related courses.

What happens if I make a mistake on my tuition tax form?

+Mistakes on tax forms can have varying consequences, depending on the nature of the error. Minor errors, such as a simple typo, may be easily corrected without significant implications. However, more substantial mistakes, such as misreporting income or expenses, can lead to audits and potential penalties. It’s crucial to review forms carefully before submission to minimize errors.

Are there any income limits for claiming education tax credits or deductions?

+Yes, many education tax credits and deductions have income limits. For instance, the American Opportunity Tax Credit is phased out for taxpayers with modified adjusted gross income above certain thresholds. It’s important to check the specific criteria for each credit or deduction to ensure eligibility.