Property Taxes Philadelphia

Property taxes are an essential component of municipal revenue for cities like Philadelphia, contributing significantly to the funding of local services and infrastructure. Understanding the property tax system in Philadelphia is crucial for both residents and investors, as it directly impacts their financial obligations and the city's economic landscape. This article aims to provide an in-depth analysis of property taxes in Philadelphia, exploring its assessment process, rates, exemptions, and the overall impact on the city's economy and property market.

The Property Tax System in Philadelphia

Philadelphia’s property tax system is administered by the Philadelphia Office of Property Assessment (OPA), a city agency responsible for assessing the market value of all real estate properties within the city limits. The OPA’s primary role is to ensure fair and accurate assessments, which serve as the basis for calculating property taxes.

Assessment Process

The OPA employs a mass appraisal approach, utilizing a combination of automated valuation models and physical inspections to determine property values. This process involves considering various factors such as the property’s location, size, age, condition, and recent sales data of comparable properties. The assessment is typically conducted every 15 years, with interim adjustments made as necessary.

During the assessment process, property owners have the right to appeal if they believe their property's assessed value is inaccurate. The OPA provides guidelines and procedures for filing appeals, ensuring transparency and fairness in the system.

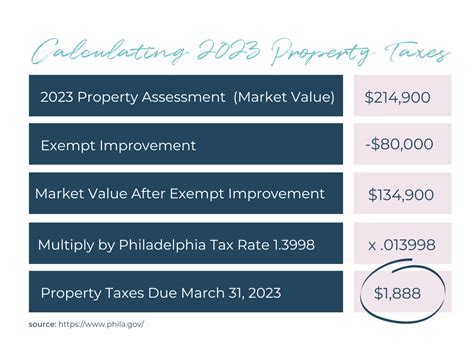

Property Tax Rates

Property taxes in Philadelphia are calculated based on the assessed value of the property and the tax rate, which is set annually by the City Council. The tax rate is expressed as a millage rate, where one mill represents 1 of tax for every 1,000 of assessed value. For the current fiscal year, the tax rate in Philadelphia is 13.419 mills, one of the highest in the state.

| Fiscal Year | Tax Rate (Mills) |

|---|---|

| 2023-2024 | 13.419 |

| 2022-2023 | 13.394 |

| 2021-2022 | 13.174 |

The tax rate can vary slightly between different areas within Philadelphia due to additional local taxes imposed by smaller taxing districts, such as school districts or municipalities.

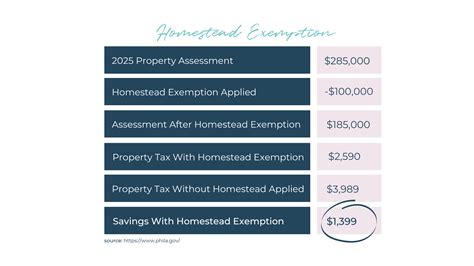

Exemptions and Abatements

Philadelphia offers several property tax exemptions and abatements to encourage specific types of development and support certain segments of the population. These include:

- Homestead Exemption: Provides a partial exemption for owner-occupied residential properties, reducing the assessed value by up to $30,000.

- Senior Citizen Tax Freeze: Freezes the property tax liability for qualifying seniors, protecting them from increases due to rising property values.

- Business Improvement District (BID) Abatements: Offers tax abatements to commercial properties within designated BIDs to encourage business growth and investment.

- Green Building Tax Abatements: Incentivizes the construction of environmentally sustainable buildings by providing tax abatements for up to 10 years.

Impact on Philadelphia’s Economy and Property Market

Property taxes play a pivotal role in shaping Philadelphia’s economy and property market dynamics. Here’s a closer look at their impact:

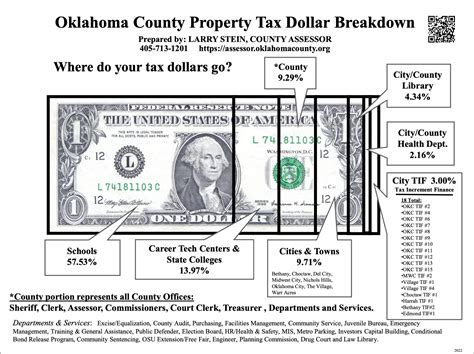

Revenue Generation

Property taxes are a primary source of revenue for the city, funding essential services such as public education, public safety, infrastructure maintenance, and social programs. In the fiscal year 2022-2023, property taxes accounted for approximately 40% of Philadelphia’s total revenue, highlighting their significance in the city’s financial landscape.

Property Market Dynamics

The property tax system influences property values and investment decisions. High property taxes can act as a deterrent for potential investors, particularly in commercial real estate, as they increase the overall cost of ownership. On the other hand, tax exemptions and abatements can stimulate investment and development in targeted areas.

For homeowners, property taxes are a significant expense, and fluctuations in tax rates or assessed values can impact their financial planning and overall cost of living. The city's efforts to provide exemptions and appeals processes aim to mitigate these concerns and ensure fairness.

Community Development and Equity

The property tax system also plays a role in community development and equity. Tax abatements for specific developments can help revitalize underdeveloped areas, while exemptions for seniors and low-income homeowners can prevent displacement and promote long-term residency. However, the complex nature of the system can sometimes lead to disparities and challenges in achieving equitable outcomes.

Future Outlook and Challenges

As Philadelphia continues to evolve, its property tax system will face ongoing challenges and opportunities. Some key considerations for the future include:

- Ensuring the accuracy and fairness of property assessments, particularly with the increasing use of automated valuation models.

- Managing the impact of rising property values on tax liabilities, especially for long-term residents.

- Evaluating the effectiveness of tax exemptions and abatements in achieving desired economic and community development goals.

- Addressing the potential disparities in tax burdens between residential and commercial properties.

- Exploring innovative approaches to property taxation, such as land value taxation or value capture mechanisms, to promote sustainable urban development.

Conclusion

Philadelphia’s property tax system is a complex yet vital component of the city’s financial and economic infrastructure. By understanding the assessment process, tax rates, and exemptions, residents and investors can make more informed decisions regarding property ownership and investment. As the city navigates future challenges and opportunities, a well-informed and engaged citizenry will be crucial in shaping a fair and sustainable property tax system that benefits all Philadelphians.

How often are properties reassessed in Philadelphia?

+Properties in Philadelphia are typically reassessed every 15 years, with interim adjustments made as necessary. The Office of Property Assessment (OPA) conducts these reassessments to ensure fair and accurate property values.

Can I appeal my property’s assessed value?

+Yes, property owners have the right to appeal their assessed value if they believe it is inaccurate. The OPA provides guidelines and procedures for filing appeals, allowing property owners to present their case and seek a fair assessment.

What are the property tax rates in Philadelphia for the current fiscal year?

+For the fiscal year 2023-2024, the property tax rate in Philadelphia is 13.419 mills. This rate can vary slightly in different areas due to additional local taxes.

Are there any property tax exemptions or abatements available in Philadelphia?

+Yes, Philadelphia offers several exemptions and abatements. These include the Homestead Exemption for owner-occupied residential properties, the Senior Citizen Tax Freeze, Business Improvement District (BID) Abatements, and Green Building Tax Abatements.

How do property taxes impact Philadelphia’s economy and property market?

+Property taxes are a significant source of revenue for the city, funding essential services. They can influence investment decisions and property values. Exemptions and abatements play a role in community development and equity, but disparities and challenges can arise.