Oasdi Tax Limit

The Oasdi tax, often known as the Social Security tax, is an essential component of the U.S. tax system. It plays a crucial role in funding Social Security benefits, which provide financial support to retired workers, their families, and eligible survivors. This tax is one of the key revenue streams for the Social Security Administration (SSA) and is an important consideration for taxpayers, especially when it comes to understanding the Oasdi tax limit and its implications.

Understanding the Oasdi Tax

The Oasdi acronym stands for Old-Age, Survivors, and Disability Insurance, which are the three primary programs funded by this tax. The Oasdi tax is a payroll tax, meaning it is deducted from employees’ wages and salaries, and it is also paid by employers. It is a vital source of funding for the Social Security system, which provides a safety net for millions of Americans.

The Oasdi tax rate for the year 2023 is 6.2% for employees and an additional 6.2% for employers, totaling 12.4%. Self-employed individuals are responsible for the entire 12.4% tax on their net earnings.

Oasdi Tax Limit: Wage Base and Implications

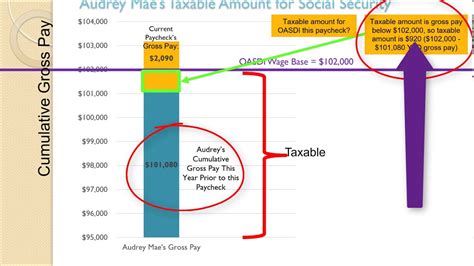

One of the critical aspects of the Oasdi tax is the wage base limit, which sets a cap on the amount of earnings subject to this tax. In simpler terms, it is the maximum amount of income that is taxed for Social Security purposes.

The 2023 Oasdi Tax Limit

For the tax year 2023, the Oasdi tax limit or wage base is set at $160,200. This means that earnings above this threshold are not subject to the Oasdi tax. This limit is adjusted annually to keep pace with economic growth and changes in average wages.

| Year | Oasdi Tax Limit |

|---|---|

| 2023 | $160,200 |

| 2022 | $147,000 |

| 2021 | $142,800 |

The wage base limit has a significant impact on both taxpayers and the Social Security program. For taxpayers, it means that a portion of their earnings is not taxed for Social Security, providing some relief on high-income earners. However, it also affects the overall funding of the Social Security Trust Fund, which relies on these tax contributions to support its beneficiaries.

Impact on High-Income Earners

High-income earners often face unique challenges when it comes to the Oasdi tax limit. While they contribute significantly to the Social Security system, the wage base limit means that a portion of their income is not taxed for Social Security purposes. This can result in a situation where high-income earners pay a lower effective tax rate for Social Security compared to those with lower incomes.

However, it's important to note that the Oasdi tax is just one component of the overall tax system. High-income earners may still face higher tax obligations due to other tax brackets and additional tax considerations.

Social Security Trust Fund and the Oasdi Tax Limit

The Oasdi tax limit also has implications for the Social Security Trust Fund, which is the primary source of funding for Social Security benefits. As the wage base limit increases each year, it can impact the Trust Fund’s ability to keep up with rising benefit costs. This is a critical consideration, especially as the Baby Boomer generation retires and places increased demand on the Social Security system.

Oasdi Tax Limit and Medicare Tax

It’s worth noting that the Oasdi tax is distinct from the Medicare tax, another payroll tax that funds the Medicare program. Unlike the Oasdi tax, the Medicare tax does not have a wage base limit. This means that all earnings, regardless of amount, are subject to the Medicare tax.

Medicare Tax Rates

For the year 2023, the Medicare tax rate is 1.45% for both employees and employers, totaling 2.9%. Additionally, there is an Additional Medicare Tax for high-income earners, which is 0.9% on earnings above a certain threshold.

Tax Planning and the Oasdi Tax Limit

Understanding the Oasdi tax limit can be crucial for effective tax planning, especially for high-income earners. It’s important to consider strategies that optimize tax obligations while also ensuring compliance with the law.

Maximizing Pre-Tax Contributions

One strategy for high-income earners is to maximize pre-tax contributions to retirement plans, such as 401(k)s and traditional IRAs. These contributions reduce taxable income, which can help lower the impact of the Oasdi tax and other income taxes.

Exploring Alternative Investments

Another approach is to consider alternative investments that may provide tax advantages. For example, investing in real estate through a self-directed IRA can offer tax benefits while also diversifying one’s portfolio.

Consulting Tax Professionals

Given the complexity of tax laws and the potential impact of the Oasdi tax limit, it’s highly recommended to consult with tax professionals or financial advisors. They can provide personalized advice and ensure that your tax planning strategies are effective and compliant with the latest regulations.

Future Considerations and Reforms

The Oasdi tax limit is a dynamic aspect of the U.S. tax system, subject to annual adjustments and potential reforms. As the Social Security program faces long-term financial challenges, there are ongoing discussions about potential changes to the Oasdi tax structure.

Proposed Reforms

Some proposed reforms include raising the wage base limit, implementing a progressive Social Security tax rate, or even eliminating the limit altogether. These changes aim to address the funding challenges faced by the Social Security Trust Fund while ensuring the program remains sustainable for future generations.

The Importance of Public Discourse

The future of the Oasdi tax limit and the Social Security program is a topic of significant public interest and debate. It is crucial for taxpayers to stay informed about potential changes and engage in the public discourse surrounding these issues. By understanding the implications of the Oasdi tax limit and advocating for informed policies, taxpayers can help shape the future of Social Security and ensure its long-term viability.

How often is the Oasdi tax limit adjusted, and by whom?

+The Oasdi tax limit is adjusted annually by the Social Security Administration (SSA) based on the national average wage index. This adjustment ensures that the tax limit keeps pace with economic growth and changes in average wages.

What happens if the Oasdi tax limit is not adjusted for a year?

+If the Oasdi tax limit remains unchanged for a year, it means that the same income threshold from the previous year will apply. This can impact the funding of the Social Security Trust Fund, as a static limit may not keep up with rising benefit costs.

Are there any proposed changes to the Oasdi tax structure for the future?

+There are ongoing discussions and proposed reforms to address the long-term financial challenges of the Social Security program. Some proposed changes include raising the wage base limit, implementing a progressive tax rate, or even removing the limit altogether. These reforms aim to ensure the program’s sustainability while maintaining its critical role in providing financial support to retirees and their families.