Oklahoma Property Tax

Property taxes in Oklahoma play a crucial role in funding essential public services and infrastructure. The state's property tax system is unique, with a blend of local and state influences. This article aims to provide an in-depth analysis of Oklahoma property taxes, covering everything from assessment procedures to tax rates and relief options.

Understanding Oklahoma’s Property Tax System

Oklahoma’s property tax system is primarily administered at the local level, with each of the state’s 77 counties responsible for assessing and collecting property taxes. The Oklahoma Tax Commission oversees and provides guidance to ensure uniformity and compliance with state laws. This local control allows for flexibility in tax rates and assessment practices, resulting in varying tax burdens across the state.

The property tax system in Oklahoma is based on the assessed value of real property, including land and improvements such as buildings. The assessed value is then used to calculate the tax liability for each property owner. This process involves several key steps, from valuation to tax rate determination.

Property Assessment Process

Property assessment in Oklahoma is a comprehensive process that aims to establish a fair and accurate value for each property. The assessment is conducted by the county assessor’s office, which is responsible for identifying, locating, and valuing all taxable property within their jurisdiction. The assessed value is typically based on the property’s market value, taking into account factors such as location, size, condition, and recent sales data.

To ensure fairness, the assessment process follows a set of guidelines and standards. Assessors use a variety of methods, including sales comparison, cost approach, and income approach, to determine the property's value. They also consider any improvements or changes made to the property since the last assessment. This process is critical in ensuring that property owners are taxed fairly and accurately.

| County | Average Assessed Value (2022) |

|---|---|

| Oklahoma County | $172,600 |

| Tulsa County | $124,500 |

| Cleveland County | $152,300 |

💡 It's important to note that assessment values can vary significantly between counties due to differences in property values and assessment practices.

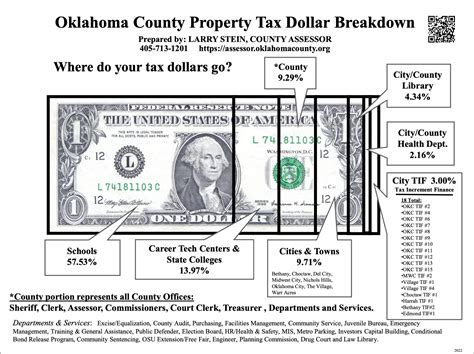

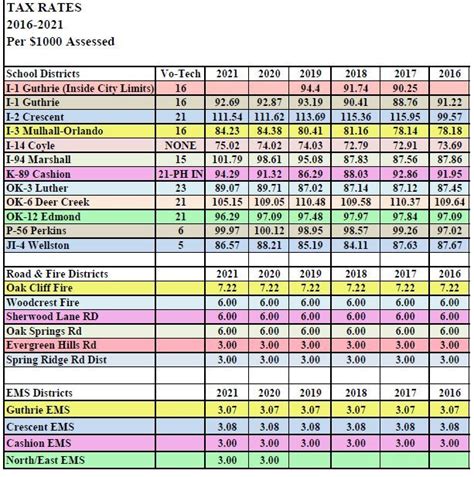

Tax Rates and Calculation

Once the assessed value of a property is determined, the applicable tax rate is applied to calculate the property tax liability. Tax rates in Oklahoma are set by local government entities, including cities, towns, school districts, and special taxing districts. These entities have the authority to set their own tax rates within certain limits set by state law.

The tax rate is expressed as a millage rate, which represents the amount of tax per dollar of assessed value. For instance, a millage rate of 100 mills would equate to $1 in tax for every $1,000 of assessed value. The combined tax rate for a property is the sum of the rates set by all the taxing entities in which the property is located.

| Entity | Millage Rate |

|---|---|

| City of Oklahoma City | 10.50 mills |

| Oklahoma County | 15.00 mills |

| Oklahoma City Public Schools | 35.00 mills |

In the above example, the total tax rate for a property located in Oklahoma City would be the sum of these rates, resulting in a tax liability calculation based on the property's assessed value.

Tax Relief Programs

Oklahoma offers various tax relief programs to ease the burden on property owners. These programs aim to assist seniors, disabled individuals, and low-income households in managing their property tax obligations. One notable program is the Homestead Exemption, which provides a reduction in the assessed value of a homeowner’s primary residence. This exemption can significantly lower the tax liability for eligible homeowners.

Additionally, the state offers the Disabled Veteran Exemption, which provides a full or partial exemption from property taxes for qualifying veterans. Other relief programs include the Circuit Breaker Program, which provides a refund for eligible low-income homeowners, and the Senior Citizens Exemption, which offers a reduction in tax liability for seniors based on their income and property value.

Property Tax Rates Across Oklahoma

Oklahoma’s property tax rates can vary significantly across the state due to the local control over tax setting. This variation is influenced by factors such as the cost of providing local services, the need for funding specific projects, and the overall economic conditions in each county.

To illustrate the range of tax rates, here's a comparison of effective tax rates (the total tax rate as a percentage of a property's value) for several counties in Oklahoma:

| County | Effective Tax Rate (2022) |

|---|---|

| Canadian County | 0.72% |

| Washington County | 1.05% |

| Caddo County | 0.98% |

| Tulsa County | 1.20% |

As seen above, effective tax rates can differ substantially, with some counties having rates almost twice as high as others. These variations reflect the unique needs and priorities of each local community.

Factors Influencing Tax Rates

Several factors contribute to the variation in property tax rates across Oklahoma. These include:

- Cost of Local Services: Counties with higher costs for providing services, such as education, public safety, and infrastructure maintenance, may have higher tax rates to cover these expenses.

- Local Projects and Initiatives: Tax rates may increase to fund specific projects, such as new schools, road improvements, or community development initiatives.

- Economic Conditions: Counties with a higher concentration of commercial or industrial properties may have lower residential tax rates due to the increased tax base provided by these properties.

- Budget Constraints: In times of financial strain, local governments may increase tax rates to maintain essential services and balance their budgets.

Impact of Tax Rates on Property Owners

The varying tax rates across Oklahoma have a significant impact on property owners. For instance, a property owner in a county with a lower tax rate may pay less in property taxes, even if their property is assessed at a higher value. On the other hand, owners in counties with higher tax rates may face a greater financial burden, despite potentially having lower property values.

It's essential for property owners to be aware of the tax rates in their area and to understand how these rates are determined. This knowledge can help them make informed decisions about their property ownership and potentially influence local tax policies.

Performance and Impact Analysis

Oklahoma’s property tax system has a significant impact on the state’s economy and its residents. While property taxes are a primary source of revenue for local governments, they also influence investment decisions, property values, and the overall economic health of communities.

Revenue Generation

Property taxes are a critical source of revenue for local governments in Oklahoma. This revenue is used to fund essential services, such as education, public safety, and infrastructure development. For instance, property taxes account for a significant portion of school district budgets, ensuring the education system’s sustainability.

The revenue generated from property taxes is often reinvested into the community, creating a positive feedback loop. This investment in public services and infrastructure can enhance the quality of life for residents and attract new businesses and residents, further boosting the local economy.

Impact on Property Values

Property tax rates can have a direct impact on property values. In areas with higher tax rates, property values may be lower due to the increased financial burden on potential buyers. Conversely, lower tax rates can make properties more affordable and attractive to buyers, potentially driving up property values over time.

It's a delicate balance for local governments, as they must set tax rates that are high enough to fund necessary services but not so high as to deter investment and drive down property values. This balance is crucial for maintaining a healthy real estate market and a stable tax base.

Influence on Investment Decisions

Property tax rates can also influence investment decisions in Oklahoma. Investors and developers consider tax rates when deciding where to allocate their resources. Areas with competitive tax rates may attract more investment, leading to economic growth and job creation. On the other hand, high tax rates can deter investment, potentially stalling economic development in certain regions.

Local governments often use tax incentives and abatement programs to attract businesses and developers, offering temporary relief from property taxes to encourage investment. These strategies can help stimulate economic growth and create a more competitive business environment.

Future Implications and Recommendations

As Oklahoma continues to evolve, its property tax system will play a crucial role in shaping the state’s future. To ensure the system remains fair and effective, several key considerations and potential improvements should be addressed.

Fairness and Equity

One of the primary concerns with any tax system is ensuring fairness and equity. In Oklahoma, the variation in tax rates across counties can lead to disparities in the tax burden borne by property owners. While local control is essential for tailoring tax policies to specific community needs, it’s crucial to ensure that these policies do not result in excessive tax burdens for some residents.

To address this, a comprehensive review of tax rates and assessment practices across the state could be conducted. This review could identify areas where tax rates are excessively high or where assessment values may not accurately reflect property values. By identifying and rectifying these disparities, Oklahoma can ensure a more equitable tax system.

Modernization and Efficiency

The property tax system in Oklahoma, like many other states, could benefit from modernization and technological advancements. Implementing digital assessment and tax collection systems could enhance efficiency, reduce administrative costs, and improve transparency. These systems could also provide property owners with easier access to information about their tax obligations and payment options.

Additionally, exploring alternative valuation methods and technologies could improve the accuracy and consistency of property assessments. This could involve utilizing advanced data analytics and satellite imagery to more precisely assess property values, ensuring a fair and accurate tax base.

Community Engagement and Transparency

Engaging with the community and ensuring transparency in tax policies is vital for maintaining public trust and understanding. Local governments should actively communicate their tax rates, assessment practices, and the allocation of tax revenue to fund specific services and projects. This transparency can help property owners understand the value they receive from their tax contributions and encourage participation in local decision-making processes.

Regular community forums, online platforms for feedback, and accessible tax information resources can all contribute to a more engaged and informed citizenry. This engagement can lead to better-informed tax policies and a stronger sense of community ownership over local governance.

Conclusion

Oklahoma’s property tax system is a vital component of the state’s economic and social fabric. By understanding the assessment process, tax rates, and relief options, property owners can make informed decisions and actively participate in their local communities. Meanwhile, policymakers and local governments must continually strive to improve the system’s fairness, efficiency, and transparency to ensure a bright and sustainable future for Oklahoma.

How often are property taxes assessed in Oklahoma?

+Property taxes in Oklahoma are typically assessed annually. The assessment process involves evaluating the property’s value and determining the applicable tax rate. This ensures that property taxes remain up-to-date and reflective of current market conditions.

Can property owners appeal their assessed value in Oklahoma?

+Yes, property owners in Oklahoma have the right to appeal their assessed value if they believe it is inaccurate or unfair. The appeal process involves submitting a formal request to the county assessor’s office, providing evidence to support their claim, and potentially attending a hearing to present their case.

What happens if property taxes are not paid on time in Oklahoma?

+Unpaid property taxes in Oklahoma can lead to penalties, interest charges, and potential legal consequences. If taxes remain unpaid, the county may place a tax lien on the property, which could eventually lead to a tax sale if the debt remains outstanding.

Are there any programs to assist low-income homeowners with property taxes in Oklahoma?

+Yes, Oklahoma offers several programs to assist low-income homeowners with their property tax obligations. These include the Circuit Breaker Program, which provides a refund for eligible homeowners, and various tax relief programs aimed at seniors and disabled individuals.